Another Biotech Firm Plans IPO!

The global market for sweetener is experiencing a shift. Xiqian Technology Co., Ltd. (referred to as "Xiqian"), a leading Chinese food additive company, resubmitted its prospectus to the Hong Kong Stock Exchange in February 2025, aiming to go public during a window of opportunity marked by the end of industry price wars and the rebound of sucralose prices. However, declining net profits year after year, family governance disputes, and regulatory inquiries cast a shadow over its path to listing.

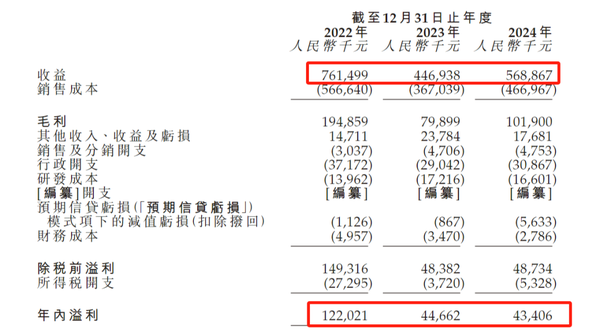

Xinq'an is a company specializing in the production of food additives, with its main products including food-grade glycine and sucralose. For fiscal years 2022-2024, Xinq'an Technology's revenues were 761 million yuan, 447 million yuan, and 569 million yuan, respectively; and its net profits were 122 million yuan, 44.662 million yuan, and 43.406 million yuan, respectively.

Industry Warming Up: When has the price window for chlorinated sucrose closed?

Price底部反弹,行业产能清理

In the third quarter of 2024, the domestic market price of sucralose in China rebounded from 105,800 yuan/ton in June to 191,300 yuan/ton in September, an increase of over 80%. This rebound was attributed to the temporary end of the price war in the industry: from 2022 to 2024, nearly half of the small and medium-sized domestic manufacturers exited the market due to losses, strengthening the pricing power of leading companies. In its prospectus, Xinqia'an predicted that the price of sucralose is expected to further increase with the reduction in production capacity.

Stable international demand, overseas layout becomes crucial.

The long-term price of sucralose in overseas markets is higher than that in the domestic market (the average price in 2023 is about 623 yuan/kg). Xin Qian plans to expand production through its factory in Thailand (with a designed annual capacity of 500 tons) and aims to increase the proportion of international sales from 54.9% in 2023. The high profit margins and stability of the overseas market may serve as a "moat" to help it withstand domestic price fluctuations.

Industry collaboration strengthens, long-term growth logic is clear.

In February 2025, the sucralose industry summit was held, where four leading companies, including Shineway, proposed to establish a regular cooperation mechanism to jointly foster a healthy market ecosystem. With the increase in industry concentration and the trend towards healthy consumption (such as the demand for "sugar-free" beverages), it is estimated that the global sucralose market size will have a compound annual growth rate of 7.8% from 2023 to 2028.

Core Advantages

Industry Leadership: Based on sales volume in 2023, Xin Qi'an's food-grade glycine has a global market share of 5.1% (ranked first), and its sucralose has a global market share of 4.8% (ranked among the top five).

Sponsor:Guokai Kailei(可口可乐)、Rabbit Corporation(草莓公司)等跨国企业为大客户提供了高价值的支持,提高了业务稳定性。

China's only overseas sugar factory producer, Thai sugar factory, tests successful production to reduce export tax risk.

Potential Risks

Significant performance volatility: Net profit plummeted from 122 million yuan to 43 million yuan between 2022 and 2024, with net profit margin decreasing from 16% to 7.6%, highlighting price sensitivity and challenges in cost control.

The dilemma of product单一化 (single-product focus): Glycine and sucralose together account for over 90% of the revenue, while new products (such as curcumin, isomaltulose) are still in the R&D stage and will unlikely become a growth driver in the short term.

Family governance disputes: Founder Wang Xiaoqiang's family holds 54.8% of the shares, and 4/5 of the executive directors on the board are family members, causing investors to be concerned about decision-making transparency and governance efficiency.

CSRC Issues Four Consecutive Inquiries

In August 2024, the China Securities Regulatory Commission required New Qi'an to provide additional explanations regarding the fairness of the pricing for equity changes, whether the fundraising projects involve "high energy consumption" issues, and to explain the coordination between the A-share and Hong Kong stock listing plans. Failure to respond adequately may delay the listing process.

Employee High Turnover Rate and ESG Concerns

In 2023, the employee turnover rate reached as high as 39%, with a near 60% loss rate among Gen Z employees, and there are issues with unpaid social security and public pension contributions (accumulating to 3.7 million yuan). The Hong Kong Stock Exchange's assessment of its ESG performance may impact its listing valuation.

Pressure of the Valuation Adjustment Mechanism (VAM)

Shareholder Wang Xiaqiang signed a "guaranteed return" agreement with external investors, stipulating that if the stock price performance fails to meet expectations after listing, he will have to compensate the difference out of his own pocket. This move may exacerbate short-term performance pressure.

Opportunity Window

Industry recovery + fundraising expansion: Upon successful listing, fundraising will be used for factory expansion in Thailand, international sales network construction, and new product research and development, in line with industry synergy and overseas expansion trends.

According to the amendment, New Qi'an would be required to complete its public listing by the end of June 2025 in order to be entitled to compensation.

Risk Constraints

Risk of price war reigniting: If leading players restart price cuts to争夺份额, the price of sucralose may come under pressure again, eroding the expected recovery in profitability. (注:原文中的“为争夺份额”在翻译时未完整给出,推测应为“为了争夺市场份额”,因此进行了补充。)

Market confidence is waning: a persistent decline in net profit margin may impact investors' judgments about its long-term growth potential, needing to improve performance to rebuild the market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track