Afternoon Surge! National Energy Administration to Strictly Inspect, Overproducing Coal Mines Shut Down, Plastic Prices Supported!

At noon on July 22, an important inspection notice circulated in the market, issued by the Comprehensive Department of the National Energy Administration, requiring all coal mines operating beyond their capacity to be ordered to suspend production for rectification. This move can be seen as a continuation of the "anti-involution" effort, like a stone thrown into the lake of the coal industry, stirring up waves. As a result, coking coal futures and coal sector stocks collectively surged, while there was also a noticeable support effect on the plastics industry.

Against the backdrop of society’s current emphasis on combating involution and eliminating outdated production capacity, the longstanding issue of overcapacity production in the coal industry has become increasingly problematic.

The overproduction not only disrupts the fair competition in the market, plunging the industry into a vicious "involution" cycle of low-price competition, but also poses significant safety hazards due to prolonged overload operations and the difficulty of ensuring safety measures. In the long run, this disordered production model is detrimental to the rational development and sustainable use of coal resources. The issuance of the notice by the National Energy Administration comes at the right time, aiming to firmly curb such improper production behavior and promote the healthy and orderly development of the coal industry.

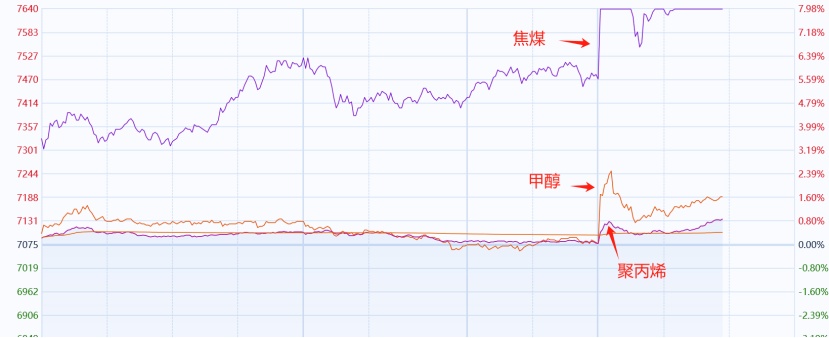

From the perspective of the futures market, this policy will trigger a series of chain reactions. In the past, similar policies have led to significant market fluctuations. For instance, when Shanxi Province conducted the "three excesses" rectification of coal mines in 2024, the expectation of supply contraction led to a strong rise in coke and coal futures, with the main coking coal futures soaring by nearly 9% and the main coke futures rising over 6%. This time, the nationwide comprehensive rectification against excessive capacity production is expected to tighten supply expectations in the coal futures market. Consequently, after the announcement, the main coking coal futures contract surged to the limit, reflecting the market's enthusiastic sentiment. The significant rise in coal prices also supported downstream coal chemical products from the cost side.

Figure: Intraday chart of major contracts in the coal chemical industry chain

The stock market has also been significantly boosted, with a surge of limit-ups in the coal sector. With the shutdown and rectification of coal mines with excessive production capacity, the effective supply in the coal market will be reasonably regulated, avoiding large price fluctuations caused by oversupply. This will create a more favorable market environment for high-quality coal enterprises and further promote industry consolidation. Among the many coal enterprises, China Shenhua, Shaanxi Coal and Chemical Industry, Yancoal Energy, China Coal Energy, Shanxi Coal International, Shanxi Coking Coal, Shaanxi Energy, and Guanghui Energy have notable advantages.

In summary, the Energy Administration's production restrictions on ultra-capacity coal mines demonstrate a further deepening of the "anti-involution" campaign. After nearly two years of prolonged involution, the anti-involution movement may change the logic of market operations, leading to a continued recovery in the valuation of commodities and stock markets.

Author: Zhou Yongle, Senior Market Analysis Expert at Zhuansu Vision

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track