After Nine Months, Fed May Restart Rate Cuts Tonight

Introduction: (1) It is widely expected that, driven by the recent slowdown in employment growth, Federal Reserve officials will cut interest rates by 25 basis points at the conclusion of their two-day meeting on Wednesday; (2) However, although the Fed’s resumption of rate cuts after a nine-month hiatus is already enough to attract significant attention, the highlights of this special rate decision night clearly go far beyond just this.

As described by the renowned journalist Nick Timiraos, known as the "new Fed whisperer," the Federal Reserve is about to hold one of the most unusual policy meetings in years tonight...

It is widely expected that, influenced by the recent slowdown in employment growth, Federal Reserve officials will lower interest rates by 25 basis points at the conclusion of their two-day meeting on Wednesday. At last month's Jackson Hole Global Central Bank Conference, Fed Chairman Powell had already hinted at the proximity of a rate cut when he shifted his focus to prioritizing employment issues rather than the persistent concerns about inflation.

However,Although the Federal Reserve’s resumption of interest rate cuts after a nine-month hiatus is already remarkable in itself, the highlights of this special rate-setting night clearly go far beyond that—never in history has the Fed, until this week, finalized the list of officials attending a rate-setting meeting only on the very last day before the meeting itself…

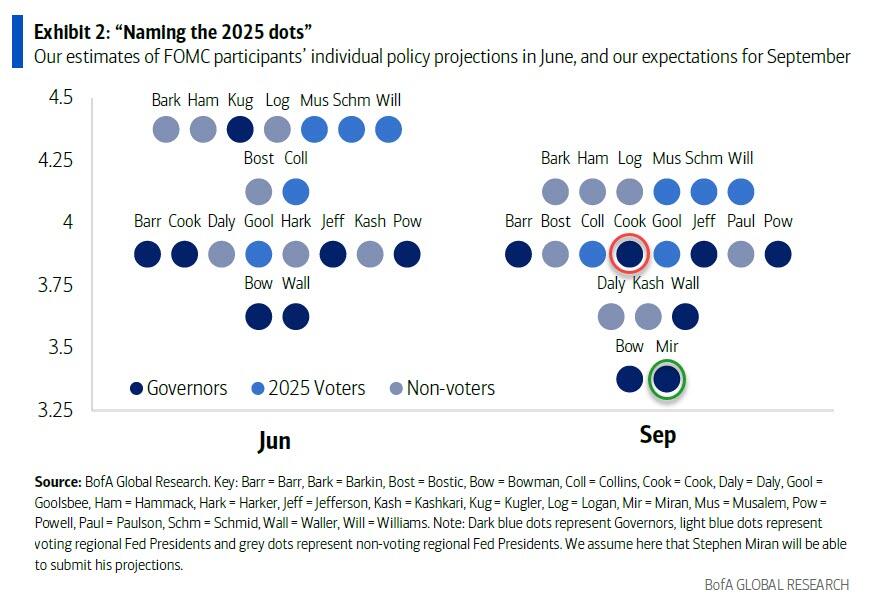

On Monday this week, the U.S. Senate narrowly approved the nomination of White House Economic Adviser Chairman Milan to become a Federal Reserve Board member by a single vote; also on Monday, Federal Reserve Board member Cook managed to "luckily" remain on the Board after going through a lawsuit with the Trump administration. It is not difficult to foresee that these two individuals—Trump’s "loyalists" and "thorn in the side"—are likely to first engage in a "war of words" within the Federal Reserve. Earlier this week, Trump explicitly called on the Federal Reserve to "cut interest rates significantly"!

Milan will be sitting in Kugler's seat tonight, just one seat away from Cook.

Setting aside these political disputes, investors are also expected to closely focus on Federal Reserve Chair Jerome Powell’s remarks this week and seek clues about the future path of interest rates from the latest dot plot and quarterly economic projections. These forecasts will be released simultaneously with the interest rate decision at 2 a.m. Beijing time on Thursday, with Powell’s press conference beginning 30 minutes later.

The following is a multi-dimensional preview by Cailian Press of tonight's Federal Reserve decision:

How much will the Federal Reserve cut interest rates tonight: 25 or 50 basis points?

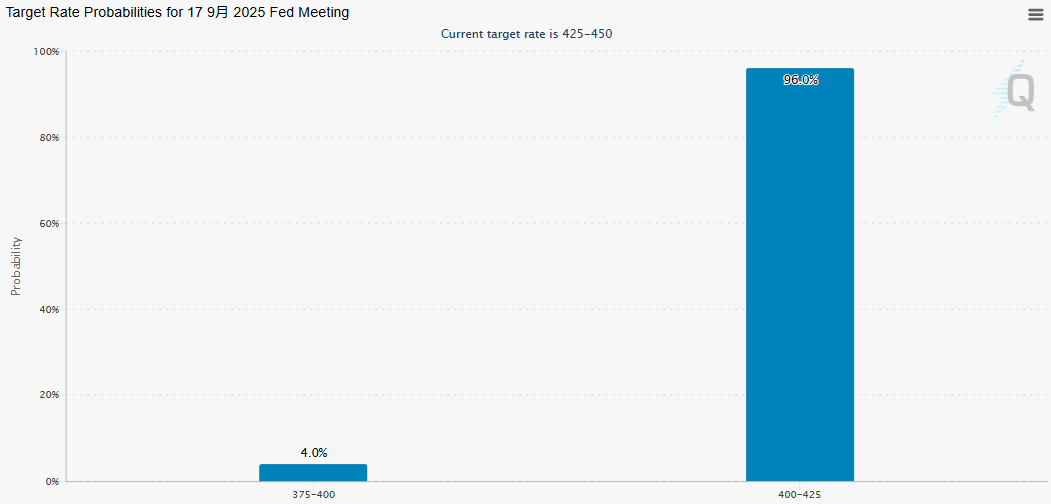

According to the CME Group's FedWatch Tool, the probability of the Federal Reserve lowering interest rates by 25 basis points tonight is approximately 96.0%, while the probability of a 50 basis point cut is 4%.

In recent weeks, a series of disappointing data has undoubtedly intensified market concerns: the U.S. labor market may be facing a more severe slowdown, which could in turn dampen consumer spending and economic growth. However, given that the inflation rate remains above the Federal Reserve's 2% target, and that Trump's tariff measures could further drive up inflation in the coming months, some Federal Reserve decision-makers are cautious about taking action too quickly.

Therefore,Compared to the significant 50 basis point rate cut last September, the market currently overwhelmingly expects a 25 basis point rate cut by the Federal Reserve tonight. Of course, as mentioned in our earlier report today, some interest rate market traders are increasing their bets.It is expected that the Federal Reserve will implement at least one significant rate cut of 50 basis points in the remaining three policy meetings this year. Some bold individuals are even betting heavily that this will happen tonight, so for now, the possibility of a 50 basis point rate cut cannot be completely ruled out.

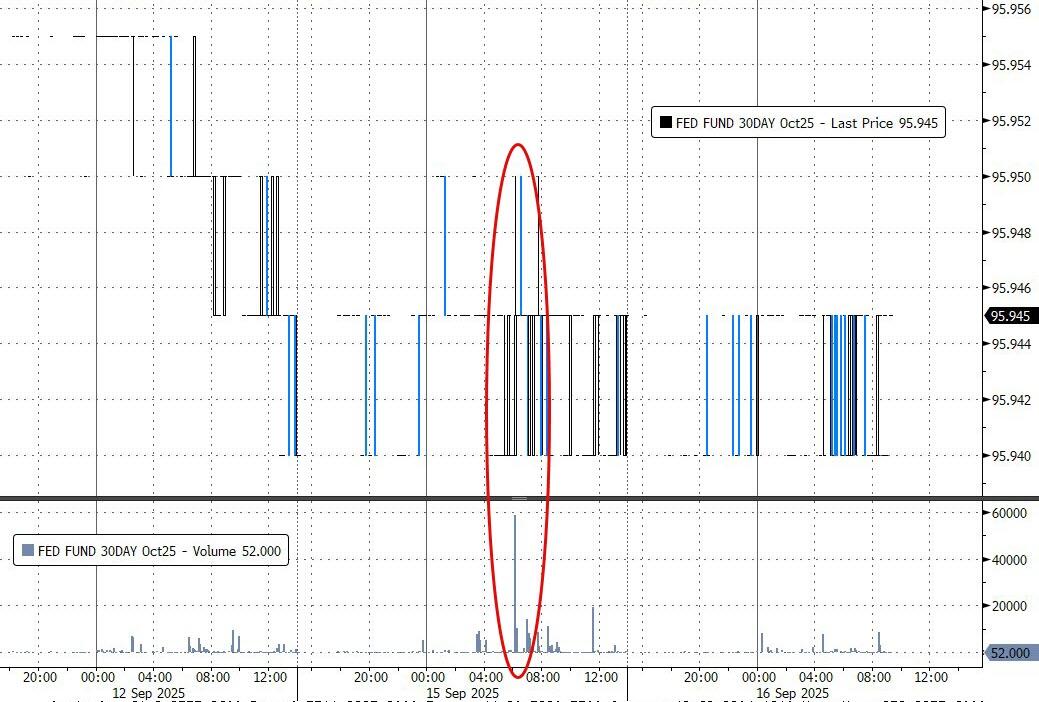

According to findings by researcher Ed Bolingbroke, there was the largest block trade ever recorded in the front end of the Monday curve for federal funds futures—the trade involved 84,000 contracts of the October federal funds futures, corresponding to a risk exposure of $3.5 million per basis point move. Bolingbroke pointed out that both the pricing and timing of the block trade were characteristic of a buyer. Given that the current swap market has fully priced in a 25 basis point rate cut, this move may suggest that the mysterious trader is hedging the risk of a direct 50 basis point cut in Wednesday’s FOMC decision.

Voting Watch: Will the Fed Be More Divided Tonight Than in July?

At the last Federal Reserve meeting in July, an unprecedented situation occurred where as many as two Federal Reserve governors (Waller and Bowman) cast dissenting votes against the decision to maintain the status quo.

Facing tonight's interest rate meeting,Many observers of the Federal Reserve have anticipated that there may be even more division within the Federal Reserve than in July. They believe that if the Fed is expected to lower interest rates by 25 basis points this month, there may be opposing opinions from both hawks and doves: some officials may support a larger rate cut, while others may prefer to keep rates unchanged.

Deutsche Bank strategist Jim Reid has warned that divisions within the Federal Reserve may reach the sharpest levels in decades—Chairman Powell's social skills may face unprecedented tests this week.

He believes that there may be differing opinions within the FOMC. On the dovish side, there may be three FOMC members calling for a 50 basis point rate cut, while on the hawkish side, one or two members may vote to keep rates unchanged.It is possible that this will be the first meeting since 1988 with at least three members dissenting, and it may also be the first meeting since September 2019 in which both hawks and doves have officials expressing dissenting opinions.

The concerns and speculations of investment banks are not difficult to understand. With the addition of Milan, the chief architect of the "Mar-a-Lago Agreement" and chairman of the White House Council of Economic Advisers, to the Federal Reserve, the faction within the Fed that is viewed as Trump's "own people" is undoubtedly growing stronger. Whether it is Milan, Waller, or Bowman, any of them could vote tonight in favor of the Federal Reserve taking more significant rate cuts.

At the same time, the stance of the hawkish faction within the Federal Reserve should not be underestimated—let’s not forget that in June’s “tight” dot plot, as many as seven Fed officials supported no rate cuts this year, just one less than the number of officials who supported two rate cuts.

Dot Plot Highlights: How Many Rate Cuts Will There Be This Year?

In the quarterly decisions of the Federal Reserve, the interest rate dot plot has always been one of the most watched focal points by market participants. Tonight's dot plot may also be very important...

From the general analysis of industry insiders, there are three main highlights in the Fed's dot plot this time.Firstly, the most noteworthy aspect is the interest rate cut path for 2025—if a 25 basis point cut occurs tonight, how many times will the Federal Reserve cut rates in the remaining two meetings of the year? Secondly, whether the dot plot's forecast for 2026 will show increased dispersion could reflect whether internal disagreements among Federal Reserve officials regarding next year's policy path are intensifying. Lastly, after Milan joins the Federal Reserve, how will the Fed adjust its forecast for the long-term neutral interest rate?

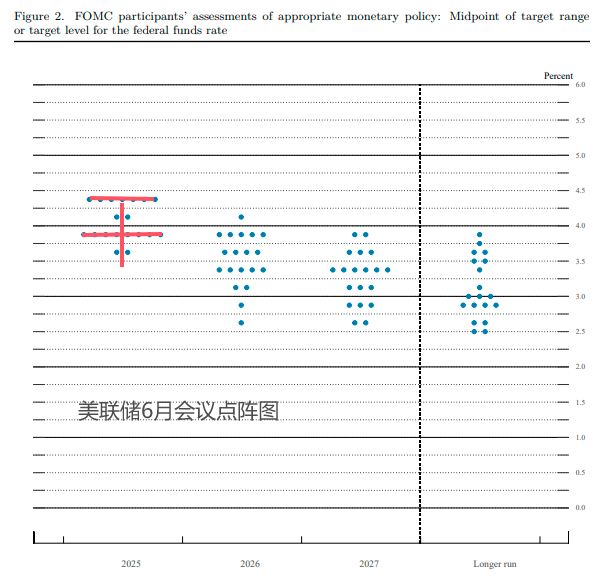

Among them, the interest rate cut path for 2025 is undoubtedly one of the key focal points most closely tied to market trends and has the greatest impact. In the dot plot released in June, the Federal Reserve maintained its forecast of two rate cuts this year, but as mentioned earlier, there was considerable internal disagreement within the Fed at that time— the number of members supporting two rate cuts this year was almost equal to the number of those advocating for no cuts.

And this time,The market’s focus is undoubtedly on whether the Fed’s dot plot forecast for two rate cuts this year can be revised to three—this would align more closely with the latest pricing in the interest rate markets. In other words, if the dot plot’s expectation for rate cuts this year moves toward three, this decision may be interpreted by the industry as “dovish”; but if it remains at two, it can only be regarded as a “hawkish” rate cut.

It is worth mentioning that some industry institutions are currently attempting to "draw the dot plot for the Federal Reserve" based on their own guesses. For example, Bank of America has made the following predictions — even marking the points they believe represent different officials. In terms of the median,Bank of America still expects the dot plot to show two rate cuts within the year.:

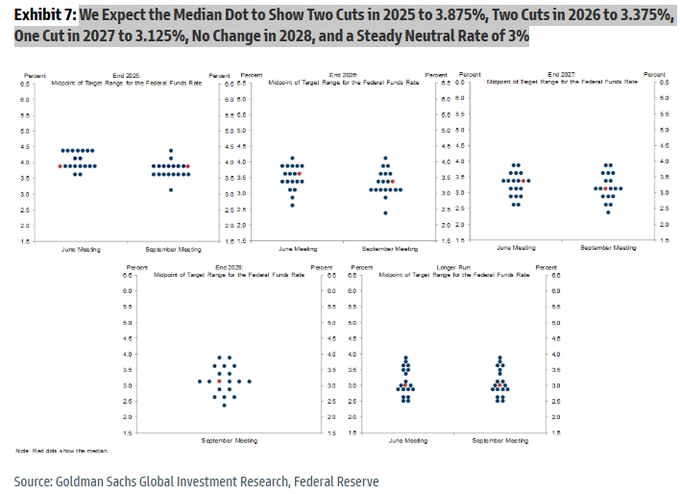

Goldman Sachs has a similar forecast: the firm also expects the dot plot to show two rate cuts within the year.After this month's interest rate cut, there will be another cut by the end of the year, bringing the median interest rate down to 3.875%.

Press conference highlights: How will Powell express his grievances?

Without a doubt, the person under the most pressure tonight during this Fed rate decision meeting is Fed Chairman Jerome Powell. After the press conference following the meeting, it is almost certain that the media will ask Powell about some behind-the-scenes details of this meeting, such as the stance and attitude of the "newcomer" Adrian Millar.

At the press conference, Powell's views on the current state of the U.S. economy and the direction of interest rates will undoubtedly attract attention from all parties.

Nick Timiraos of "New Federal Reserve Communications" stated that given the strategic uncertainty, what signals Powell will send beyond a rate cut this week will become a core issue. In his speech at last month's global central bank conference, Powell hinted that compared to inflation, he is more concerned about the labor market than some of his colleagues. Powell believes that Fed officials can assume tariff-related price increases are temporary unless there is evidence to the contrary — a stance that echoes the Fed's initial misguided response to inflation in 2021.

Timiraos pointed out that the question is whether he will further emphasize these concerns after the weak August jobs report. If Powell makes such an indication, it will confirm market expectations of a rate cut by the Federal Reserve in the upcoming meetings. However, this may need to overcome the unease from colleagues—they still have doubts about the level of the neutral rate and whether rates should be at a neutral level, and are reluctant to commit to such swift action.

Matthew Luzzetti, Chief U.S. Economist at Deutsche Bank, expects that.Powell may face a "challenging press conference" as he attempts to articulate the internal debates of the Federal Reserve.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track