After Driverless Cars, The MINI Truck That Just Can't Be Revived

The new energy MINI trucks were once highly anticipated and regarded as the ideal solution to the "last mile" delivery challenge. However, both the monthly sales figures and the production difficulties faced by manufacturers now reveal a worrying downturn in the performance of MINI trucks.

The MINI truck has never managed to replace the million-unit electric tricycle market as expected; instead, it is on the decline. Now, an even more disruptive challenge is looming—the rapid rise of unmanned delivery vehicles, which may well become the final straw that breaks the MINI truck market.

No demand market for MINI cards

Let's first look at a set of data.

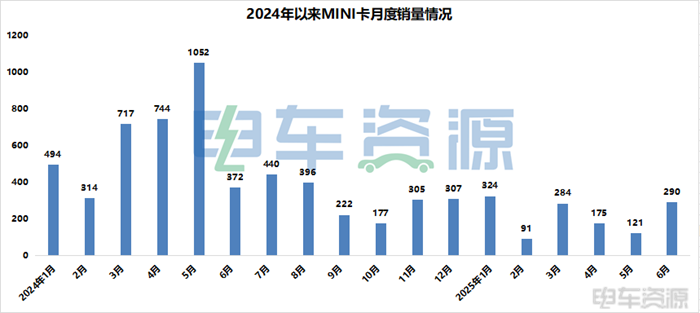

In 2024, sales of new energy MINI trucks reached 5,540 units.By the first half of 2025, sales were only 1,285 units, less than a quarter of those in 2024.Year-on-year significant decline of 65%.

What is even more worrying is that from January to May 2024, the average monthly sales could still reach over 600 units, with a peak of 1,052 units. However, starting from June until the end of 2024, the average monthly sales have plummeted to around 300 units. By the first half of this year, the market stability of the MINI truck has become even worse.Monthly average sales are 200 vehicles.The month with the lowest sales had only 91 vehicles sold.

Not only is the market performance extremely pessimistic,Automakers seem to be abandoning this niche market.

Since 2025, the sales of most models have dropped to zero and exited the market. Models such as the Dali Bull Demon King D03/D05 and Jiaao eD1 MINI no longer have any sales. The once-prominent Huoyue Shentong 01 only has 383 units sold, and Dali Bull Demon King D01/D02 sold fewer than 200 units.

Various signs indicate that the current MINI card market is experiencing an unprecedented downturn.

The MINI car, which was once highly anticipated and expected to replace millions of electric tricycles,Why have I fallen to this point?

The most important thing is,MINI has consistently failed to find a clear market positioning.In the last-mile delivery sector, MINI trucks are not as flexible and convenient as electric tricycles, and in the urban freight transportation market, they struggle to compete with light trucks. The technical shortcomings, such as insufficient battery life and limited cargo space, have not been effectively overcome, making it difficult for MINI trucks to meet market demands in terms of logistics efficiency. This awkward situation of being "neither here nor there" has led to the market space for MINI trucks being continuously squeezed.

A delivery worker stated: "In the city, delivering packages with an electric tricycle is the most practical. The MINI truck is considered a motor vehicle, which means you have to drive on motor vehicle lanes, wait for traffic lights, and find parking spaces. However, a compliant electric tricycle doesn't have these issues; you can park it anywhere there's a space, and it navigates through old neighborhoods with ease."Traffic jams during peak hours do not exist.”

“Now compliant electric tricycles all come with insurance and license plates, making them safe and worry-free, and their cargo capacity isn’t much less than that of mini trucks,” another delivery worker admitted.

More importantly, the cost advantage of electric tricycles will be more prominent.The bare car price of a new energy MINI truck is around 40,000 to 60,000 yuan, and the price including insurance is at least over 50,000 yuan. In contrast, the on-road price of an electric three-wheeler starts at only 3,000 yuan.

For express logistics companies,Tricycles or four-wheeled vehicles are merely tools used for loading and transporting express deliveries; what they focus on more are the vehicle's practicality, cost-effectiveness, and compliance.As long as it can get on the road smoothly.

02 Fatal Impact Brought by Driverless Cars

While the MINI card was still searching for its market positioning, an even more disruptive challenge was approaching.

The rapid rise of unmanned delivery vehicles.

Early autonomous vehicles were mainly limited to testing within enclosed campuses, but now they are able to operate smoothly in complex urban environments. With continuous breakthroughs in key technologies such as 5G communication, high-precision positioning, and multi-sensor fusion, the reliability and adaptability of autonomous vehicles are rapidly improving.

At the same time, first-tier cities such as Beijing, Shanghai, and Shenzhen have successively introduced policies to open testing roads for autonomous vehicles. This policy orientation will further promote the commercialization process of autonomous vehicles.

Currently, companies such as JD.com, Meituan, and SF Express have deployed sizable fleets of unmanned delivery vehicles in multiple cities across the country. According to data from the State Post Bureau,As of 2024, the large-scale application of unmanned delivery vehicles in the express logistics sector has exceeded 6,000 units in total.Since the beginning of this year, more and more companies have been racing to expand their presence. For example, Neolix plans to deploy over 10,000 unmanned delivery vehicles nationwide this year. Clearly, the market's expectations for the application of unmanned vehicles go far beyond those for MINI trucks.

What is even more noteworthy is that,Unmanned delivery vehicles are being deeply integrated with new technologies such as intelligent warehousing.Building a comprehensive smart logistics system is a systemic advantage that traditional MINI cards can hardly match.

Although in the short term, MINI trucks may still maintain a certain survival space in remote areas and specific professional transportation fields, in the long run, as the cost of autonomous vehicles continues to decrease and their application scenarios continue to expand, the market space for MINI trucks will be continuously compressed. It is worth mentioning that...Autonomous vehicles are not merely a simple replacement for MINI cards; they are redefining the operational model of urban last-mile logistics. This paradigm shift will completely change the landscape of market competition.

03 Where does the future path lie?

For companies still persisting in the MINI card market, transformation is imperative. The possible future path lies in:

It is not recommended to develop products based on mainstream market demand.Product repositioning should be based on the logic of meeting the demand for personalized non-standard products.Collaborate with B-end corporate clients to develop exclusive models. Focus on exploring C-end user needs to create an innovative online participation in vehicle customization.Positioned as a commercial vehicle for urban young people starting businesses or side hustles.;

2. Proactively embrace change and accelerate technological upgrades to achieve breakthroughs in range and intelligent connectivity.Strategic transformation towards the autonomous vehicle sector.

No matter what choice is made, companies need to clearly recognize that the traditional MINI card business model is no longer sustainable.

In the future, as autonomous driving technology matures and the construction of smart cities progresses, urban last-mile logistics is undergoing profound changes. In this transformation, MINI trucks are likely to be gradually replaced by smarter and more efficient solutions, much like how feature phones were once replaced.Although this replacement process may take 3 to 5 years, the trend is already very clear.For industry participants, instead of struggling to survive in the shrinking traditional market, it is better to proactively embrace change and seek development opportunities in emerging fields.

After all, in the wave of technological innovation, only by following the trend can one win the future.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track