[ABS Daily Review] Market Transactions Mainly Driven by Rigid Demand, Price Fluctuations Limited Today

1 Today's Summary:

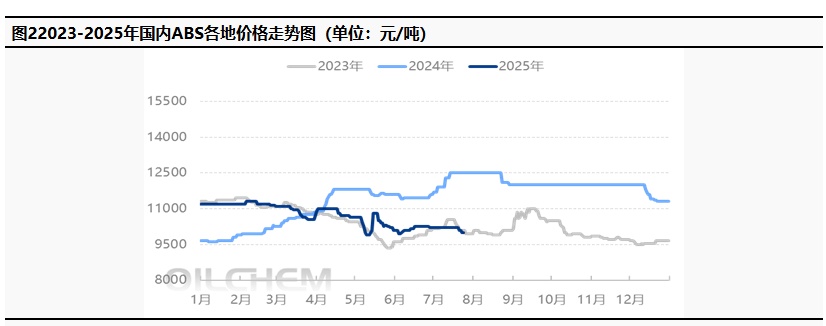

① Today, prices in the East China market slightly declined in some areas; prices in the South China market also slightly declined in some areas, with market transactions meeting just the necessary demand.

② The monthly production of ABS increased month-on-month in August.

2 Spot Market Overview Table 1 Summary of Domestic ABS Prices (Unit: Yuan/Ton)

Based on Yuyao and Dongguan areas, the market prices in East China have slightly decreased, and the market prices in South China have slightly decreased. Today's market transactions are mainly driven by rigid demand, and terminal demand remains weak. All three major raw materials have risen across the board today, strengthening cost support.

3 Production Dynamics

The 600,000-ton/year ABS plant of Liaoning Jinfa is scheduled to undergo maintenance from May 15 to June 30, lasting 45 days. The plant has already started operation and is being fed with materials.

|

Figure 2 Weekly Domestic ABS Capacity Utilization Rate Trend Chart |

Figure 3 Weekly Domestic ABS Cost and Profit Trend Chart |

|

|

|

|

Data source: Longzhong Information |

Source of data: Longzhong Information |

4 Price Prediction:

Based on Yuyao and Dongguan regions, prices in the East China market have partially declined, and prices in the South China market have also decreased in certain areas. Today's market transactions remained primarily driven by rigid demand, with terminal demand lacking strength. Traders offered discounts to facilitate sales. The three major raw materials are on the rise, enhancing the cost support for ABS. It is expected that ABS prices will maintain a narrow-range consolidation trend tomorrow.

5 Relevant Product Information:

Styrene Market In the afternoon, raw material prices slightly increased, the main contract showed a small rebound and consolidation, with trading sentiment for styrene in a state of negotiation, resulting in limited upward momentum in trading activity. Zhejiang market. There is a selling intention around 7,400 yuan/ton, and actual orders can be negotiated. 。

Acrylonitrile Market Today in East ChinaAcrylonitrile market priceStable for now, with mainstream delivered reference prices at 8,400-8,500 yuan/ton, unchanged from the previous trading day. Supply has decreased in some areas, and producers continue to hold prices firm. The focus of spot negotiations remains unchanged.

Butadiene Market : As of the time of publication, the ex-tank self-pickup price of butadiene in Jiangyin, Jiangsu is around 9,100-9,200 yuan/ton, up by 100 yuan compared to the previous period. Spot supply for external sales at East China ports remains limited, and although only a few traders are offering quotes, suppliers’ price adjustments have boosted market sentiment, pushing the market focus upward.

6 Data Calendar

Table 4 Overview of Domestic ABS Data (Unit: 10,000 tons)

|

Data |

Release Date |

Previous data |

Current trend forecast |

|

ABS Capacity utilization rate |

Thursday 11:30 AM |

66.82% |

↗ |

|

ABS Weekly Output |

Wednesday 4:00 PM |

12.96 |

↗ |

|

Manufacturer inventory |

Monday and Thursday 1:45 PM |

16.9 |

↘ |

|

Source of data: Longzhong Information Note: 1 Treat ↓↑ as significant fluctuations, highlighting data dimensions where the increase or decrease exceeds 3%. 2 Considered as narrow fluctuations, highlighting data with a rise or fall within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

![[ABS日评]:今日成交刚需 市场价格有涨有跌(20250723) [ABS日评]:今日成交刚需 市场价格有涨有跌(20250723)](https://oss.plastmatch.com/zx/image/1b1f9dda1f8d4266a7e7de794dd2a45b.png)

![[ABS日评]:今日成交刚需 市场价格有涨有跌(20250723) [ABS日评]:今日成交刚需 市场价格有涨有跌(20250723)](https://oss.plastmatch.com/zx/image/30ce23e36a91494d9298c6828a441b1e.png)