A Subtle Moment in China-U.S. Negotiations! DuPont's Antitrust Investigation in China Suspended: What Are the Reasons Behind It?

After more than three months of conducting an antitrust investigation into DuPont China Holding Co., Ltd. (hereinafter referred to as "DuPont China"), the State Administration for Market Regulation announced on the evening of July 22, 2025, that the investigation would be suspended.

Source: State Administration for Market Regulation

On the evening of April 4, 2025, the State Administration for Market Regulation announced that DuPont China Group Co., Ltd. is suspected of violating the Anti-Monopoly Law, and an investigation has been launched against the company in accordance with the law. This news attracted widespread market attention at the time, especially considering DuPont's position as a global chemical industry giant.

DuPont China responded: "We have noted that the State Administration for Market Regulation has suspended this investigation, and we welcome this action by the regulatory authority." This statement demonstrates the company's positive attitude toward the suspension of the investigation, but does not disclose further details.

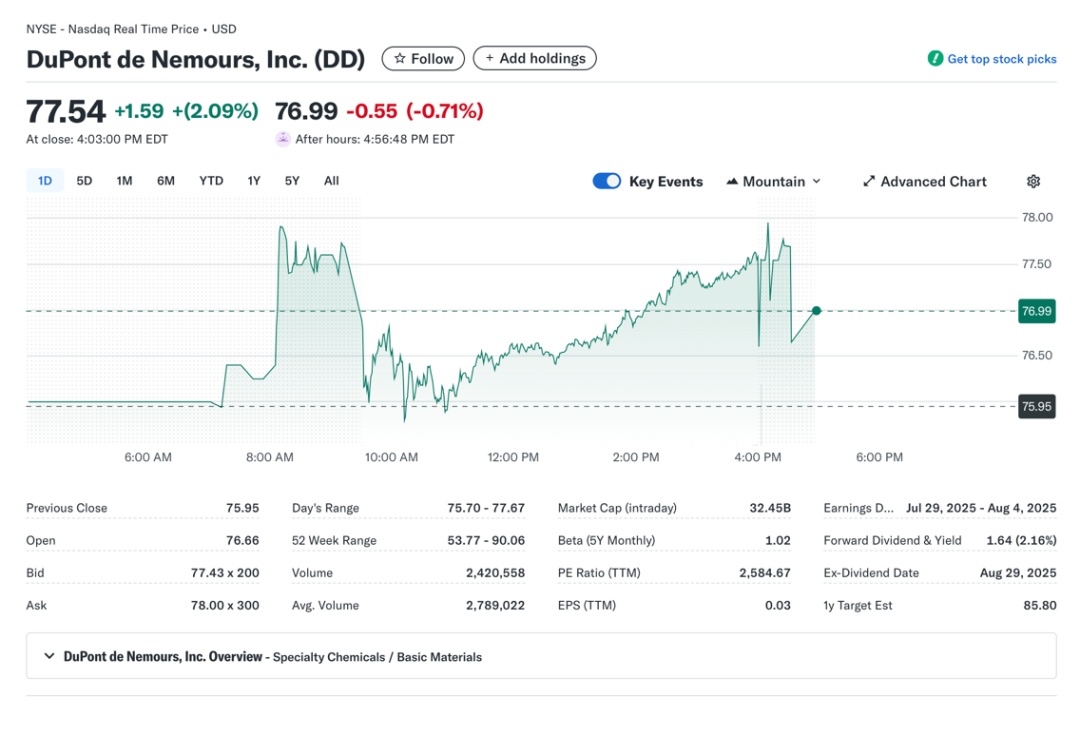

The market responded quickly and positively to this news. After the announcement, DuPont (NYSE: DD) surged sharply in pre-market trading on July 22 local time, closing the day with a 2.09% increase at $77.54 per share.

DuPont has deep ties with the Chinese market.

It is reported that DuPont's products and services cover a wide range of fields, including agriculture and food, building and construction, electronic materials, transportation, and energy. The company is renowned for producing high-quality chemicals, synthetic fibers, building materials, electronic materials, and other products.

Image source: DuPont

As early as 1863, DuPont established a connection with China. With the deepening of China's reform and opening up, DuPont set up a representative office in Beijing in 1984 and officially registered DuPont China Group Ltd. in Shenzhen in 1988. This move not only marked DuPont's deepening presence in the Chinese market but also made it one of the first Fortune 500 companies to invest in China.

China, as DuPont's second largest revenue source globally (contributing nearly 19% of the company's global income in 2024), has seen continuous investment from DuPont over the years. The company has established production bases in multiple cities and set up a research and development center in Shanghai, demonstrating a long-term commitment to the Chinese market.

Analysis of Potential Reasons for the Suspension of the Investigation

According to Article 53 of the Anti-Monopoly Law, an anti-monopoly investigation may be suspended under the following circumstances:

- If the investigated operator commits to taking specific measures within a time frame recognized by the anti-monopoly enforcement agency to eliminate the consequences of the conduct, the agency may decide to suspend the investigation. This clause is similar to the "commitment decision" system in European and American anti-monopoly laws, which allows companies to address competition concerns by changing their behavior without admitting to any wrongdoing.

- If there is a significant change in the facts on which the decision to suspend the investigation is based, or if the decision to suspend the investigation was made based on incomplete or untrue information provided by the operator, it may also lead to the suspension of the investigation.

Several antitrust experts have pointed out that in the past, there have been very few instances in China's antitrust enforcement where the suspension of an antitrust investigation has been announced, making the DuPont case particularly unusual. According to informed sources, due to the complexity of the case, the State Administration for Market Regulation conducted extensive work on the investigation of DuPont, suggesting that the investigation process may involve multiple factors.

It is worth noting that on November 15, 2019, the State Administration for Market Regulation made a decision to suspend the investigation into Lenovo (Beijing) Co., Ltd.'s suspected monopolistic behavior. The reason was that "the party actively cooperated with the investigation, had a deep understanding of the issues at hand, and proposed and actively implemented corrective measures that could eliminate and mitigate the undue impact of its behavior on competition." This precedent may provide a reference for understanding the DuPont case.

Zhuansù Shìjiè has noticed recent signs of easing in China-US economic and trade relations.

On the morning of Tuesday, July 22, Eastern Time, U.S. Treasury Secretary Scott Besant stated that the United States will hold talks with China in Stockholm, the capital of Sweden, next Monday and Tuesday. Besant said that trade negotiations with China have entered a new phase. According to reports, the talks may discuss extending the trade deadline that is set to expire on August 12.

According to China Securities Journal, shortly after U.S. President Trump announced tariffs on Chinese goods in early April this year, Chinese regulatory authorities announced an investigation into DuPont China Group Co., Ltd. Subsequently, DuPont's stock price experienced a significant decline. Prior to this (March 2025), BlackRock (one of DuPont's major shareholders) led a consortium to reach an agreement with Cheung Kong Holdings, controlled by Li Ka-shing, to pre-purchase its 43 global port assets.

Recently, media reports have indicated that COSCO Shipping Group is working to join a consortium led by Mediterranean Shipping Company to acquire more than 40 port assets, including the Panama Canal, making COSCO Shipping a partner and shareholder in these ports. The reports state that currently, BlackRock, Mediterranean Shipping Company, and CK Hutchison are open to COSCO Shipping's investment.

DuPont continues to advance its transformation "from diversification to focus."

In recent years, DuPont has continuously advanced its transformation from diversification to focus.

In January this year, DuPont announced that it would accelerate the process of spinning off its electronics business for an independent listing, with plans to complete the spin-off by November 2025.

At the same time, the company canceled the plan announced last May to spin off its water treatment business for an independent listing.

Recently, DuPont is preparing to divest its Nomex and Kevlar heat-resistant fiber brands by mid-2025. These are also DuPont's most renowned specialty aramid fiber materials. Private equity firms Advent International and Platinum Equity are preparing to submit bids for the transaction, which is expected to be valued at approximately $2 billion (about 14.4 billion RMB). Interestingly, one of the reasons why the State Administration for Market Regulation initiated an antitrust investigation into DuPont China was because the price of its aramid fibers in China was more than 30% higher than the international average.

From various actions, it appears that DuPont plans to reposition itself as a "high-tech materials company."

Conclusion and Outlook

The suspension of the antitrust investigation into DuPont China reflects the increasing maturity and flexibility of China's antitrust enforcement. According to the Anti-Monopoly Law, a suspension of the investigation does not signify its termination. If there is evidence indicating that the operator has not fulfilled their commitments, if significant changes in facts occur, or if the initial decision was based on incomplete information, the investigation can still be resumed.

Since December 2024, the State Administration for Market Regulation has launched antitrust investigations into several international giants (such as Nvidia and Google), demonstrating China's determination to maintain fair market competition. The DuPont case might serve as a reference for how international companies respond to China's antitrust regulations.

In the future, attention needs to be paid to two aspects: first, whether DuPont has indeed taken corrective measures and the implementation of these measures; second, whether this case will affect the response strategies of other international companies currently under investigation.

Edited by: Lily

Sources: Caijing Magazine, Gelonghui, DT New Materials, Chemical New Materials, China Fund News, and other public reports.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track