A Hengrui Evaporates in a Day! Giant Collapses on CEO’s First Day as Domestic Dark Horses Break Through

On July 29, the CEO change at Novo Nordisk was not unexpected.

Rewinding to May 16, the global CEO Lars Fruergaard Jørgensen suddenly resigned, marking the company’s first aggressive leadership change since the 1960s. This move was driven by the harsh realities of underwhelming weight loss drug sales and the failure of a key clinical trial. Since then, Wall Street has been anticipating that, facing competition from Eli Lilly and American generic drugs, this traditionally European internal-promotions-oriented company might break convention and choose an external candidate proficient in the U.S. pharmaceutical market to take over — a scenario similar to Bayer’s recent challenges, where they ultimately selected an American outsider as successor, meeting Wall Street’s expectations.

After more than two months of searching, the answer was finally revealed on July 29: current Executive Vice President of International Operations, Maziar Mike Doustdar, will succeed Lars and take office as the new President and CEO on August 7. In a subsequent media conference call, Novo Nordisk’s incoming CEO Mike Doustdar stated that he will focus on the company’s cost base in the future. He noted that after a period of "rapid growth," the company needs to consider costs. At the same time, he believes there is room for improvement in the company’s execution and that it is necessary to restore a performance-driven culture.

However, the result of this internal promotion appears to have fallen short of Wall Street's expectations. On July 29, after the US market opened, Novo Nordisk plummeted by more than 20% to $54.60, at one point dropping to as low as $53.82—the lowest level since November 2022. In a single day, its market capitalization evaporated by more than $60 billion (equivalent to 428.6 billion yuan; for comparison, Hengrui Medicine's total market capitalization at today's close was 422 billion yuan). Since the beginning of the year, the stock has already fallen by more than 35% in total. The Novo Nordisk that once created a capital legend with its weight-loss drugs now also has to face mounting pressure from Wall Street.

Meanwhile, competitor Eli Lilly also fell nearly 6%, as the valuation logic of the GLP-1 sector was called into question. Investors are concerned about ongoing challenges such as the impact of generic drugs and the long timeline for new drug launches (for example, oral drugs are not expected until 2026). This strong reaction from the capital market points directly to a sudden shift in the GLP-1 weight loss drug sector.

However, the competition between the two is far from over.

On the other hand, competition in the domestic GLP-1 market is accelerating. On June 27, a "dark horse" emerged in the domestic GLP-1 weight loss drug field. With Innovent Biologics' Masteptide injection being approved for market launch, directly using weight loss as the initial indication, the number of approved GLP-1 weight loss drugs in China has increased to five.

On June 30, CSPC and Gannex once again engaged in a close confrontation over a GLP-1 U.S. patent, stirring up the landscape of this niche sector.

On July 15th, Hengrui Medicine and American Kailera Therapeutics jointly announced that HRS9531 has achieved positive top-line results in its Phase III clinical trial (HRS9531-301) for treating obesity or overweight subjects in China, with a weight loss of 19.2%! Yinnuo Pharmaceuticals also announced that its original new drug, Yinonuqing, has been approved and is currently undergoing clinical research for obesity and overweight.

On July 30, CSPC Pharmaceutical Group announced that it has granted Madrigal Pharmaceuticals the global rights (excluding China) to its small-molecule GLP-1 receptor agonist SYH2086. Madrigal will pay an upfront payment of $120 million, milestone payments totaling $1.955 billion, and double-digit percentage royalties on sales.

From the close combat among global giants to the collective breakthrough of domestic pharmaceutical companies, the story of GLP-1 weight-loss drugs is reaching its climax.

01

The most valuable track in history

There are at least three factors behind the sharp drop in Novo Nordisk's stock price this time.

Initially, in the United States, the compounded GLP-1 drugs primarily involve the active ingredient semaglutide from Novo Nordisk's Ozempic and Wegovy. In early 2022, due to supply shortages, the FDA allowed compounding pharmacies to produce compounded versions of semaglutide to fill the market gap. However, these low-cost alternatives (about $300-500 per month, significantly lower than Wegovy’s $1300) have significantly impacted the sales of Novo Nordisk's branded drugs. As of 2025, approximately 1 million American patients are using compounded semaglutide, taking up an important share of the GLP-1 market, leading to a slowdown in sales growth for Wegovy and Ozempic.

Secondly, competitor Eli Lilly's tirzepatide has brought significant pressure to Novo Nordisk, causing market turmoil based on the results of the SURMOUNT-5 study.

In addition, on July 29, Novo Nordisk issued an announcement before the U.S. stock market opened, significantly lowering its full-year 2025 performance guidance. At constant exchange rates, projected sales growth for 2025 was revised down from the previous 13%-21% to 8%-14%, and operating profit growth was revised down from the previous 16%-24% to 10%-16%.

The competition between Eli Lilly and Novo Nordisk is far from over.

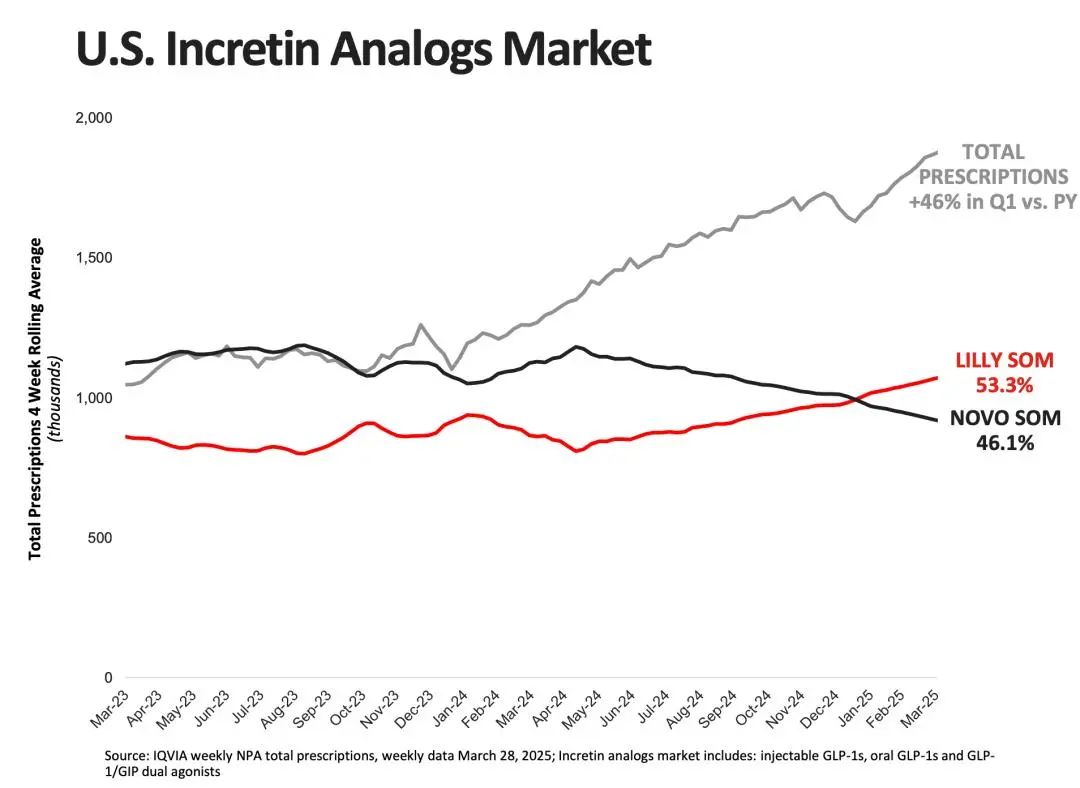

According to statistics, the global market size for GLP-1 peptide drugs reached $51.8 billion in 2024, representing a year-on-year growth of 42%, while the weight-loss drug market reached 14 billion yuan. Previously, Goldman Sachs predicted that Novo Nordisk and Eli Lilly would control 80% of the weight-loss drug market. Among them, the United States is the largest market for GLP-1 weight-loss drugs. As of April 2025, the prescription volume for branded weight-loss drugs in the U.S. increased by 160%, with the overall market share of GLP-1 drugs rising to over 50%.

Figure: Growth of the U.S. GLP-1 receptor agonists market; Source: Eli Lilly financial report

After Tirzepatide opened the market, Eli Lilly subsequently developed a series of follow-up products to "take over": Mounjaro, orforglipron, retatrutide, and others. Additionally, on June 3rd, Eli Lilly reached a business development agreement with Camurus, granting Lilly rights based on Camurus's FluidCrystal technology, aiming at the next generation of ultra-long-acting GLP-1 receptor agonist products.

Novo Nordisk is also seeking the next generation of weight-loss drugs through business development. In March, it signed a licensing agreement worth up to $2 billion with United Laboratories for the GLP-1/GIP/GCG triple agonist UBT251. In May, it reached a collaboration agreement with Septerna for an oral small molecule therapy, with a deal value of up to $2.2 billion.

Figure: BD Achievements of MNCs in the Field of Weight Loss Drugs

Moreover, recently, Novo Nordisk has reached an agreement with CVS Caremark (the pharmacy benefit management division of CVS Health, PBM) to list Novo Nordisk's weight loss drug Wegovy as the preferred GLP-1 medication starting from July 1, 2025, while removing Eli Lilly's weight loss drug Zepbound from its standard formulary.

Nowadays, both giants are betting on AI-driven drug development, and their competition will continue as they strive to consolidate their positions in the trillion-dollar market.

02

Domestic GLP-1 Emerges as a "Dark Horse"

Returning to the Chinese market, it is estimated that the GLP-1 peptide drug market will exceed 3.5 billion USD in 2024, with a growth rate of 25%, and is expected to reach 4.5 billion USD in 2025.

Currently, there are five GLP-1 class weight loss drugs approved in China. Among them, two are original drugs from foreign companies: Novo Nordisk's Semaglutide (Wegovy) and Eli Lilly's Tirzepatide (Mufenda). The other three are domestic brands: Hisun Pharmaceutical's Liraglutide biosimilar, Hua Medicine's Benaglutide, and Innovent Biologics' Mazdutide.

Liraglutide injection under Huadong Medicine is the first domestically produced GLP-1 receptor agonist approved for weight loss treatment. Its indication application was approved by the National Medical Products Administration on July 5, 2023. However, this product is a biosimilar, priced at 410 yuan per injection (3ml:18mg specification), administered once daily, with a monthly cost of approximately 1,230 yuan. It is currently the lowest-priced domestic GLP-1 weight loss medication among several options and has been made available in over 1,000 hospitals and 20,000 pharmacies nationwide.

In the same month, Benaglutide, a product of Jiangsu Hansoh Pharmaceutical Group, was approved as the second GLP-1 weight-loss drug and is the first original new drug in China to be approved for "weight loss indication". From the perspective of global R&D progress, Benaglutide is the third approved innovative GLP-1 drug following Liraglutide and Semaglutide. However, due to the requirement of three daily injections, patient compliance is low. Despite being approved earlier, its market share has been squeezed by long-acting drugs. Priced at approximately 600 RMB per vial (4.2 mg), it offers a high cost-performance ratio, but its usage frequency restricts wider adoption.

Two foreign-funded brands are Novo Nordisk's semaglutide and Eli Lilly's tirzepatide. In China, these two drugs were approved for marketing in June and July 2024, respectively, for weight loss or long-term weight management.

The two companies have adopted different strategies in China. Novo Nordisk focuses more on weight loss efficacy and supplementing its product pipeline. According to the latest data from Novo Nordisk, a higher dose of semaglutide (7.2mg) can lead to an average weight reduction of 21% in obese patients, with one third of participants experiencing a weight loss of 25% or more. Additionally, Novo Nordisk is actively pursuing acquisitions in China.

What Eli Lilly needs to address most is its production capacity issue. Last month, Lilly launched the new multi-dose pre-filled pen of tirzepatide in China to increase supply in the country and meet the needs of more patients. In October last year, Lilly China announced plans to invest about 1.5 billion yuan to upgrade the production capacity of its Suzhou plant and support the manufacturing of future pipeline products. In response, Lilly told Yicai Global: "Offering multiple device options allows us to fully leverage the flexibility of our global supply chain and quickly assess and adjust supply plans."

Unlike the above four products that entered the market focusing on blood glucose reduction, on June 27, Innovent Biologics' GLP-1 dual receptor agonist, Mazdutide injection, was approved for market launch with weight loss as its first indication, directly targeting the two major foreign brands.

It took nearly five months from the approval of Novo Nordisk's semaglutide (Ozempic®) to the issuance of the first prescription in a public hospital, while Eli Lilly's tirzepatide (Mounjaro®) took even longer. However, after the launch of Mazdutide, the first prescription nationwide was issued on July 3rd, taking only six days.

From a price perspective, the retail price of Marsdou Peptide on e-commerce platforms is 630 yuan per box, with each box containing two injections, resulting in a monthly cost of approximately 1260 yuan for patients. Novo Nordisk's NovoRapid costs about 1040 yuan per month, while Eli Lilly's Mounjaro ranges from 1600 to 2400 yuan per month. The price of Marsdou Peptide is in the median range, and Innovent's strategy is to compare efficacy with the former and compete on cost-effectiveness with the latter.

According to the previous results of the GLORY-1 Phase III clinical trial of Mazdutide, the efficacy of Mazdutide is superior to that of Semaglutide, as the discontinuation rate due to side effects (0.5% in the 6 mg group) is significantly lower than that of Semaglutide (approximately 4%) and Tirzepatide (approximately 3%).

However, among the current five GLP-1 drugs, none have obesity indications included in medical insurance.

03

Uninvited new opponents

GLP-1 has fueled the entire weight loss sector and intensified competition. The GLP-1 “cake” has attracted not only the five companies mentioned above; a number of other enterprises are gearing up to enter the field.

On the global stage, as Pfizer, AstraZeneca, Amgen, and others make strategic moves in the metabolic weight loss arena, the competition has escalated. Amgen’s main asset, AMG 133, stands out in the weight loss field. In March 2025, Amgen has already initiated two phase III clinical trials (MARITIME-1 and MARITIME-2) for AMG 133. AstraZeneca, on the other hand, places greater emphasis on oral small-molecule GLP-1 agonists. As early as November 2023, AstraZeneca secured exclusive rights to an oral small-molecule GLP-1 agonist from Chia Tai Tianqing with an upfront payment of $185 million. In addition, Boehringer Ingelheim’s Survodutide has also demonstrated excellent performance in clinical trials.

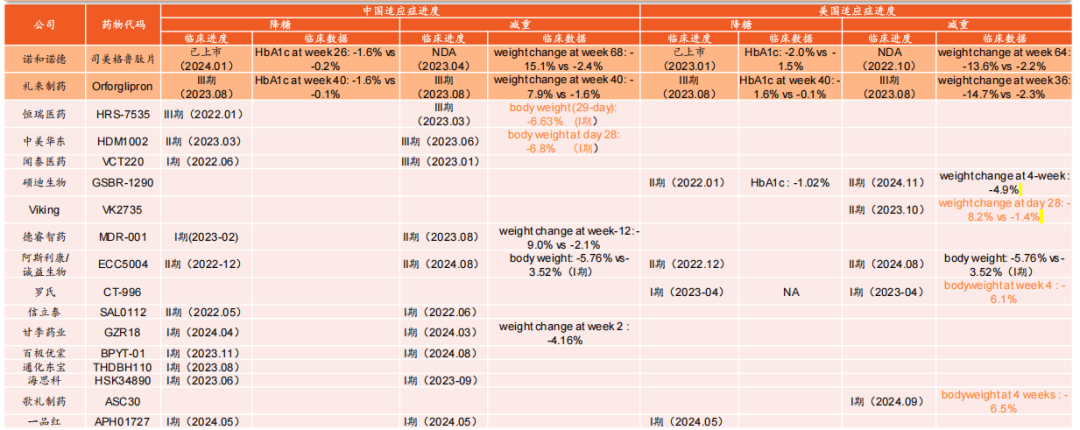

Figure: Global Progress in the Development of Oral GLP-1 Formulations, Source: Ping An Securities

Overall, in a series of GLP-1 studies, multi-target research and development is a trend. Currently, among the new dual-target drugs, Hengrui Medicine's HRS9531 is in Phase 3 clinical trials, while products from companies like Borui Medicine, Zhongsheng Pharmaceutical, and Hansoh Pharmaceutical are still in Phase 2 clinical trials. Additionally, in the future, domestic companies have a certain advantage in long-acting formulations. For example, Yinuo Medicine's Yinuoqing has an average half-life of up to 204 hours, which is longer than Novo Nordisk's semaglutide at 168 hours.

Additionally, in the face of the intense competition in the GLP-1 weight loss market, many leading domestic companies have already started to expand overseas.

Previously, Hengrui Medicine and Sinepharm Biotech each bundled their three GLP-1 products and went overseas using the NewCo model. In March this year, United Laboratories announced that it had licensed its GLP-1 product to Novo Nordisk, among others, with a $200 million advance payment and potential milestone payments of up to $1.8 billion.

In the recently released 2025 interim results, Hybio Pharmaceutical achieved profitability for the first time in seven years, thanks to the overseas success of its "weight-loss miracle drug," the generic version of liraglutide injection. The company is expected to report a net profit of 142 million to 162 million yuan, representing a year-on-year increase of 1,470% to 1,664%.

It is evident that GLP-1 is still a "good business." However, it's clear that on the eve of the GLP-1 boom, it must be faster, even faster.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track