800 million investment! 98 million fund supports! prilite sodium battery base launched, decoding the new energy breakthrough of modified plastic enterprises

PST has taken another step forward in accelerating the commercialization of sodium-ion batteries.

Recently, its holding subsidiary Guangdong Haisida Naxing Technology Co., Ltd. formally signed the "Haisida Naxing Annual Production" with the Neijiang Economic and Technological Development Zone Management Committee. The "6GWh Sodium-ion Battery Production Base Project Investment Agreement" plans to establish a subsidiary in the Neijiang Economic Development Zone to construct a new production base with an annual capacity of 6GWh of sodium-ion batteries, adding another key step to the company's sodium battery industrialization layout.

Focus on and deepen the sodium-ion battery strategy, firmly optimistic about the enormous application prospects of sodium-ion batteries, and accelerate comprehensive commercialization development.

Special View and everyone discuss Pret's annual production.The 6GWh sodium-ion battery production base project and how this company, which is based on the plastics business, can explore and develop this new track of sodium-ion batteries outside the plastics field.

I. Investment8亿元,加速钠离子电池商业化

According to the announcement, the total investment of the production base project is approximately The project will involve a total investment of 800 million yuan and will be implemented in two phases: Phase one will have a designed capacity of 2 GWh, with an investment of approximately 300 million yuan and a construction period of about 6 months (counting from the date the main production plant of phase one is delivered); Phase two will expand the capacity by 4 GWh, and is expected to commence construction within 24 months after phase one begins operation, and to be completed and operational within 32 months after phase one begins operation.

In the production line planning, the project will simultaneously construct a line. The 46 series large cylindrical sodium battery production line and one ultra-large square or other model sodium battery production line aim to create a cost-leading and technologically advanced sodium-ion battery scale and industrialization demonstration production base, further improving the company's product matrix and capacity layout in the sodium battery segment.

To ensure the smooth progress of the first phase of the project, the Neijiang Economic and Technological Development Zone Management Committee will also actively coordinate. A 98 million RMB industrial guidance fund is used to increase capital and invest in Sodium Star by Hai Sida, specifically for the construction of the first phase.

In the context of intensified fluctuations in lithium resource prices and highlighted challenges in supply chain security, sodium-ion batteries are widely regarded in the industry as promising for energy storage and automotive start-stop power sources due to their abundant resources, excellent low-temperature performance, and high safety. The "next-generation leading technology," with the establishment of a 6GWh capacity, will help Pulit rapidly enhance its supply capabilities to meet the increasing delivery demands of its customers, accelerating the transition of sodium battery technology from the "verification stage" to the "mass application stage."

Source of image: Zhuoyan Sodium Electric

It is worth mentioning that the announcement indicates that during the construction and operation of the project, there may be risks of not being completed on schedule or not achieving expected returns due to various factors such as macroeconomic conditions, industry policies, market environment changes, and management. The company will dynamically adjust its advancement strategy based on project progress to actively mitigate related risks.

2. The Cross-Industry Path of Modified Plastics Company Pret.

Puri Technology has been deeply involved in the modified composite materials industry for over thirty years and has become a leading enterprise in the industry, with locations in Shanghai Qingpu and Shanghai Jin. Shan, Jiaxing in Zhejiang, Tongliang in Chongqing, Wuhan in Hubei, Foshan in Guangdong, Binhai in Tianjin, South Carolina in the United States, Chonburi in Thailand, Monterrey in Mexico The company has 12 new material production bases, including 3 under construction. The current production capacity is 500,000 tons, and the annual production capacity is expected to exceed 1 million tons in the future.

The sodium-ion battery, as an important direction in the new energy sector, has become the core choice for its cross-industry expansion. The acquisition of Haisida Power is the crucial starting point for implementing this strategy.

The year 2022PrittAcquisition of Haishida Power, formingThe "new materials + new energy" dual-driven business model. Haid Power was established in 1994, focusing on battery research and development for 31 years. It is one of the earliest secondary battery R&D and production enterprises in China, covering core technologies such as key materials, cells, BMS, and system integration. Currently, it has an annual cylindrical capacity of 2.83GWh, an annual prismatic capacity of 12.49GWh, with a total annual capacity of 15.32GWh.

Leveraging the technological accumulation and production capacity of Haishida Power in the battery field, Politer has not only quickly entered the secondary battery track but also laid a solid foundation for the subsequent research and industrialization of sodium-ion batteries.

First, PrittThrough equity mixed reform, the sodium battery sector was independently operated and established in Baiyun, Guangzhou, forming Guangdong Haisida Naxing Technology Co., Ltd., and received strategic investment from the National New Energy Storage Innovation Center. In terms of product certification system, multiple sodium-ion cells and modules...The group obtained certification.GBT 44265, UL, TUV, IEC and other authoritative certifications, and extensive application and verification by leading downstream customers.

In terms of product matrix, the company mainly focuses onThe products 46145-15AH and 71173208-160AH have achieved large-scale shipments, and the newly developed 50160118-50AH has entered the small-scale application stage.,Widely used in energy storage, backup power, start-stop systems, special vehicles, etc., the value of signed orders has exceeded.200 million yuan.

With the gradual advancement of the sodium battery business, Polestar's recognition and market competitiveness within the industry continue to improve.。In 2025, Haisida Sodium Battery made its debut at the 2025 New Energy Industry Expo and was ranked on the 2025 SMM Global Tier 1 Sodium Battery List. It ranked fourth in the domestic sodium-ion battery production ranking from January to June 2025 released by Xinluo Consulting. The company's sodium battery products received the nation's first Jianheng GB/T 44265 certification for sodium-ion batteries in power storage stations.

It is worth noting that Pulead's efforts in the sodium-ion battery field not only focus on current commercialization but also look towards future technological iterations. While promoting the scaling up of existing sodium battery products, they also leverage their battery research and development experience to extend into the higher technical threshold areas of semi-solid and solid-state batteries.。

In the first half of 2025, the Zhuhai base of Haizhida achieved the world's first mass production of 314Ah large-capacity semi-solid-state batteries, marking the beginning of the "semi-solid-state era" for secondary batteries and filling the gap in large-capacity semi-solid-state battery mass production in China. Meanwhile, Pulite has begun to develop solid-state sodium-ion batteries, designating the research and industrialization of solid-state batteries as a major strategic direction for the company's future development. It has also partnered with Weilan New Energy, a leading solid-state battery company, to jointly support the research and development of new solid-state batteries and system structure materials. This collaboration aims to gain a competitive edge in next-generation battery technology and prepare for applications in large-scale energy storage systems, backup power supplies, and specific industrial and consumer electronics fields.

3. How is the main business of modified plastics performing?

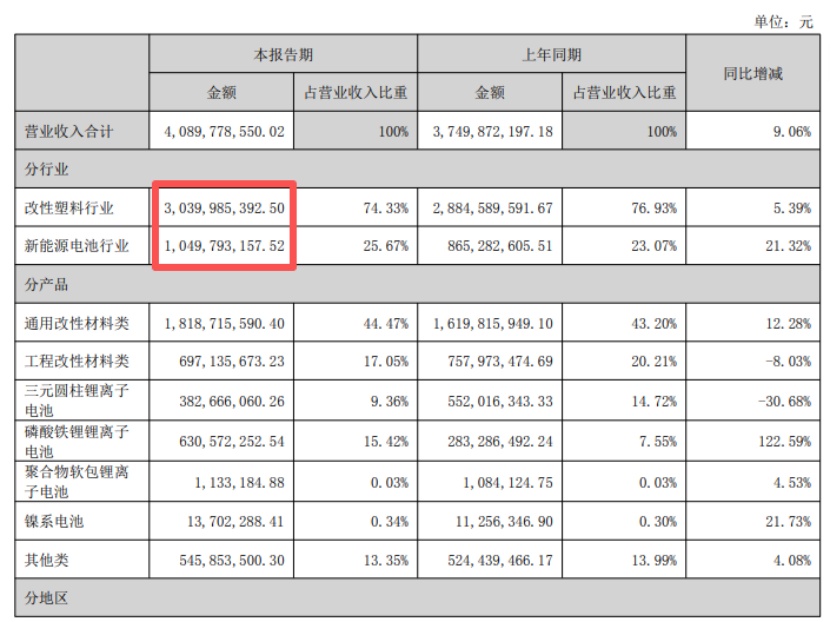

In the mid-2025 report, Zhuansu Vision found that the modified plastics business remains the "fundamental base" of Pulit’s revenue.

During the reporting period, the modified plastics industry secured approximately The modified plastics industry achieved a revenue of 3.04 billion yuan, accounting for 74.33% of the total revenue. The new energy battery industry also performed well, with a revenue of approximately 1.05 billion yuan, accounting for 25.67% of the total revenue. Looking at the data from the same period last year, the modified plastics industry had a revenue of about 2.885 billion yuan, accounting for 76.93%, while the new energy battery industry had a revenue of about 865 million yuan, accounting for 23.07%.

Source: Pulis Technology Interim Report

In comparison, it is evident that the company's business in the new energy battery sector is developing in an upward trend, which also shows that the company is... In the dual drive of "new materials + new energy," the weight of the new energy sector is gradually increasing.

However, in terms of revenue scale and proportion, the core position of the modified plastics business remains unshaken, and its internal product matrix is relatively diverse, with each having its own focus in application scenarios and development potential.

General modified materials are an important component of Pret's modified plastics product system and account for a significant proportion of the company's revenue.In the 2025 interim report, the revenue proportion of this category reached 44.47%.

Including modificationsPP, modified ABS, modified PS, modified PE, etc., these materials possess good overall performance and can meet the needs of a wide range of fields such as daily consumption, packaging, and general industrial products. Various plastic daily necessities and ordinary packaging materials may utilize general modified materials.

Compared to general modified materials The "broad coverage" feature and the focus on "high performance" needs in the category of engineering modified materials are key categories supporting the company's competitiveness in core industrial fields.

The engineering modified materials category covers modification.PA, modified PC/ABS, modified polyester, etc.,Focusing on meeting the high-performance material requirements in industrial applications, engineering modified materials are superior to general modified materials in terms of mechanical properties, heat resistance, and chemical corrosion resistance. They are commonly used in the manufacturing of automotive parts, electronic and electrical product housings, aerospace, and other fields. However, inThe mid-2025 report shows that the revenue of this category has declined compared to the same period last year, accounting for 17.05% of the operating income.

In addition to general materials for the mass market and engineering materials for the industrial sector, Polynt is also actively expanding its presence in the specialty engineering materials field, which has a higher technical threshold, in order to capture high-end market share and create opportunities for long-term growth.

In the field of special engineering materials, Polytech focuses on modified materials.PEEK, modified PPS, modified PPA, modified PPO, and other high-performance products are benchmarked against international high-end market standards in core performance areas such as high-temperature resistance, corrosion resistance, and mechanical strength. These materials meet the stringent requirements of the high-end manufacturing industry. Currently, these materials have entered the application verification stage in emerging fields such as robotics, low-altitude flight equipment, and the three electric systems (battery, motor, electronic control) of new energy vehicles, and have achieved small-batch supply. Some products, with performance comparable to imported materials, are capable of replacing imports. This has become an important strategic direction for the company to break into the high-end materials market and create new growth opportunities.

In summary,In the first half of 2025, the modified plastics business will have a "stable scale and a clear structural gradient."。With the commissioning of new production capacities in Ma'anshan, Anhui, and Binhai, Tianjin, combined with the application of specialty materials in emerging fields, the company will further consolidate its leading position in the modified materials industry. "New materials + new energy" dual drivers provide continuous support.

Edited by: Yun Shimeng (Carrie)

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track