60-day payment term commitment reached: Breaking Tradition or Laying New Hidden Dangers?

In June this year, major automotive companies such as China FAW, Dongfeng Motor, GAC Group, and Seres made public commitments that "payment terms for suppliers will not exceed 60 days," which has sparked significant public attention. How these commitments will be further implemented and fulfilled is of great concern to society.

July 9th,Ministry of Industry and Information TechnologyAn "Online Issue (Suggestion) Reporting Window for Key Automotive Companies to Fulfill Payment Term Commitments" has been established on the "National Platform for Complaints about Default and Arrears to SMEs," primarily to address issues such as the failure of key automotive companies to fulfill the commitment of a 60-day payment term, unreasonable commencement of payment periods, and payment methods.

Source of the image: Gongxin Weibo

From the Ministry of Industry and Information Technology calling for a halt to "false" and "non-standard promotion" of intelligent driving, to the State Council Executive Meeting clearly proposing to regulate the competitive order of the new energy vehicle industry, and then to the Ministry of Industry and Information Technology taking action to address the 60-day payment deadline issue, the "anti-involution" in the automotive industry has taken serious action this year.

As of now, it's been nearly 60 days since major car manufacturers made their declarations. To what extent have they fulfilled their commitments? Through a survey of some automotive parts companies, Gasgoo Auto has discovered that...Automakers generally face cash flow pressure.The issue of the "60-day payment term" is difficult to implement.

A 60-day payment term, while breaking the traditional model, has it also left new hidden risks?

,The "tightening curse" over the supplier's head

In the automotive industry, traditional payment terms have always been a "tightening curse" for suppliers and a "scar" on the supply chain.

Previously, the average payment period for domestic car companies exceeded 170 days, with some companies even surpassing 240 days. Data from 2024 shows that the average accounts payable turnover days for mainstream car companies is 182 days, with the payment cycle for certain companies reaching as high as 274 days. Suppliers often find themselves in the predicament of "receiving payment 6-12 months after delivery."

Automakers commonly use the combination of "three-month payment terms plus six-month acceptance bills," which significantly extends the actual payment cycle for suppliers. This practice causes suppliers, especially private small and medium-sized enterprises, to face long-term financial strain.

This phenomenon is described in the industry as chain arrears. The core issue is that vehicle manufacturers outsource financial costs to the supply chain, exacerbating its fragmentation and tension. Essentially, it is the OEMs shifting operational risks onto downstream suppliers in the supply chain.

For example, if a battery cell factory has a payment term of 180 days, the funds tied up in accounts receivable each year could reach a scale of tens of billions, equivalent to three times the company's annual R&D investment.

Image Source: Shetu.com

However, the extended account period is also a result of intensified competition within the industry. As profits in the automotive industry become increasingly thin, in addition to opting for annual cost reductions, extending the account period is also one of the methods car companies use to cut costs.

In the relationship between whole and zero, suppliers are often in a weak position, with a significant disparity in bargaining power between the two parties.In a situation where supply exceeds demand, most suppliers are helpless in the face of payment term issues and can only seek survival by making concessions.

"Accepting long payment terms might give us a chance to survive. Without accepting long payment terms, we might not even have orders, let alone survive," a business executive of a supplier told Gasgoo Auto. "In such a fiercely competitive environment, suppliers have no choice but to comply with harsh business conditions. As long as we are not eliminated, we are willing to do anything."

On June 1, the revised version of the "Regulations on Ensuring Payment to Small and Medium-sized Enterprises" officially came into effect, clearly stipulating that large enterprises should pay for goods, projects, and services procured from small and medium-sized enterprises within 60 days from the date of delivery of the goods, projects, and services. The use of commercial bills and other non-cash methods to indirectly extend the payment period is prohibited.

This policy sword precisely blocks the common practices used by car companies, providing a legal basis for the implementation of the 60-day payment term.

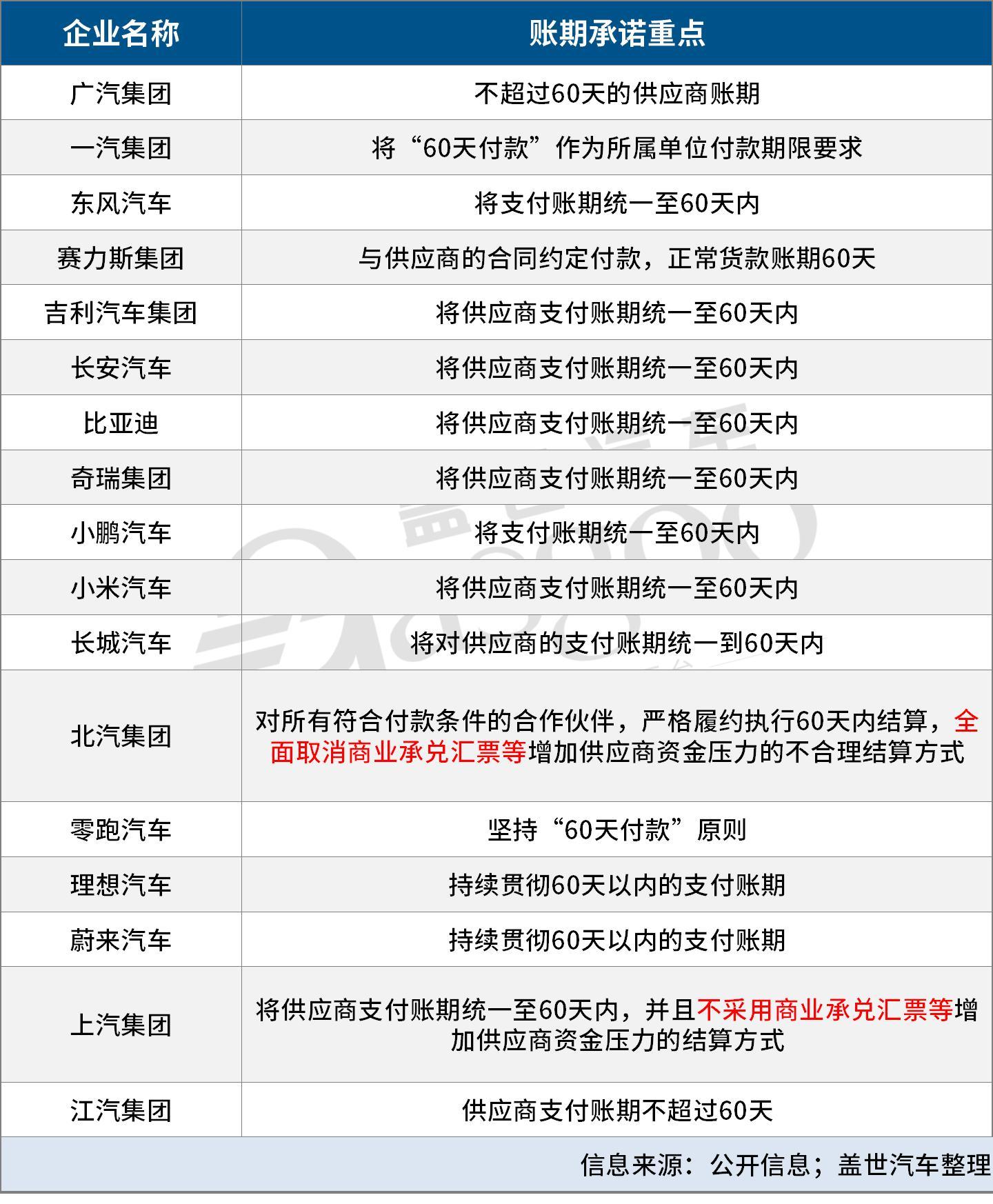

Under the impetus of policy, on the evening of June 10, China FAW, Dongfeng Motor, GAC Group, and Seres were the first four automakers to issue statements promising to keep supplier payment terms within 60 days. Subsequently, Geely, BYD, Chery, and other car manufacturers followed suit, and by mid-June, about 20 automakers had clearly stated that they would keep payment terms within 60 days.

The collective action of car companies marks the official initiation of a revolutionary transformation in the flow of funds within the supply chain of the Chinese automotive industry, driven by both policy and industry self-discipline. It seems that the "tightening curse" hanging over the heads of suppliers is about to be lifted.

Traditional Operating Model of the Automotive Industry

For suppliers, the implementation of a 60-day payment term means a significant shortening of the capital turnover cycle, greatly improving cash flow.

In the past, suppliers often faced issues such as being unable to promptly procure raw materials, pay labor costs, and maintain inventory due to extended payment terms, which even impacted product delivery and their own survival.

After the payment terms were shortened to 60 days, the financial pressure on small and medium suppliers eased, their financing needs decreased, and their profit margins improved.

Taking the aforementioned cell factory as an example, due to the shortened account period, more than 60% of the deposited funds can be released annually. This not only significantly improves the company's cash flow but also enhances its initiative in the global resource competition.

For car companies, the implementation of a 60-day payment term means a direct increase in cash flow pressure.

In the past, automakers have alleviated financial pressure by extending payment terms to achieve "disguised financing." However, as payment terms shorten, this model is no longer viable. For instance, an automaker with an annual production capacity of one million vehicles may need to advance over ten billion yuan each year for account reconciliation and settlement.

Moreover, the organizational system capabilities of car companies are also facing challenges. The compression of payment terms means that multiple nodes such as procurement ordering, contract review, financial payment, and invoice entry all need to shorten their cycles.

From the perspective of the entire industry chain,The implementation of a 60-day payment term helps to break the traditional "conflict between manufacturers and retailers," and build a more fair, transparent, and sustainable industrial ecosystem.

In the past, long payment terms exacerbated the conflicts between component suppliers and car manufacturers, with component suppliers' net profit margin dropping from 9% in 2015 to 3.8% in the first quarter of 2025. Nowadays, the regulation of payment terms helps alleviate the operational pressure on suppliers, improves the capital usage efficiency of the entire supply chain, and enhances the willingness and depth of collaboration between upstream and downstream enterprises.

60-day payment termPotential risksUnignorable

Undeniably, a 60-day payment term is a positive development for the automotive industry. The industrial chain and supply chain are the "muscles and veins" of the automotive industry, and establishing a good supply chain ecosystem is crucial for the development of the automotive industry.

However, the 60-day billing period challenges the traditional operations model on the other side, posing a significant test to the capital pool of automobile companies. Some companies may be compelled by financial pressures to adopt new financing methods, such as bank loans or equity financing. This will not only increase the financial costs for the companies but may also lead to a rise in debt risk.

For example, by the end of 2024, a new power company's debt ratio reached as high as 87.45%, and further increased to 92.55% by the end of the first quarter of 2025. Its accounts payable turnover days were as high as 195 days. This means that if the company strictly adheres to a 60-day payment term, its financial pressure will further intensify.

According to Wind data, the accounts payable and notes payable in the automotive industry have already exceeded 1 trillion yuan in 2024. This means that if the payment terms are shortened, it is highly likely to trigger a debt crisis for vehicle manufacturers. "If executed according to a 60-day payment term,The funds of 8 listed car companies in the A-shares and some new power automakers will all be below the safety line.Automotive industry analyst Zhang Feng told Gasgoo Auto.

From the perspective of car companies, many prefer to implement a 60-day payment term for new accounts.As for existing debts, alternative measures will be taken to resolve them in order to balance financial pressure.

This also raises another layer of concern, which is the abuse of supply chain finance.

Gaishi Automotive, through reviewing the commitment documents of car companies, found that among those publicly committed to a 60-day payment period, onlySAIC Motor Corporation and BAIC Group have explicitly stated that they will not use commercial acceptance bills and other similar settlement methods.Most car companies are likely to "pay" through bank acceptance bills, commercial acceptance bills, or accounts receivable electronic vouchers (X-chain), rather than paying directly in cash.

"The automaker's promise of a 60-day payment term does not mean that the supplier will receive payment within 60 days," the business manager of the supplier said. "Automaker settlements generally follow several steps, including contract signing, execution, acceptance, invoicing, and payment collection."

Due to multiple steps involved, the settlement methods of different car companies vary. Some companies settle in stages, while others only settle after 100% of the work is completed. This complexity may lead to inconsistencies in the execution of payment terms, and some car companies may not fulfill their promises. The commitments are promising, but the reality is disappointing.

Additionally, shorter payment terms can benefit suppliers, and some automakers may also seek other ways to balance costs. For example,Some car companies may request suppliers to shorten the payment terms as a reason. Price reduction. This may lead to suppliers facing new cost pressures while alleviating financial stress.

Gasgoo Auto found through research that the implementation of the 60-day billing cycle was not achieved overnight. Now, the 60-day deadline is approaching, but judging from the suppliers' reactions, the execution efficiency does not look promising.

This also indicates that the 60-day payment term, which appears to be a quick and simple solution, involves many complex processes in actual execution and is difficult to standardize with a uniform set of criteria.

The Ministry of Industry and Information Technology has clearly stated that it will guide industry organizations in researching and formulating settlement and payment standards for the automotive industry, promote model contracts, further standardize the payment process of suppliers by automobile enterprises, and promote the construction of a collaborative and win-win development ecosystem between complete vehicles and components, thereby promoting the healthy and sustainable development of the automotive industry.

It is evident that building a healthy industrial ecosystem is a long and arduous task.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track