6 Years of Massive Losses Totaling 7 Billion! From "Stopping the Bleeding" to "Generating Revenue," What Signals Does the Strategic Restructuring of Sinochem Equipment Release?

After divesting loss-making assets for half a year, the state-owned enterprise-controlled company Sinochem Equipment Technology (Qingdao) Co., Ltd. (hereinafter referred to as "Sinochem Equipment") is embarking on a strategic restructuring once again.

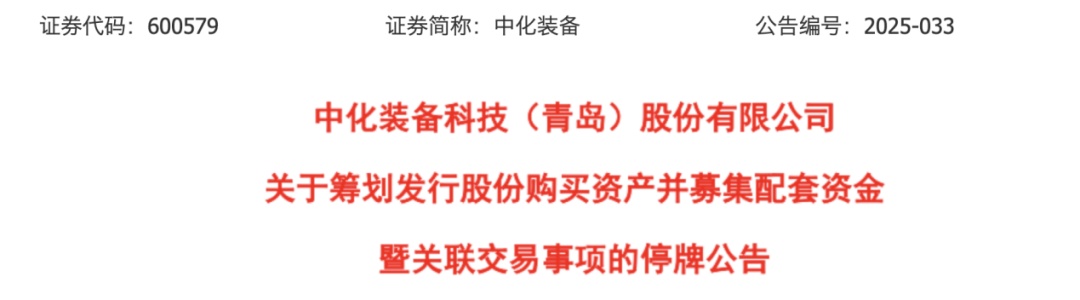

Recently, Sinochem Equipment announced that the company plans to issue shares to acquire 100% equity of Yiyang Rubber & Plastic Machinery Group Co., Ltd. ("Yiyang Rubber Machinery") and 100% equity of Bluestar (Beijing) Chemical Machinery Co., Ltd. ("Beijing Chemical Machinery"), and to issue shares to no more than 35 qualified specific investors to raise supporting funds.

This transaction constitutes a related-party transaction and is expected to meet the criteria for a major asset restructuring, but it will not result in a change of control of the company. It is noteworthy that all parties involved in the transaction are enterprises under Sinochem Holdings Corporation Limited, which makes this restructuring a typical example of internal resource integration within a central enterprise.

So, why has Sinochem Equipment initiated this restructuring? What considerations lie behind its frequent adjustments in the past two years? Zhuansu Vision provides an analysis for you.

6Annual loss of 70A Billion: A Transformation Storm Triggered by a Troubled Acquisition

The strategic breakthrough amid six years of losses constitutes the direct motivation for this restructuring.

Financial data shows that between 2019 and 2024, the net profit attributable to shareholders of Sinochem Equipment was consistently negative. In 2019, the loss was 158 million yuan, in 2020 it was 230 million yuan, in 2021 it was 246 million yuan, in 2022 the loss sharply increased to 1.618 billion yuan, and in 2023 it further expanded to 2.768 billion yuan. Although the loss narrowed in 2024, it was still 2.202 billion yuan, with the cumulative loss exceeding 7 billion yuan. This predicament largely stems from a problematic acquisition at the end of 2018—Sinochem Equipment spent 6.062 billion yuan to acquire 100% equity of Equipment Luxembourg, bringing the German veteran rubber and plastic machinery manufacturer KM Group under its wing. However, except for briefly achieving profitability in 2018, KM Group subsequently fell into consecutive years of losses, directly dragging down the performance of the listed company.

Under the pressure of six consecutive years of losses, Sinochem Equipment urgently needs to achieve business transformation and performance improvement through strategic restructuring.

Image source: Sinochem Equipment official website

From the perspective of industry development, the structural adjustment of the chemical equipment industry is the industry background driving this restructuring. Currently, China's equipment manufacturing sector is undergoing profound changes. On one hand, the traditional equipment market faces pressure due to the slowdown in investment growth in downstream industries such as petrochemicals and tires; on the other hand, driven by the "dual carbon" goals and industrial upgrading, the demand for high-end and green equipment is showing an upward trend.

According to Sinochem Equipment’s performance for the first half of 2025, although revenue from chemical equipment and rubber machinery businesses declined year-on-year, the company reduced its net loss attributable to shareholders by more than 85% compared to the same period last year by divesting loss-making overseas assets. This indicates that its strategy of focusing on core businesses has begun to show results. The acquisition of Yiyang Rubber & Plastics Machinery and Beihua Machinery will further strengthen the company’s competitiveness in the high-end chemical equipment and rubber machinery sectors, in line with the industry’s trend toward transformation and upgrading.

Collaborative Combat: Decoding the Integration Strategy between Yiyang Rubber Machinery and Beihua Machinery

Maximizing synergies is the core strategic consideration for this reorganization. Although Yiyang Rubber & Plastics Machinery Group and North Chemical Machinery belong to the same chemical equipment sector, they each have their own advantages in different sub-fields.

Yiyang Rubber Machinery was established in 2000 and is a state-owned sole proprietorship limited liability company with a registered capital of 85 million yuan. According to information on its official website, the company is one of the largest rubber machinery manufacturers in China and a well-known international supplier of rubber machinery. Its main products include internal mixers, tire vulcanizing machines, platen vulcanizing machines, and twin-screw extruders. These products are deeply integrated into various stages of tire production and are the "heart" components that determine tire efficiency, quality, and consistency.

And Beihua Machinery in refining. The experience in the field of specialized equipment manufacturing is expected to create a synergistic effect with the existing business of SinoChem Equipment.

By integrating the technological advantages and market resources of these two companies, Sinochem Equipment is expected to build a complete equipment manufacturing system covering multiple scenarios such as chemicals, environmental protection, rubber, and tires, achieving a closed-loop industrial chain.

From the perspective of central state-owned enterprise reform, this restructuring is an important step in the optimization of internal resource allocation for Sinochem Group. As an A-share listed company under Sinochem Group, Sinochem Equipment's acquisition of the two target companies, both of which are quality assets within the group, represents a market-based approach to professional integration. This not only avoids intra-industry competition but also achieves the concentration of resources towards advantageous enterprises and core businesses, aligning with the policy direction of the State-owned Assets Supervision and Administration Commission (SASAC) to promote the professional integration of central enterprises.

Rebirth After Breaking the Wrist: A Comprehensive Review of Two Years of Strategic Adjustment at Sinochem Equipment

In the past two years, Sinochem Equipment has implemented a series of bold strategic adjustments, from business restructuring to brand reshaping, demonstrating the determination of this established equipment manufacturing company to cut its losses and focus on its core business.

Divesting overseas loss-making assets has become a crucial first step in the strategic transformation of Sinochem Equipment. On December 31, 2024, the company announced the completion of the sale of its 90.76% stake in Equipment Luxembourg. This major asset restructuring project marks a substantial separation from the problematic KM Group. Before the transaction, Equipment Luxembourg was a wholly-owned subsidiary of Sinochem Equipment. After the transaction, Sinochem Equipment's shareholding in Equipment Luxembourg significantly decreased, transforming it from a wholly-owned subsidiary to an associate company. Consequently, KM Group and its subsidiaries are no longer included in the consolidated financial statements of the listed company.

Image source: AI-generated

The direct effect of this measure is a significant improvement in the company's financial situation—by the end of 2024, the company's debt-to-asset ratio is 55.68%, a decrease of 26.7 percentage points from the end of 2023. In the first half of 2025, the net profit attributable to shareholders is expected to be between -22.06 million yuan and -14.71 million yuan, a substantial narrowing compared to the loss of 287 million yuan in the same period of 2024.

With the completion of the sale of Luxembourg equity, the company's main business has undergone a fundamental change: shifting from the original plastic machinery business to two main sectors—chemical equipment and rubber machinery. This adjustment is not accidental, but is based on the company's positioning considerations within the overall layout of Sinochem. As a chemical equipment platform under Sinochem, Sinochem Equipment's current business structure includes Tianhua Institute, which undertakes the chemical equipment business, and Sinochem Rubber Machinery, which is responsible for the rubber machinery sector.

By divesting the underperforming plastic machinery business, the company is able to concentrate resources on developing its core businesses with greater strategic synergy. Notably, the proposed acquisition of Yiyang Rubber Machinery will enhance Sinochem Rubber Machinery's rubber machinery segment strength, while Beihua Machinery will complete Tianhua Institute's chemical equipment industry chain, forming a clearer...Specialized business layout.

In January 2025, Sinochem Equipment will be renamed "Sinochem Equipment Technology (Qingdao) Co., Ltd." to strengthen its central enterprise attributes and technological positioning. Through a series of adjustments over the past two years, Sinochem Equipment has initially completed the first stage of its strategic transformation: "stop the bleeding—recovery—regeneration." Next, with the injection of Yiyang Rubber & Plastics Machinery Group and Beihua Machinery, the company is expected to enter a new development phase of "quality improvement—expansion—leadership," ultimately achieving its strategic positioning as a "high-end equipment manufacturer." Of course, this transformation process still faces challenges such as industry cycle fluctuations and integration effects not meeting expectations, and its ultimate success still requires market validation.

The asset restructuring of Sinochem Equipment marks its strategic deepening in the high-end equipment sector. By integrating the industrial resources of Yiyang Rubber & Plastics Machinery Group and Beihua Machinery, it is expected to accelerate the construction of an equipment manufacturing system covering multiple scenarios such as chemical and environmental protection. Although the first half of the year still saw losses (estimated losses of 14.7 million to 22.06 million yuan), the loss reduction was significant. With the injection of Yiyang Rubber & Plastics Machinery and Beihua Machinery, the company is poised to enter a new development phase of "quality improvement—expansion—leadership." Driven by the dual factors of the industry's demand recovery and the release of internal synergies, this restructuring may become a crucial turning point for Sinochem Equipment to turn losses into profits, and it sets a new example of central enterprise reform for the rubber chemical equipment industry. The future effects of the integration are worth the industry's continuous attention.

Editor: Lily

Sources: Tire Report, China Report Hall, Shanghai Securities News, Tencent News, Phoenix News, JuJiao Official Account

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track