$520 Million Market! Global Mono-Oriented Polypropylene (MOPP) Film Industry

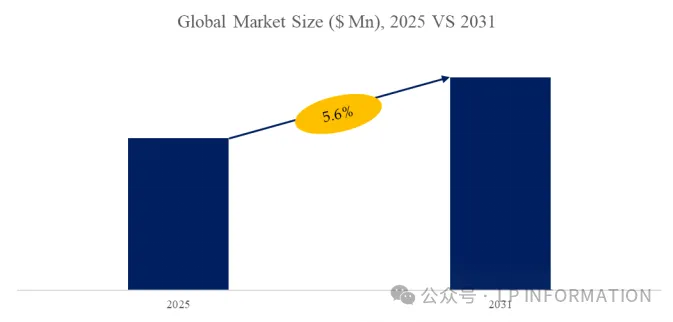

According to the US market research publisher LP Information, the global Mono-Oriented Polypropylene (MOPP) film market is expected to reach USD 520 million by 2031, with a compound annual growth rate (CAGR) of 5.6% in the coming years.

Figure 00001. Global Market Size of Monoaxially Oriented Polypropylene (MOPP) Film

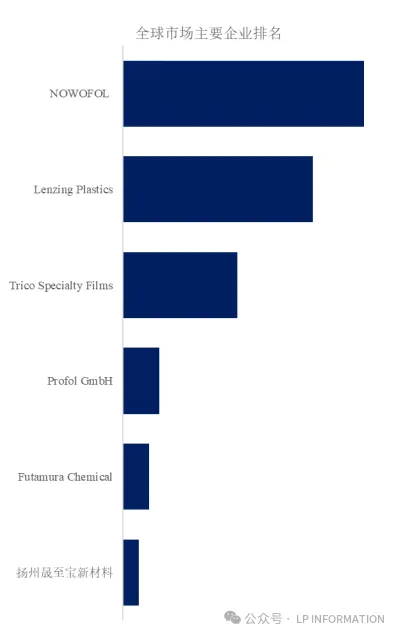

Figure 00002. Top 6 Global Manufacturers of Mono-Oriented Polypropylene (MOPP) Films and Their Market Shares (Based on 2024 Survey Data)

Major global manufacturers of mono-oriented polypropylene (MOPP) films include NOWOFOL, Lenzing Plastics, Trico Specialty Films, Profol GmbH, Futamura Chemical, and Yangzhou Sheng Zhibao New Materials. In 2024, the top five manufacturers worldwide accounted for approximately 59.0% of the market share.

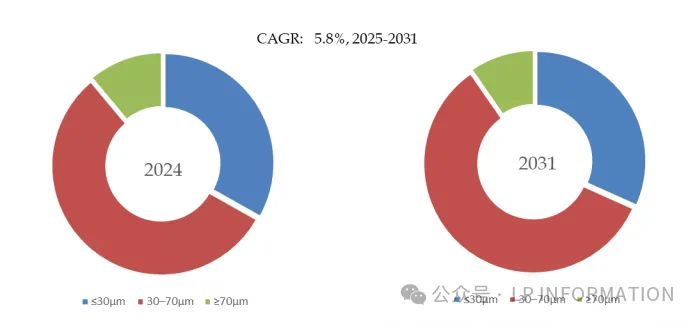

Figure 00003. Global Market Size of Mono-Oriented Polypropylene (MOPP) Films, by Product Type, with 30–70μm Segment Dominating

In terms of product type, the 30–70μm segment is currently the main product category, accounting for approximately 55.8% of the market share.

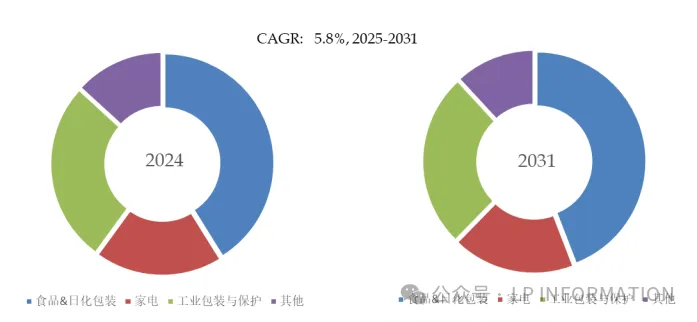

According to Figure 00004, the global market size of mono-oriented polypropylene (MOPP) films is segmented by application, with food & consumer goods packaging being the primary source of demand, accounting for approximately 41.1% of the share.

In terms of product application, food and daily chemical packaging is currently the primary source of demand, accounting for approximately 41.1% of the share.

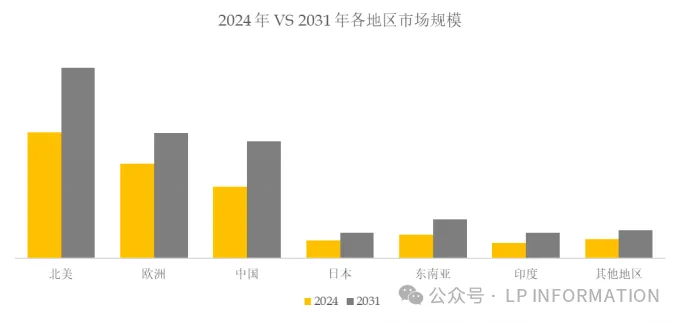

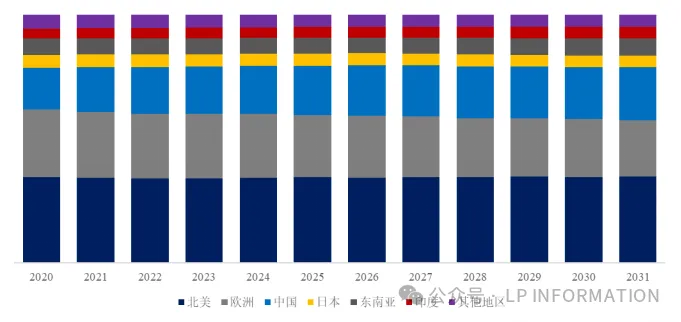

Figure 00005. Global Mono-oriented Polypropylene (MOPP) Film Scale, Major Regional Share

Figure 00006. Global Major Market Single-Oriented Polypropylene (MOPP) Film Scale

Main driving factors:

The mono-oriented polypropylene (MOPP) film industry is ushering in structural growth opportunities, especially against the backdrop of rising global demand for green packaging and functional materials. With increasing requirements for high-strength, easy-to-process, and environmentally friendly film materials in downstream sectors such as food packaging, labeling, home appliance protection, and industrial consumables, MOPP films are gradually replacing traditional materials in specific applications due to their superior longitudinal tensile strength, excellent stiffness, and good printability. The global market is transitioning from stability to growth, particularly in emerging regions like the Asia-Pacific, where MOPP film consumption is rapidly expanding and becoming a key driver of industry growth.

Currently, single-material plastic packaging films worldwide mainly focus on polyethylene and polypropylene. In developed regions such as Europe and the United States, concerns about recycling efficiency and environmental impact have placed policy and market pressures on traditional multilayer composite materials. In contrast, polypropylene-based single-material packaging, such as MOPP films, offers outstanding environmental advantages. Its simple structure and clear recycling pathways promote effective waste reutilization and drive the circular economy, significantly reducing the carbon footprint. It is a key direction for the future upgrade of sustainable packaging materials.

The development of the MOPP film market is being accelerated by policies and regulations. The European Union has introduced a revision of the Packaging and Packaging Waste Regulation (PPWR), and China is continuously advancing its action plan for managing plastic pollution. Both are advocating for packaging materials to be more environmentally friendly, functional, and easy to recycle. In this trend, MOPP films, which offer higher mechanical performance and environmental adaptability, are becoming a potential alternative in many brands' green material strategies. With improvements in process technology, optimization of raw materials, and expansion of application fields, MOPP films are expected to achieve technological breakthroughs, expand their market share in flexible packaging and industrial films, and enter a period of rapid growth.

Main obstacles:

One of the main challenges faced in the manufacturing of MOPP films is the high complexity of process control. Machine Direction Orientation (MDO) can significantly improve the film’s barrier properties, rigidity, flatness, and tensile strength, but it is very difficult to master in actual operation. For example, in multilayer films containing nylon or EVOH, although stretching can enhance barrier performance, it can also make the material brittle. Therefore, without precise control of process parameters such as preheating temperature, stretching ratio, and annealing position, product instability or deterioration of physical properties is highly likely to occur. This demands a very high level of technical capability, raising the industry’s entry barriers and making it difficult for small and medium-sized enterprises to enter the high-end market.

The product development cycle is long and the cost of trial and error is high. Since the structure and formulation design of MOPP films must be highly matched with the final application, even slight mismatches can result in products failing to meet strength, adhesion, or processing requirements. Many complex MDO products (such as multilayer functional films) are not only difficult to design, but also prone to issues such as wrinkling, film breakage, and edge warping during mass production. This requires prolonged and repeated adjustment of equipment parameters, extending the time to market and increasing both R&D and raw material consumption costs. Adhesive tapes produced with MOPP films may also experience problems such as delamination and insufficient adhesion.

In addition to technical and development challenges, supply chain and transportation risks are also external factors that cannot be overlooked. The MOPP film market is concentrated in Europe and the United States, but its customers are distributed globally, and the products are sensitive to transportation conditions. During periods of logistical constraints (such as the COVID-19 pandemic), delays in long-distance transportation will directly affect the normal use by downstream customers, especially in industries such as home appliances and food packaging, which have extremely high requirements for delivery stability. Furthermore, manufacturers being far from the end markets results in long feedback cycles, which is unfavorable for rapid iteration and optimization of product performance, thus placing them at a disadvantage in fierce competition.

Industry Development Opportunities

In the coming years, MOPP film is expected to attract more attention under the trend of single-material soft packaging. With the rising global demand for sustainable materials, MOPP film is gradually becoming a candidate for environmentally friendly packaging alternatives due to its good recyclability and simple structure. Particularly in niche applications such as labels, tapes, and protective films for electronic components, its high strength and excellent processing performance make it highly competitive. Meanwhile, with the application of new technologies such as anti-static, low-shrinkage, and high-transparency modifications, the performance of MOPP film will continue to improve, meeting more high-end demands.

The global market is also showing a trend of regional focus gradually shifting towards the Asia-Pacific region, particularly China. Although European and American manufacturers currently still dominate a large portion of the high-end market, the expansion rate of China's production capacity is significant. If domestic companies can overcome key technical bottlenecks, such as eliminating shrinkage and adhesion, and improving thermal stability and antistatic performance, they are expected to make breakthroughs in the mid-to-high-end industrial film market, further promoting the localization of MOPP film.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track