5000 tons of pps expansion completed! why are giants like toray, wanhua chemical, and solvay so optimistic about pps?

Summary:

Expanding capacity, increasing research and development, and establishing a full industry chain layout... Global chemical giants are investing real money in polyphenylene sulfide (PPS).

In October 2025, the second PPS production line at Toray Advanced Materials Korea's Gunsan plant was completed, increasing the annual production capacity by 5,000 tons, bringing Toray's total capacity in Korea to 13,600 tons, firmly maintaining its leading position in the industry.

Source: Toray

This is just a microcosm of the rapid development of the PPS industry in recent years.

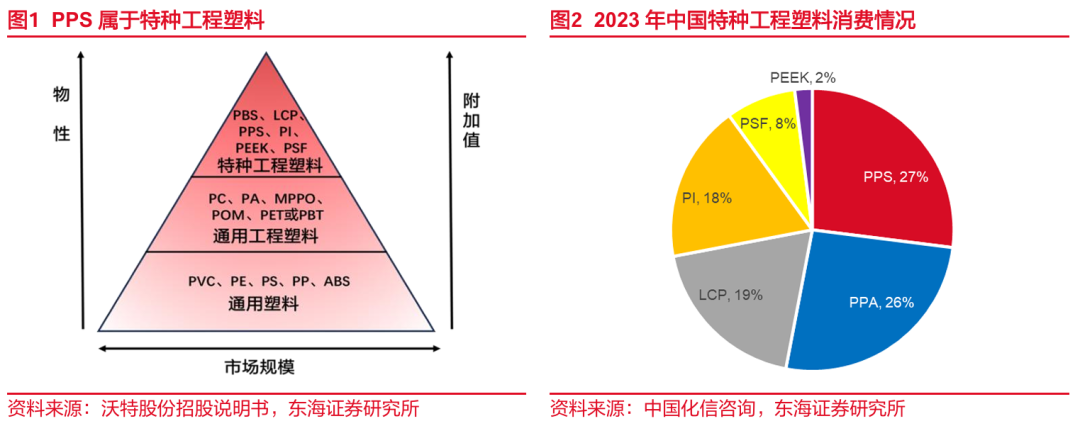

According to the report by China Huaxin, PPS accounted for 27% of consumption in 2023, ranking first among the six types of special engineering plastics. This material, known as "plastic gold," is becoming one of the most highly regarded stars in the new materials field. This article will start from the current industry situation and delve into the underlying logic and future opportunities for PPS.

Source: Donghai Securities

01Global capacity expansion accelerates, with China becoming the main battlefield.

The most notable feature of the current PPS industry is the rapid expansion of production capacity, with the main battleground being in China. According to think tank data, by 2024, the global PPS resin production capacity will have reached 210,000 tons per year, an increase of 34,000 tons per year compared to 2020, with a compound annual growth rate of approximately 4.5%.

The global PPS resin production capacity is mainly distributed in Northeast Asia and North America, concentrated in China, Japan, South Korea, and the United States. By the end of 2024, the top five manufacturers will account for 60% of the global total production capacity, indicating a high concentration of capacity. Japanese companies have long maintained a technological lead, with Toray, Kureha, and DIC occupying about 45% of the global capacity.

TableGlobal PPSResin Main Producers (Source: Donghai Securities Research Institute)

The rise of the Chinese market is particularly remarkable. From 2020 to 2023, China's PPS self-sufficiency rate increased from 45% to 64%. In 2024, China has a total of 11 PPS resin production companies, with a nominal production capacity of 92,000 tons per year and an effective production capacity of 68,000 tons per year.

2025The second half of the year in China PPSThe industry is ushering in a new wave of enthusiasm.

In September, the patent for "A Polyphenylene Sulfide Resin and Its Preparation Method" applied by Wanhua Chemical Group Co., Ltd. was published. This invention discloses a polyphenylene sulfide resin and its preparation method, wherein the weight-average molecular weight of the polyphenylene sulfide resin is 20,000 to 50,000, the molar ratio of thiol end groups to chloro end groups is 1 to 9, and the chloro end group content is 15 to 60 μmol/g. This is already the company's second related patent this year. As early as April, it released technology aimed at reducing the generation of oligomer waste during the polymerization process.

On August 28, the project of Huangshan Dongtai Qixin Technology Co., Ltd. to produce 80,000 tons of polyphenylene sulfide resin annually officially commenced. The project plans a total investment of 1.6 billion yuan, and upon completion, it is expected to achieve an annual output value of 4 billion yuan. The project targets high-end demands such as 5G communication and humanoid robots, with the first phase expected to be completed and put into operation by the end of June 2026.

In July, Shengji New Materials disclosed that its project with an annual production capacity of 100,000 tons of polyphenylene sulfide is planned to be completed in November, with the overall facility expected to be operational in December. Once the project is put into production, it will have a profound impact on the new materials industry in Shandong and is expected to drive the rapid development of the related industrial chain.

At the construction site of the Shandong Shengji New Material Project in the Lubao High-tech Development Zone, Wudi County, Shandong Province, workers are busy hoisting the filling materials for the cooling water station.Image Source: Dazhong Daily

In June of this year, Solvay announced the completion of its capacity expansion plan for specialty polymer modification at its Changshu plant. The expanded capacity is now fully operational. The scope of this expansion includes Amodel.® PPA、Ryton® PPS、Kalix® HPPA、Omnix® HPPA and Ixef®The polymer modification production line, including PARA, focuses on serving strategic emerging industries such as electric vehicles and semiconductors.

In June, NHU stated on the interactive platform that the company's current PPS annual production capacity is 22,000 tons, with the goal of achieving 100% capacity utilization by 2024. Subsequently, expansion plans will be made based on market demand.

These trends fully demonstrate capital's recognition of PPS's prospects.

02 PPS Excellent performance builds high barriers.

The widespread optimism about PPS is based on its excellent performance indicators. As a high-performance thermoplastic resin with phenylthio groups in its molecular chain, PPS is composed of benzene rings and sulfur atoms arranged alternately. This structural regularity gives PPS a high degree of crystallinity, while also possessing both rigidity and flexibility.

The core performance advantages of PPS are mainly reflected in six aspects: high temperature resistance (long-term use temperature reaches 220-240℃), chemical corrosion resistance (resistant to strong acids, strong bases, and organic solvents), high mechanical strength (tensile strength about 70-90 MPa), flame retardancy (UL94 V-0 level), dimensional stability (low moisture absorption <0.05%), and excellent electrical insulation (dielectric constant as low as 3.0-3.5).

Compared to other specialty engineering plastics, PPS stands out in terms of cost-effectiveness. Particularly in emerging fields such as humanoid robots, PPS not only possesses excellent heat resistance, chemical corrosion resistance, and good electrical insulation properties, but also features outstanding mechanical strength and toughness. It can satisfy the performance requirements of most critical components, while its cost is significantly lower than that of high-end materials like PEEK.

PPS usually requires modification to meet the demands of more application scenarios. Through modifications such as inorganic particle filling, glass fiber/carbon fiber reinforcement, alloy blending, and elastomer toughening, PPS can satisfy the requirements of more specific application scenarios. Currently, more than 80% of PPS consumption is realized through composite reinforced modified materials. Domestic PPS modification companies such as Kingfa Sci & Tech and Waterborne Co., Ltd. have built competitive advantages in niche markets through their technological accumulation.

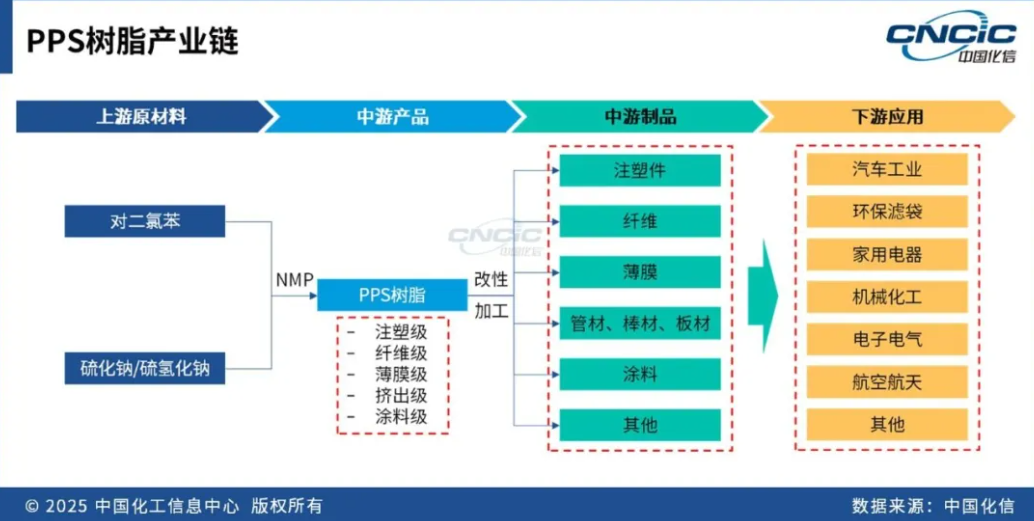

According to the processing and molding technology, PPS resin can be classified into injection molding grade, fiber grade, film grade, extrusion grade, and coating grade. Different types of PPS resins can be modified and/or processed to produce injection molded parts, fibers, films, pipes, rods, sheets, coatings, etc., and further processed into components, pipe fittings, structural parts, environmental protection filter bags, other textiles, protective coatings, and other products. They are widely used in various fields such as automotive, environmental protection, household appliances, mechanical and chemical industries, and electronics and electrical industries.

Source: China Chemical Information

03New energy vehicles become the biggest driving force.

The rapid growth of the PPS market is largely attributed to the continuous expansion of its application scenarios.

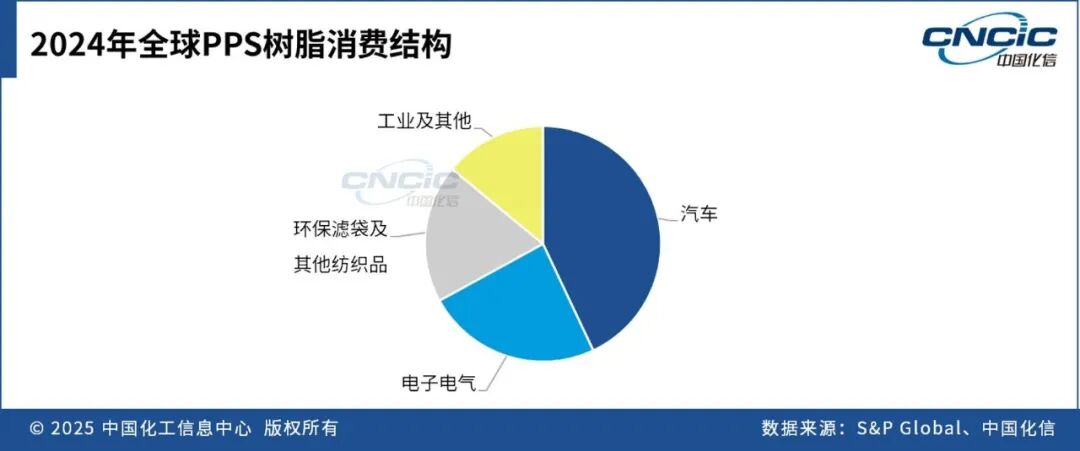

In 2024, the global consumption is approximately 129,000 tons, primarily used in the automotive, electronics and electrical, environmental filter bags, and industrial sectors. Among these, the automotive sector is the largest consumer of PPS resin globally, followed by the electronics and electrical sector.

Source: China Huaxin

New energy vehicles are PPS.The core engine of demand growthAccording to public information, the usage of PPS in traditional automobiles is about 700 grams, while in new energy vehicles it can reach 2500 grams, an increase of more than three times. The application scenarios of PPS in the new energy vehicle field include explosion-proof battery covers, busbars and terminal connectors in motor and electric drive devices, electronic water pumps, electronic oil pumps, etc.

Market data supports this trend: in 2024, the production and sales of new energy vehicles in China will reach 12.888 million and 12.866 million units, respectively, with a year-on-year growth of over 35%. New energy vehicle sales will account for 40.9% of total new car sales. According to the plan, by 2035, new energy vehicles are expected to account for more than 50% of total car sales in China, which will provide continuous growth momentum for PPS.

The high heat deflection temperature of PPS resin enables it to withstand infrared and vapor phase welding, and the miniaturization and automation of circuit board soldering demand higher processing temperatures, which will also drive...The demand in the electronic and electrical field is growing at an average annual rate.3.8%The speed increase。

The intelligent robot is another emerging market with great potential.Humanoid robots are in the early stages of development, with a huge future market potential. PPS can be applied to various components such as housing materials, some transmission components, motor insulation frameworks and connectors, robotic arms, joint linkages, and drive wheels.

According to the prediction by the China Academy of Information and Communications Technology, the market size of humanoid robots is expected to reach approximately 5 to 50 billion yuan between 2028 and 2035. After 2045, the market size could reach around the 10 trillion yuan level. This will create a huge incremental market space for PPS.

Additionally, with the development of industries such as 5G communication, low-altitude aircraft, and humanoid robots, new requirements will be posed for PPS materials.

04 PPSDemand continues to grow, and high-end is the trend.

The global PPS market will continue to maintain rapid growth in the coming years.

According to Global Info Research, the global PPS resin revenue was approximately USD 1.035 billion in 2023 and is expected to reach USD 1.677 billion by 2030, with a compound annual growth rate of 7.2% from 2024 to 2030.

The trend towards high-end development is a major future trend.Currently, the general specifications of PPS resin in China can meet conventional needs, but there are still gaps in special specifications and high-end applications. High-end products such as fiber-grade PPS (used for environmental protection filter bags), battery-grade PPS (used in new energy battery components), and low-chlorine high-purity PPS (used in high-end electronic packaging) still mainly rely on imports.

Furthermore,Integration of the industrial chain has become a common choice for leading enterprises.Zhejiang NHU has established a comprehensive industrial chain from "basic raw materials - high polymer - modified processing - specialty fibers," which is rare in China. It can stably supply various specifications of PPS resin, with a current PPS production capacity of 22,000 tons, ranking first in China. In 2024, it aims to achieve a 100% capacity utilization rate. This integrated layout helps the company reduce production costs, ensure raw material supply, and improve product quality.

It should be noted that the industry also faces certain risks. The PPS anti-dumping policy is expected to expire by the end of 2025, which may lead to greater competitive pressure from overseas brands. In addition, PPS production requires significant environmental protection investments, and changes in environmental policies may affect capacity deployment. Fluctuations in raw material prices can also impact the industry's profitability.

As the global manufacturing industry transitions towards high-end and intelligent development, PPS, as a key fundamental material, will continue to see its strategic value rise. The capacity expansion by international giants like Toray, the entry of chemical leaders like Wanhua Chemical, and the high level of attention from capital markets on the PPS concept all attest to this.

In the next five years, whether Chinese PPS companies can achieve breakthroughs in high-end fields and secure a more significant position in the global industrial chain remains to be seen. The only certainty is that the race for "plastic gold" has just begun.

Edited by: Lily

Source: Think Tank Industry Report, Donghai Securities Research, Chinaplas|China Chemical Information, Public Information of Enterprises

The data in this article is up to the end of 2024.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage