500 Billion Yuan: Deep Dive Into How Sichuan Challenges Jiangsu's Leading Position in the Battery Industry

The Great Westward Migration, with batteries as the vanguard.

For readers and media in the East, the concept of the "Western Migration" is somewhat obscure. In fact, this refers to a policy action announced on September 25, 2024, by the Central Committee of the Communist Party of China and the State Council, guiding the orderly transfer of industries from the East to the central and western regions, and from central cities to their hinterlands.

An important part of the "Great Western Migration" is the establishment of the battery industry in the southwest. This background is characterized by the accelerated global energy transition, where the new energy battery industry has become one of the core sectors. As a significant source of raw materials for new energy batteries, Sichuan's lithium ore resources account for 57% of the national total, making its resource advantages truly exceptional.

Moreover, Sichuan has abundant hydropower resources and sufficient power generation capacity. Its advantageous geographical location adjacent to Chongqing, a major automobile manufacturing hub, combined with multiple other advantages, has gradually made Sichuan and the surrounding areas an important cluster for the new energy battery industry.

Last year, Zhai Gang, the director of the Sichuan Provincial Department of Economy and Information Technology, predicted that by 2025, the total output value of the entire power battery industry chain in the province will reach 500 billion yuan.

In order to clarify the layout strategy of this area in the new energy sector, the Auto Commune conducted an on-site investigation, visiting several battery enterprises and new energy industrial parks from Longquanyi in Chengdu to Qionglai and then to Meishan, deeply observing the unique yet mutually supportive development pattern.

China Innovation Aviation's Two-Round Migration

When arriving at the Zhongchuang Xinhang Phase I project in Longquanyi, Chengdu, it just happened to be lunchtime. Workers streamed out of the factory on the east side of the road and headed straight to the restaurant and dormitory area on the west side of the road for their meal and rest.

On both sides of the road, employee vehicles occupy the entire non-motorized lane, and various cars are densely parked in the green area planned in front of the factory building. Additionally, in the small grove beside the main entrance, we also saw many employees gathered together, chatting and smoking.

As the "third" in power batteries, the Chengdu base, one of the nine global bases of CALB, has a phase one project for a 20GWh energy storage and power battery production base. The project has now been officially completed and entered the production stage, with the production line operating in an orderly manner. The roar of machines can be clearly heard near the plant area.

In fact, in the well-equipped park in Longquanyi, Chengdu, CALB and EVE Energy, two major battery companies, have become neighbors. Not far from them is Zeekr Auto.

Moreover, before Zhongchuang Xinhang Industry relocated westward, it had already undergone a round of eastward movement, shifting its production focus from the central region to Changzhou City in Jiangsu Province, eastern China. Undoubtedly, these two rounds of migration reflect the battery industry chain's transition from an industry-based foundation to a market-oriented approach, and then to resource agglomeration.

According to public information, the first phase of the CALB project covers an area of 594 mu, with a construction area of approximately 570,000 square meters. Once the project is fully completed and reaches full production capacity, it is expected to achieve an annual output value of 12 to 15 billion RMB and create employment for 8,000 people.

When we inquired about the occupancy rate of the dormitories and the total number of employees with the security guard on duty at the west campus, the security guard mentioned, "There are 5 dormitory buildings inside." Meanwhile, an employee we encountered in front of the main gate of the east plant area said that initially there were about 3000 to 4000 employees, but now it's unclear.

Next to the Phase One factory area, we also saw that the countdown for the Zhongchuang Xinhang Phase Two project is 139 days. The Phase Two project plans an investment of 12 billion yuan and is expected to begin mass production early next year. After the commencement of production, the capacities and efficiencies of Phase One and Phase Two projects will be integrated. When fully operational, the total capacity will reach 50 GWh. It is expected to achieve an annual output value of 40 billion yuan, create 13,000 new jobs, and further drive upstream and downstream industry chain investments exceeding 10 billion yuan.

For Longquanyiy, it is a fortunate event to create such a large-scale and complete industrial chain of the new energy battery industry cluster.

Zhongchuang Xinhang not only has a base in Longquanyi, but in fact, its factory in the Pengshan Economic Development Zone of Meishan is larger. Among Zhongchuang Xinhang's nine industrial bases located in China, Europe, and ASEAN, Sichuan Province occupies two positions.

At the same time, several products from CALB's Meishan base have become "highlights" in the industry. These include the second-generation PHEV platform-specific "top high-power battery," the mass-produced first-generation "top high-energy super flight battery," as well as the planned second-generation flight-specific battery.

In Longquan Yuy, in addition to Zhongchuang Xinhang, another power storage battery company, Yiwei Lithium Energy, has also garnered attention for its layout. In October last year, Yiwei Lithium Energy's factory here officially commenced production. This factory mainly produces 21700 and 26105 type ternary lithium cylindrical batteries, which are the same specifications as the Panasonic batteries supplied to Tesla.

Unlike CALB, which concentrates its industrial focus, EVE Energy has adopted a multi-point approach for its domestic layout. The facility we visited this time is already EVE Energy’s 33rd factory.

At the factory entrance, which looks somewhat small, we didn't see many people or vehicles, but it was the afternoon shift start time, and we could clearly hear the roar of machines operating. The total area of EVE Energy's 33rd factory is about 11,000 square meters, with an annual production capacity of nearly 500,000 battery cells. Currently, its second phase plans to achieve an annual production capacity delivery of 100 MWh by December 2026.

In addition, on September 2, 2024, EVE Energy's Solid-State Battery Research Institute officially inaugurated its mass production base in Chengdu, and the "Longquan No.2" all-solid-state battery successfully rolled off the production line. The "Longquan No.2" is a 10Ah all-solid-state battery mainly targeted at high-end equipment applications such as humanoid robots, low-altitude aircraft, and AI. Of course, for automotive applications, it is estimated that it will still take a few more years.

Currently, Longquanyi has gathered 10 leading complete vehicle companies and more than 300 key component enterprises, forming a relatively complete automotive industry ecosystem. Therefore, whether it is Zhongchuang Xinhang or EVE Energy, both actually value the strong industrial foundation here.

The two major "chain leaders" of Qionglai

Setting out from Longquan Yi and heading southwest, we head straight for the "Tianfu New Area New Energy and New Materials Industrial Park" in Qionglai, continuing to explore the layout of Chengdu's new energy industry.

The name of this industrial park in Qionglai is clearly intended to be associated with Chengdu. The planned area of the park covers 18.7 square kilometers, and reportedly, more than 320 enterprises have settled there. Among them, the new energy battery materials industry has formed an industrial cluster with Putailai and Rongjie Lithium as the "leading" enterprises. In addition to Rongjie Lithium and Putailai, several other new energy enterprises such as Changhong, Hongli, and Aimint have also set up operations in the park.

However, we drove around for a long time, and actual investigations and visits revealed that the number of enterprises in the park seems to differ somewhat from the data. Moreover, there are hardly any living facilities within the industrial zone, with the nearest ones several kilometers away.

"You can't take photos; only those from the government are allowed to." The security guard of Rongjie Lithium Industry immediately came out to stop us when he saw us taking pictures. After we inquired, he revealed that there are only about dozens of companies located in the nearby park. Rongjie Lithium Industry itself covers an area of approximately 400 acres and occupies an important position within the park.

Data shows that the company has completed the construction of a 20,000 t/a lithium salt production line and supporting utility and environmental protection facilities, enabling an annual output of 12,000 tons of battery-grade lithium carbonate and 8,000 tons of battery-grade lithium hydroxide monohydrate. Additionally, it can also produce 44,300 tons of anhydrous sodium sulfate (Glauber's salt) as a by-product.

Diagonally opposite to the factory area of Rongjie Lithium Industry, there is another planned project to utilize reserved land for the construction of the "Chengdu Rongjie Lithium Industry Lithium Iron Phosphate Cathode Material Integrated Production Base Project." This project mainly includes production lines for lithium carbonate, iron phosphate, and lithium iron phosphate.

According to the plan, after completion the project is expected to achieve an annual output of 80,000 tons of lithium iron phosphate products. However, during the on-site inspection, it was found that although the project’s signboard had already been erected, the project itself appeared not to have started. There was neither a relevant information board nor any project announcement posted. The guardhouse was unstaffed and instead filled with bicycles temporarily parked for charging. The reserved land behind the signboard was overgrown with weeds, and the entire area was deserted.

Another major enterprise in the park is Putailai. Its subsidiary, Sichuan Zhuoqin New Material Technology Co., Ltd.—a company specializing in membrane materials and coatings—is located here. The company’s project is adjacent to that of Sichuan Zihuan Technology, with a total investment of 8 billion yuan and a land area of 645 mu. It serves as a core supplier to well-known battery companies such as CATL and BYD.

According to the plan, Sichuan ZhuoQin New Material Technology Co., Ltd. will advance construction in two phases. Phase I is a project with an annual production capacity of 400 million square meters of lithium-ion battery separators and 600 million square meters of coated lithium-ion battery separators. Phase II plans to build a project with an annual production capacity of 1.8 billion square meters of lithium-ion battery separators and 5.94 billion square meters of coated lithium-ion battery separators, which is scheduled to be completed and put into operation before December 2025.

Sichuan Zihuan Technology, another subsidiary under Putailai's anode materials and graphitization division, is also advancing the construction of an integrated project with an annual capacity of 200,000 tons of high-performance lithium-ion battery anode materials.

The total construction area of Zihuan Technology's factory reaches 171,400 square meters. From the outside, it looks very grand, much like Aichi Motors when we visited it before. We walked around the factory area, and it was obvious that all the production buildings had been structurally enclosed, but it felt quite deserted. Many of the windows had broken glass. However, there are plenty of job postings online.

The two largest battery material companies have driven other satellite enterprises. However, what most people may not know is that Rongjie and Putailai are not the true "chain master" enterprises; behind them, in fact, stand two battery giants.

The parent company of Rongjie Lithium is Rongjie Group. The chairman of Rongjie Group is Lv Xiangyang, who is the cousin of Wang Chuanfu, the chairman of BYD. Putailai is also quite interesting. Its co-founder Chen Wei comes from the new energy technology company ATL, which is the predecessor of CATL (Contemporary Amperex Technology Co. Limited). Chen Wei once served as ATL’s engineering director and vice president of R&D, and can be considered a colleague and comrade-in-arms of Zeng Yuqun, the chairman of CATL.

When it comes to the relationship with BYD and CATL, there are many complexities involved. In short, these two new energy material companies both serve battery manufacturers and are a very important part of the supply chain, where a concentration of leading players is evident. Additionally, it should be noted that CATL's operations in Sichuan are mainly concentrated in Yibin.

In addition to these four battery companies, there is also Hive Energy, which has established production bases in Chengdu, Suining, and Dazhou, with a planned production capacity exceeding 110 GWh, and has set up a Southwest R&D base in Chengdu. Another company, Xinwanda, has invested 8 billion yuan in Deyang to build a 20 GW lithium battery and energy storage production base. With the gathering of six major battery companies, Sichuan's confidence in "summoning the dragon" (Dragon Ball reference, please don't mind) for industrial takeoff is undoubtedly strong.

Benefiting from the Great Western Migration

Speaking of the historical context of this investigation, it certainly begins with the "Great Western Migration" that started in 2021.

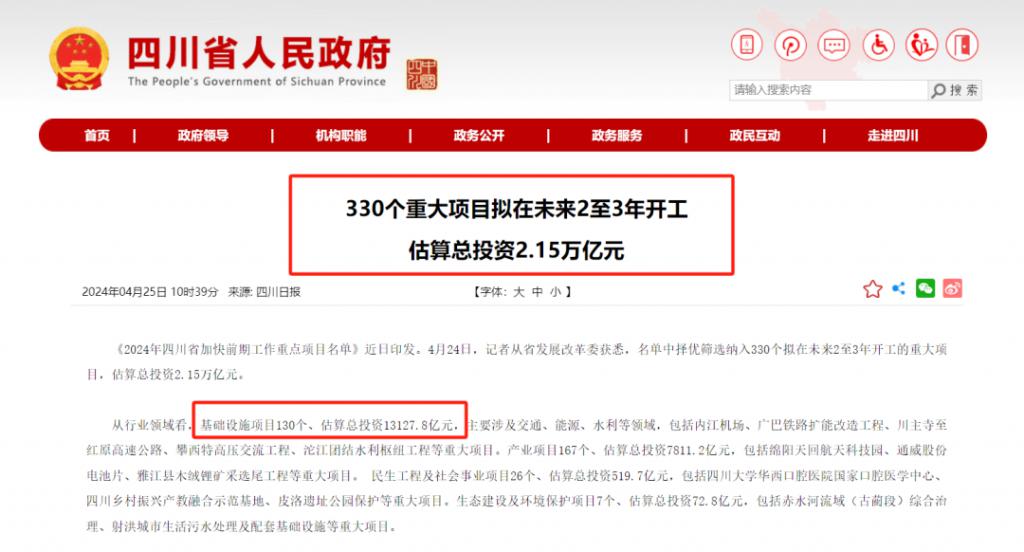

"The Western Development Initiative" involves multiple fields and major projects, with a total investment reaching 2.15 trillion yuan. Among these, the battery industry is also a key focus. After the concentration of six major battery enterprises, the number of upstream and downstream companies in the industry chain has exceeded 1,000. This has also played a role in promoting the upgrade of China's new energy industry from scale-oriented to quality-oriented, and from reliance on overseas resources to self-sufficiency and controllability.

At the same time, as one of the few provinces in China possessing all 41 industrial categories and 31 manufacturing categories, and with particularly outstanding development in the new energy vehicle and power battery industries, Sichuan has gathered 26 complete vehicle enterprises including FAW-Volkswagen, Dongfeng Peugeot-Citroën, Sichuan Lynk & Co, Volvo, and Yibin Kaiyi.

According to the data, in 2024, the total automobile production in Sichuan Province is expected to reach 890,000 units, with 134,000 units being new energy vehicles. The total output value of the entire industry chain will exceed 350 billion yuan. In addition, the production of power batteries will exceed 165.8 GWh, accounting for about one-fifth of the national total production. Based on data from the first half of this year, Sichuan's power battery production was 64.6 GWh, a year-on-year increase of 56.4%, demonstrating a strong momentum.

In addition, as early as 2022, Academician Ouyang Minggao of the Chinese Academy of Sciences stated at the opening ceremony of the 2022 World Power Battery Conference that the industrial trend of China’s power battery sector will inevitably shift to the western region.

Furthermore, the shipment volume of China's battery industry is expected to exceed 1 TWh by 2025, with a production value surpassing one trillion RMB, making it an industry with significant global competitiveness. Therefore, as a core city cluster of the national strategy, Sichuan will also take on more significant productivity layout responsibilities. While Europe and the United States are busy setting up their battery industries, China, through the construction of a resource base in the southwest, has already established a dual barrier for resource security and industrial chain security ahead of time.

From the perspective of the Western Development Strategy, Yibin should benefit significantly, with both CATL and Academician Ouyang Minggao choosing to establish bases here. By 2025, enterprises incubated by Sichuan New Energy Vehicle Innovation Center Co., Ltd. (Academician Ouyang Minggao's workstation), such as Sike Power, are also actively under construction in the Sanjiang New Area of Yibin.

Chengdu is the main beneficiary of this "Great Migration to the West," reportedly receiving more than 300 billion yuan in fiscal allocations. However, how much will the surrounding areas such as Qionglai and Meishan benefit?

During our investigation at the Tianfu New District New Energy and New Materials Industrial Park (Qionglai Economic Development Zone), we found that the Haowang Innovation Space, located opposite Zhuoqin under PuTaiLai, which started attracting investments at the end of 2023, is almost ready.

The goal of constructing this industrial park is to attract third-generation semiconductor materials, new energy batteries, chip cutting, new electronic materials, new battery materials, and their upstream and downstream industries, achieving a green development loop of "green production - green application - green recycling" in the battery industry.

We learned from Manager Wang, a manager at Haowang Tianqiong New Materials Industrial Park (Haowang Kechuang Space), that the industrial park is divided into two phases, covering a total area of 702 acres, with a total planned area of 392,000 square meters and a total investment of 5 billion yuan. It aims to attract 150 enterprises, with an annual output value of 2 billion yuan, an average annual tax revenue of 200 million yuan, and approximately 15,000 job opportunities.

However, we observed on-site that Area A, which was the first to open among the four recruitment zones, still has many vacancies, and the entire park is clearly lacking in foot traffic. Area B, which is set to be delivered in October, is even more empty. The rent is quite high, but there are subsidies available that can lower it a bit. However, solving the employment issue for 15,000 people seems to be quite challenging. Lastly, Manager Wang mentioned, "Currently, there is only one company in the park that works on battery disassembly."

In the Meishan Pengshan Economic Development Zone, there are two battery-related companies in the park. Besides CALB mentioned earlier, the other one is Sichuan Shanshan. Shanshan is investing in a project to construct an annual production of 200,000 tons of lithium battery anode materials. The total investment of the project is as high as 10 billion yuan, with a total planned area of approximately 1,600 mu. Since the park is closed, outside vehicles are not allowed to enter, so we were unable to go in and inspect.

We took a drive around the Economic Development Zone and its vicinity and noticed that there weren’t many other buildings surrounding the vast industrial area. The nearest residential area was several kilometers away. When passing by an intersection next to the Zhongchuang Xinhang factory area, we saw a large billboard that read, "Striving to build one of the top ten lithium battery material zones in the country."

From the full industry chain cluster in Longquanyi, to the park construction in Qionglai, and the project implementation and technological breakthroughs in Meishan, our field investigation left us with the impression that the development of the new energy battery industry in Chengdu and its surrounding areas is already relatively complete. Each region leverages its own advantages to form a complementary industrial structure. However, to present a complete picture, a more in-depth investigation is needed. Please stay tuned.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track