¥3,600 per year infant subsidy: The Link Between Polypropylene Raw Materials and the Infant Products Industry

Lead-in: On July 28, 2025, a significant livelihood policy was unveiled. The implementation plan for the national childcare subsidy system clearly announced that starting from January 1, 2025, families with children under the age of 3 who are legally eligible for childbirth will receive an annual childcare subsidy of 3,600 yuan until the child reaches the age of 3. This policy is expected to benefit over 20 million families with infants and toddlers each year, playing a positive role in reducing the cost of childbearing and upbringing. Meanwhile, what role does polypropylene play in the infant and toddler products industry? What kinds of products related to infants and toddlers are associated with polypropylene? How will the implementation of this policy promote the consumption of polypropylene materials?

I: Polypropylene: Excellent Product Characteristics Help It Become the Cornerstone of the Infant Industry

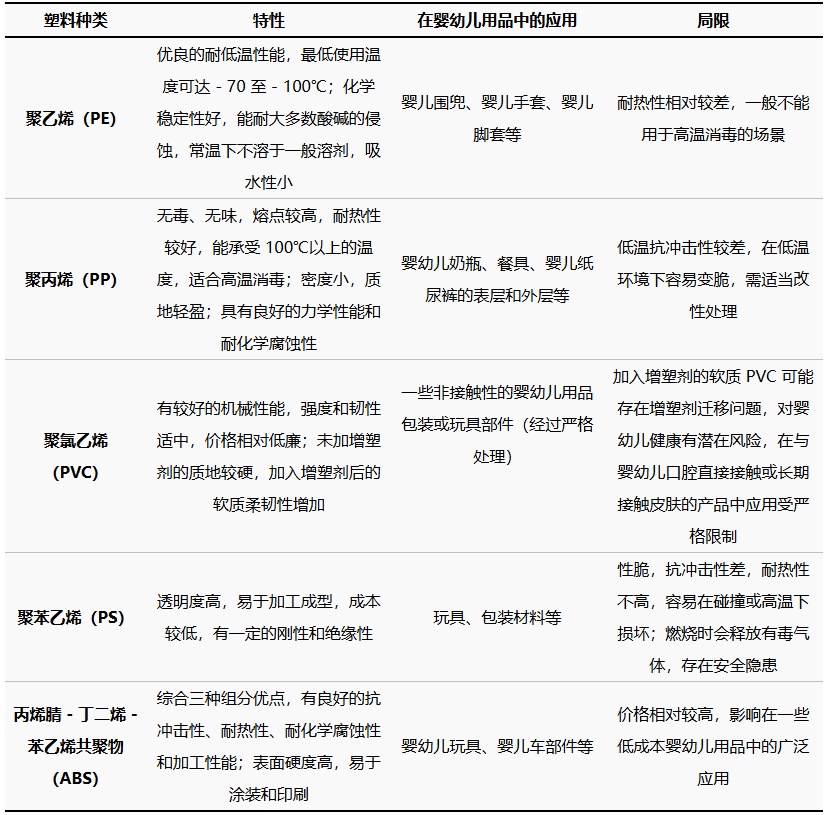

From the comparison of the characteristics of the five major general-purpose plastics, different products have varying characteristics, resulting in their application in different fields of infant products. Polypropylene is mainly used in products that can be in direct contact with infants, such as baby bottles, tableware, and baby diapers. The main reason is that polypropylene is non-toxic, odorless, and heat-resistant, making it highly favored in the field of infant products.

Polypropylene Products Vary: Infant Products Account for Over 30% of Its Applications

![[隆众聚焦]:基本面影响弱化 聚丙烯进入强政策周期 [隆众聚焦]:基本面影响弱化 聚丙烯进入强政策周期](https://oss.plastmatch.com/zx/image/0d3bb4923b8a4816964a954405880dc4.png)

Data source: Longzhong Information

From the tracking of downstream applications of polypropylene, homopolymer injection molding accounts for as much as 16.7%. Its downstream applications include infant toys, supplementary food tools, and disposable tableware. Due to its characteristics of being wear-resistant and capable of high-temperature sterilization, it has become an ideal choice for raw materials used in infant utensils.

Baby diapers account for a large proportion of polypropylene raw material consumption. According to tracking data from Longzhong Information, fibers account for 9% of downstream applications of polypropylene, among which spunbond nonwoven fabric is the main raw material for baby wipes and diapers. Due to its softness, breathability, and good liquid permeability, it can effectively keep a baby's skin dry and comfortable, making it the preferred choice for infant hygiene products.

In addition, 80% of baby bottles worldwide are made from polypropylene (PP) materials. PP bottles include various types such as standard, wide-neck, anti-colic, and leak-proof, meeting the needs of different consumers. With technological advancements, new PP bottles with added antibacterial agents and anti-drop materials are continuously emerging, in addition to traditional PP materials. Transparent polypropylene, as an important modified variety of polypropylene, is particularly suitable for baby bottles and other utensils that require high transparency and need to be used or sterilized at high temperatures due to its excellent heat resistance.

3: Conversion of Finished Products to Polypropylene Raw Material Consumption - Nearly One Million Tons of Polypropylene Consumed Annually for Baby Products

Hygiene products: Taking diapers as an example, children under one year old consume about 10 diapers per day, totaling around 3,000 diapers per year. Each diaper contains approximately 20 grams of non-woven fabric, of which 80% is polypropylene fiber material. Therefore, each child uses approximately 0.048 tons of fiber material per year. Based on the newborn birth rate calculation, 0.048 * 9.6 million equals 460,000 tons. Hence, the annual consumption of polypropylene fiber material for newborn diapers is roughly 460,000 tons. In addition, the consumption of polypropylene materials for disposable underpads, sanitary wipes, etc., exceeds 100,000 tons annually.

Daily necessities Due to the wide variety of products such as toys and complementary food utensils, it is impossible to estimate their raw material consumption directly. Therefore, we deduce it from the downstream applications of homopolymer injection-molded polypropylene. Among the downstream products of homopolymer injection molding, toys account for about 30%, of which infant products make up approximately 20% of the entire toy industry. Thus, the annual consumption of polypropylene raw materials for this sector is: 3.566 million tons (actual downstream consumption of polypropylene raw materials) * 16.7% * 30% * 20% = 357,000 tons.

Baby bottle The consumption proportion of polypropylene raw materials for infant feeding bottles is relatively low. The weight of a single bottle is about 140g. Based on an estimate of 3 bottles per child per year, 0.00014*3*9.6 million = 4,032 tons. Therefore, using the highest bottle conversion rate, approximately 4,000 tons of transparent polypropylene are consumed annually.

Overall, In the downstream industries of polypropylene, baby products account for a relatively low proportion, consuming about 3% of polypropylene raw materials. However, the number of newborns and the purchase of newborn products involve various aspects of society and the economy.

4: Interpreting Subsidy Policies from a Policy Perspective to Stimulate Demand for Infant Products

The implementation of the national childcare subsidy system has directly increased the disposable income of families with children. For many families, although the annual subsidy of 3,600 yuan may not seem like a large amount, over time it can play a certain role in the purchase of infant and toddler supplies.

On one hand, for families already struggling with childcare expenses, the subsidy is like a "timely rain." They may use this funding to purchase essential infant products such as baby formula, diapers, and bottles. Take diapers as an example; a baby might need approximately 200-300 diapers per month. Based on a moderate price range, monthly diaper expenses could be around 200-500 yuan. A portion of the childcare subsidy can be directly used to cover these expenses, allowing some families more options in choosing diapers, and potentially prompting some families to switch from lower-end products to higher-quality, more comfortable ones.

On the other hand, for families with relatively better economic conditions, subsidies may make them more willing to try some high-end and new types of infant products. As consumers' demands for the quality and safety of infant products continue to rise, many products with innovative features and environmentally friendly characteristics have emerged in the market. These products have indirectly or directly promoted the consumption of polypropylene materials and the upgrading of products.

In summary, the "annual subsidy of 3,600 yuan for each child under three years old" forms a close industrial link with polypropylene raw materials through the infant products industry. This connection not only promotes the development of the infant products industry and increases the consumption of polypropylene raw materials but also injects new vitality into social and economic development. In the future, with the continuous advancement and deepening of policies, the industry will also upgrade and innovate to adapt to this change. The synergy of industrial linkage will play a greater role, bringing more positive impacts to families, society, and the economy.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track