2025 china modified plastics industry market outlook forecast research report

Modified plastic components can not only achieve the strength performance of some steel materials but also offer a range of advantages such as being lightweight, colorful, and easy to mold. Therefore, the trend of "replacing steel with plastic" has emerged in many industries. The production of modified plastics has doubled in seven years, driven by the demand growth from home appliance upgrades and automotive lightweighting. The penetration rate of new energy vehicles exceeding 40% brings new opportunities, and companies are exploring incremental markets overseas.

Modified plastic definition

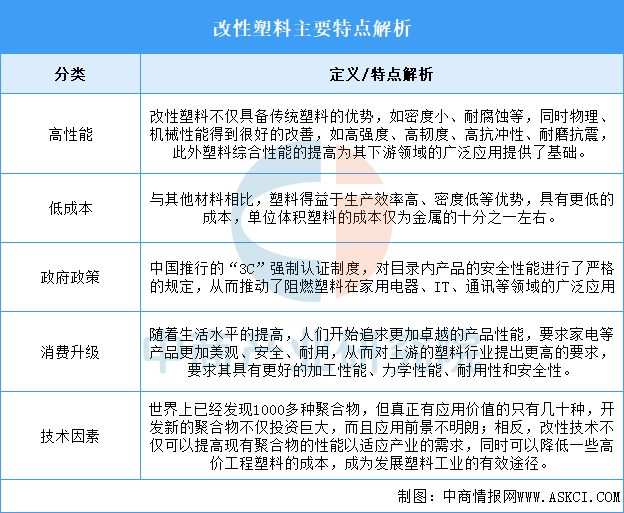

Modified plastics refer to plastic products that are based on general-purpose plastics and engineering plastics and have been processed and modified through methods such as filling, blending, and reinforcement to improve properties such as flame resistance, strength, impact resistance, and toughness. Due to their superior cost-effectiveness, modified plastics are being used in an increasing number of downstream fields. It can be said that modified plastics have become a consumer trend, and this trend is driven by the following five factors:

Source: Compiled by China Business Industry Research Institute

Modified Plastics Industry Development Policy

Modified plastics, as a new material product, fall within the category of national strategic emerging industries. In recent years, both national and local governments have introduced a series of encouraging policies to vigorously promote the accelerated development of industries such as modified plastics and other polymer materials. The modified plastics industry is encouraged and supported by national policies, and the high level of attention from relevant national departments to the development of the modified plastics industry will continue to drive the industry's positive growth.

Source: Compiled by China Business Industry Research Institute

Current Situation of the Modified Plastics Industry

1. Output

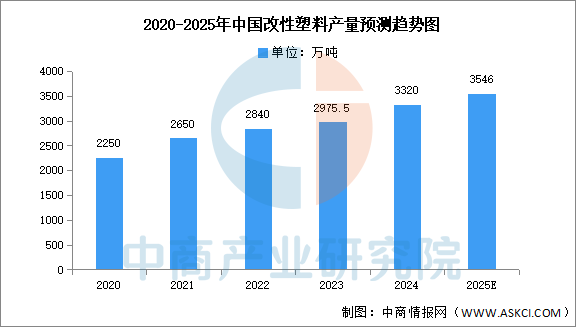

The demand growth in emerging fields such as high-end home appliances, new energy vehicles, and aerospace is driving the continuous increase in the production of modified plastics. According to the "2025-2030 Market Status and Investment Advisory Report on China's Modified Plastics Industry" released by the China Business Industry Research Institute, as of 2024, China's modified plastics production will reach 33.2 million tons, an increase of 11.6% year-on-year. Analysts from the China Business Industry Research Institute predict that in 2025, China's modified plastics production will reach 35.46 million tons.

Data Source: Compiled by China Business Industry Research Institute

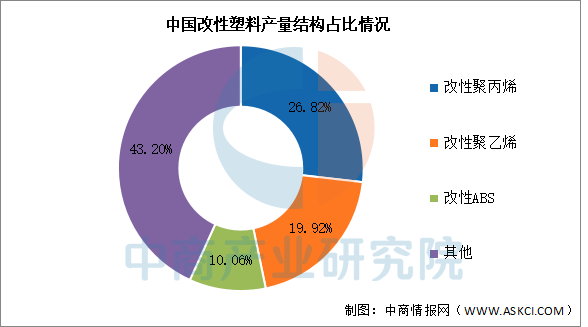

2. Production Structure

In the modified plastics market, modified polypropylene has the highest production, accounting for 26.82%. It is followed by modified polyethylene and modified ABS products, accounting for 19.92% and 10.06%, respectively.

Data Source: Compiled by China Business Industry Research Institute

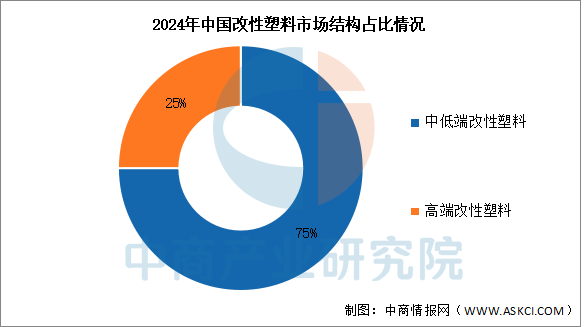

3. Market Structure

Currently, modified plastics in China are mainly low to medium-end products, accounting for 75%. High-end modified plastics only account for 25%.

Data Source: Compiled by China Business Industry Research Institute

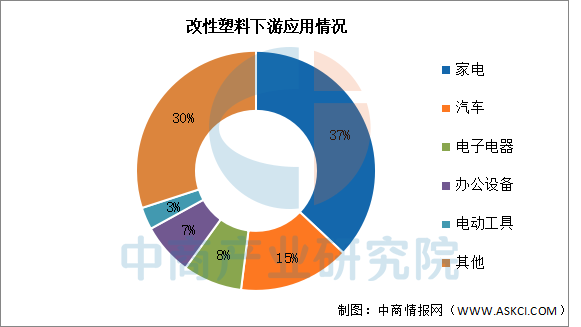

4. Downstream Application Situation

Compared to regular plastics, modified plastics have a wider range of downstream applications, including home appliances, electrical, automotive, photovoltaic, consumer electronics, medical, and other industries. Among these, home appliances have the highest demand, accounting for about 37%. This is followed by automotive, electronics and electrical appliances, office equipment, and power tools, with demand shares of 15%, 8%, 7%, and 3% respectively.

Data Source: Compiled by China Business Industry Research Institute

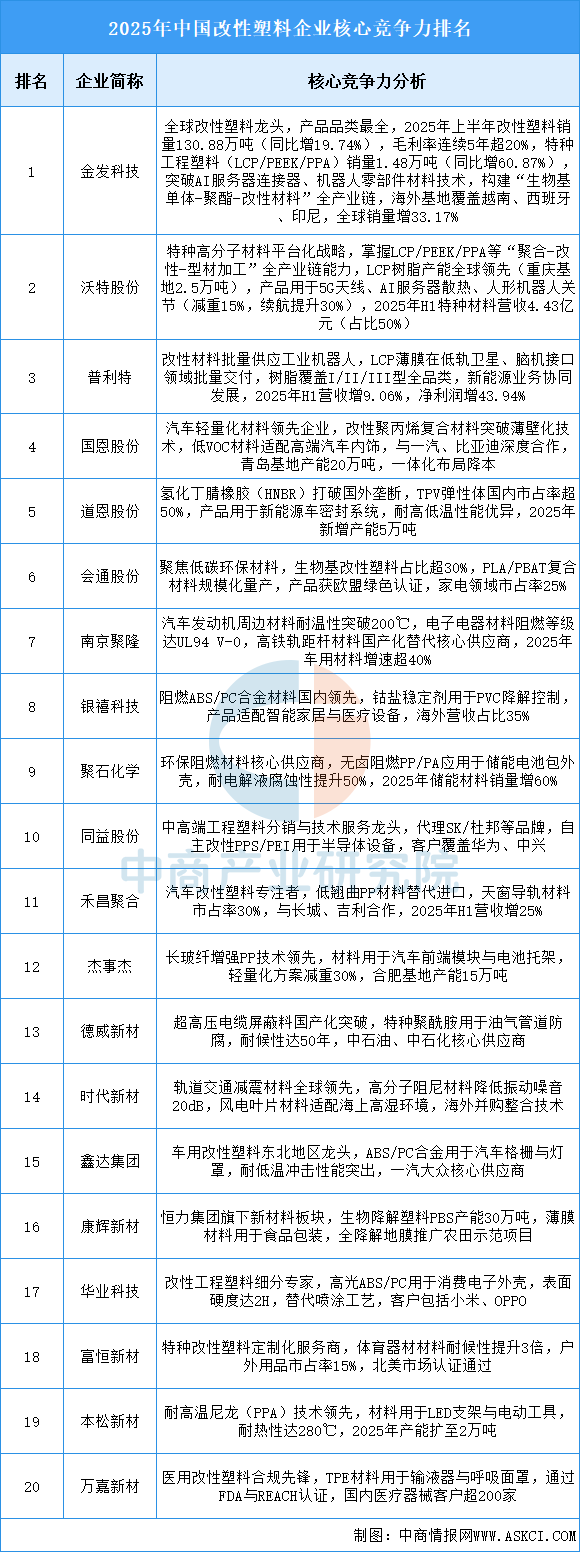

5. Enterprise Core Competitiveness Ranking

The modified plastics industry in China has developed a three-dimensional pattern of "breakthroughs in high-end technology - full industry chain integration - global layout." Leading companies have significantly increased the domestic production rate and gross profit margin through specialty engineering plastics (such as LCP, PEEK), bio-based materials, and integrated processes. The technology end focuses on low-carbon and environmentally friendly features, lightweight, and weather resistance, breaking overseas monopolies and adapting to emerging scenarios such as new energy, AI servers, and humanoid robots. The industry chain is vertically deepening cost reduction synergy from monomer synthesis to modification processing, and horizontally accelerating global penetration through the construction of overseas bases (Southeast Asia, Europe), driving the industry's transformation from "scale competition" to "technology + solution" output.

Source: Compiled by China Business Industry Research Institute

Key Enterprises in the Modified Plastics Industry

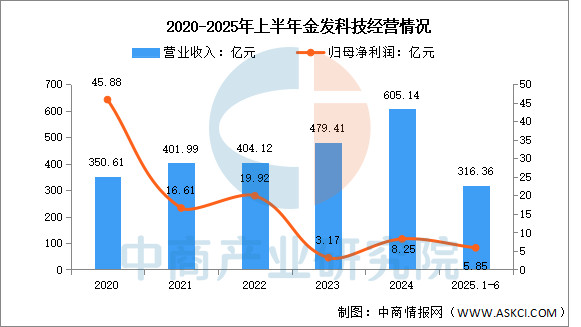

1. Kingfa Sci & Tech

The main business of Kingfa Sci. & Tech. Co., Ltd. is the research and development, production, and sales of new chemical materials. Kingfa Sci. & Tech.'s main products include modified plastics, environmentally friendly high-performance recycled plastics, biodegradable plastics, special engineering plastics, carbon fibers and composite materials, light hydrocarbons and hydrogen energy, polypropylene resin, styrene resins, and medical and health polymer materials.

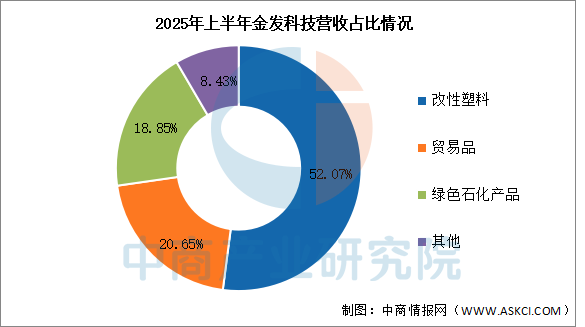

In the first half of 2025, revenue reached 31.636 billion yuan, an increase of 35.5% year-on-year; net profit attributable to the parent company was 585 million yuan, an increase of 53.95% year-on-year. The main products in the first half of 2025 included modified plastics, traded goods, and green petrochemical products, accounting for 52.07%, 20.65%, and 18.85% of the total revenue, respectively.

Data Source: Compiled by China Business Industry Research Institute

Data Source: Compiled by China Business Industry Research Institute

2. Guo En Co., Ltd.

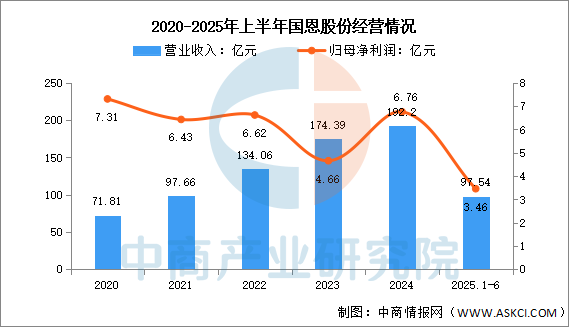

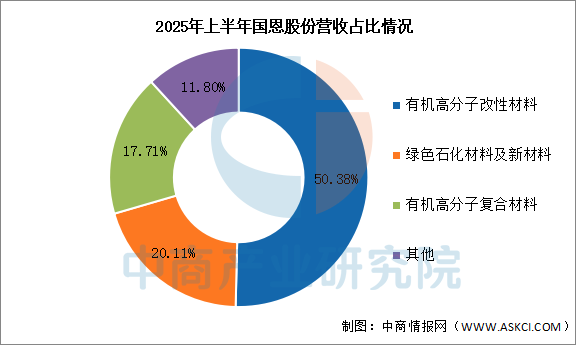

Qingdao Gon Technology Co., Ltd.'s main businesses are the large chemical industry and the large health industry. Gon Technology's main products include organic polymer modified materials, organic polymer composite materials, green petrochemical materials and new materials, gelatin, collagen and its derivatives, biological medicine, and health products.

In the first half of 2025, the company achieved a revenue of 9.754 billion yuan, representing a year-on-year increase of 4.58%. The net profit attributable to shareholders was 346 million yuan, marking a year-on-year growth of 25.82%. During this period, the company's main products included organic polymer modified materials, green petrochemical materials and new materials, and organic polymer composite materials, which accounted for 50.38%, 20.11%, and 17.71% of the total revenue, respectively.

Data Source: Compiled by China Business Industry Research Institute

Data Source: Compiled by China Business Industry Research Institute

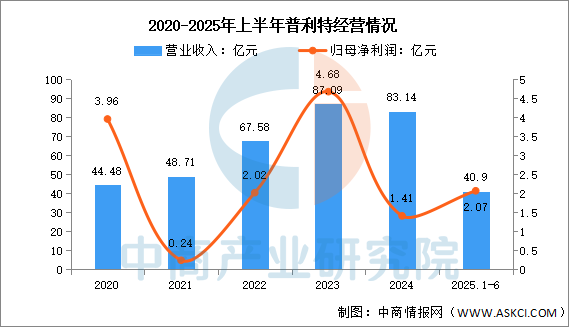

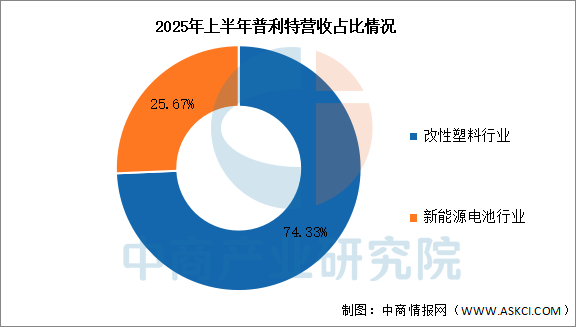

3. Pulit

Shanghai Pret Composites Co., Ltd.'s main business involves high polymer new material products and their composites, as well as the research, development, production, sales, and service of ternary lithium-ion batteries, lithium iron phosphate lithium-ion batteries, sodium-ion batteries, and their systems. Pret's main products include general modified materials, engineering modified materials, ternary cylindrical lithium-ion batteries, lithium iron phosphate lithium-ion batteries, polymer soft-pack lithium-ion batteries, nickel-based batteries, and others.

In the first half of 2025, the company achieved a revenue of 4.09 billion yuan, an increase of 9.07% year-on-year; the net profit attributable to shareholders was 207 million yuan, an increase of 43.75% year-on-year. The main businesses in 2025 include the modified plastics industry and the new energy battery industry, accounting for 74.33% and 25.67% of the total revenue, respectively.

Data Source: Compiled by China Business Industry Research Institute

Data Source: Compiled by China Business Industry Research Institute

4. Dawn Holdings

Shandong Dawn Polymer Co., Ltd.'s main business involves the research and development, production, and sales of functional polymer composite materials, including thermoplastic elastomers, modified plastics, color masterbatches, biodegradable materials, and copolyester materials. Dawn Polymer's main products are thermoplastic elastomers, modified plastics, color masterbatches, biodegradable materials, and copolyester materials.

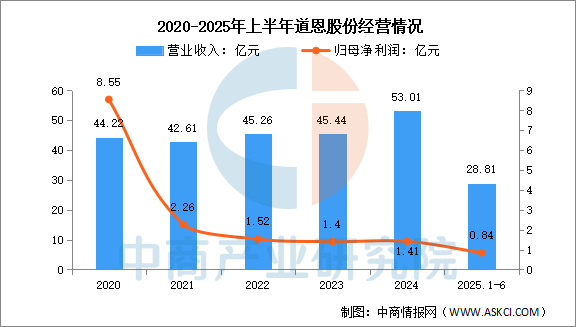

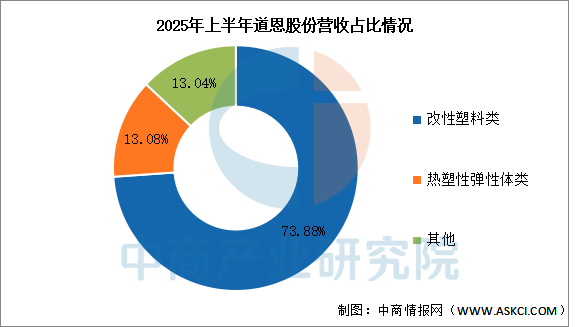

In the first half of 2025, the company achieved a revenue of 2.881 billion yuan, representing a year-on-year increase of 24.07%. The net profit attributable to shareholders was 84 million yuan, marking a year-on-year growth of 25.37%. The main products in the first half of 2025 included modified plastics and thermoplastic elastomers, accounting for 73.88% and 13.08% of the total revenue, respectively.

Data Source: Compiled by China Business Industry Research Institute

Data Source: Compiled by China Business Industry Research Institute

5. Nanjing Julong

Nanjing Julong Technology Co., Ltd.'s main business is the research and development, production, and sales of high-performance polymer new materials and advanced composite material applications. Nanjing Julong's main products are high-performance modified plastics, thermoplastic elastomer materials, carbon fiber composite structural parts and components manufacturing and assembly, and bio-based resource recycling wood-plastic profiles.

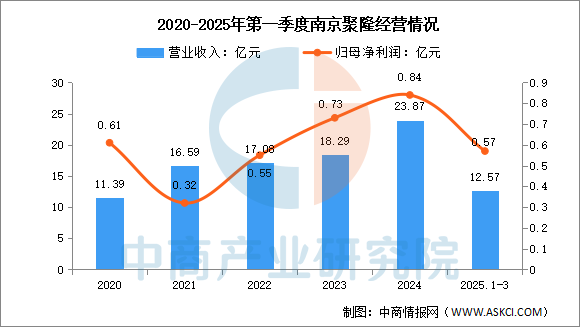

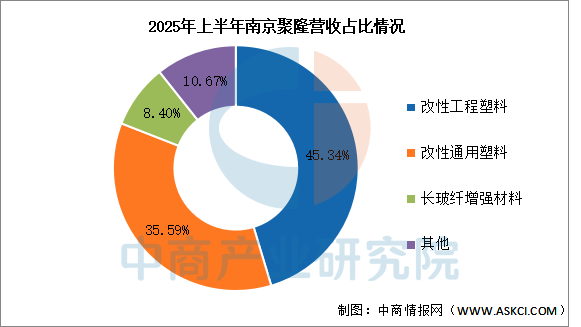

In the first half of 2025, the company achieved a revenue of 1.257 billion yuan, representing a year-on-year growth of 25.7%. The net profit attributable to shareholders was 57 million yuan, showing a year-on-year increase of 39.02%. The main products in the first half of 2025 included modified engineering plastics, modified general-purpose plastics, and long glass fiber reinforced materials, accounting for 45.34%, 35.59%, and 8.40% of the total revenue, respectively.

Data Source: Compiled by China Business Industry Research Institute

Data Source: Compiled by China Business Industry Research Institute

The development prospects of the modified plastics industry.

1. Technological upgrades drive the development of high-performance products.

The modified plastics industry, through continuous technological innovation, is upgrading from general-purpose materials to high-performance and multifunctional directions. Relying on core technology platforms such as dynamic vulcanization and esterification synthesis, companies have developed new materials with excellent mechanical properties, heat resistance, and specific functions. In response to the demand for lightweight, high-strength, and chemical-resistant materials in fields such as automotive and electronics, the industry has significantly enhanced the mechanical strength and durability of its products through molecular structure modification and nanocomposite technology. This technological upgrade not only meets the stringent requirements of high-end manufacturing for material performance but also propels the industry from price competition to technology competition, laying a solid foundation for replacing imported high-end plastics.

2. Expanding application areas to create new demand

Modified plastics are rapidly infiltrating emerging fields from traditional home appliances and automobiles to new energy and smart manufacturing. In the field of new energy vehicles, modified plastics are used in battery pack casings and charging pile components to meet the requirements for lightweight and flame retardancy. In the low-altitude economy sector, lightweight materials provide solutions for drone structural components. In the AI server domain, special engineering plastics are applied to liquid cooling system pipelines. These emerging scenarios demand new properties such as high-temperature resistance and thermal conductivity, prompting companies to develop customized products, thereby opening up new market opportunities.

3. Green transformation enhances sustainable development capability.

The industry is actively responding to environmental policies by developing biodegradable plastics and promoting recycling technologies to reduce environmental impact. Bio-based biodegradable materials replace traditional plastics in the field of disposable products, reducing white pollution. Chemical recycling technology achieves high-value regeneration of waste plastics, promoting resource recycling. Green transformation not only helps enterprises meet increasingly stringent environmental regulatory requirements but also reduces production costs through energy-saving measures, enhancing product ESG competitiveness in the international market, and injecting momentum into the industry's long-term development.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track