171 Billion! Earnings Report Released! Johnson & Johnson Plans to Spin Off Orthopedics Business

This means that after spinning off its consumer health business into Kenvue in 2023, Johnson & Johnson's portfolio optimization strategy is further focusing on core high-growth areas.

The management stated that this move will help the company strengthen its strategic focus on six core areas: oncology, immunology, neuroscience, cardiovascular, surgery, and vision, while providing DePuy Synthes with the flexibility and capital space for independent development.

The financial report shows that the company's performance this quarter continued the strong momentum from the first half of the year, with global sales and net profit exceeding market expectations driven by the oncology and MedTech businesses. However, after the spin-off announcement, Johnson & Johnson's stock price briefly fell about 2% in early trading, reflecting investors' cautious sentiment towards short-term uncertainties.

# Key Financial Highlights: Stable Revenue Growth, MedTech Continues Upward Trend

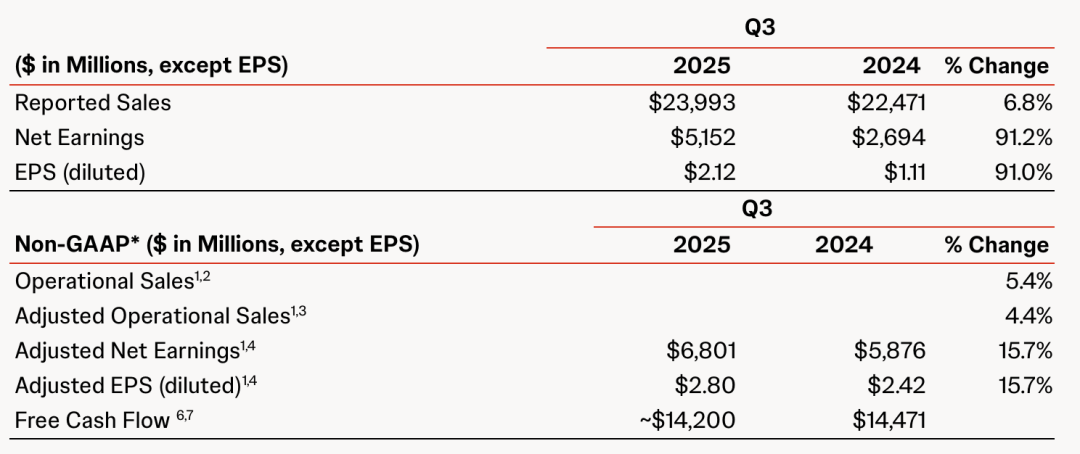

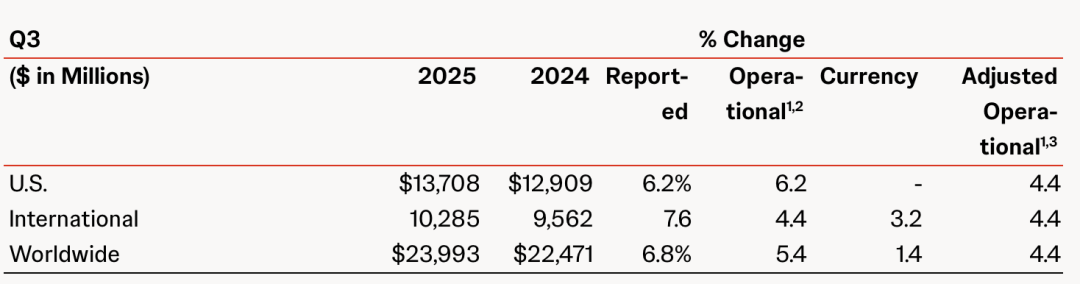

In the third quarter of 2025, Johnson & Johnson achieved global sales of $24 billion (approximately RMB 171 billion), representing a year-over-year increase of 6.8% on a reported basis and 5.4% on an operational basis, surpassing the market expectation of $23.17 billion. The U.S. market contributed $13.7 billion, a year-over-year increase of 6.2%, while international market sales amounted to $10.3 billion, growing by 7.6% on a reported basis and 4.4% on an operational basis.

The reported earnings per share (EPS) is $2.12, up 91% year over year; adjusted EPS is $2.80, up 15.7% year over year, exceeding the market expectation of $2.76. This quarter's net profit reached $5.152 billion, up 91.2% year over year.

Business Segment Performance:

-

Innovative Medicine: Sales reached approximately $15.2 billion, an increase of 5.3% (operational basis). Among them, the sales of innovative oncology drugs such as Darzalex and Carvykti continued to be strong; new products like INLEXZO and TREMFYA contributed additional growth. The patent expiration of Stelara caused a sales impact of over $1.1 billion, but progress in the new pipeline offset the negative effects.

-

MedTech: Sales reached approximately $8.8 billion, a year-on-year increase of 6.1% (on an operational basis). The cardiovascular business grew by more than 22%, and the surgical and vision business performed impressively. The company's continuous investment in AI and robotics is driving penetration into the high-end market.

-

Orthopedic business (DePuy Synthes): Orthopedics accounts for approximately 10% of the overall MedTech sector, with projected revenue of about $9.2 billion in fiscal year 2024. It has stable profitability but relatively slow growth, primarily focused on joint reconstruction, trauma, spine, and digital surgery. This "slow growth" segment is the focus of the current spin-off initiative.

Annual guidance adjustment:

Johnson & Johnson has raised its full-year sales guidance for 2025 to approximately $93.7 billion (midpoint), representing a growth of about 5.7%, which is higher than previous expectations. At the same time, it maintains its full-year adjusted EPS target at $10.85, primarily because the increase in tax burden and changes in cost structure are offset by growth. The company expects overall sales growth in 2026 to still exceed 5%.

Splitting the DePuy Synthes Orthopedics Business: Scale, Pace, and Personnel Arrangements

The most notable news from this earnings report is the plan to spin off the DePuy Synthes orthopedics business. The company is one of the most representative enterprises in the global orthopedics market and a significant component of Johnson & Johnson's MedTech segment.

1. Scale and Business Structure

According to the company's disclosure, DePuy Synthes' revenue for fiscal year 2024 is approximately $9.2 billion, accounting for about 10% of Johnson & Johnson's total revenue. This business covers four core areas:

-

Joint Reconstruction

-

Trauma

-

Spine

-

Digital Surgery

Its products serve approximately 7 million patients annually, targeting the global orthopedic market valued at over $50 billion. Although this segment is steadily profitable, its growth rate is significantly lower than that of the cardiovascular, surgical, and AI-related sectors, as well as the growth trajectory of the pharmaceutical business.

The company emphasizes that the long-term value of the orthopedics business has not been overlooked. Instead, it hopes to allow for a more flexible capital structure and focused development strategy through the spin-off, in order to respond to the rapidly changing global market.

2. Breakdown of Paths and Timetable

According to the announcement, Johnson & Johnson plans to complete the separation of DePuy Synthes within the next 18 to 24 months, with a target date in mid-2027. The company will prioritize a "tax-free spin-off" approach but will also explore various structural options, including potential sales or partial equity spin-offs, depending on market conditions and regulatory progress.

Before the spin-off is completed, the orthopedics business will maintain its current operational strategy, focusing on sustaining growth, profit expansion, and continuous investment in research and innovation.

3. Leadership Appointments and Governance Arrangements

The company announced that Namal Nawana, a current member of Johnson & Johnson MedTech's global leadership team and former CEO of Smith+Nephew, will assume the role of Worldwide President of DePuy Synthes. Effective immediately, he will lead the spin-off and continue to serve as the leader of the new company after the spin-off is completed.

Nawana has over 20 years of experience in the orthopedic and medical device industry. He previously served as CEO at Alere (acquired by Abbott) and held long-term positions within the Johnson & Johnson orthopedic system (formerly serving as Global President of DePuy Synthes Spine). His joining is seen as laying a solid management and strategic foundation for the independent company post-spin-off.

4. Strategic Intent and Value Logic

For Johnson & Johnson, this spin-off will further strengthen its focus on high-growth, high-profit sectors. After divesting the orthopedics business, Johnson & Johnson's MedTech will concentrate on fields such as cardiovascular, surgery, and vision, and will further enhance its competitiveness and profitability through AI and robotic technologies. This will also help the company improve its overall revenue growth rate and operating profit margin.

For DePuy Synthes, operating independently means a clearer strategic direction and more room for capital operations. The company will be able to expand its market more flexibly, invest in innovative technologies (such as regenerative implants and orthopedic robotics), and quickly respond to changes in the competitive landscape. Industry analysts believe that this move will make DePuy Synthes one of the largest and most focused orthopedic companies in the world.

Market Impact and Industry Landscape Observation

The recent financial report and spin-off announcement have attracted significant attention from the capital markets. Although the performance exceeded expectations, the uncertainty surrounding the spin-off plan has caused short-term fluctuations in the stock price.

1. Short-term market reaction

On the day of the earnings report, Johnson & Johnson's stock price briefly fell about 2% in pre-market and early trading. Market analysts believe this reaction is due to the short-term uncertainty surrounding the spin-off, rather than a negative interpretation of the performance. Analysts generally point out that as the timeline and transaction structure of the spin-off become clearer, stock price fluctuations may stabilize.

2. Restructuring of Valuation Structure

Through the spin-off, Johnson & Johnson will achieve a clearer business separation in the capital market.

-

The parent company Johnson & Johnson (remaining business) will focus more on innovative drugs and high-growth medical technology sectors.

-

The orthopedics business will become an independent valuation unit and is expected to receive a price-to-earnings ratio reference that is closer to the leading companies in the orthopedics industry (such as Stryker Corporation, Zimmer Biomet).

This kind of "structural separation" may also attract different types of investors—integrated funding for pharmaceuticals and medical devices will gradually distinguish itself from pure asset funding in orthopedics, allowing the two parts of the business to achieve more matched capital pricing.

3. Impact on the Competitive Landscape of the Industry

DePuy Synthes, as an independent company, will directly compete with orthopedic giants like Stryker and Zimmer Biomet in the global market. Unlike its competitors, DePuy has strong technological reserves in digital surgery and robotic surgical systems, which may become its differentiating competitive advantage after independence.

On the other hand, for Johnson & Johnson, the spin-off allows it to focus more on the high-growth sectors within the MedTech segment, and it may further strengthen its cardiovascular and surgical device portfolio through acquisitions or internal investments, creating a new growth curve. This will put more direct pressure on competitors in the same field, such as Boston Scientific and Abbott Laboratories.

4. Risk Factors

-

Regulatory and Transaction Structure: The tax-free spin-off path requires approvals from multiple regulators, and there is uncertainty regarding the time and process.

-

Transition Operations: During the 18–24 month transition period, business synergy, channel management, and the stability of brand and talent will be key.

-

Valuation realization: If the market's growth expectations for the two companies after the spinoff do not match their actual performance, the valuation premium may not be fully realized.

In conclusion: focus on the core, separate the non-core.

From the spin-off of Kenvue's consumer business to the separation of DePuy Synthes' orthopedics business, Johnson & Johnson is systematically reshaping its business portfolio. The strategic logic is very clear: by focusing on high-growth, high-profit innovative pharmaceuticals and medical technology sectors, it aims to unleash long-term growth potential; by allowing non-core but stable businesses to develop independently, it provides the capital market with clearer investment targets and value logic.

This ongoing structural adjustment will directly reshape the competitive landscape of the global medical device industry. In the short term, uncertainty is unavoidable; however, in the medium to long term, both Johnson & Johnson's parent company and the soon-to-be-independent DePuy Synthes may gain new development opportunities due to "clearer strategies and capital structures."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track