Top 10 lithium battery main materials shipment volume in 2025 revealed! what's the trend in 2026?

Lithium battery

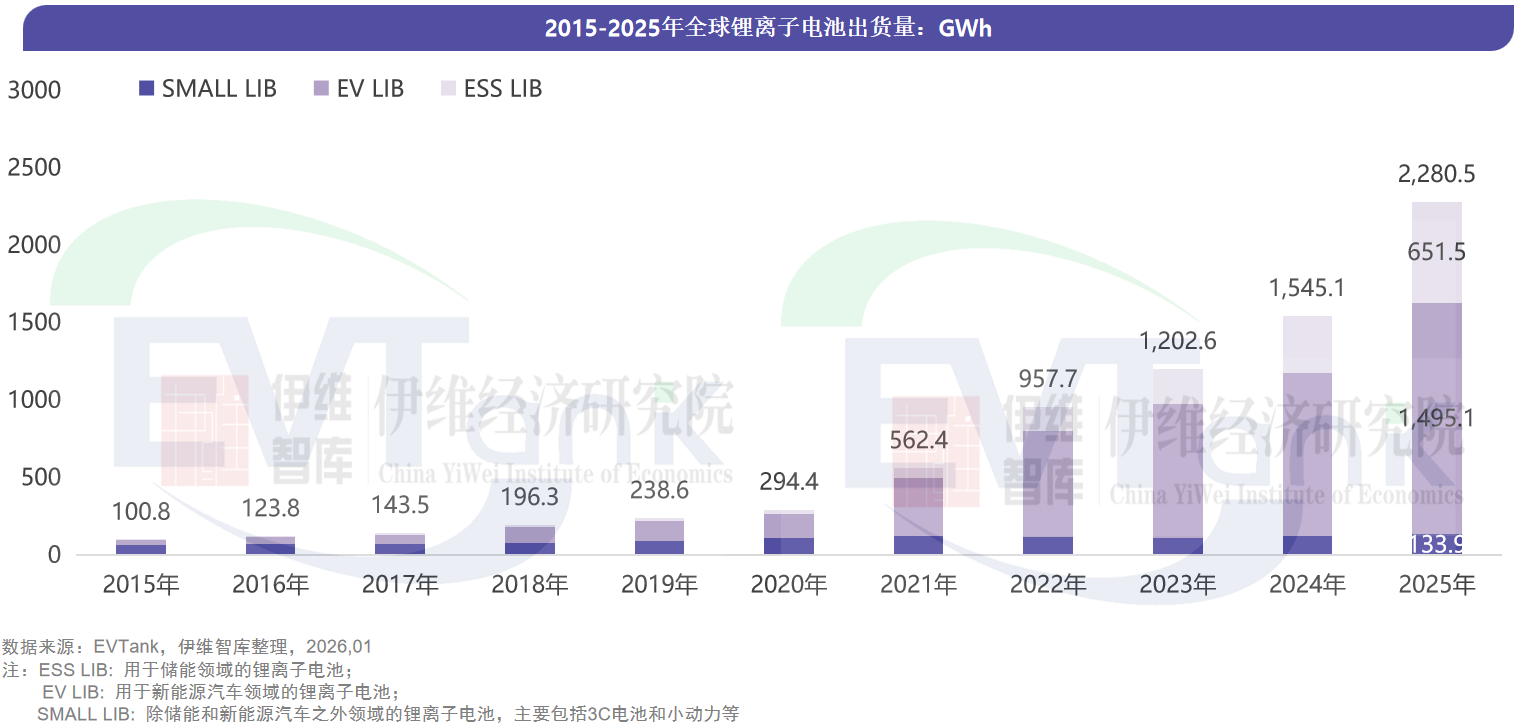

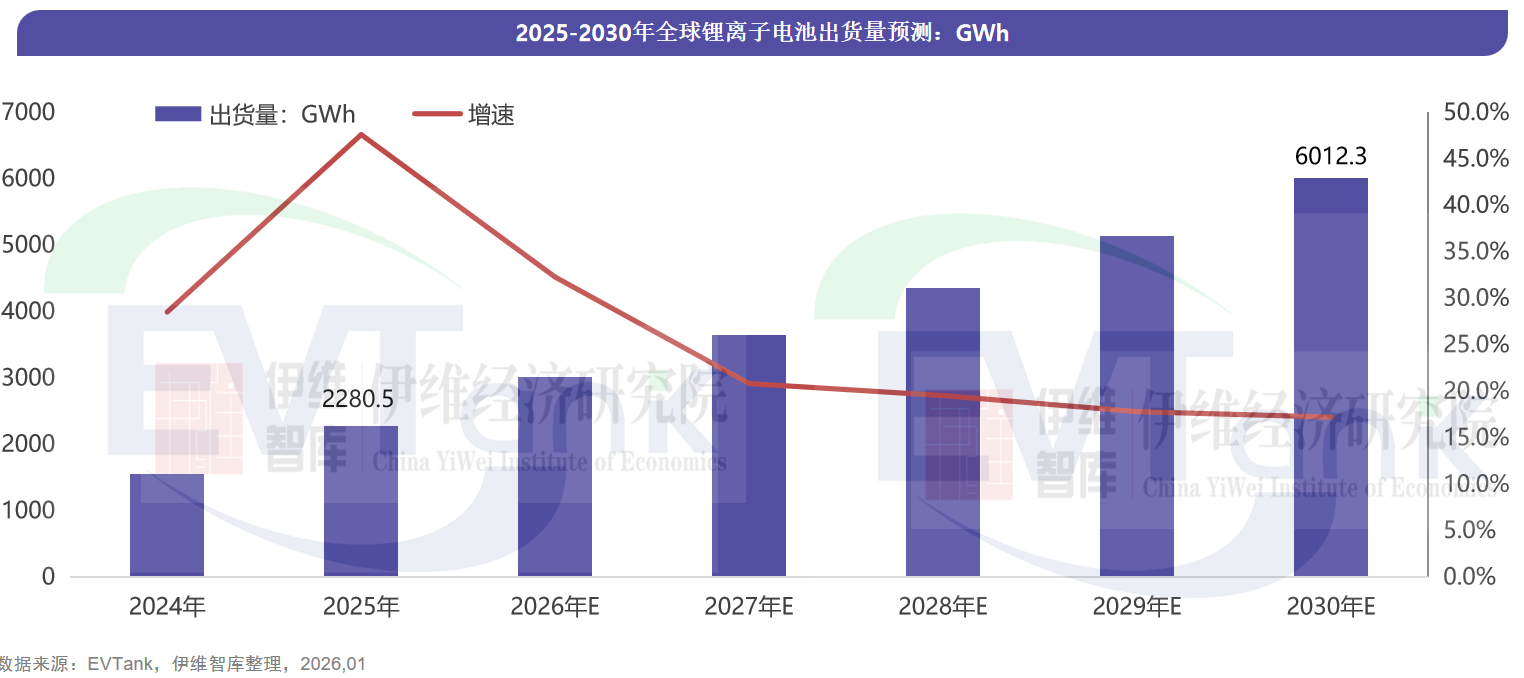

According to EVTank data, the global lithium-ion battery shipment volume will reach 2280.5GWh in 2025, a year-on-year increase of 47.6%. Among them, China's lithium-ion battery shipment volume will reach 1888.6GWh in 2025, a year-on-year increase of 55.5%, 18.6 percentage points higher than the growth rate in 2024. Its proportion in the global lithium-ion battery shipment volume will reach 82.8%, and the shipment volume proportion will continue to increase.

Specifically, Power battery In terms of volume, global shipments of power batteries reached 1495.2 GWh in 2025, a year-on-year increase of 42.2%, mainly due to factors such as China's continued promotion of trade-in programs, the emergence of new models, and the doubling of new energy vehicle exports.

Energy storage battery Regarding aspects, the global shipments of energy storage batteries are projected to reach 651.5 GWh in 2025, representing a substantial year-on-year increase of 76.2%, with the majority of shipping companies originating from China.

Small battery Regarding the aspect, global small battery shipments are projected to reach 133.9 GWh in 2025, representing a year-on-year increase of 7.9%. Emerging fields such as AI, humanoid robots, and eVTOL are entering the early stages of industrialization, creating significant market potential for small batteries in the future.

Positive electrode material

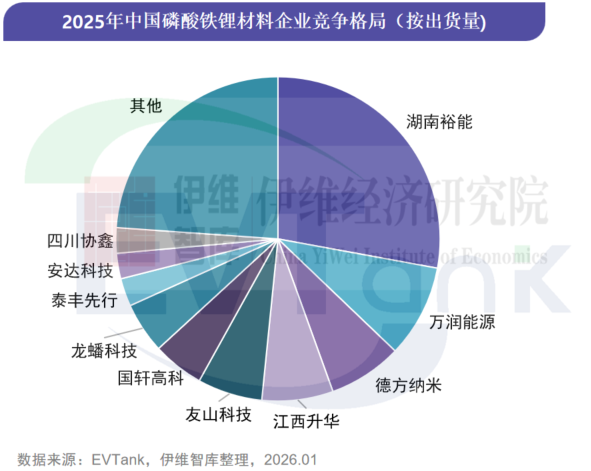

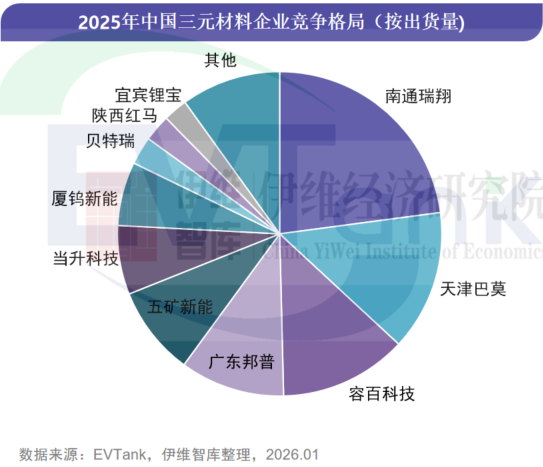

In 2025, China's total cathode material shipments reached 4.987 million tons, a year-on-year increase of 51.5%, of which... Lithium iron phosphate Positive electrode material shipments increased to 79.1% of the total. In 2025, China's lithium iron phosphate material shipments reached 3.944 million tons, a year-on-year increase of 62.5%; ternary material shipments were 786,000 tons, a year-on-year increase of 22.2%. Lithium cobalt oxide Shipments reached 119,000 tons, a year-on-year increase of 20.2%. Lithium manganate Shipments reached 138,000 tons, a year-on-year increase of 12.2%.

From the perspective of corporate shipments, Hunan Yuneng, a lithium iron phosphate cathode material company, leads by a wide margin with shipments exceeding 1 million tons, and has ranked first in the industry for many consecutive years. Wanrun New Energy replaced Dynanonic as the second-ranked company. Sichuan Xiexin and Anda Technology replaced JinTang Times and Rongtong Hi-Tech in the top ten. For the year 2025, the top ten lithium iron phosphate material companies by shipment also include Jiangxi Shenghua, Youshan Technology, Guoxuan High-tech, Lopal Tech, and Taifeng Pioneer.

The top ten ternary material companies in terms of shipment volume in 2025 include Nantong Ruixiang, Tianjin Bamo, Ronbay Technology, Guangdong Brunp, Minmetals New Energy, CNGR Advanced Material, Xiamen Tungsten New Energy, BTR, Shaanxi Hongma, and EVE Lithium Energy. Among them, Nantong Ruixiang ranked first in the industry with a shipment volume of nearly 200,000 tons, relying on its medium-nickel high-voltage products. Tianjin Bamo's shipment volume rose to second place in the industry, driven by high-nickel product shipments. Ronbay Technology's shipment volume decreased by nearly 20% year-on-year, leading to a drop in its ranking to third place, making it the ternary cathode material company with the largest year-on-year decline in 2025. In the lithium cobalt oxide (LCO) material sector, Xiamen Tungsten New Energy ranked first with a market share of over 50%, followed by Tianjin Bamo, BASF Shanshan, Mengguli, and Jiangmen Keheng. In the lithium manganese oxide (LMO) material sector, Boshi High-Tech ranked first with a shipment volume of nearly 40,000 tons, followed by Guangxi Lijing, Xinxiang Hongli, Best, Ganzhou Jiexing, Jiangxi Chaoshi, Southern Manganese, Hebei Qiangneng, Guangxi Guiliu, and Wuxi Jingshi.

Negative electrode material

In 2025, China's anode material shipments reached 2.922 million tons, a year-on-year increase of 38.1%, an increase of 14.5 percentage points compared to 2024.

EVTank indicates that the steadily growing lithium-ion battery market in 2025 provides a strong guarantee for orders for anode material companies, with mainstream anode material companies generally operating at full capacity. The price of the anode material industry remained stable throughout 2025, with the average price maintained at around 35,000 yuan/ton, and the price of high-end anode materials exceeding 40,000 yuan/ton. However, the… Graphitization The graphitization link still suffers from overcapacity, and graphitization companies face intense competition.

According to EVTank data, looking at major companies, the top three companies in terms of anode material shipments in 2025 will still be BTR, Shanghai Shanshan, and Sinosteel Xingcheng, with annual shipments of 595,000 tons, 518,000 tons, and 373,000 tons, respectively. The combined market share of these three companies will reach 50.9%.

In 2025, the leading Chinese anode material companies in terms of shipments also included Shantai Technology, Kaijin New Energy, Jiangxi Zichen, Hebei Kuntian, Carbon One New Energy, Guangdong Dongdao, Xiangfenghua, Baichuan Shares, Jinhui Energy, Keda New Materials, Guizhou Huiyang, and Shenzhen Sinuo. Among them, Baichuan Shares ranked eleventh with shipments exceeding 50,000 tons, a year-on-year increase of 165.8%.

【Electrolyte 】

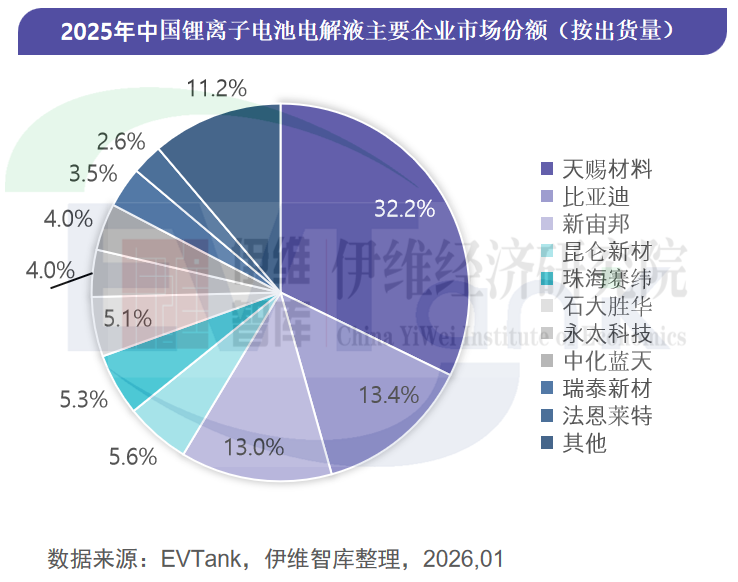

In 2025, global shipments of lithium-ion battery electrolyte are projected to increase by 44.5% year-on-year, reaching 2.402 million tons. Among them, China's actual electrolyte shipments will reach 2.235 million tons, increasing its share in the global electrolyte market to 93.05%.

From the perspective of major enterprises, Tianci Materials ranked first with a shipment volume of 720,000 tons, and its market share increased to 32.2%, ranking first in the world for ten consecutive years. In 2025, companies with faster year-on-year shipment growth included SHIDA SHENGHUA, Yongtai Technology, Kunlun New Materials, and Zhuhai Celgard, with year-on-year shipment growth rates exceeding 70%, significantly outperforming the industry growth rate.

From the perspective of the competitive landscape of Chinese electrolyte companies, Tinci Materials has consistently been far ahead, while BYD produces for its own consumption. Among independent electrolyte companies, Kunlun New Material and Zhuhai Seine have gradually increased their market share, leading to intense competition. Shida Shenghua and Yongtai Technology have developed rapidly in recent years, and the top ten positions of Ruitai New Material and Capchem are being challenged.

Diaphragm

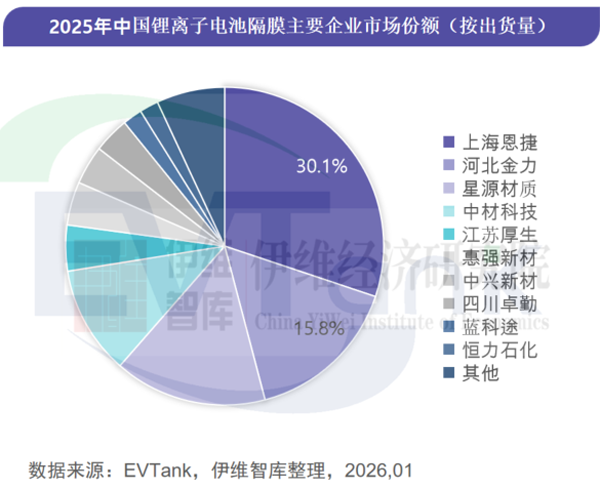

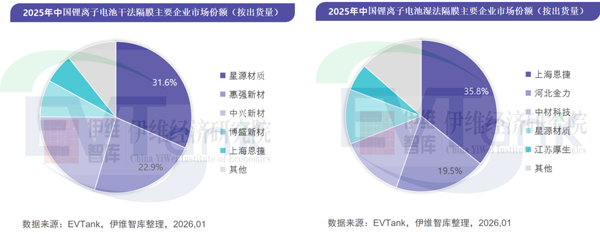

In 2025, China's total shipments of lithium-ion battery separators reached 32.85 billion square meters, a year-on-year increase of 44.4%. Among them, dry-process separator shipments were 6.33 billion square meters, a year-on-year increase of 20.2%, and wet-process separator shipments were 26.52 billion square meters, a year-on-year increase of 51.6%.

According to EVTank data on major Chinese separator companies, Shanghai Enjie still holds a market share of over 30%, ranking first with shipments of nearly 10 billion square meters. Goldstone New Energy replaced Starwin Science & Technology as the second largest in the industry. Sichuan Zhuoqin ranked eighth with a year-on-year growth rate of over 100%, showing strong momentum. The list of China's TOP 10 companies also includes: Sinoma Science & Technology, Jiangsu Highstar, Huineng Technology, Zhongxing New Material, Lanke Tu, and Hengli Petrochemical, with Hengli Petrochemical being a new entrant in 2025. The threshold for the TOP 10 has increased from 400 million square meters in 2024 to 600 million square meters in 2025.

From the perspective of diaphragm companies with different technical routes, the top five wet-process diaphragm companies in terms of shipment volume in 2025 are Shanghai Energy, Gold Power New Energy, Sinoma Science & Technology, Senior Material, and Jiangsu Highhope. The top five dry-process diaphragm companies in terms of shipment volume in 2025 are Senior Material, Huiqiang New Material, Zhongxing New Material, Bosheng New Material, and Shanghai Energy.

[Foresee 2026]

Looking ahead to 2026, Lithium battery In the field, EVTank expects that global lithium-ion battery shipments will reach 3016.3GWh and 6012.3GWh in 2026 and 2030, respectively. The forecast for global lithium-ion battery shipments in 2026 is 17.3% higher than the 2025 white paper version, with the main driving force coming from the demand for energy storage batteries.

Cathode Material In the field, in 2025, thanks to a significant increase in shipments, the total output value of China's cathode material industry rebounded strongly after two consecutive years of year-on-year decline, with a year-on-year increase of 30.9% to reach 274.39 billion yuan. From the perspective of product structure, in 2025, lithium iron phosphate cathode materials dominated shipments, accounting for approximately 80%; meanwhile, Iron(III) phosphate Lithium manganese materials are experiencing exponential growth, with annual shipments exceeding 30,000 tons. In 2026, lithium iron phosphate (LFP) is projected to maintain its dominant position in the cathode material market. Despite intense competition and ongoing industry efforts to eliminate excess capacity, rising demand from downstream markets for high-performance LFP with high tap density, fast charging capabilities, and long cycle life, coupled with the increased release of LFP materials in overseas markets, is accelerating the iteration of material technology. Furthermore, driven by leading battery companies such as CATL, the industrialization process of fifth-generation high-performance LFP materials is expected to accelerate.

Negative electrode material In 2025, artificial graphite anode materials further consolidated their market dominance in the field, with shipments accounting for 86.9% and a total volume of 2.54 million tons. It is projected that their market share will continue to climb in 2026. Simultaneously, with the rapid development of incremental markets such as high-end 3C digital products, high-rate batteries, large cylindrical batteries, and solid-state batteries, silicon-based anode materials will enter a phase of rapid growth. Lithium carbonate price The increase in the cost of lithium has elevated the cost advantage of sodium-ion batteries, and their large-scale application will bring new incremental demand for hard carbon anodes.

Electrolyte In 2025, the electrolyte sector experienced a surge in both volume and price, with the global electrolyte market size exceeding 56.4 billion yuan. Notably, the price of electrolyte products was driven up by the rising costs of key raw materials, including lithium hexafluorophosphate, solvents, and additives, particularly in the second half of 2025. In 2026, with the anticipated continued tight supply and demand of core materials such as lithium hexafluorophosphate, solvents, VC, and FEC, the industry's profitability is expected to further recover. Downstream battery companies are also taking proactive measures, securing advance orders to stabilize their supply chains.

In the separator field, technology routes are diverging increasingly significantly in 2025, with wet-process separators accounting for 80.7%, a further increase from 76.9% in 2024, and the dry-process separator market shrinking. In 2026, with the growing downstream demand for high-energy-density ternary batteries, large-capacity energy storage cells, and fast-charging batteries, the demand and capacity utilization rate of wet-process separators are expected to continue to increase simultaneously. Meanwhile, under the solid-state battery trend, the R&D and layout of key innovative materials such as skeleton membranes will be actively enhanced by companies in the industry chain. In addition, with Foshan Plastics Technology's acquisition of Jinli New Energy, Enjie's proposed acquisition of Zhongke Hualian, and the effectiveness of anti-involution in the industry, the concentration of the separator market will also increase.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Goldhair Technology Stock Soars, Operating Quality Gradually Improves