[Today's Plastics Market] Continues Weakness! Spot Prices Generally Decline, ABS Drops Up to 150

Abstract:On October 17th, the price and forecast summary for general-purpose plastics and engineering plastics markets is as follows. In the general-purpose plastics sector, market sentiment is weak, with PP and PE experiencing narrow fluctuations; PS is being sold at low prices; ABS continues to decline by 20-50; EVA maintains its downward trend, with some prices dropping by 100-150. In the engineering plastics sector, spot circulation is under pressure, with PC, PET, and POM seeing a narrow decline of 5-50; PA6 and PA66 are down by 50-100; PBT and PMMA are in a wait-and-see mode.

General Material

PE: Market sentiment is weak, leading to discounts and inventory reduction.

1. Today's Summary

U.S. commercial crude oil inventories have increased for three consecutive weeks, and with hopes for renewed talks between Russia and Ukraine, international oil prices have declined. NYMEX crude oil futures for the November contract fell by $0.81 to $57.46 per barrel, a decrease of 1.39%; ICE Brent crude futures for the December contract dropped by $0.85 to $61.06 per barrel, a decrease of 1.37%.

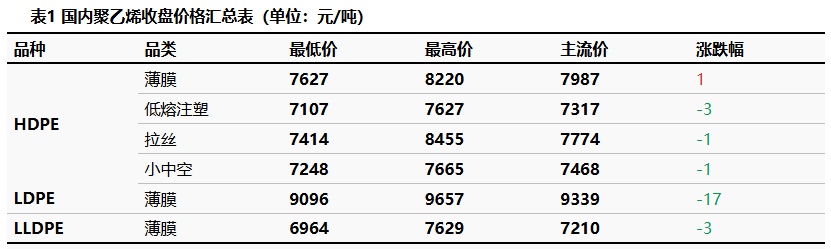

②. The HDPE market price change range is -3 to -1 yuan/ton, the LDPE market price is -17 yuan/ton, and the LLDPE market price is -3 yuan/ton.

2. Spot Overview

Today, the domestic polyethylene spot market prices are stable. The macroeconomic outlook is uncertain, and international crude oil prices continue to decline, weakening support. Although there are transactions at low prices, the replenishment efforts from downstream are weakening. The market is following the trend for sales, primarily focusing on price concessions, resulting in average market transactions. The market price change for HDPE is -3 to -1 yuan/ton, for LDPE it is -17 yuan/ton, and for LLDPE it is -3 yuan/ton.

3. Price Prediction

According to current market demand feedback, there is an expectation of an increase in overall downstream operations, which is beneficial for demand support and enhances rigid demand. On the supply side, there is significant short-term supply pressure. With supply recovery and cost reduction, price expectations are under downward pressure. However, considering that the current market price is close to the bottom, it is expected that the polyethylene market will fluctuate next week, with an estimated fluctuation range of 20-80 yuan/ton.

PP: Downstream demand is primarily rigid, and the polypropylene market is operating weakly.

1 Today's Summary

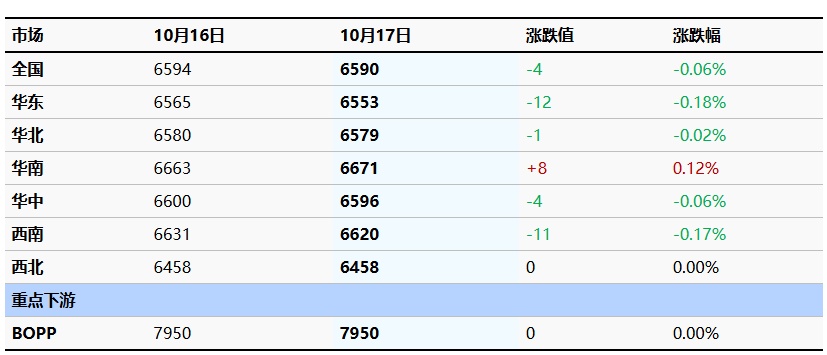

①, Sinopec South China PP price adjustment: Maoming M55 decreased by 100 to 6900; Beihai MN60 decreased by 50 to 6900, MN80 decreased by 100 to 6900; Dongxing generally decreased by 50, among which M17 is 6650, 9012 is 6950. Sinopec Central China PP price partially adjusted downward: Luoyang MN70 adjusted downward by 50 yuan; MN80 powder product price decreased to 6750 yuan/ton; BOPP film material generally decreased by 100 yuan, after adjustment, Jingmen F03D is 6850 yuan/ton, Changling F03D/F03G is 6800 yuan/ton.

Today, the domestic polypropylene shutdown impact increased by 0.62% to 18.09%. Today's domestic PP facilities: Tianjin Bohua and Lihe Zhixin facilities are shut down. The daily production ratio of drawn wire increased by 0.92% to 27.12%.

③、 The supply-demand balance in this period has shifted from tight equilibrium before the holiday to surplus, exerting some pressure on market sentiment. In the next period, the supply-demand balance will be affected by the resumption of factory operations after the holiday, and the demand growth in most downstream sectors will provide some support to the market. 。

2 Spot Overview

Based on the East China region, today's polypropylene filament price is 6553 yuan/ton, down 12 yuan/ton from yesterday, in line with morning expectations. Morning Futures continue to fluctuate within a narrow range. Today, the polypropylene market prices are also fluctuating within a range. Cost support is weakening, and the sentiment in the spot market is bearish. Traders remain cautious, offering discounts to reduce inventory with a wait-and-see approach to spot quotations. As of midday, the mainstream price for raffia in East China is between 6480-6600 RMB/ton. 。

3 Price Prediction

International oil prices continue to fall, causing weak support for the spot market from the cost side. After the holiday, petrochemical companies continue their destocking operations, with some ex-factory prices being adjusted downward. In terms of the polypropylene (PP) fundamentals, there is a relatively concentrated period of plant maintenance, but the commissioning of the second phase of Guangxi Petrochemical adds pressure to the supply side. Downstream maintains just-in-time inventory replenishment as the primary approach, with limited follow-up on new orders. The realization of peak season demand is insufficient, coupled with the impact of a weak macroeconomic environment. It is expected that the polypropylene market will... next week. Weak organization.

PS: Insufficient cost support, market selling at low levels.

1 Today's Summary

Today, the GPPS in East China is stable at 6,900 yuan/ton.

② 、 On Friday, the price of styrene in the East China market dropped by 40 to 6495 yuan/ton, in South China it fell by 85 to 6510 yuan/ton, while in Shandong it remained stable at 6425 yuan/ton.

2 Spot Overview

According to Longzhong Information, the current price of GPPS in East China is stable at 6,900 yuan/ton.The raw material styrene is consolidating at a low level, with low support from the cost side, and the market mainly focuses on low-level sales. The supply of goods is relatively loose, putting some pressure on the spot market. Downstream players are mainly observing, resulting in poor transactions.

3 Price Prediction

The trend of raw material styrene is weak, and the cost focus is also relatively low. The supply in the industry is relatively ample, and the downstream purchasing pace has slowed down. In the short term, the PS market is expected to remain weak within a narrow range. It is anticipated that the price of modified benzene in the East China market will be around 6900-8000 yuan/ton.

ABS: Today's market transactions are driven by rigid demand, and prices continue to decline.

1 Today's summary:

1. Today, the market prices in East China are declining; the market prices in South China are also declining, with market transactions maintained at just-needed levels.

In October, the monthly production of ABS increased significantly compared to the previous month.

2 Spot Overview:

Based on the regions of Yuyao and Dongguan, prices in the East China market are declining, and prices in the South China market are falling. Today, the market trading is sluggish with many bearish factors, and some traders are bottom-fishing. It is expected that the domestic ABS market prices will remain bearish next week.

3 Price Forecast:

Based on the regions of Yuyao and Dongguan, the market prices in East China are declining, while the prices in South China are experiencing localized downward trends. Today, market prices have fallen, while supply remains high. With many negative factors in the market, some manufacturers continue to reduce prices to boost sales. It is expected that ABS prices will maintain a slight downward trend in some areas next week.

EVA: No Market Support from Positive News, Continuing Downward Trend

1 Today's Summary

This week, the ex-factory price of EVA petrochemicals remained stable with a slight decrease, and the auction source prices saw a wide decline.

②. This week's EVA petrochemical units: Gulei Petrochemical shut down for maintenance on the 13th for 5 days, while other units, except for the long-stopped unit at Yanshan Petrochemical, are in stable production. Hanwha-GS Energy in Korea commissioned a 300,000-ton/year unit on September 25th.

2. Spot Overview

Today, the domestic EVA market remains weak. On Friday, downstream factories maintained a wait-and-see approach in their purchasing, with sporadic purchases focused on small orders. Market participants are generally pessimistic and very concerned about the future. Prices for soft materials are reportedly low, and the focus of actual transactions is declining. Mainstream prices: soft materials are priced at 10,200-10,600 yuan/ton, while hard materials are priced at 10,500-10,800 yuan/ton.

3 Price Prediction

In the short term, there is a lack of favorable support from on-site news. The expected production volume of photovoltaics in the later period, along with weak new orders from downstream shoe factories, has led to a cautious purchasing willingness, increasing the supply-demand conflict. It is anticipated that petrochemical factory prices will adjust downward next week, and short-term expectations are set accordingly. The domestic EVA market prices still have room to decline. 。

Engineering materials

PC: The market is weak and fluctuating.

1 Today's Summary

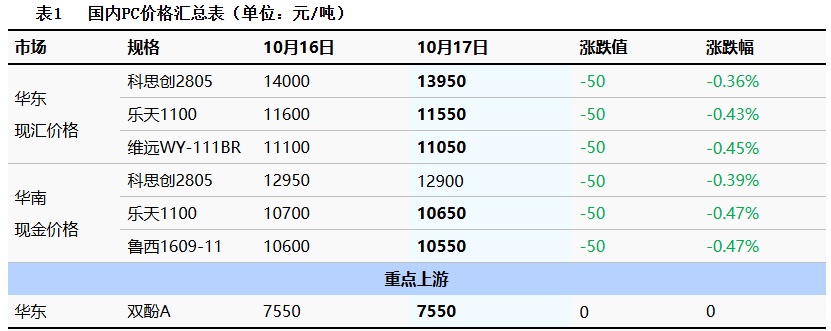

①. Thursday International crude oil Decline , ICE Brent crude oil futures for the 12 contract are down $0.85 at $61.06 per barrel.

②、 The closing price of raw material Bisphenol A in the East China market is 7,550. Yuan/ton, stable compared to the previous period.

③. As the weekend approaches, there are no new ex-factory price adjustments from domestic PC manufacturers.

2 Spot Overview

The domestic PC market remained weak and volatile today. As of the close in the afternoon, mainstream negotiations for low-end injection molding grades in East China were in the range of 10,400-13,400 yuan/ton, while mid-to-high-end grades were negotiated at 13,950-14,800 yuan/ton. Some domestic prices continued to drop by 50 yuan/ton compared to yesterday. As the weekend approaches, domestic PC manufacturers have not announced any new factory price adjustments. In the spot market, both East China and South China continue to show a weak adjustment pattern, with no new positive fundamentals. The overall weak sentiment in upstream raw materials and related products, coupled with the pressure to recoup funds, leads traders to offer discounts to facilitate sales. Downstream demand is insufficient, resulting in mostly small orders.

3 Price Prediction

After the holiday, profit-taking and follow-up selling activities led to a fluctuating adjustment in the domestic PC market prices, with the overall trading pace slowing down compared to before the holiday. Looking into next week, domestic PC factories are facing relatively low production and sales pressure, likely maintaining firm pricing strategies. Meanwhile, the spot market is gradually absorbing profit-taking and engaging in turnover trading, with support from cost factors strengthening accordingly. However, considering the sluggish downstream demand and the weak influence of related products, it is expected that the domestic PC market may narrow its weak trend before transitioning to a stalemate.

POM: Spot circulation under pressure, flexible real-time transactions.

1. Today's Summary

The Kaifeng Longyu POM plant will be shut down for maintenance on October 9th, with the planned duration being around 20 days.

Tianjin Bohua POM plant was shut down for maintenance on July 7th, and the restart date is undetermined.

2 Spot Overview

Based on the Yuyao area, Yun Tianhua M90 is priced at 10,800 RMB/ton today, with the price remaining stable compared to the previous period.Today's POM market is stable with minor fluctuations. The ex-factory price of petrochemical plants has been reduced by 200-500 yuan per ton, the fundamentals are weak, traders are relatively unmotivated, and the purchasing and sales atmosphere is hard to be optimistic. As of the market close, the tax-inclusive price of domestic POM in the Yuyao market is 8,100-11,100 yuan/ton, and the cash price of POM in the Dongguan market is 7,300-10,400 yuan/ton.

3. Price Forecast

During the week, some manufacturers have lowered their ex-factory prices, and there is no effective support on the supply side. The market sentiment is increasingly bearish, and traders are relatively lackluster in their operations. Some offer prices continue to negotiate for sales, with a range of 100-200 yuan/ton. Given that end-user factories have sufficient inventory, customers are not very enthusiastic about purchasing. In the short term, the focus remains on inventory digestion, with actual transactions being negotiated.Longzhong expects the domestic POM market to be under pressure and decline in the short term.

PMMA: PMMA particle size classification

1 Today's summary

①、 Today's PMMA particles Market price stability 。

②. Today, the domestic utilization rate of PMMA particles remains at 60%.

2 Spot Overview

Based on the East China region, today's PMMA particles are priced at 13,600 yuan/ton, stable compared to the previous working day and in line with morning expectations. 。 The price of raw material MMA continues to decline, leading to weakening cost support. Market participants are adopting a wait-and-see attitude, resulting in mostly stagnant offers. On the demand side, purchasing interest is low, and actual transactions are few and far between, with prices but no market.

3 Price Prediction

The raw material MMA is showing signs of weakness, leading to reduced cost support and growing bearish sentiment in the market. Holders are under pressure in their quotations, with some room for negotiation and concessions. Downstream purchasing remains cautious, and trading is subdued. It is expected that the PMMA market will maintain a steady trend in the short term.

PET: Polyester bottle chip market declines

1 Today's Summary

1. Wankai and Sinopec Yizheng Chemical Fiber have lowered prices by 30, while other factories remain stable. (Unit: yuan/ton)

Today, the domestic polyester bottle chip capacity utilization rate has reached 73.37%.

2 Spot Overview

As a benchmark for the East China region, today's spot price of polyester bottle-grade PET is 5645, down 5 compared to the previous working day, in line with morning expectations.

Crude oil has fallen again, and market sentiment towards commodities is pessimistic. Raw materials are dragging down the focus of the polyester bottle chip market slightly. It is heard that transactions for October-November sources are between 5580-5730, with some slightly higher at 5780, slightly lower at 5560, or futures contract 2511 with a premium of 10 or 2601 with a premium of 85 to 125. Overall transactions are few throughout the day, with strong market observation sentiment within the industry. (Unit: yuan/ton)

3. Price Prediction

The supply and demand situation lacks substantial positive factors, and the industry sentiment remains cautious. Influenced by crude oil and raw materials, the polyester bottle chip market is expected to remain weak, with a forecasted adjustment of the spot price for polyester bottle-grade chips in the East China region to operate in the range of 5550-5700 yuan/ton. Attention should be paid to macroeconomic news.

PBT: Raw material support is average, PBT market remains watchful in operation.

1 Today's Summary

This week's PBT manufacturer quotes remain stable overall.

This week, there is less maintenance on the PBT equipment.

③ The PBT production for this period is 22,600 tons.The capacity utilization rate is 53.14%, remaining stable compared to the previous period. The average domestic PBT gross profit this week is -343 yuan/ton, a decrease of 19 yuan/ton compared to the previous week. 。

2 Spot Overview

Based on the East China region as a benchmark, the mainstream price of medium and low viscosity PBT resin today is between 7450-7750 yuan/ton, unchanged from the previous working day. Today, the PBT market is operating in a wait-and-see mode, the PTA market continues its weakness, and the BDO market is undergoing narrow-range consolidation. The support from the raw material side is moderate, and as the weekend approaches, the PBT market is experiencing relatively quiet news, with negotiation focus fluctuating within a range. , According to Longzhong Information, the price of low-viscosity PBT pure resin in the East China market is 7,450-7,750 yuan/ton.

3 Price Prediction

The PBT market is expected to continue its weak operation. On the raw material side, the main PTA producers have reduced their production due to issues, leading to a slight decrease in supply and an expansion in the balance sheet inventory reduction. However, there are many external instabilities, resulting in a sluggish overall commodity trend and a pessimistic sentiment throughout the industry chain. In the short term, the PTA spot market is expected to maintain a volatile pattern. As the BDO settlement period approaches, market participants are mainly in a wait-and-see mood, with few spot negotiations as contract orders are fulfilled. Costs are unlikely to provide effective support, leading to a negative sentiment within the PBT market. In this buyer's market, the market focus still has a risk of declining. Therefore, Longzhong expects that tomorrow the East China market price for low to medium viscosity PBT resin will be around 7,450-7,750 yuan/ton.

PBT: Raw material support is generally weak, and the PBT market is operating with a wait-and-see attitude.

1 Today's Summary

This week's PBT manufacturers' quotes remain stable overall.

This week, there are fewer PBT equipment maintenance activities.

③ The PBT production for this period is 22,600 tons.The capacity utilization rate is 53.14%, remaining stable compared to the previous period. The average domestic PBT gross profit this week is -343 yuan/ton, a decrease of 19 yuan/ton compared to the previous week. 。

2 Spot Overview

The mainstream price of medium and low viscosity PBT resin in the East China region is 7,450-7,750 RMB/ton today, remaining unchanged from the previous working day. Today, the PBT market is running with a wait-and-see attitude, the PTA market continues to be weak, and the BDO market is narrowly consolidating. The support from the raw material side is average, with the PBT market news being relatively quiet as the weekend approaches, and the focus of negotiations fluctuating within a range. , According to statistics from Longzhong Information, the price of low-viscosity PBT pure resin in the East China market is 7450-3.Price prediction

The PBT market is expected to continue its weak performance. On the raw material side, major PTA producers have reduced their operating rates due to unforeseen circumstances, leading to a slight decrease in supply and an expanded drawdown in the balance sheet. However, there are many external uncertainties, and the overall commodity trend remains sluggish, with a pessimistic sentiment prevailing throughout the industry chain. In the short term, the PTA spot market is expected to remain volatile. As the BDO settlement period approaches, market participants are mainly adopting a wait-and-see attitude, focusing on fulfilling contract orders with few spot transactions reported. With costs failing to provide effective support, the sentiment within the PBT sector remains pessimistic. Under a buyer's market, there is still a risk of the market center declining. Therefore, Longzhong expects tomorrow's East China market for low to medium viscosity PBT resin to be priced at 7,450-7,750 yuan/ton.

PA6: The market trading atmosphere is average, and the PA6 market is operating weakly.

1 Today's Summary

①、 Sinopec's caprolactam weekly closing price last week was 8,580 yuan/ton (six-month acceptance without interest).

②、 Sinopec's listed price for pure benzene is reduced by 100 yuan/ton to 5,650 yuan/ton, effective October 14.

2 Spot Overview

Today, the nylon 6 market is operating weakly, with a continued negative market atmosphere. The low-level adjustment of raw material prices provides limited cost support. Downstream demand is primarily driven by rigid demand for replenishment at lower levels, with limited demand overall. The overall market transactions are average, with actual transactions subject to negotiation. Regular spinning PA6 in the eastern region is priced at 8,700-9,100 RMB/ton for cash with short delivery, while high-speed spinning spot price is 9,200-9,500 RMB/ton with acceptance and delivery. In Chaohu, the cash self-pickup price is 8,050-8,150 RMB/ton.

3 Price prediction

From the cost perspective, the caprolactam market is operating weakly, and the cost support expectation is weakening. From the supply and demand perspective, domestic polymerization enterprises are operating stably, Guangxi Hengyi continues to put into production, and domestic supply is expected to increase. However, downstream terminal orders are generally limited in demand, and it is expected that the PA6 market will be sorted at a low level in the near future.

PA66: Weak Market Performance Due to Low Downstream Procurement Enthusiasm

1 Today's Summary

① On October 16: U.S. commercial crude oil inventories have increased for three consecutive weeks, combined with the possibility of Russia and Ukraine resuming peace talks, leading to a decline in international oil prices. NYMEX crude oil futures for November contract fell $0.81 to $57.46 per barrel, a decrease of 1.39% compared to the previous period; ICE Brent crude futures for December contract fell $0.85 to $61.06 per barrel, a decrease of 1.37% compared to the previous period. China's INE crude oil futures for December contract rose 0.7 to 445.6 yuan per barrel, with the night session falling 8.5 to 437.1 yuan per barrel.

Today, the domestic PA66 capacity utilization rate is 67%, with a daily output of approximately 2,650 tons. Some enterprises have increased their capacity utilization. The downstream demand is average, and new capacity is gradually being released, leading to a sufficient supply of PA66 in the domestic industry.

2 Spot Overview

Based on the Yuyao market in East China, today's EPR27 market price is referenced at 14,700-14,800 RMB/ton, which is a decrease of 100 RMB/ton compared to yesterday's price, representing a drop of approximately 0.67%. 。 Downstream demand is weak, market spot supply is abundant, high-price transactions are hindered, and the market is operating weakly.

3 Price Prediction

Raw material prices are fluctuating, and cost pressures remain significant. The market has ample spot supply, but demand is performing moderately. Industry sentiment is cautious, and it is expected that the domestic PA66 market will undergo weak consolidation in the short term.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Join the K Exhibition Feast | 2025 Mold-Masters Latest Technology Highlights Quick Dispatch

-

European TDI Soars Due To Covestro Plant Shutdown

-

Dow To Restart Pe Units 5 And 7 This Week, Recovery Date For Unit 6 Remains Undetermined In The United States (US)

-

Metal Stamping Supplier Autokiniton to Close Detroit Plant and Lay Off Workers

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories