To achieve million-level annual sales, blockbuster products are essential

In 2025, the Chinese auto market concluded the "14th Five-Year Plan" period. According to data from the China Association of Automobile Manufacturers (CAAM), the cumulative sales of passenger vehicles for the whole year reached 30.1 million units, a year-on-year increase of 9.2%. Among them, new energy vehicle sales reached 16.49 million units, a year-on-year increase of 28.2%, with penetration rate approaching 48%.

Against the backdrop of global economic fluctuations, industrial restructuring, and still-recovering consumer confidence, this indicates that the Chinese auto market has entered a relatively stable development phase within a more complex competitive environment.

For automakers, beyond scale and growth, the strength of their product lineup is key. Looking back at the past year, the automakers with larger sales volumes and faster growth were not relying on a single "miracle car," but rather supported by multiple best-selling models.

In other words, the importance of hit products has not decreased, but the "single-point effect" of hit products is being weakened.

, and there's more than one blockbuster product.

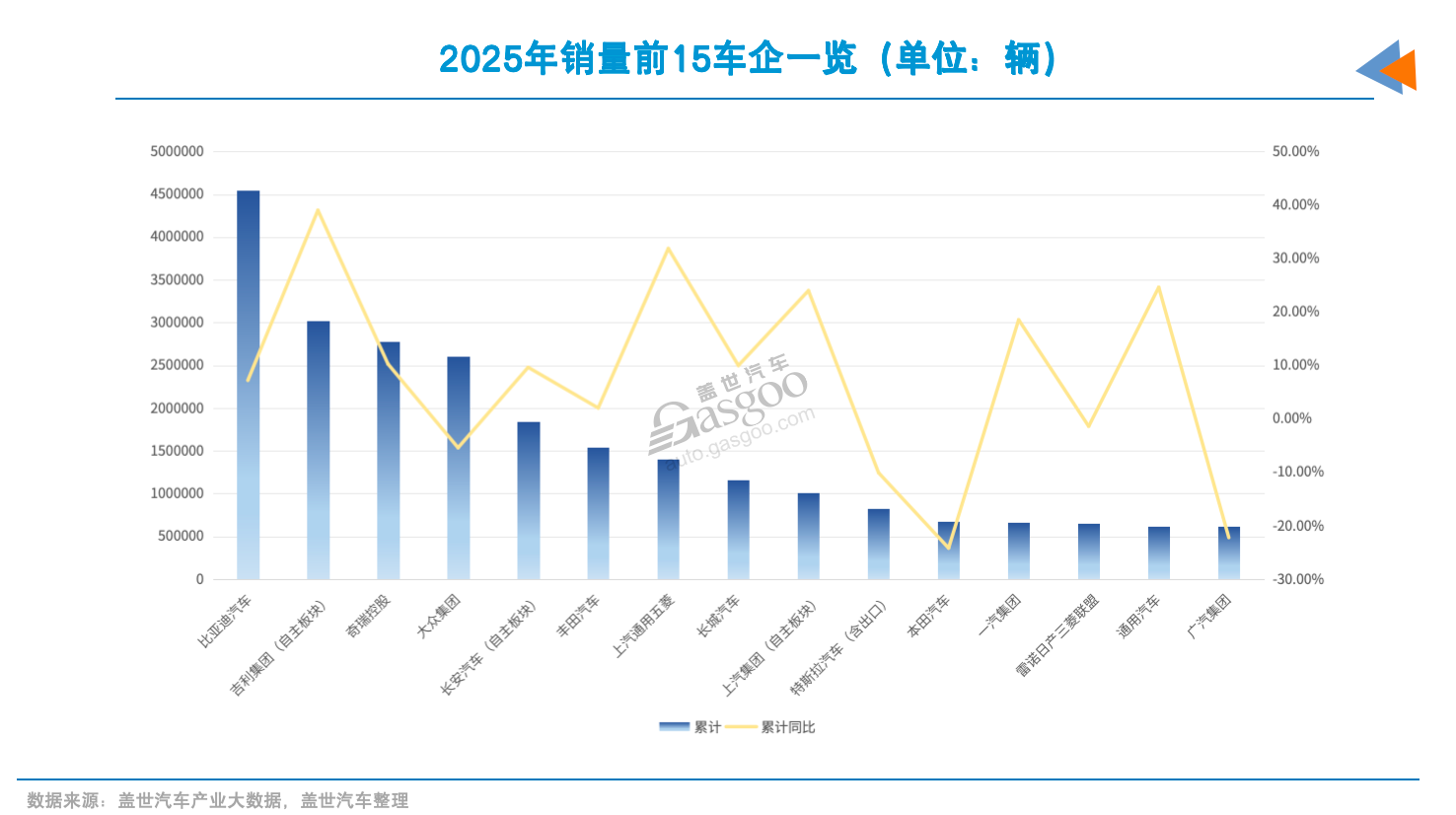

Looking at the overall performance of the top 15 car companies in sales in 2025, leading companies like BYD, Geely, and Chery have achieved market share gains through a "multi-brand, multi-product" strategy. Even though there are still so-called best-selling models, their proportion of the company's total sales is significantly lower than in the early stages when "blockbusters were everything or most of it."

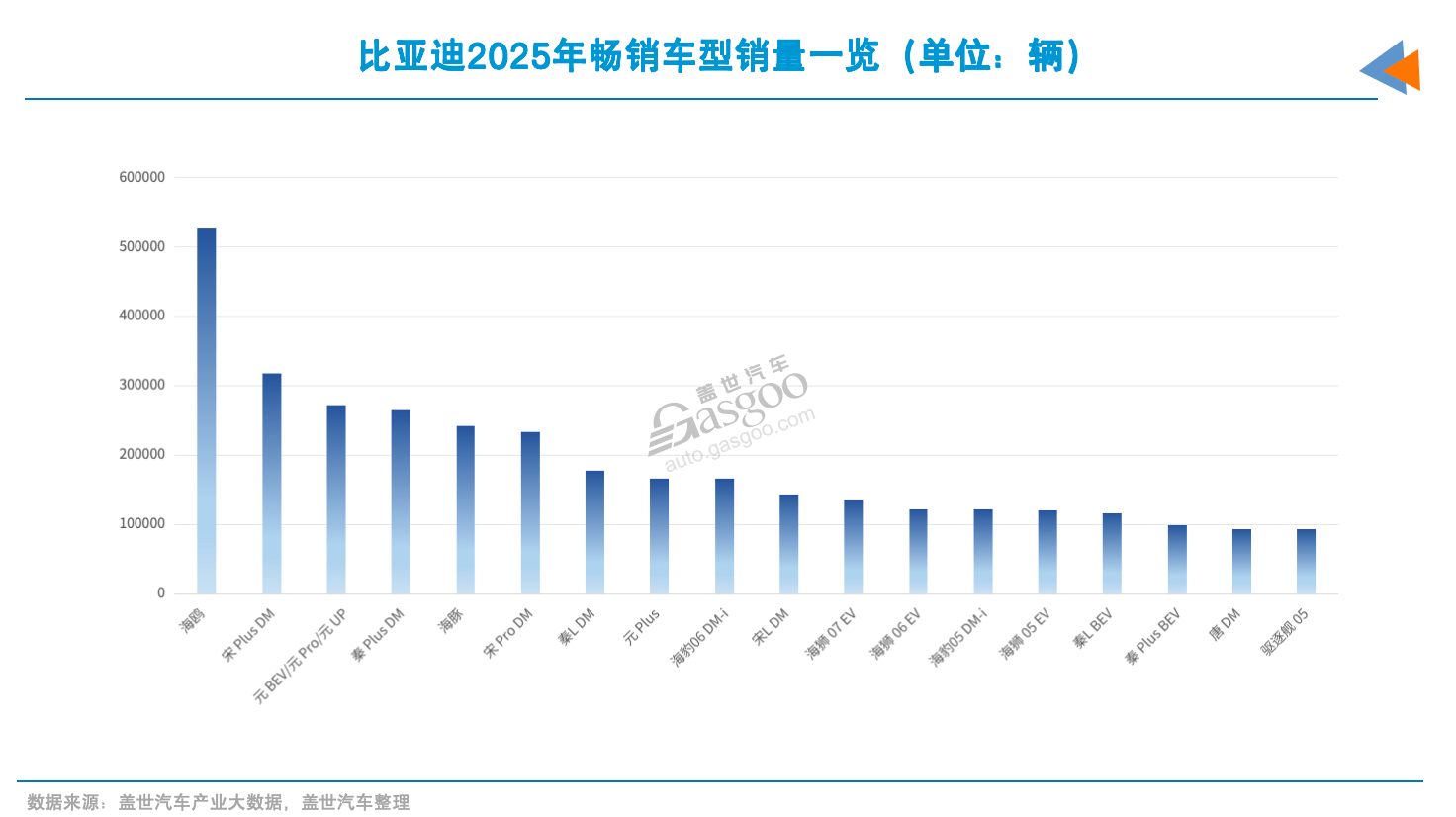

Taking BYD, the sales leader, as an example, its annual sales reached 4.6 million vehicles in 2025, a year-on-year increase of 7.7%. The Seagull, with sales exceeding 500,000 units, became the automaker's best-selling model, accounting for approximately 12%.

Of course, the Seagull alone is far from enough to support its massive sales system. According to data from Gasgoo Automotive Industry Big Data, BYD has more than ten models with annual sales exceeding 100,000 units. The Song Plus DM has annual sales of over 300,000 units; models in the 200,000-300,000 annual sales range include the Yuan series, Qin Plus DM, Dolphin, and Song Pro DM; models in the 100,000-200,000 annual sales range include the Sea Lion 05 EV and Qin L BEV; and several other models have annual sales approaching 100,000 units.

These models are spread across multiple core price ranges from 70,000 to 200,000 yuan, covering different categories such as sedans and SUVs. This "multiple points of growth" layout gives BYD a high degree of resilience when facing fluctuations in segmented market competition.

Geely's growth drivers also stem from the synergy of multiple brands and product lines. In 2025, its sales exceeded 3 million units, a year-on-year increase of 39%. Among them, the Geely Galaxy series achieved annual sales of 1.236 million units, a year-on-year increase of 150%, contributing 40% of the total. Geely covers the entire price range from 50,000 yuan to 1 million yuan through the differentiated positioning of multiple sub-brands such as Zeekr, Galaxy, and Lynk & Co.

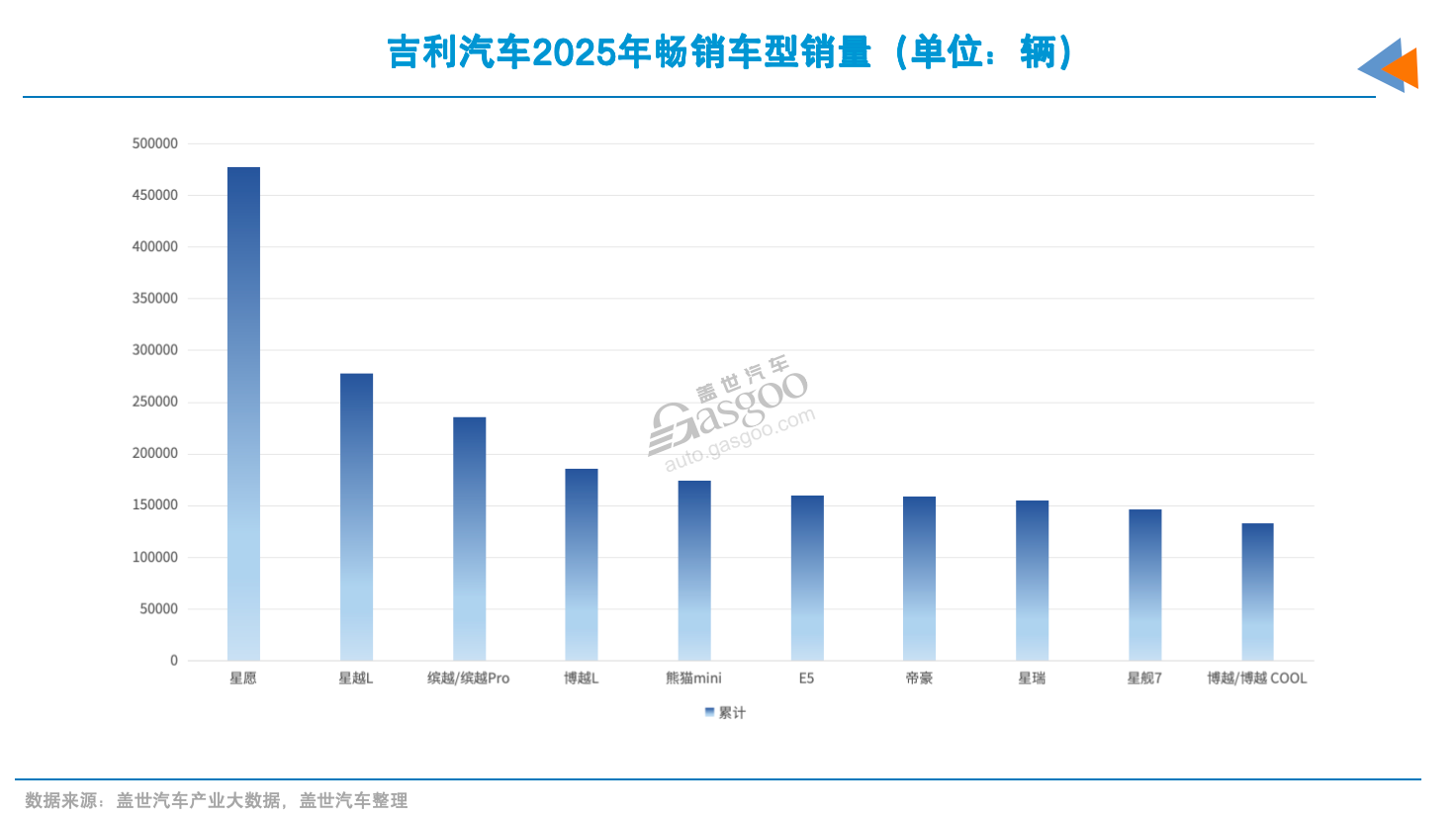

Among them, Xingrui is Geely's best-selling model, with sales approaching 500,000 units in 2025, accounting for approximately 15%. Meanwhile, both the Xingyue L and Binyue series models achieved annual sales of over 200,000 units, and several other models, including Boyue L and Panda mini, had annual sales exceeding 130,000 units. Geely has one or two models supporting it in each major segment, forming a group army-style product offensive.

This product competition strategy is common among most leading traditional automakers. SAIC-GM-Wuling relies on several small cars, such as the Hongguang MINI EV (over 400,000 units) and the Bingo series (approximately 200,000 units), to support its growth. Chery, on the other hand, is leveraging multiple SUV models with annual sales of around 200,000 units each, including the Tiggo 5X, Tiggo 7 series, and Tiggo 8 series, to achieve strong performance.

Regarding multinational automakers, the Volkswagen Group experienced a slight overall sales decline year-on-year, but still boasts several pillar models with annual sales of around 200,000 units, such as the Sagitar, Passat, and Magotan. It also has products like the Audi A6L and Lavida that maintain annual sales of over 100,000 units. Toyota also has multiple gasoline vehicles, including the RAV4 and Corolla Cross, with monthly sales consistently exceeding 10,000 units.

General Motors' performance is also noteworthy, achieving double-digit sales recovery in 2025 and once again exceeding 600,000 units (excluding SAIC-GM-Wuling's sales). The automaker's best-selling model was the Envision family, with annual sales exceeding 160,000 units, of which the Envision Plus grew by 88% year-over-year.

Cui Dongshu, Secretary-General of the CPCA (China Passenger Car Association), analyzed that Buick's ability to maintain stability amidst an overall downward trend is attributable to the precise positioning and implementation of a "one-price" strategy for models like the Envision Plus. The Envision Plus has demonstrated relatively stable market performance in 2025 through its competitive pricing and higher-level product capabilities.

Among traditional luxury brands, BMW has achieved commendable market performance, with sales in China stabilizing at 600,000 units in 2025. This success is largely due to the support of its two main models, the 3 Series and 5 Series, which accounted for 40% of total sales last year.

Analyzing the sales of top-ranked car companies, it's clear that in the current market environment, relying on a single blockbuster model to drive long-term growth is unsustainable. This is due to two reasons: first, competition within specific market segments is intensifying, significantly shortening product lifecycles; and second, user needs are becoming increasingly fragmented, with diverging preferences regarding price, powertrain type, and size class.

Against this backdrop, relying on a single model to cover all mainstream demands inherently presents a structural limitation. Therefore, automakers capable of creating multiple blockbuster models are more likely to further advance in sales volume, and even lay the foundation for achieving annual sales of one million units.

New forces also have blockbuster products.

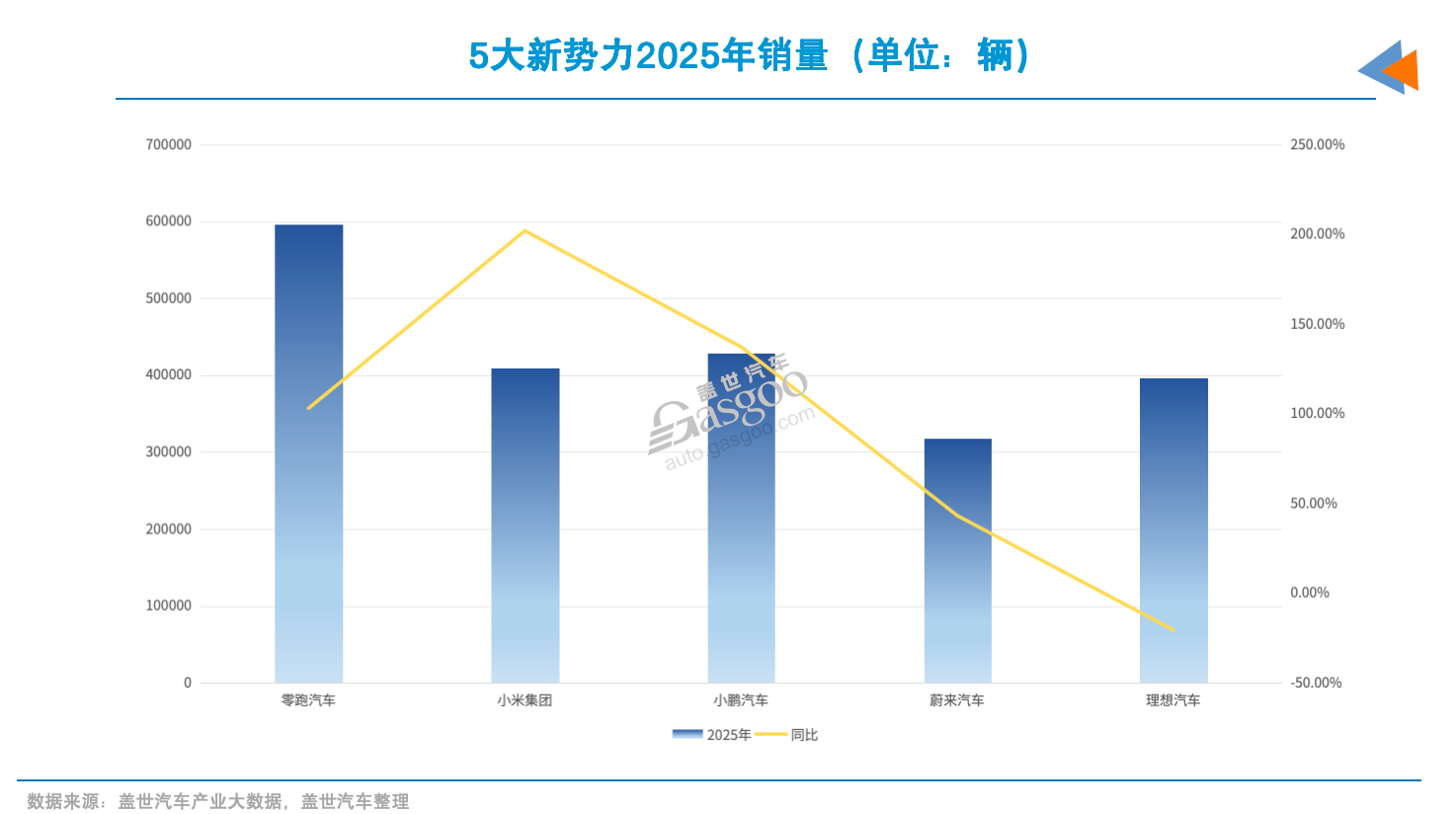

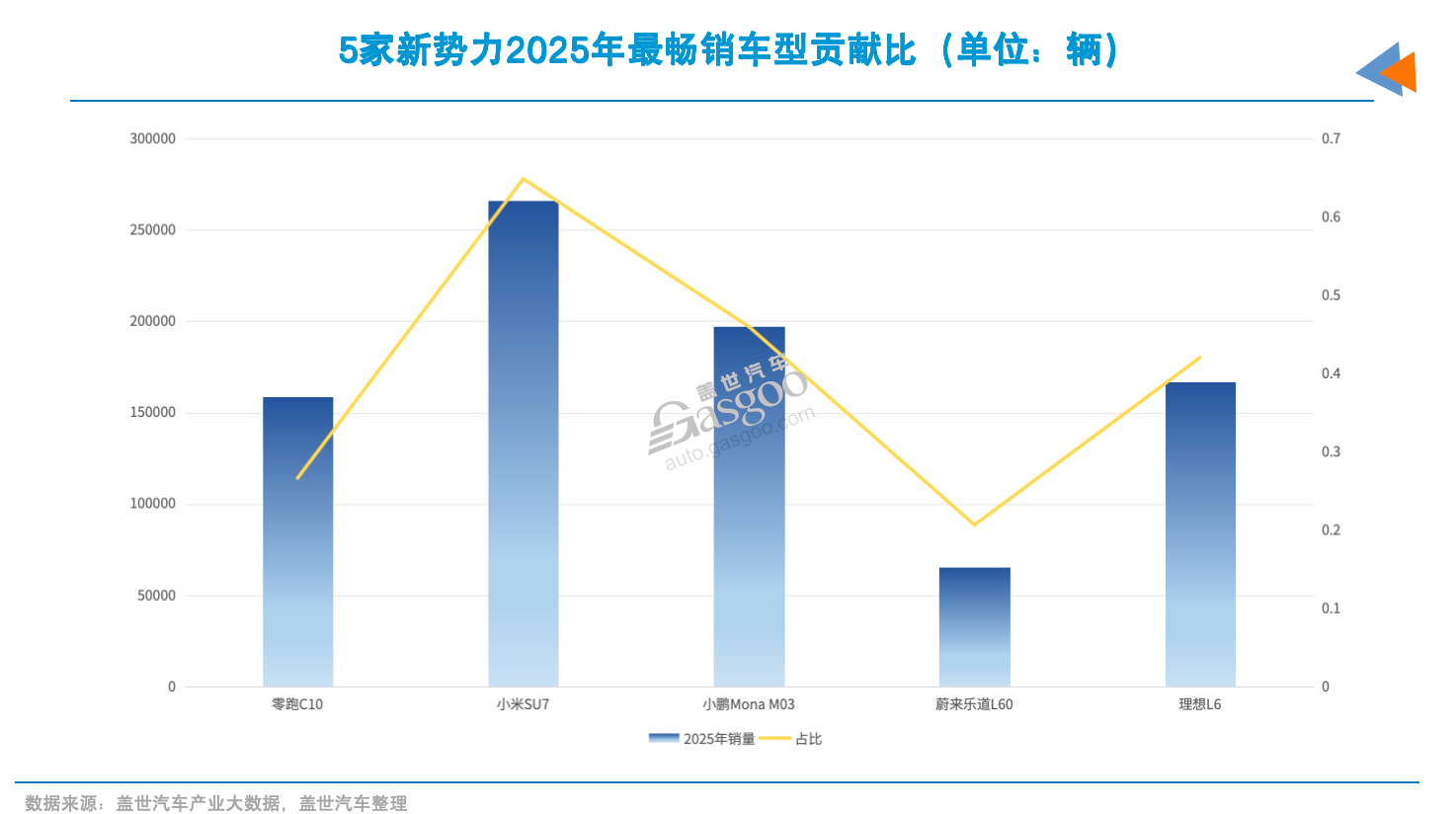

Within the new energy vehicle startups, blockbuster products also exist and play a more crucial role for a considerable period. Data shows that new players rely on single blockbuster models significantly more than traditional automakers. Taking Xiaomi Auto as an example, its annual sales in 2025 exceeded 400,000 units, primarily driven by two models on sale. Among them, the SU7, as its first model, contributed approximately 250,000 units in sales for the year, accounting for as much as 60%.

In contrast, for BYD and Geely, the sales contribution of their best-selling models is mostly less than 20%. This reflects that in the early stages of brand building, emerging EV brands often need to quickly capture user mindshare through the explosive popularity of a single product.

In 2025, Leapmotor's sales are expected to approach 600,000 units, with its best-selling model, the C10, reaching 160,000 units annually, accounting for 26% of the brand's total sales. When combined with the B10, which boasts sales exceeding 90,000 units, these two models alone contribute 40% of the brand's sales.

XPeng Motors also exceeded 400,000 vehicle sales last year, with the MONA M03 alone selling nearly 200,000 units, accounting for a high proportion of 46%. Li Auto sold over 400,000 vehicles during the same period, with its L6 model independently contributing 40% of the sales. Nio's sub-brand Letao, targeting the mainstream market, saw its first model, the L60, achieve sales of approximately 60,000 units in its first year of launch, accounting for 20% of Nio's total sales.

Tesla's retail sales in China in 2025 are estimated to be around 600,000 vehicles (excluding exports), accounting for approximately 5% of the new energy vehicle market. Although slightly lower than the previous year, it still remains among the top players.

Model Y and Model 3 remain the primary contributors to its sales, with Model Y consistently ranking among the top-selling pure electric vehicles in China, contributing up to 60% of Tesla's sales. Together with Model 3, Tesla has, to some extent, formed a structure in China where "blockbuster models support overall sales."

New forces can create hit products mainly due to their precise product definition and the disruptive impact of intelligent experience. New energy vehicle models mostly enter the mainstream or high-end price range, forming a perceptible advantage in configuration and intelligent experience, and reducing user decision-making costs through relatively simplified product lines.

Taking the XPENG MONA M03 as an example, it brings high-level assisted driving and stylish design down to the 100,000 to 150,000 yuan price range, tapping into the younger generation's desire for technological equality. The explosion of the Xiaomi SU7, in addition to Lei Jun's personal brand appeal, lies in its breakthrough in creating a closed-loop "human-vehicle-home full ecosystem," providing an interactive experience that traditional models cannot match.

Wang Xianbin, an analyst at Gasgoo Automotive Research Institute, believes that during the market growth phase, new energy vehicle startups have achieved a high degree of platform unification and standardization of production processes through a lean and focused approach, thereby forming competitive barriers in specific market segments.

Comparing traditional automakers with new energy vehicle startups reveals a shift and convergence in their competitive logic. Traditional automakers focus on casting a wide net and then developing blockbuster models, while new entrants start with a single blockbuster and expand towards multiple products and matrices.

New energy vehicle startups currently have fewer blockbuster models due to their development stage and resource constraints. Compared to traditional automakers, they have limitations in the number of platforms, production capacity layout, and channel coverage, making them more inclined to concentrate resources and thoroughly develop a single product first. This strategy helps build market awareness in the early stages and is more conducive to controlling costs and pace.

As sales volume continues to expand, a single model not only has to bear the sales task, but also absorb pressure from after-sales service, supply chain, quality control, and so on, its risk exposure will be continuously amplified.

Taking Tesla as an example, although the Model 3 and Model Y once dominated the global new energy vehicle market for a long time, the pressure on single products is increasing due to the current landscape of numerous competitors and diversified consumer demand. Affected by factors such as the impact of Chinese car companies, Tesla's sales in core markets such as China and Europe declined in 2025, leading to an overall year-on-year sales decline of 8%.

For emerging EV brands, transitioning from "establishing a foothold with a single model" to "achieving growth through multiple models" is a critical juncture they must face. In fact, leading new energy vehicle companies are doing just that. NIO, XPeng, Li Auto, Leapmotor, and others are all expanding their brands or product lines in an effort to cover a broader market.

Mostly, they still don't sell.

Whether traditional giants or emerging brands, the brand/product strategy of "having more children to fight better" has become the mainstream choice in today's auto market. Companies hope to capture more opportunities in the fierce market competition by covering a wider price range and user base through a richer product matrix.

However, the reality is that among the product matrix composed of numerous car models, only a few ultimately become bestsellers, while the vast majority of models linger on the edge of sales.

This characteristic is particularly prominent among traditional automakers. Most of the top-selling traditional automakers currently have a large number of models on sale, generally between forty and fifty, with some group companies even approaching or exceeding seventy. These models cover different brands, different power types, and different price ranges, seemingly forming a dense market coverage network. However, in terms of actual sales performance, only a small portion of these models can generate stable sales.

According to incomplete statistics from Gasgoo Automotive Industry Big Data, Geely Group (including Volvo and other brands) has approximately 80 models currently on sale; Chery Holding follows closely with about 75 models; Volkswagen Group and BYD also have about 70 and 60 models respectively. Toyota, Honda, GAC and other automakers also have more than 30 models on sale. (Note: Sales are counted separately for different powertrain types, such as Han DM and Han BEV.)

Behind the vast array of models on sale lies automakers' strategic layout in every niche market. However, sales contributions are highly concentrated in a small number of top-selling models.

For example, the top 10 best-selling Geely models account for 70% of its total sales, and the top 18 best-selling BYD models contribute about 70% to the overall sales. Similar situations exist for other automakers. This means that the remaining dozens of models have to share the remaining market share, with many models having monthly sales of only thousands or even hundreds of units.

The trend of new energy vehicle startups expanding into multiple brands and products is also evident. Leapmotor currently has approximately 13 models on sale, Xpeng has about 12, and NIO has around 14. Only Li Auto continues to stick to a single version strategy. However, their sales structure also exhibits a "pointed cone" shape, where a core blockbuster model accounts for the majority of the brand's sales, while other models play a supplementary or market-testing role to varying degrees.

However, this does not stop the determination of new forces to expand their product matrix. Even Tesla, known for its "less is more" approach and long-term reliance on two models to "conquer the world," has launched the Model Y L model in response to the diverse needs and fierce competition in the global market, and plans to launch an affordable model in 2026. Xiaomi will launch three heavyweight new cars this year in one go.

New forces are shifting to a multi-product strategy because, in the current Chinese auto market environment, a single-product structure is increasingly difficult to cope with complex competition. Automotive industry analyst Bai Yiyang said that during the market growth phase, a multi-product strategy can maximize the exploration of niche markets, with the core being to meet differentiated needs across different price ranges and purposes.

Image source: Xiaomi Auto

At the same time, user needs are becoming increasingly fragmented and personalized. More than one automotive executive has told Gasgoo that it is difficult to have a "one-size-fits-all" car that satisfies all groups. By differentiating brand positioning (such as NIO's high-end, Leda's mainstream, and Firefly's entry-level) and product characteristics (such as BYD Dynasty's stability and Ocean's youthfulness), the aim is to seize the mindshare of different user groups in advance.

For traditional automakers, multi-brand strategies serve as important bridges in the transition to new energy vehicles, helping to differentiate from the brand image of the internal combustion engine era, such as Geely's launch of Zeekr and Galaxy, and Changan's Avatr, Deepal, and Qiyuan.

Industry insiders in the automotive sector have stated that the success of various models from brands like BYD and Geely demonstrates that, in addition to reasonable pricing, a strong product offensive is equally important, creating a sense of "value for money." "Regarding BYD's hybrid products, based on the user experience, I believe they currently outperform Toyota."

The current competitive and fast-paced environment makes it difficult for each car model to have enough room to grow. User attention, channel resources, and internal corporate investment are always limited. When the number of products continues to increase without a clear hierarchy of priorities, sales will naturally concentrate on a few dominant models, while the majority will be squeezed to the periphery.

On the other hand, having multiple brands and products means a dispersion of resources in R&D, marketing, channels, and supply chains. If the positioning between brands is unclear, the price bands overlap, or the products are simply "clones," it can easily lead to internal competition.

There are precedents for this lesson. Geely Automobile once suffered from resource depletion due to overlapping positioning of multiple sub-brands, leading to slow progress in its new energy transformation, and only began to see results after reorganizing its brand matrix. Chery's past setbacks in implementing a multi-brand strategy also serve as a cautionary tale.

Through continuous exploration, many automakers are now undergoing comprehensive integration from organizational structure to R&D systems, aiming to achieve resource sharing, improve R&D efficiency, promote modular product development, and ultimately reduce costs. Currently, some automakers have successfully advanced this integration. This means that even in the market norm of "most products selling poorly and only a few selling well," automakers can still take the initiative and achieve a situation where the benefits outweigh the disadvantages.

Analyst Bai Yiyang pointed out that during the growth phase of a market, there are often numerous untapped niche markets, making a multi-brand or multi-product strategy more suitable for seizing early opportunities. However, as the market matures and product refinement progresses, there may be a return to a focused branding strategy.

When the auto market will return to a "less is more" approach remains to be seen. Perhaps it will only be determined after this round of market competition and elimination is over.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

CBAM Officially Implemented In Its First Month: How Chinese Export Enterprises To Europe Complete Their First Compliance Declaration?

-

100% Recycled Plastic Bricks: A New Tool to Replace Traditional Concrete and Combat Floods

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!