The technological evolution, market pattern, and future trends of nylon flame retardant masterbatch

Nylon flame-retardant masterbatch is a high-efficiency functional modified material designed to enhance the flame-retardant properties of nylon (PA) materials. It is made by pre-mixing, plastifying, and granulating high-efficiency flame retardants, synergists, and other components with nylon carrier resin. When added to nylon base material for processing, it can disperse uniformly and effectively suppress flame propagation during combustion, significantly improving the flame-retardant grade of the material (such as reaching UL94 V-0 grade), while striving to minimize the impact on the original mechanical properties of nylon. This masterbatch is mainly used in fields with stringent flame-retardant safety requirements, such as electronics, electrical appliances, and automotive components.

I. Introduction and Overview

1. Definition and Connotation of Nylon Flame Retardant Masterbatch

Nylon flame retardant masterbatch (also known as flame retardant masterbatch) is a functional concentrated additive designed to enhance the fire resistance of nylon (polyamide, PA) materials. It is not a directly used final plastic but an intermediate granular product made by pre-dispersing and encapsulating high-efficiency flame retardants, synergists, dispersants, lubricants, and other additives into a nylon carrier resin through specific processes. Users can easily produce flame-retardant nylon materials with predetermined flame retardant levels by physically blending a certain proportion of the masterbatch with regular nylon base material. Compared to directly adding powdered flame retardants, this "masterbatch method" has significant advantages, including ease of addition, accurate measurement, uniform dispersion, less dust pollution, and a smaller impact on the mechanical properties of the base material.

The necessity and urgency of flame retardant modification for nylon materials.

Nylon, as an important engineering plastic, is widely used in fields such as electronics and electrical, automotive transportation, machinery, and textiles and clothing due to its excellent properties like high strength, wear resistance, oil resistance, and self-lubrication. However, nylon itself is a flammable material with a low limiting oxygen index (LOI). It exhibits severe dripping during combustion, which can easily spread flames and poses significant fire hazards. As the trend of replacing metal components with nylon accelerates in high safety-demanding scenarios such as coal mine underground parts (like rollers and pipelines), new energy vehicle battery components, high-speed train interiors, and high-rise building cables, mandatory and efficient flame-retardant modification of nylon has become a necessary requirement to ensure the safety of people's lives and property and to comply with international and domestic mandatory regulatory standards.

II. In-depth Analysis of the Technical System

Flame Retardant Mechanism

The effectiveness of nylon flame retardant masterbatch is based on the complex physical and chemical actions triggered by its core flame retardant components during combustion, mainly including:

Gas-phase flame retardant mechanism: Flame retardants decompose upon heating to produce free radical scavengers (such as halogen free radicals), interrupting the combustion chain reaction; or decompose to produce non-flammable gases (such as nitrogen, water vapor), diluting the concentration of oxygen and combustible gases.

Condensed phase flame retardant mechanism: Flame retardants promote the formation of a dense and robust char layer on the burning surface of the nylon matrix. This char layer can isolate heat and oxygen, prevent the escape of internal combustibles, and suppress dripping. The phosphorus-nitrogen intumescent system is a typical example of this mechanism.

Cooling/endothermic mechanism: Inorganic flame retardants such as aluminum hydroxide and magnesium hydroxide absorb a large amount of heat during decomposition, reducing the surface temperature of the material and delaying thermal decomposition.

In practical applications, efficient flame retardant masterbatches often achieve optimal flame retardant effects through the synergistic action of multiple mechanisms (UL94 V-0 grade is a common high standard requirement).

2. Evolution of Technical Route and Comparison of Formulation System

The technological development history of nylon flame-retardant masterbatch is a narrative of pursuing higher efficiency, greater environmental friendliness, and minimal impact on the inherent properties of the material.

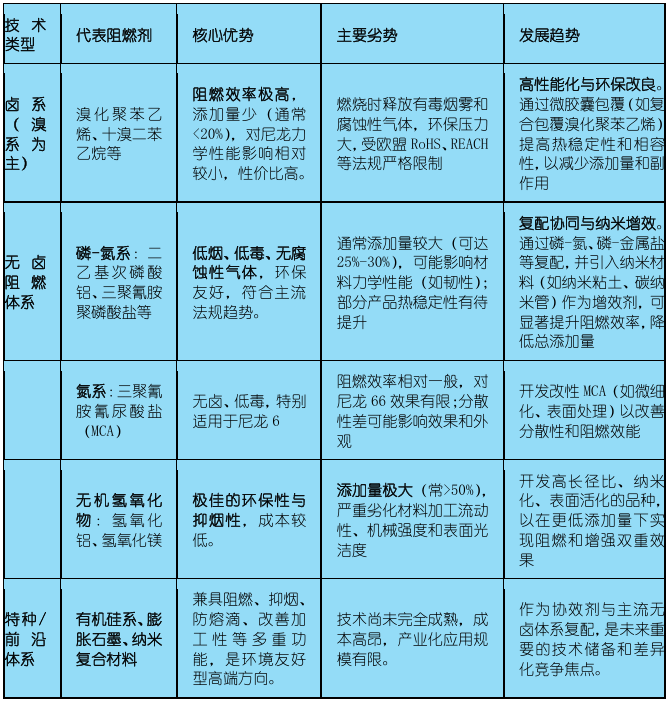

Table 1: Comparative Analysis of Major Technical Routes for Nylon Flame Retardant Masterbatch

Progress in Key Preparation Processes

The preparation process directly affects the dispersion uniformity, thermal stability, and final performance of each component in the masterbatch. Modern processes have surpassed simple blending extrusion.

Microencapsulation and Surface Modification: The latest technology uses chemical or physical methods to coat the surface of flame retardant powder. For example, after compounding aluminum diethylphosphinate with melamine polyphosphate, it is treated in a formic acid/nylon solution to form a microencapsulated structure. This effectively prevents the thermal decomposition and migration of the flame retardant during processing, enhancing compatibility with the nylon matrix.

Nanocomposite and Precision Compounding: By incorporating nano-scale flame retardant synergists (such as modified nano-silica and layered silicates) into the formulation, their large specific surface area and interface effects can be utilized to form a more robust char layer in the condensed phase, achieving an exponential enhancement in flame retardant performance. This allows for a reduction in the amount of traditional flame retardants used, mitigating the negative impact on mechanical properties.

Carrier resin adaptation technology: For different nylon models (such as PA6, PA66, high-temperature PA) and final product requirements (such as thin-walled parts, fibers), select or customize matching carrier resins (such as PA6 with different viscosities), and even use specially structured resins like star-shaped nylon to optimize the processing window and final performance.

3. Market and Industry Chain Panorama Analysis

1. Global and Chinese Market Status and Scale

The global flame-retardant nylon market continues to grow driven by safety regulations and industrial upgrades. According to industry reports, the market size in both the global and Chinese markets shows a steady upward trend from 2020 to 2024. The Asia-Pacific region, especially China, has become the world's largest consumer market and growth engine, thanks to China's leading position in global terminal industries such as electronics manufacturing, new energy vehicles, and rail transportation.

2. Deep Segmentation of the Application Market

The downstream applications of nylon flame-retardant masterbatch are highly diversified and increasingly demanding.

Electronics and electrical: the largest application field. Used for connectors, switch sockets, circuit breakers, charger housings, etc. It must pass certifications such as UL94 V-0 to prevent fires caused by short circuits and overheating.

Automotive transportation: One of the fastest-growing sectors. Applied in new energy vehicle battery modules, wiring harness connectors, engine peripheral components, interior parts, etc., it needs to meet automotive-grade flame retardant standards such as ISO 3795.

Textiles and clothing: used for flame retardant protective clothing, firefighting equipment, airbags, interior fabrics for high-speed trains and airplanes, etc. The mainstream process for preparing flame retardant nylon fibers is melt spinning by adding flame retardant masterbatch online.

Other fields: including electrical wire and cable insulation sheaths (meeting IEC 60332), building insulation tubes, mining machinery wear-resistant and flame-retardant components, etc.

3. Analysis of the Competitive Landscape in the Industry Chain

Upstream: Mainly includes basic nylon resins (caprolactam, adipic acid, etc.), various flame retardants and auxiliary agent manufacturers. Price fluctuations in upstream raw materials and environmental policies pose challenges to cost control for midstream masterbatch manufacturers.

Midstream (masterbatch manufacturing): The market exhibits a tiered competitive landscape. The high-end market is dominated by a few leading domestic and international companies (such as Techmer PM from the United States and some listed companies in China) that possess core formulation technology and patents. They can provide customized, high-performance halogen-free solutions. In contrast, the mid-to-low-end market is crowded with numerous companies, where competition is fierce and product homogeneity is high, with cost-effectiveness as the primary competitive strategy.

Downstream: For various nylon product modification factories and end-product manufacturers. Their demand for masterbatches is evolving from "having flame-retardant functions" to "meeting comprehensive performance for specific scenarios (flame retardancy, mechanical properties, appearance, environmental protection)." They have strong bargaining power and are deeply involved in the joint development of masterbatch formulations.

IV. Future Development Trends, Challenges, and Strategic Recommendations

Core Development Trends

Halogen-free has become an irreversible mainstream trend: global environmental regulations (such as the EU Green Deal and China's "dual carbon" goals) are continuously intensifying, and the environmental requirements of end-brand manufacturers (such as Apple and Sony) in their supply chains have collectively driven the transition of halogen-free flame retardant masterbatches from "optional" to "mandatory."

The technology is developing towards "efficient synergy" and "functional integration": a single flame retardant system is difficult to meet comprehensive performance requirements. Future technology breakthroughs lie in: deeply developing phosphorus-nitrogen-silicon-metal multi-element synergistic systems; utilizing nanotechnology and microencapsulation technology to achieve efficient use of flame retardants; developing "package" masterbatch solutions with multiple functions such as flame retardancy, reinforcement, anti-dripping, and anti-static properties.

Customization and Service Extension: Market competition has shifted from single product competition to "material solutions + technical services" competition. Masterbatch suppliers need to deeply understand the pain points of downstream customers under specific processing conditions (such as thin-wall high-speed injection molding, spinning) and application environments, and provide tailor-made formulations and process support.

The main challenges faced

The technical balancing challenge: How to achieve a high flame retardant rating (UL94 V-0) while maximizing the inherent excellent mechanical properties of nylon (especially toughness and strength) is the biggest technical bottleneck in the promotion of halogen-free technology.

Cost Pressure: The cost of high-performance halogen-free flame retardants and compounding technology is significantly higher than that of traditional halogen-based products. The key to widespread market adoption is how to reduce overall costs through technological innovation.

Standard and certification barriers: The flame retardant standards across different countries and industries (automotive, aviation, electronics) are complex and constantly updating, making the process of obtaining relevant certifications time-consuming and labor-intensive, thus constituting high market entry barriers.

Strategic Recommendations

For manufacturers: Increase investment in research and development, focusing on engineering breakthroughs in cutting-edge halogen-free technologies such as phosphorus-nitrogen synergy and nanomodification; establish joint laboratories with leading downstream customers to deepen application research; actively pursue product certification in major global markets.

For investors and policymakers: attention should be focused on companies with substantial patent layouts in halogen-free core technologies, as well as those with rapid customer response and customization capabilities. At the national level, policies can be introduced to encourage the research and application of environmentally friendly flame retardant materials, and to promote the establishment of a unified, scientific, and internationally aligned flame retardant material evaluation standard system.

The nylon flame retardant masterbatch industry is at a critical juncture of technology and market convergence. Driven by the dual rigid demands for safety and environmental protection, the industry is bidding farewell to the old era dominated by halogen-based solutions and moving towards a new halogen-free era characterized by efficiency, low toxicity, low smoke, and multifunctionality. Future competition will be a comprehensive contest of core formulation technology, integration capabilities of advanced materials such as nanotechnology, and deep customer service abilities. Those who can take the lead in...Halogen-free high-efficiency synergistic technologyAchieve a breakthrough and successfully implement the above content.Mass production, cost-controllable productionThe companies will dominate the reshaped competitive landscape, sharing the broad market dividends brought by global industrial upgrades and green transitions.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants