The Internal Combustion Engine Cars You Look Down On Are These Manufacturers' Lifelines

Under the guidance of the global "dual carbon" goals and the continuous support of policy dividends, China's new energy vehicle market is visibly reshaping the industry landscape at an accelerating pace, becoming a significant force driving the transformation of the global automotive industry.

According to data from the China Association of Automobile Manufacturers (CAAM), China's production and sales of new energy vehicles (NEVs) exceeded 16 million units in 2025, reaching 16.626 million and 16.49 million units respectively, with year-on-year growth rates of over 28%. The proportion of NEV sales in new car sales climbed to 47.9%, an increase of 7 percentage points compared to the previous year, meaning that one out of every two newly added cars is a new energy vehicle.

From the consumer perspective, market acceptance has shifted from policy-driven to self-selection, with the retail penetration rate of new energy passenger vehicles reaching 59.1% in December 2025. 147 cities nationwide have a new energy penetration rate exceeding 50%, and dense consumer clusters have formed, especially in the eastern coastal areas.

Against this backdrop, "going all in on new energy" has become a strategic choice for many automakers, and there are no shortage of success stories. Several independent brands have achieved rapid growth in the new energy vehicle sector, with Chinese brands' passenger car sales reaching a market share of 69.5% in 2025. Their penetration rate in the new energy vehicle segment is even higher, reaching 80.9%, completely breaking the market monopoly of traditional joint venture brands.

However, the rapid advance of new energy vehicles has not completely squeezed the living space of fuel vehicles. While the industry focuses on the continuous breakthrough of new energy penetration rate, a set of data is worth noting: in 2025, China's production of fuel vehicles will still reach 18.25 million units, a slight year-on-year decrease of 1%, but still accounting for more than half of the total automobile production.

In fact, many automakers still rely on gasoline vehicles to achieve steady profits, with gasoline vehicle sales accounting for more than 50% of their total sales. These gasoline models are not only a stable source of sales for the companies, but also serve as "profit cows" to support their new energy transition and technology research and development. During the painful period of new energy transition, the continued contribution of gasoline vehicles provides many automakers with more buffer in the fierce market competition.

Internal combustion engine vehicles hold up half the sky.

In the 2025 car market, the value of gasoline vehicles has not been completely overshadowed by the brilliance of new energy vehicles. In particular, joint venture brands, luxury brands, and some leading independent brands have still achieved both sales and profit guarantees with their strong gasoline vehicle product matrix.

However, not all automakers that prioritize gasoline cars achieve sales recognition. Data shows that many car manufacturers have gasoline cars accounting for over 50% of their sales. Their common characteristics are that their gasoline models have undergone long-term market testing, forming stable user bases and brand reputations, and becoming the core pillars of their profitability.

For example, Volkswagen's performance in joint venture brands is quite good, with both SAIC Volkswagen and FAW-Volkswagen aiming for over 90% of their sales to be gasoline vehicles in 2025. Specifically, FAW-Volkswagen sold 1.587 million vehicles, increasing its gasoline car market share by 0.9 percentage points against the trend. Its classic models such as Sagitar and Magotan continue to lead the compact and mid-size car markets with their durability, practicality, and high cost-performance ratio, becoming stable "ballasts" for sales. SAIC Volkswagen's annual sales exceeded 1 million vehicles, with models like Passat and Tiguan L still possessing strong competitiveness. Its annual gasoline car market share reached 8.3%, contributing the majority of revenue and profit to the company.

In the luxury brand sector, the German "Big Three" (BMW, Mercedes-Benz, and Audi) continue to offer highly valued internal combustion engine vehicles, with their ICE car sales in China still exceeding 70% in 2025.

Specifically, BMW's sales in China reached 625,500 units in 2025, with its 3 Series, 5 Series, and X3 fuel-powered models remaining the sales pillars, especially the 5 Series which consistently ranked among the top sellers in the mid-to-large luxury sedan market. Mercedes-Benz sold 575,000 units in China, and the strong performance of its C-Class, E-Class sedans, and GLC SUV fuel-powered models meant that Mercedes-Benz did not need to rush its electrification transition. Audi's sales in China were 617,000 units, with FAW-Audi's fuel-powered vehicles securing the leading market share in the domestic fuel-powered luxury car market. Models like the Q5L and A6L consistently topped their respective segment sales charts, providing a solid guarantee for Audi's brand influence and profit growth.

Meanwhile, Japanese brands continued their reliance on gasoline-powered vehicles.

In 2025, Toyota's total sales in China reached 1.78 million units. The stable sales of gasoline models such as RAV4, Avalon, and Corolla became the core competitiveness of Japanese gasoline vehicles. Nissan's sales in China were approximately 800,000 units, with Sylphy, a "long-standing evergreen" in the compact car market, consistently ranking high on the sales charts, becoming one of Nissan's most core sales sources. Honda's sales in China were approximately 700,000 units. Although sales of gasoline models such as Accord and CR-V slightly declined, they remained the main sales force, maintaining strong market competitiveness.

Furthermore, within independent brands, there are also many companies that have achieved steady development relying on gasoline vehicles.

In 2025, Hongqi's full-year sales exceeded 400,000 vehicles, with gasoline vehicles accounting for over 60%. Gasoline models such as the Hongqi H5 and HS5 performed outstandingly in the mid-size car and SUV markets, becoming benchmark models for independent brand gasoline vehicles. Geely's gasoline SUVs, including the Xingyue L and Boyue, ranked among the top sellers of independent brand gasoline vehicles, providing ample financial support for Geely's new energy transition. These independent brands' gasoline vehicle businesses are not only a supplement to sales but also lay the foundation for the companies' comprehensive transformation in terms of technology accumulation, supply chain improvement, and other aspects.

New energy is the future, but gasoline cars won't disappear.

Currently, new energy vehicles are a consensus future direction for the industry, with almost all automakers elevating electrification transformation to a strategic level. The sales ratio of new energy vehicles has also become an important indicator for measuring the effectiveness of corporate transformation.

According to industry data, in 2025, the penetration rate of Chinese brands in the new energy vehicle sector reached 80.9%, while that of mainstream joint venture brands was only 8.2%. This significant gap has prompted joint venture brands to accelerate their electrification strategies, launching new energy vehicle models and platforms in an attempt to narrow the gap with domestic brands.

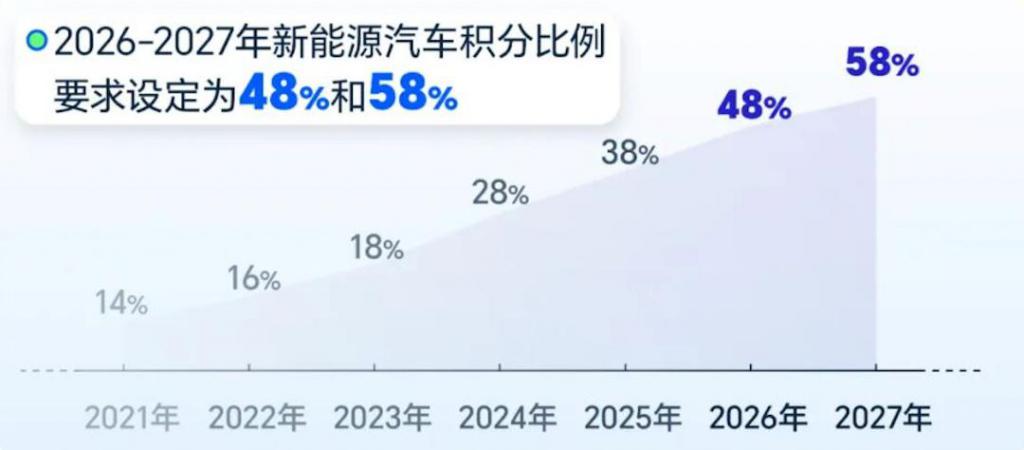

Simultaneously, on a policy level, the "Passenger Car Fuel Consumption Evaluation Methods and Indicators" to be implemented in 2026 is dubbed the "strictest fuel consumption standard." Through differentiated assessment and full-lifecycle supervision, it compels car manufacturers to accelerate their transition to new energy vehicles. The new energy vehicle credit ratio for car manufacturers needs to reach 48% in 2026 and further increase to 58% in 2027, further strengthening the development orientation towards new energy.

Undeniably, the core trend in the future automotive market will be the continuous increase in the proportion of new energy vehicles. With the continuous breakthroughs in battery technology, the increasingly==== charging infrastructure, and the deep integration of intelligent technologies, the product competitiveness of new energy vehicles will continue to increase, further squeezing the market space for fuel vehicles.

Globally, the widespread adoption of new energy vehicles (NEVs) is an irreversible trend. As the world's largest NEV market, China will continue to lead this transformation. It is expected that the penetration rate of NEVs will continue to rise to higher levels in the coming years, gradually becoming the absolute mainstream of the auto market.

That doesn't mean that gasoline cars will disappear completely. On the contrary, gasoline cars will remain an important source of sales and profits for many automakers for a considerable period of time to come.

From the perspective of market demand, gasoline vehicles still have a stable core audience. For example, users who frequently travel long distances and do not have fixed charging stations value the "5-minute refueling" efficiency of gasoline vehicles, eliminating the need to face charging waits and range anxiety. Consumers in cold northern regions prefer the stability of gasoline vehicles in low-temperature environments, avoiding the range reduction issues of new energy vehicles. Middle-aged groups aged 45 and above place more emphasis on the continuation of the driving experience. The linear power output, mature mechanical quality, and long-term accumulated usage habits of gasoline vehicles make it difficult for them to quickly transition to new energy vehicles.

The existence of these segmented demands provides continued space for gasoline vehicles to survive.

From a technological development perspective, gasoline vehicles are undergoing a "second evolution" through efficiency and cleanliness upgrades, rather than heading towards extinction. Currently, the industry is pushing the thermal efficiency of internal combustion engines towards the theoretical limit of 48%, optimizing the combustion system through technologies such as gasoline direct injection, variable valve timing and lift, and significantly reducing fuel consumption in conjunction with the application of lightweight new materials.

Meanwhile, hybridization has become an important direction for the transformation of fuel vehicles. Hybrid technologies such as BYD DM-i 5.0 have achieved a fuel consumption as low as 2.6 liters under depleted battery conditions, fully meeting stringent fuel consumption standards while addressing consumers' range anxiety, serving as a strategic buffer during the transition period. In addition, the industrialization exploration of clean fuel technologies such as hydrogen fuel and methanol also provides the possibility for the long-term existence of fuel vehicles, enabling them to adapt to the environmental requirements under the "dual carbon" goals.

Therefore, for automakers, the continued profitability of gasoline-powered vehicles cannot be ignored. After all, the transition to new energy vehicles requires huge capital investment, including R&D, production line upgrades, supply chain construction, and more, and the stable profit stream from gasoline-powered vehicles can provide strong support for these investments. Especially for joint venture brands and luxury brands, gasoline-powered vehicle business is not only the current core of profitability, but also the key to maintaining brand influence and stabilizing the dealer network.

The automotive market will likely shape into a pattern of "new energy vehicles as the primary force, with gasoline vehicles as supplementary." Gasoline vehicles will focus on niche scenarios and specific user groups, continuing to exist as "boutique niche" products and contributing value to automakers.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

European Supermarket Shelves Full of "Misleading" Recycled Plastic Packaging Claims