Tariff Easing, Demand Surge! China's Building Materials Enterprises Enter North America at Just the Right Time

Golden Window Period for Enterprises Expanding to North America

North America is located in the northern part of the Americas, bordered by the Arctic Ocean to the north, the Pacific Ocean to the west, and the Atlantic Ocean to the east. The region includes areas such as the United States, Canada, and Greenland, and is one of the most economically developed regions in the world and one of the 15 major regions globally. The two main countries in North America, the United States and Canada, are both developed countries with high human development indices and a high level of economic integration.

PART 01

The global building materials industry is undergoing profound changes, and the North American market, as the world's second-largest building materials consumption region, accounts for more than 22% of the total global construction materials market. Its immense market capacity, stable growth expectations, and continuously upgrading consumer demands provide unprecedented development opportunities for Chinese building materials enterprises. The structural growth opportunities in the North American building materials market are mainly reflected in two key areas:

01

Traditional building materials still dominate the market, with a scale accounting for more than 60%. Among them, major categories such as steel, wood, cement and concrete, glass, and plastics are showing structural differentiation driven by infrastructure bills, residential construction, commercial real estate, and energy-saving renovations.

02

Green building materials and smart building materials have become the core growth engines of the North American construction materials market. By 2025, the market size of green building materials in North America will reach $268 billion, accounting for 24.2% of the overall construction materials market in North America. The penetration rate of green building materials in the Canadian market is even higher, reaching 32%. Bio-based insulation materials and low-carbon steel are key growth points in the green building materials sector. The smart building materials sector will exceed $89 billion, with rapid growth in several sub-sectors, such as a 42.9% annual growth rate for 3D concrete printing technology and an 18.7% annual growth rate for smart glass. In the global smart building materials market, the United States holds a 35% share.

PART 02

U.S. construction materials market

The market size is large and growing steadily: the US building materials market is expected to reach $980 billion by 2025 and increase to $1.2 trillion by 2030, with growth driven by residential, commercial real estate, and public infrastructure.

Renovation demand supports normalized consumption: In 2024, new housing starts in the United States are expected to reach 1.46 million units, and the aging of existing homes has led to an annual growth rate of over 5% in renovation demand. There is strong demand for various subcategories, including kitchen and bathroom building materials, energy-efficient doors and windows, and smart home building materials.

Technological-driven industrial upgrades: The widespread application of 3D printing construction technology and intelligent manufacturing not only shortens the construction period but also reduces material waste; new building materials such as smart concrete and smart glass are gradually becoming popular, aligning with the market's demand for intelligent buildings.Canada's Construction and Building Materials Market

The overall market size of the construction industry in Canada is expected to reach $359.8 billion by 2025, and it is projected to grow to $422 billion by 2030 (with a CAGR of 4.2% from 2025 to 2030). The Canadian construction market mainly exhibits the following characteristics:

Green building materials as a core theme: The green building materials market is growing at an annual rate of approximately 8%, with market share expected to rise to 30% by 2025 and reach a scale of 14.5 billion Canadian dollars by 2030. Energy-saving insulation materials and prefabricated components are favored in residential construction, while new types of green building materials such as bio-based materials are gradually being promoted.

There is a significant gap in certain product categories in the market: the shortage of building materials such as timber, stone, and steel is prominent. Timber supply is unstable due to the impact of natural disasters, local stone resources are limited, steel production capacity is insufficient, and labor shortages exacerbate supply pressure, resulting in many building materials being reliant on imports.

Infrastructure and Population Growth Driving Demand: The government is advancing the "Building Canada Plan," initiating 6,500 infrastructure projects. Open immigration policies are driving population growth, which is expected to surpass 40 million. There is an increase in high-end residential and commercial complex projects, continuously expanding the demand for building materials.

The trade environment continues to improve.

Window Period for Easing China-U.S. Tariffs

On November 1, 2025, China and the United States successively announced tariff adjustment notices, suspending the implementation of tariff increase policies, marking a phase of easing in bilateral trade. This tariff adjustment significantly reduces the comprehensive tariff costs faced by Chinese building materials products. Coupled with the policy stability expectation of "one-year renewal," it clears key obstacles for enterprises planning to enter the U.S. market.

On November 26 local time, the United States Trade Representative's office announced the extension of tariff exemption measures under "Section 301" for 178 Chinese products until November 10, 2026. This extension is based on the historic trade agreement reached between China and the United States in November 2025, aimed at continuously easing bilateral economic and trade relations. This move further reduces the tariff costs for Chinese exports to the U.S., including building materials, providing Chinese exporters, including building material companies, with a more stable trade expectation and policy window, which is conducive to companies planning their presence in the North American market more confidently and expanding their business.

02

In October 2025, Canada announced the reduction of tariffs on some steel and aluminum products imported from China and the United States to alleviate domestic supply pressure. Additionally, Canada encourages sourcing affordable and quality building materials from developing countries, providing foreign building material companies with vast opportunities. This initiative also addresses the issue of insufficient domestic production capacity, ensuring market supply while reducing building material costs for construction projects. It offers a more convenient trade environment for international suppliers, including Chinese companies.

PART 04

To assist you in effectively expanding into the North American market, Xintian has selected the major industry exhibitions in the North American region for 2026 for your reference and planning.

01

01

Date: February 17-19, 2026

Location: Orlando, USA

Cycle: Once a year

Scale: 124,000+ audience

The International Builders' Show (IBS) in the United States is the largest construction industry event in North America, and the Kitchen & Bath Industry Show (KBIS) is the largest and most prestigious kitchen and bath design trade show in North America. Both shows are held simultaneously, together forming the annual benchmark for the global construction, residential building, and kitchen and bath industry. They provide industry professionals with a one-stop platform for trend insights, product innovation, and business exchange.

Date: March 15-18, 2026

Location: New Orleans, USA

Period: Once a year

Scale: 458 exhibitors, 19,000+ attendees

North America's leading exhibition for the wall and ceiling industry, focusing on the entire industry chain of curtain walls and ceilings, provides a core platform for companies to showcase products, exchange technologies, and establish business collaborations. Exhibits include gypsum boards, ceiling systems, acoustic materials, slats and metal frames, plastering materials, exterior wall insulation and finish systems (EIFS), thermal insulation materials, industry-specific software, and other comprehensive products for the wall and ceiling industry. It is the preferred platform for expanding into the North American infrastructure and architectural decoration market.

New York Building Materials Expo

Date: March 18-19, 2026

Location: New York, USA

Cycle: Once a year

Scale: 480+ exhibitors, 38,500+ attendees

The largest and market-leading construction exhibition in the New York Metropolitan Area, and the only major construction exhibition in the region showcasing construction projects and opportunities in New York and the Eastern United States. This exhibition brings together thousands of contractors, architects, engineers, real estate developers, owners, government representatives, and construction professionals from the tri-state area. In recent years, the exhibition has continued to expand and has become an indispensable part of the global construction ecosystem.

Time: June 10-13, 2026

Location: San Diego, USA

Period: Once a year

600+ exhibitors, 13,000+ attendees

AIA26 is a premier event in the architecture, engineering, and construction (AEC) industry. Thousands of decision-makers from the fields of architecture, engineering, construction, and design gather here to explore technological expertise, innovative products, and project solutions. AIA26 is an excellent opportunity for you to connect with numerous high-quality AEC professionals and sell products to them.

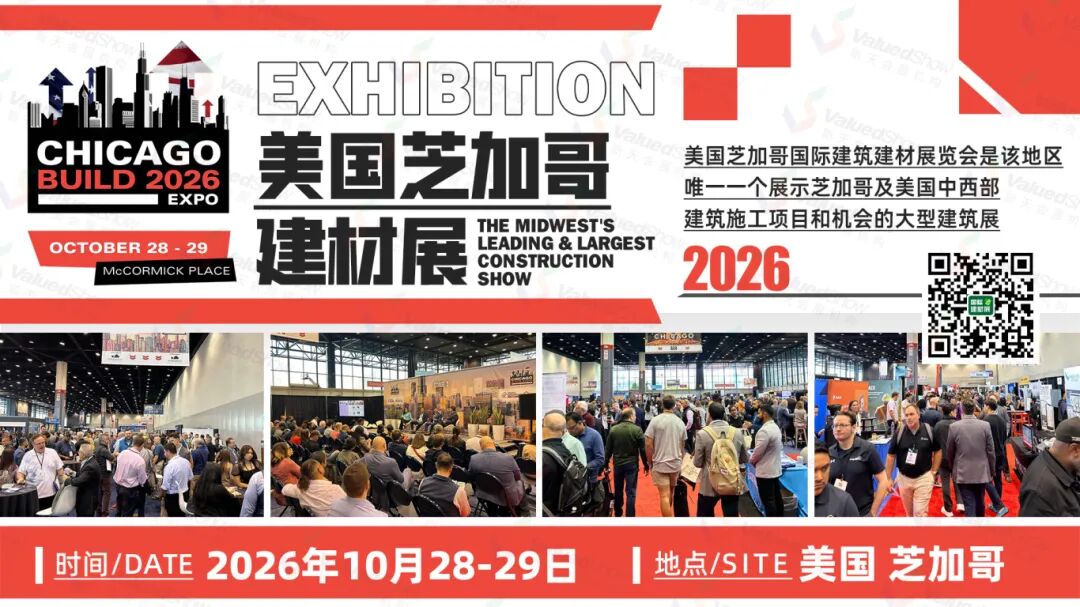

Date: October 28-29, 2026

Location: Chicago, USA

Cycle: Annual

Scale: 458 exhibitors, 19,000+ attendees

The only large-scale construction exhibition in the region showcasing construction projects and opportunities in Chicago and the Midwest. It attracts over 30,000 attendees from across the Midwest construction industry and serves as a one-stop platform to connect with leading contractors, developers, real estate agents, architects, and construction professionals in the Midwest, and to obtain thousands of new business leads.

Date: February 11-12, 2026

Location: Vancouver, Canada

Cycle: Once a year

Scale: 340+ exhibitors, 8,000+ attendees

The largest design, architecture, and real estate exhibition and conference in Western Canada. For 35 years, industry professionals have regarded BUILDEX as a must-attend event for networking, discovering new products and services, understanding industry standards, and staying updated on the latest trends affecting projects.

Time: December 2026

Location: Toronto, Canada

Period: Once a year

700+ exhibitors, 18,000+ attendees

Canada's most professional and largest architectural exhibition, with significant influence in the North American building materials market. It showcases exclusive innovative products, cutting-edge technologies, and professional services in the construction industry, attracting architects, builders, contractors, engineers, and other professionals from the architecture and design sectors to attend.

Time: January 25-29, 2026

Location: Las Vegas, USA

Frequency: twice a year

Scale: 3,500+ brands

The premier wholesale procurement destination on the West Coast of the United States, bringing together the core commercial forces of the furniture, home decor, and gift industries. Held twice a year, it attracts wholesale buyers and exhibitors from around the world, showcasing the latest products in the fields of furniture, home decor, and gifts. The exhibition features four modern exhibition halls, attracting thousands of professionals from around the globe.

Date: March 30 to April 2, 2026

Location: Las Vegas, USA

Cycle: Once a year

Scale: 1,265+ exhibitors

One of the largest and most renowned hardware and garden trade shows in the world, the exhibition covers a wide range of products including hardware tools, garden tools, small appliances, and home goods. Exhibitors and attendees can participate in various industry conferences featuring presentations by professionals discussing fashion trends and current market opportunities for home/home décor retailers. Additionally, a variety of exciting activities will be held concurrently, adding more flair to the NHS exhibition and attracting more professional buyers.

Date: May 5-7, 2026

Location: Las Vegas, USA

Period: Once a year

Scale: 600+ exhibitors, 6,500+ attendees

The global hotel industry's most influential top-level professional event gathers over 25 core product categories, focusing on the hotel industry while also encompassing diverse design scenarios such as commercial spaces, educational institutions, healthcare facilities, residential projects, and senior living communities. Attendees can not only engage directly with industry experts, gain insights into cutting-edge trends, share professional knowledge, and expand high-end networks, but also draw inspiration from cross-disciplinary design and deepen their understanding of the entire industry chain resources, injecting vitality into the high-quality development of the global hotel industry.

Time: May 2026

Location: Toronto, Canada

Cycle: Biennial

Scale: 100+ exhibitors, 2,500+ visitors

Canada's only trade show dedicated to kitchen and bath, created by the same team behind North America's largest kitchen and bath industry event, KBIS. It aims to provide a world-class communication platform for Canadian professionals and global brands. Gathering thousands of professional attendees and key decision-makers from the kitchen and bath, renovation, and design industries across Canada, the event allows exhibitors to showcase innovative products and establish long-term industry partnerships. It is a must-attend event for companies looking to expand into the Canadian and North American kitchen and bath markets.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage

-

New Breakthrough in Domestic Adiponitrile! Observing the Rise of China's Nylon Industry Chain from Tianchen Qixiang's Production

-

Dow, Wanhua, Huntsman Intensively Raise Prices! Who Controls the Global MDI Prices?

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants