Plastic Market Cools, Production Capacity Under Pressure, PP Nonwoven Fabric Exports Break Through

In 2025, China's PP nonwoven fabric output reached 3 million tons, a year-on-year increase of 9.73%. However, the industry's average operating rate hovered at a low level of around 37%, and the domestic market's absorption capacity hit its ceiling. This reality has led to persistent pressure on the industry's survival due to overcapacity and weak domestic demand. Against this backdrop, the rise of Japan, Vietnam, and Indonesia as the three core export markets has not only become a "safe haven" for the industry to weather the storm but also reflects a profound transformation of China's PP nonwoven fabric industry from "scale expansion" to "value competition."

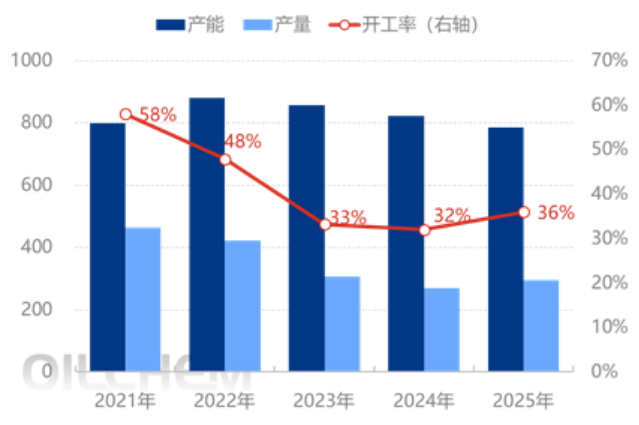

China's domestic PP nonwoven fabric industry is currently in a challenging period. The previous public health crisis spurred a pulsed growth in medical demand, coupled with a wave of enterprise expansion, pushing the industry's output to a peak of 8.788 million tons in 2020. However, with the normalization of the situation, medical demand has significantly declined, and output has fallen for four consecutive years since 2021, gradually decreasing from 8.205 million tons in 2021 to 7.73 million tons in 2023, and further to 7.4 million tons in 2024, a year-on-year decrease of 4.3%. The production capacity formed by earlier expansion contrasts sharply with the shrinking demand, and the imbalance between supply and demand continues to be prominent. In 2025, PP nonwoven fabric prices continued to fall, and the nearly 30% drop in upstream LLDPE weakened cost support, plunging the market into a "weak volume and weak price" situation. Although the accelerated elimination of outdated production capacity is improving supply and demand, the industry's concentration is low, and homogenized competition among small and medium-sized enterprises is intensifying the pain.

PP Nonwoven Fabric Capacity and Output Trends 2021-2025 (Unit: 10,000 tons)

Global manufacturing is expected to see a moderate recovery in 2025, leading to a slight rebound in demand for PP nonwovens. Chinese enterprises, leveraging their cost and production capacity advantages, continue to exhibit strong export performance. Data shows that in 2023, China's nonwoven fabric exports reached 1.27 million tons, while imports were only 100,000 tons, demonstrating significant export competitiveness. In 2025, China's PP nonwoven exports are projected to reach 1.64 million tons, representing a year-on-year increase of 6.49%, maintaining a high growth trend. As domestic market competition intensifies, exports have become a crucial breakthrough for the industry.

The Japanese market benefits from continuous tariff reductions under RCEP; Southeast Asian markets like Vietnam and Indonesia, driven by demographic dividends and consumption upgrades, are seeing increased demand for non-woven fabrics in areas such as sanitary products and packaging materials. This restructuring of the landscape is driven by a dual force of regional supply chain shifts and the resilience of demand in emerging markets. The rise of Japan, Vietnam, and Indonesia constitutes the core landscape for China's PP non-woven fabric exports.

The export breakthrough of China's PP non-woven fabric industry is not only a pragmatic choice to address domestic supply-demand imbalance but also an inevitable step in industrial transformation. The development of its three core export markets provides a time window for optimizing industry capacity and upgrading products. The policy dividends of RCEP and the demand potential in Southeast Asia also continuously empower export growth.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

CBAM Officially Implemented In Its First Month: How Chinese Export Enterprises To Europe Complete Their First Compliance Declaration?

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Continental Plans to Begin Sale of ContiTech in Early 2026