[PA66 Daily Review] Fundamentals Remain Stable, Market Consolidates

1 Today's Summary

①、 On August 21: The traditional peak season for US fuel demand continues to provide positive support, and uncertainties remain regarding the Russia-Ukraine situation, leading to a rise in international oil prices. NYMEX crude oil futures for the October contract rose by $0.81 to $63.52 per barrel, up 1.29% compared to the previous period; ICE Brent oil futures for the October contract rose by $0.83 to $67.67 per barrel, up 1.24% compared to the previous period. China's INE crude oil futures for the 2510 contract rose by 4.7 to 486.7 yuan per barrel, with the night session rising by 6.2 to 492.9 yuan per barrel.

② Currently, the domestic PA66 capacity utilization rate is 62%, with a daily output of approximately 2,430 tons. Under the pressure of costs and demand, the capacity utilization of domestic polyamide 66 enterprises remains stable; however, downstream demand is generally weak, and the supply of goods in the domestic PA66 industry is abundant.

2 Spot Overview

Based on the Yuyao market in East China, today’s EPR27 market price is quoted at 15,200-15,400 RMB/ton, which is stable compared to yesterday’s price. 。 Raw material prices fluctuate, cost support remains stable, downstream purchases are made as needed, market transaction sentiment is average, and operations are being adjusted.

|

Figure 1 Domestic PA66 Price Trend Chart in 2025 (RMB/ton) |

Figure 2 Price Trend Chart of Domestic PA66 in East China in 2025 (RMB/ton) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20250808) [聚酰胺66日评]:下游按需采购 市场整理运行(20250808)](https://oss.plastmatch.com/zx/image/28d665b2c03342dc88a2003664de5cf9.png) |

![[聚酰胺66日评]:下游按需采购 市场整理运行(20250808) [聚酰胺66日评]:下游按需采购 市场整理运行(20250808)](https://oss.plastmatch.com/zx/image/adec97b51c4d40dbab01845713b9445f.png) |

|

Data Source: Longzhong Information |

Data Source: Longzhong Information |

3 Production Updates

Today, the capacity utilization rate of domestic polymer 66 enterprises is about 62%, and the industry's supply of goods is stable. In terms of profits, raw material prices have fluctuated little, cost pressure remains, and the market is weak, continuing to operate at a loss.

|

Figure 5 Domestic PA66 Capacity Utilization Rate Trend for 2024-2025 |

Figure 6 Comparison of Domestic PA66 Profit and Price in 2025 (RMB/ton) |

![[聚酰胺66日评]:成本面压力偏大 市场整理运行(20250815) [聚酰胺66日评]:成本面压力偏大 市场整理运行(20250815)](https://oss.plastmatch.com/zx/image/34c68f58523e451ab65a24e4c818475b.png) |

![[聚酰胺66日评]:成本面压力偏大 市场整理运行(20250815) [聚酰胺66日评]:成本面压力偏大 市场整理运行(20250815)](https://oss.plastmatch.com/zx/image/c60520a351fd41979a359398c13f99ca.png) |

|

Source of data: Longzhong Information |

Data source: Longzhong Information |

4 Price Prediction

Cost pressures remain, but overall supply is sufficient. However, there is no significant recovery in demand for now, leading to a cautious industry sentiment. The domestic PA66 market is expected to experience weak fluctuations in the short term.

5 Relevant Product Information

Butadiene Market: The mainstream delivered price of butadiene in the central Shandong region is around 9,280-9,350 yuan/ton, down by 110 yuan compared with the previous period. Downstream demand is limited to just a small amount for rigid needs, and market trading sentiment remains weak. At the same time, the downstream synthetic rubber market has retreated, further dragging down the transaction focus in the market.

Adipic acid market: The reference price of adipic acid in the East China market is 7,050-7,250 yuan/ton (acceptance, delivered), remaining stable compared to yesterday's price. Today in East China...Adipic Acid MarketThe market is stabilizing and consolidating. The supply-side benefits support the sentiment of industry players, and intermediaries keep their quotations stable. However, there is no significant improvement in end-user orders, and flexible demand follows up with negotiations based on actual orders. Attention is paid to real orders.

6 , Data Calendar

Table 2 Overview of Domestic PA66 Data (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous period data |

Current Trend Forecast |

|

Capacity Utilization Rate |

Thursday 11:30 AM |

60% |

→ |

|

Weekly Output |

Thursday 4:00 PM |

1.63 |

→ |

|

Data source: Longzhong Information Note: 1 Treat ↓↑ as significant fluctuations, highlighting data dimensions where the increase or decrease exceeds 3%. 2 Considered as narrow fluctuations, highlighting data with changes within the range of 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

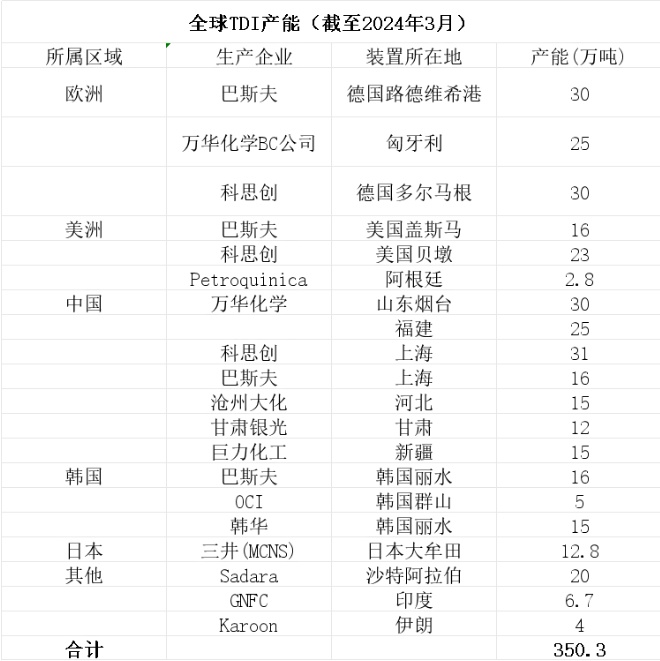

Covestro faces force majeure!

-

Covestro and Wanhua Chemical Carve Up the Industry’s No. 3 Player

-

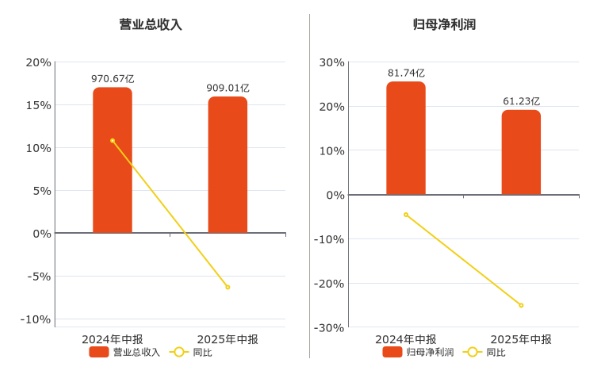

Wanhua chemical's net profit falls by 25.10%! is diversified layout the right move to counter industry cycles?

-

Breaking: 1 Dead, 1 Injured as Chemical Plant Explosion Occurs

-

Honda Plans To Implement Three Shifts At United States Factory To Mitigate Tariff Impact