Wanhua chemical's net profit falls by 25.10%! is diversified layout the right move to counter industry cycles?

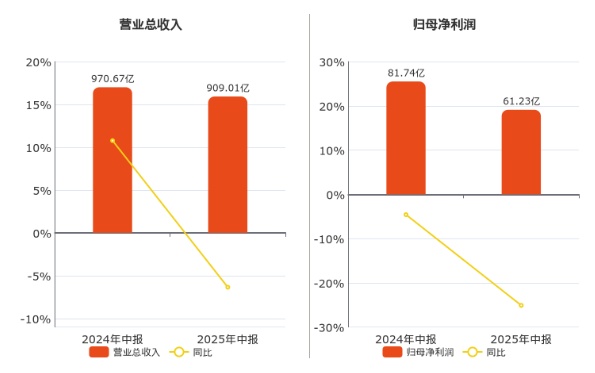

On August 11, 2025, Wanhua Chemical (600309.SH) released its semi-annual report, showing that the company achieved an operating income of 90.901 billion yuan in the first half of the year, a year-on-year decrease of 6.35%; net profit attributable to shareholders was 6.123 billion yuan, a year-on-year decrease of 25.10%.

This transcript has attracted widespread attention and discussion in the chemical industry. As a benchmark enterprise in China's chemical industry, the performance fluctuations of Wanhua Chemical not only reflect the current cyclical adjustments in the chemical industry but also reveal the deeper logic of industry transformation.

Zhuansu Shijie will analyze the industry signals behind Wanhua Chemical's semi-annual report from three dimensions: business structure, industry cycle, and strategic transformation.

I. Main Business Under Pressure: Dual Engines of Polyurethane and Petrochemicals Losing Momentum

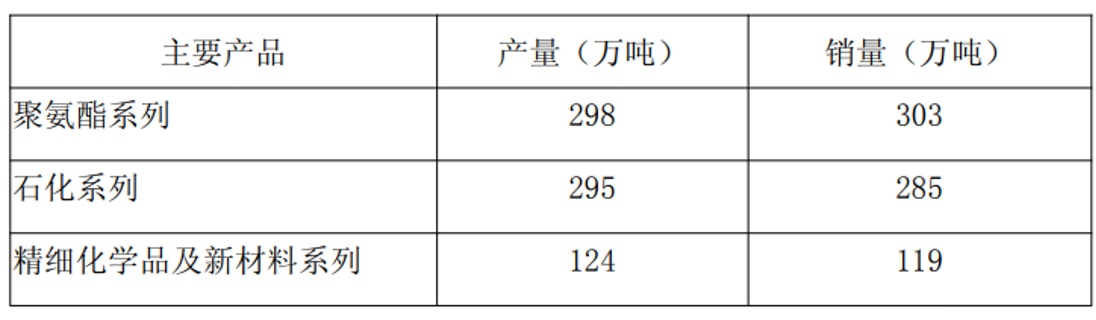

The breakdown of Wanhua Chemical's three main businesses clearly reveals the structural reasons for the decline in performance.

In the first half of the year, Wanhua Chemical achieved an operating income of 90.901 billion yuan, with sales revenue from polyurethane series products amounting to 36.88779 billion yuan, sales revenue from petrochemical series products and trade reaching 34.93356 billion yuan, and sales revenue from fine chemicals and new materials series products amounting to 15.62807 billion yuan.

Polyurethane Series ProductsAs a traditional pillar of the company, it achieved a sales revenue of 36.888 billion yuan in the first half of the year, accounting for 40.58% of the total revenue. However, core products such as MDI and TDI are facing severe challenges, which directly affects Wanhua Chemical's profitability.

In the first half of the year, downstream demand was relatively weak, and the average market price of pure MDI was around 18,800 RMB/ton.

In the first half of the year, demand in the refrigeration and construction industries was weak, and exports were affected by tariff policies, resulting in a decline in export orders. The average price of polymeric MDI was around 16,700 yuan/ton.

In the first half of the year, the automotive industry maintained a growth trend, while the demand for home furnishings was average. The average price of TDI products was around 12,400 RMB/ton.

The average market price of flexible foam polyether products in the first half of the year was around 7,800 yuan/ton.

Petrochemical business segmentThe performance is equally not optimistic. In the first half of the year, this sector achieved sales revenue of 34.934 billion yuan, accounting for 38.43% of the total revenue, but the concentrated release of industry capacity has significantly compressed profit margins. Data shows that over the past five years, ethylene capacity has increased by 59% cumulatively, and propylene capacity by 55%. It is expected that by 2025, there will be an additional ethylene capacity of 7.9 million tons per year and propylene capacity of 10.57 million tons per year. This phase of supply and demand imbalance makes it difficult for Wanhua Chemical to reverse the declining profits of petrochemical products in the short term, even if it successfully commissions the 1.2 million tons per year ethylene plant at the Yantai Industrial Park.

Notably, the company has achieved significant success in cost control. In the first half of the year, operating costs decreased by 3.47% year-on-year, administrative expenses fell by 17.11%, and financial expenses were significantly reduced by 46.09%. These efforts in refined operations have, to some extent, mitigated the impact of the decline in the main business and demonstrated the proactive measures taken by the management to address the industry's downturn.

II. Industry Cycle Fluctuations: TDIThe supply and demand logic behind price fluctuations

A deep analysis of the polyurethane market reveals that the recent abnormal fluctuations in TDI prices deserve close attention from industry insiders. In the first half of the year, the average market price of TDI remained around 12,400 yuan/ton, but since July, there has been a dramatic rebound, with prices soaring from 11,000 yuan/ton to 15,900 yuan/ton, an increase of over 40%. Behind this phenomenon is a sudden contraction in global supply: Covestro's 300,000 tons/year facility encountered force majeure, Mitsui Chemicals' Omuta Plant experienced a chlorine leak, and major domestic producers underwent concentrated maintenance. These factors combined have led to the short-term withdrawal of approximately 1.42 million tons/year of TDI capacity (accounting for more than 40% of the global total capacity) from the market.

According to estimates, a TDI price increase of 1000 yuan/ton can boost Wanhua Chemical's profit by 830 million yuan. This short-term price fluctuation has positive implications for improving the company's performance expectations in the second half of the year. However, industry professionals should be aware that such price increases driven by unexpected events are difficult to sustain.

A representative from Wanhua Chemical stated that in response to market fluctuations in the polyurethane business, the company is driving industrial upgrades through innovation. For instance, they continue to advance the development of next-generation MDI technology, expand capacity in multiple facilities, and implement projects to conserve energy and reduce consumption, aiming to achieve extreme cost competitiveness. Additionally, the company is deeply penetrating channel layouts overseas, having expanded its global marketing institutions to 28. The global supply chain and technical service network have achieved efficient localized operations.

More noteworthy is Wanhua Chemical's strategic positioning in the specialty isocyanate sector—by acquiring the IPDI business from France's Vencorex, and expanding the IPDA plant capacity from 50,000 tons/year to 100,000 tons/year, the company is building a full industry chain of IP-IPN-IPDA-IPDI. This extension towards high value-added product lines is the long-term strategy to tackle industry cycles.

In terms of the petrochemical business, the pressure of overcapacity is difficult to alleviate in the short term. Although Wanhua Chemical has achieved industrial chain synergy through the Yantai ethylene project (with an annual production of 617,400 tons of ethylene, 340,900 tons of propylene, and supporting high-end products such as 400,000 tons of POE and 250,000 tons of LDPE), under the backdrop of overall industry oversupply, how to increase the proportion of high-end products and optimize the product structure has become a common challenge faced by all large petrochemical enterprises.

3. Accelerated Strategic Transformation: Initial Success in New Materials Deployment

While traditional businesses are under pressure, Wanhua Chemical isFine Chemicals and New Materials SectorThe layout has begun to show results. In the first half of the year, this segment achieved sales revenue of 15.628 billion yuan. Although the scale cannot yet compare with traditional businesses, the growth potential should not be underestimated. In recent years, to break away from reliance on the single category of polyurethane for performance, Wanhua Chemical has continued to strategically expand against the trend. For example, it has successively deployed capacities in POE (polyolefin elastomers) and high-energy-density lithium iron phosphate. From the semi-annual report, it is evident that Wanhua Chemical continues to make breakthroughs in the fine chemicals and new materials business segments.

The company's MS (methyl methacrylate-styrene copolymer) resin facility has successfully started up on the first attempt, filling the gap in the domestic large-scale production of high-end optical-grade MS.

In terms of new battery materials, the company continues to increase investment in research and development, achieving several technological breakthroughs. The fourth generation of lithium iron phosphate has been mass-produced and supplied, and the fifth generation has completed its prototype launch.

The company also adheres to a product differentiation strategy, developing multiple high value-added POE, bio-based 1,3-butanediol, polyolefin, nylon 12, polysulfone materials (PSU/PPSU), and new modified materials, expanding niche markets and aiding the enhancement of new business capabilities.

Notably, Wanhua Chemical is building a complete industry chain from basic chemicals to high value-added fine chemicals. Taking the citral industry chain as an example, the company has achieved production of fragrance products such as geraniol, citronellol, and ionone, and the 10,000-ton/year vitamin A production line will be completed in January 2025. This vertical integration from LPG to isobutylene and then to citral and nutritional products not only enhances the ability to withstand economic cycles but also creates a differentiated competitive advantage.

4. Industry Insights: Transformation Thoughts in the Cycle Trough

Wanhua Chemical's semi-annual report provides valuable reference for the entire chemical industry. Firstly, it confirms that relying solely on scale expansion as a development model is no longer sustainable. Even in advantageous areas like MDI, Wanhua Chemical has to face the reality of slowing demand growth. Secondly, the company's breakthroughs in the fine chemicals and new materials sectors indicate that transitioning to high value-added products is not only a strategic choice but also a necessity for survival.

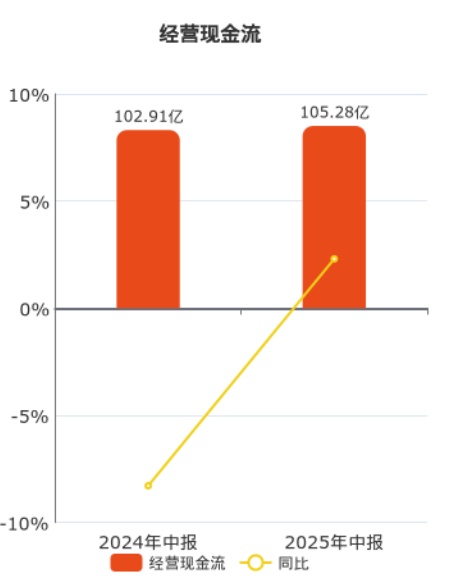

From the financial data, despite a decline in profits, Wanhua Chemical has maintained an operating cash flow of 10.528 billion yuan (a year-on-year increase of 2.30%), and its asset-liability ratio has decreased by 0.34 percentage points compared to the same period last year, to 65.80%. This financial stability provides a buffer for the company's transformation and also serves as a reminder to industry peers: during cyclical troughs, maintaining financial health is as important as advancing strategic transformation.

Despite the decline in profits, Wanhua Chemical still maintained 105.28.Operating cash flow of 100 million yuan (a year-on-year increase of 2.30%))

Looking ahead to the second half of the year, with the traditional "Golden September and Silver October" peak season approaching, coupled with the rebound in prices of products such as TDI, Wanhua Chemical's performance is expected to improve quarter on quarter. However, in the long term, whether the company can truly achieve a transformation from "bulk chemicals" to "fine chemicals + new materials" will depend on the synergy between technological innovation capabilities and market expansion efforts. For the entire chemical industry, Wanhua Chemical's transformation practice provides a case study: under the dual pressure of overcapacity and environmental constraints, transitioning to high-end, differentiated, and green development is no longer an option but a necessity.

The semi-annual report of Wanhua Chemical for 2025 reflects both the common challenges faced by the chemical industry and the transformation path of leading enterprises. Beneath the surface of declining revenue and profits lies the company's deep transformation through actively adjusting its business structure and increasing investment in technological innovation. For industry practitioners, attention to Wanhua Chemical should not only focus on its short-term performance fluctuations but also on its long-term strategic layout—these plans may reshape the competitive landscape of China's chemical industry in the future.

Edited by: Lily

Sources: DT New Materials, Chemical New Materials, You Lianyungang, Securities Times, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track