Natural Gas Prices Surge Amid Cold Wave: What Are the Implications for the Polyolefin Industry?

Recently, the global energy market has once again been swept by sudden and drastic fluctuations. On January 20, 2026, US natural gas futures prices surged by over 25% in a single day, breaking through the $3.90 per million British thermal units (MMBtu) mark. This price spike not only caught short-sellers betting on a mild winter off guard but also once again posed a challenge to the cost resilience of the global petrochemical industry.

U.S. Natural Gas Futures Price Trends

The current surge in US natural gas prices was most directly triggered by the sudden impact of extreme cold weather on the supply and demand structure. Contrary to common perception, about 60% of households nationwide still rely on natural gas pipelines for direct heating. The Arctic cold snap caused temperatures in many areas to drop to historic lows, leading to a sharp increase in demand for residential heating. More critically, natural gas is also the largest energy source for electricity production in the US. Under extremely cold weather conditions, heating and power generation create a "dual competition" for gas, putting double pressure on supply. The market's prior widespread expectation of a mild winter led to a faster-than-expected depletion of short-term inventories, ultimately causing prices to rapidly surge.

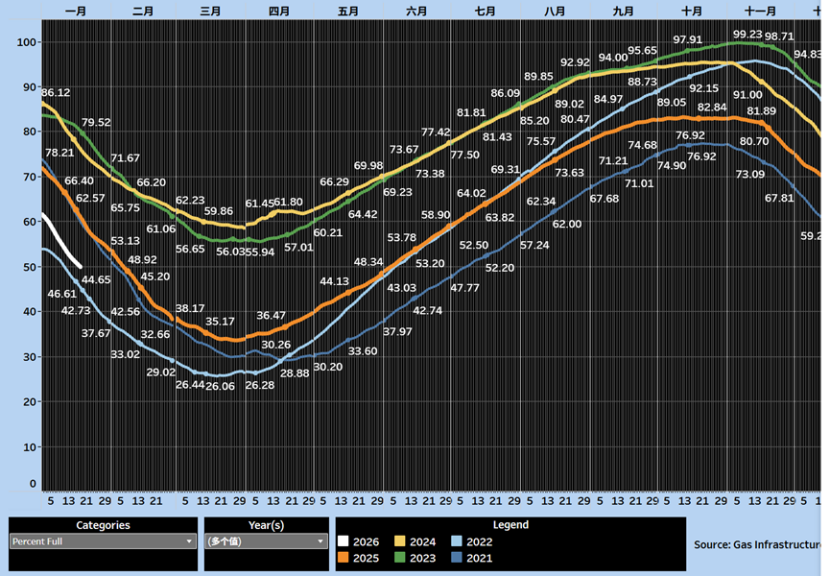

At the same time, the energy situation in Europe further intensified market anxiety. In January 2026, many parts of Europe experienced the coldest cold wave in nearly fifteen years, with temperatures 3 to 4 degrees Celsius lower than the average. As of January 17th, the EU's overall natural gas storage rate had fallen to approximately 50.4%, significantly lower than the 61.7% of the same period last year, with the storage levels in major economies such as Germany and France even falling below 43%.

Currently, nearly 60% of US liquefied natural gas exports go to Europe. This cross-market supply and demand linkage attracts US domestic natural gas resources to high-priced international markets, further exacerbating domestic supply pressure.

EU natural gas storage levels

For Chinese polyolefin enterprises, while this temporarily increases import costs, it may also alleviate the pressure of low-priced American goods on the domestic market, providing Asian local petrochemical enterprises with a certain buffer and opportunities for price adjustment.

In addition, in the short term, the direct trigger for this surge was an extreme cold snap. As the weather warms, prices have significantly retreated from their highs, with US Henry Hub natural gas futures prices having pulled back to around $3.10 per million British thermal units, confirming their pulse-like characteristic. However, in the long term, the current price surge is more like a "stress test" of global supply chain fragility and a high dependence on a single, cheap raw material model. It serves as a wake-up call for the polyolefin industry to confront two realities: first, high-frequency, large-scale fluctuations in raw material prices may become the new normal; and second, competitiveness built on single cost advantages is becoming increasingly fragile.

Author: Zhou Yongle, Senior Market Analysis Expert

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

CBAM Officially Implemented In Its First Month: How Chinese Export Enterprises To Europe Complete Their First Compliance Declaration?

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Continental Plans to Begin Sale of ContiTech in Early 2026