Nanjing julong's 2025 net profit expected to increase by over 50%, strategically lays out civil aviation materials

Recently, Nanjing Julong Science & Technology Co., Ltd. (Stock Code: 300644) Releases Two Major Key Updates Having delivered a dazzling preliminary earnings report projecting high growth for fiscal year 2025, the company is also intensifying its strategic layout by establishing a new wholly-owned subsidiary. Injecting dual momentum for high-quality enterprise development, this showcases strong competitiveness and foresight in the field of new polymer materials.

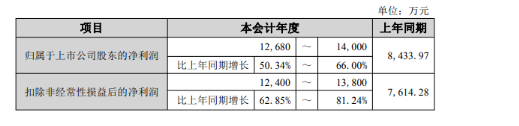

Positive earnings forecast: Net profit increase up to 66% year-on-year

Nanjing Julong's 2025 annual performance forecast reveals that the company's full year... Operating performance has achieved leapfrog growth, and profitability has significantly improved.During the reporting period (January 1, 2025, to December 31, 2025), the company expects net profit attributable to shareholders of the listed company toNet profit is expected to be between RMB 126.8 million and RMB 140 million. , compared to 84.3397 million yuan in the same period of the previous year, Year-on-year growth of 50.34% to 66.00% After deducting non-recurring gains and lossesNet profit is expected to be between 124 million yuan and 138 million yuan. ,Compared to 76.1428 million yuan in the same period last year. , year-on-yearThe increase was even higher, ranging from 62.85% to 81.24%. , the core profitability growth momentum is even more robust.

Regarding the reasons for the significant increase in performance, Nanjing Julong has identified three core driving forces, forming a triple growth loop of "R&D + Market + Cost":

Empowering R&D for New HorizonsThe company adheres to technological innovation as its core, continuously focusing on new product research and development and the exploration of new fields, constantly enriching its product matrix and expanding market boundaries, thereby opening up new space for performance growth. As a high-tech enterprise specializing in polymer new materials, Nanjing Julong has accumulated profound expertise in high-performance nylon, engineered polypropylene, and other fields, with its products widely used in key areas such as high-speed rail, new energy vehicles, and electronics and electrical appliances. Its R&D advantages are continuously translated into market competitiveness.

Core product leads, scale expands steadily. Leveraging in-depth expertise in modified plastics, the company's core products have achieved steady sales growth thanks to their stable quality and market competitiveness, further solidifying its leading position in niche markets such as high-speed rail nylon materials and automotive modified plastics.

Effective cost control, optimized profit margins. During the reporting period, the market prices of major raw materials were at reasonably low levels, creating favorable conditions for the company's cost control, which not only improved the gross profit margin of products but also further optimized the overall profitability level, providing solid support for performance growth.

Establishment of Wholly-Owned Subsidiary: Increasing Investment in South China and Entering the Civil Aviation Materials Sector

While achieving high growth in performance, Nanjing Julong is accelerating its strategic layout and has recently officially established [a new entity/division/etc.]. Huizhou Julong New Materials Technology Co., Ltd. (hereinafter referred to as "Huizhou Julong"), to further improve its national industrial layout and enter a high-potential track. Qichacha information shows that Huizhou Julong has a registered capital of 30 million yuan and is 100% wholly-owned by Nanjing Julong, with a business scope covering additive manufacturing equipment manufacturing, sales of civil aviation materials, and processing of mechanical parts and components. 110 million! Another ten-thousand-ton modified plastic project lands in South China!

The establishment of the Huizhou subsidiary is not a simple regional expansion, but a strategic move after careful consideration by the company. According to previous announcements, the company plans to use Huizhou Julong as the main entity. Investing 110 million yuan to construct a modified plastic production line project with an annual output of 60,000 tons. , with a construction period of 3 years. Funding sources include registered capital, shareholder capital increases, and self-raised funds.

It is worth noting that Huizhou Julong will Civil aviation materials Sales included in the business scope. This marks Nanjing Julong's official entry into the field of civil aviation materials. Combining this with the company's previous layout in the low-altitude economy - its subsidiary Julong Composite Materials has provided Zero Gravity Aircraft Industry with drone carbon fiber composite fuselage structures, and its products have passed aviation-grade standard testing. This strategic layout will further strengthen the company's synergistic advantages in the field of aerospace materials, and is expected to leverage the rapid development of the low-altitude economy and the civil aviation industry to open up new performance growth poles. 。

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

Multifaceted Collaboration: PA Prices Rebound Against Trend to Break Through

-

European Supermarket Shelves Full of "Misleading" Recycled Plastic Packaging Claims