Modified Plastic Company "Flashes Red Light"! Jiangsu Boyun's Net Profit Could Drop by Nearly 40% in 2025!

1月19日,国内改性塑料领域的高新技术企业江苏博云塑业股份有限公司(股票代码:301003)发布2025年度自愿性业绩预告,披露全年核心盈利指标同比下滑,业绩短期承压明显。作为深耕改性塑料细分赛道多年的企业,其业绩波动既反映了行业共性挑战,也凸显了企业转型期的阶段性特征。

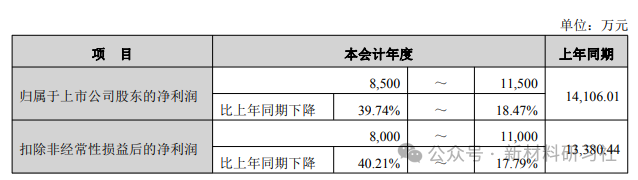

Key Performance Data: Simultaneous Decline in Both Profitability Indicators

本次业绩预告覆盖2025年1月1日至12月31日全年度,数据虽未经审计,但已清晰呈现业绩收缩态势。从核心指标来看,归属于上市公司股东的净利润预计为8500万元至11500万元,较上年同期的14106.01万元,同比降幅区间为18.47%至39.74%;扣除非经常性损益后的净利润预计为8000万元至11000万元,对应上年同期13380.44万元,降幅为17.79%至40.21%。

业绩承压三大主因:内外因素叠加挤压盈利空间

结合公司公告及行业背景,江苏博云此次业绩下滑是外部环境波动与内部产能调整叠加的结果,具体可归结为三大核心因素:

1. 下游需求放缓+出口承压,营收端遇阻。江苏博云的改性塑料产品广泛应用于电动工具、汽车零部件、家用电器、电子电气等多个领域,下游行业的需求变化直接影响公司订单量。2025年,部分下游客户需求出现放缓迹象,同时国际贸易环境的不确定性加剧,叠加中美关税政策调整对改性塑料出口成本的抬升影响,公司出口业务承压明显。对于深耕高端细分领域、客户覆盖国内外知名企业的江苏博云而言,出口端的压力直接传导至营收与净利润,成为业绩下滑的重要推手。

2. 产能扩张节奏与市场需求错配,效益释放滞后。为支撑长期发展,江苏博云此前推进了募投项目“改性塑料扩产及塑料制品成型新建项目”,其中4条挤出机生产线已于2025年投入运行,新增产能达3万吨。但在整体市场需求阶段性承压的背景下,新产能的市场消化节奏不及预期。为保障核心产品质量稳定性,公司现有订单仍集中于原有厂区生产,新产线主要用于承接新开发产品,这一过渡安排在一定程度上影响了产能利用率与规模效应的发挥,导致扩张项目的经济效益未能及时释放。

3. Increased exchange rate volatility adds uncertainty to the financial side. As a manufacturing company involved in export business, exchange rate fluctuations have a certain impact on the financial performance of Jiangsu Boyun.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

CBAM Officially Implemented In Its First Month: How Chinese Export Enterprises To Europe Complete Their First Compliance Declaration?

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Continental Plans to Begin Sale of ContiTech in Early 2026