Former supplier turns rival! upstream raw material giant enters peek resin industry, who can control the industry chain?

In the field of high-end manufacturing materials, Polyetheretherketone (PEEK) is enjoying an unprecedented moment in the spotlight.

Source: CHINAPLAS 2025 International Exhibition on Plastics and Rubber Industries

In January 2026, a seemingly ordinary acquisition announcement caught the attention of the market. PEEKCore Monomer Fluoro-ketone (DFBP)Xinhan New Material, a leading enterprise (in the field of...), with approximately 1300...Acquired a property with 200 for a price of ten thousand yuan. Metric tons of PEEK 51% of the resin production capacity of Heret Engineering Plasticsequity inIt's clear that with a large number of companies entering the PEEK field in 2025, the reshaping of the PEEK industry chain landscape has already begun.

The hallmark of this shift isn't a single technological breakthrough or a specific production capacity figure, but rather a collective strategic redirection among companies across the entire value chain. Upstream raw material giants and emerging players are no longer content with simply being "water sellers," and are increasingly penetrating downstream finished product sectors. Conversely, downstream application behemoths, concerned about being "constrained by materials," are actively integrating upstream towards the material end. This "two-way" competitive and cooperative game is propelling the PEEK industry towards a new phase, transitioning from technology-driven to scale-driven and cost-driven.

I. An Acquisition Case Sets the Stage for Industry Rivalry

Publicly available information indicates that, Hai Rui Established in July 2013 with a registered capital of 68 million RMB, and registered address in the Eastern Industrial Chemical Park of Tangyuan County, Jiamusi City, Heilongjiang Province, the company's legal representative is Jiang Zhongxi. As a high-tech enterprise, its core business focuses on the synthesis of polyetheretherketone (PEEK) special resin, PAEK low-melting-point special resin, and the R&D, production, and sales of modified resin. It has formed an industrialized production capacity of over 200 tons/year, and its products are widely used in high-end fields such as aerospace, automotive, electronics and electrical appliances, energy, and medical devices.

Regarding this acquisition, Hanhong New Materials stated that, based on the company's strategic planning and operational development needs, and in order to continuously enhance the company's ability to serve customers across the entire polyaryletherketone (PAEK) resin industry chain and explore new performance growth points.

On the surface, this appears to be a typical vertical integration, aimed at "improving the industrial chain layout." However, a deeper dive into Xinhann New Material's financial reports reveals a more complex and urgent strategic motivation. Data shows that in 2024, Xinhann New Material's revenue from core raw materials for special engineering plastics decreased by 31.32%; in the first half of 2025, revenue only saw a slight increase of 5.54%. Concurrently, its planned second phase of the 8,000-ton aromatic ketone project was announced to be delayed. With key customers (such as Victrex and Evonik) having approved its products and new production capacity ready, if the expansion rate of the downstream resin segment cannot keep up, it will directly constrain the growth of its raw material business.

Xinhan New Materials has transformed from a supplier to global PEEK manufacturers into a direct competitor. This move bears similarities to the industry shockwaves caused by "Huawei building cars" – how to balance cooperative and competitive relationships with traditional customers will be a challenge Xinhan New Materials must face.

II. Why Upstream Giants Want to Manufacture PEEK Themselves ?

Xinhan New Material's decision is not an isolated case; it reflects the collective anxiety and strategic leap of the upstream raw material end under the expectation of capacity expansion.

1.Capacity Expansion and the Struggle for Cost Discourse Power

DFBP, as the most crucial raw material for PEEK, accounts for over 60% of its production cost. Xinhan New Materials, Zhongxin Fluorochemical, and Yingkou Xingfu three companies occupy the global90%the above market.Data shows that Xinhann New Material currently has a DFBP production capacity of 8,000 tons/year and plans to increase its total capacity to 12,000 tons/year. Zhongxin Fluorine Material also plans to expand its capacity from 5,000 tons/year to 8,000 tons/year. However, whether the construction period and scale of downstream resin production capacity can timely absorb these new raw materials remains a big question mark.

Once capacity mismatch occurs, the raw material sector will be the first to fall into a price war. To avoid this risk, extending downstream to internally consume raw materials becomes the most direct solution. Zhongxin Fluoride Material, with its complete industrial chain layout of "fluorite ore - hydrofluoric acid - DFBP," already possesses significant cost advantages. New entrants like Dayang Biology are even directly planning an integrated project of "annual production of 2,000 tons of PEEK and key intermediate DFBP" with the aim of creating a closed-loop industrial chain. This "bring your own food to the table" model further exacerbates the sense of crisis among traditional raw material suppliers.

2. Supply Competitionidentity transformation

Upstream companies extend downstream with the core objective of capturing higher added value.

The profit margins of PEEK resins and modified materials far exceed those of basic raw materials. However, this shift in identity necessitates a restructuring of relationships. Yesterday’s key customers become today’s direct competitors, inevitably creating friction in commercial cooperation. This requires upstream enterprises moving downstream to possess superior technical prowess, market expansion capabilities, and the wisdom of brand isolation. They may need to adopt the "CATL model"—forging new paths of symbiosis amidst competition through strategies such as establishing joint ventures with downstream partners.

3. "Upward Breakthrough" of Downstream Petrochemical Giants

While upstream companies are "penetrating downwards," downstream application giants are actively "integrating upwards." Their motivations are equally strong: to gain supply chain autonomy, lock in core material costs, and deeply participate in product design to maximize material performance.

1.Wankai New Materials: Solution-Oriented Integration

As a leading polyester enterprise,

Wankai New Materials

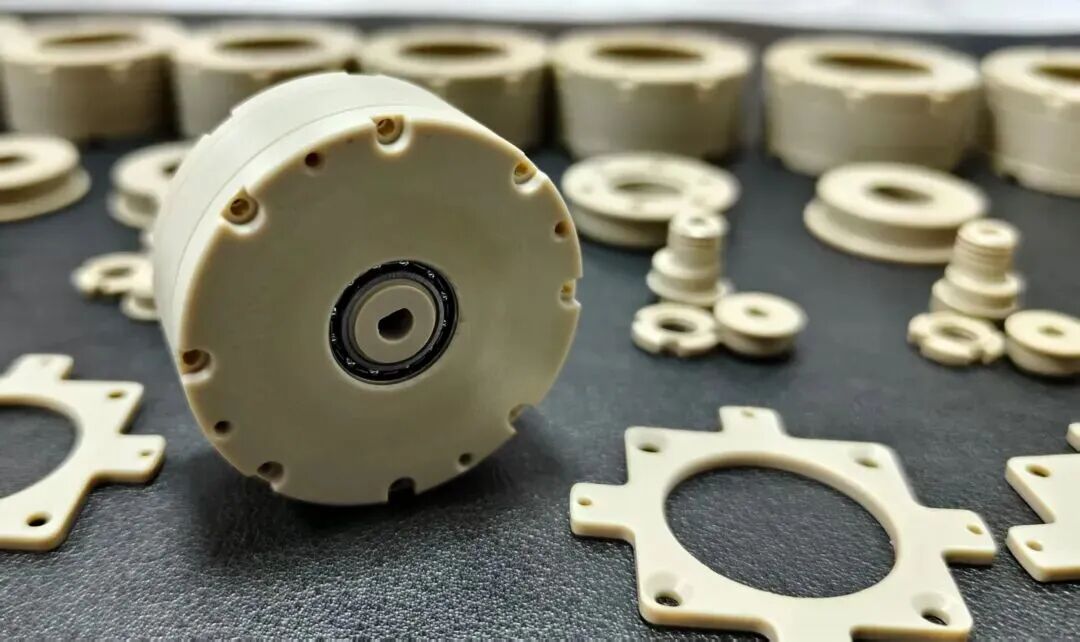

The layout is exemplary. Its controlled subsidiary "Light Magnesium Smart Plastic" and affiliated company "Lingxin Qiaoshou" jointly released the "PEEK Cycloidal Reducer" and have already secured tens of millions of yuan worth of orders for humanoid robots. This is far from a simple material sale; it's a deep integration delivered to end customers in the form of a functional component solution. Data shows that both parties expect the transaction volume for such products to reach 50 million yuan in 2026.

Source: LINKERBOT by Lingxin Qiaoshou.

In this way, Wankai New Materials not only secured an outlet for its PEEK materials but also directly entered the highest-value core component field, taking its destiny into its own hands.

2.Ningbo Huaxiang and Meihu Zhizao:Materials+ ManufacturingTwo-wheel drive

Ningbo Huaxiang, a giant in automotive components, is taking a more multi-faceted approach. On one hand, it has planned a PEEK polymerization capacity of up to 12,000 tons/year through a joint venture, directly targeting the upstream. On the other hand, its subsidiary has signed a contract for the entrusted production of robot joints, extending downstream into manufacturing. This "materials + manufacturing" dual-driven strategy aims to create differentiated competitive advantages.

Similarly, while establishing a new materials company focused on PEEK R&D, Meihu Intelligent Manufacturing Group has continuously acquired key component enterprises for robots, rapidly building end-to-end capabilities from materials to actuators. Their actions demonstrate that downstream enterprises believe a deep understanding of material applications is their unique advantage for upstream integration.

IV. PEEKIndustrial chainTwo-way penetrationIn this context, what is the key to victory?

This "two-way penetration" of the industrial chain elevates the competition dimension from a single link to a comprehensive capability contest across the entire industrial chain, with the focus on three aspects:

1.The Debate Between Technology Roadmaps and Iteration Speed

The appeal of PEEK lies in its customizability. Taking robots as an example, PEEK has various applications: CF/PEEK reinforced materials are used for harmonic reducers, PEEK gears achieve lightweighting and self-lubrication, and PEEK elastomers are used for high-performance sensors, among others.

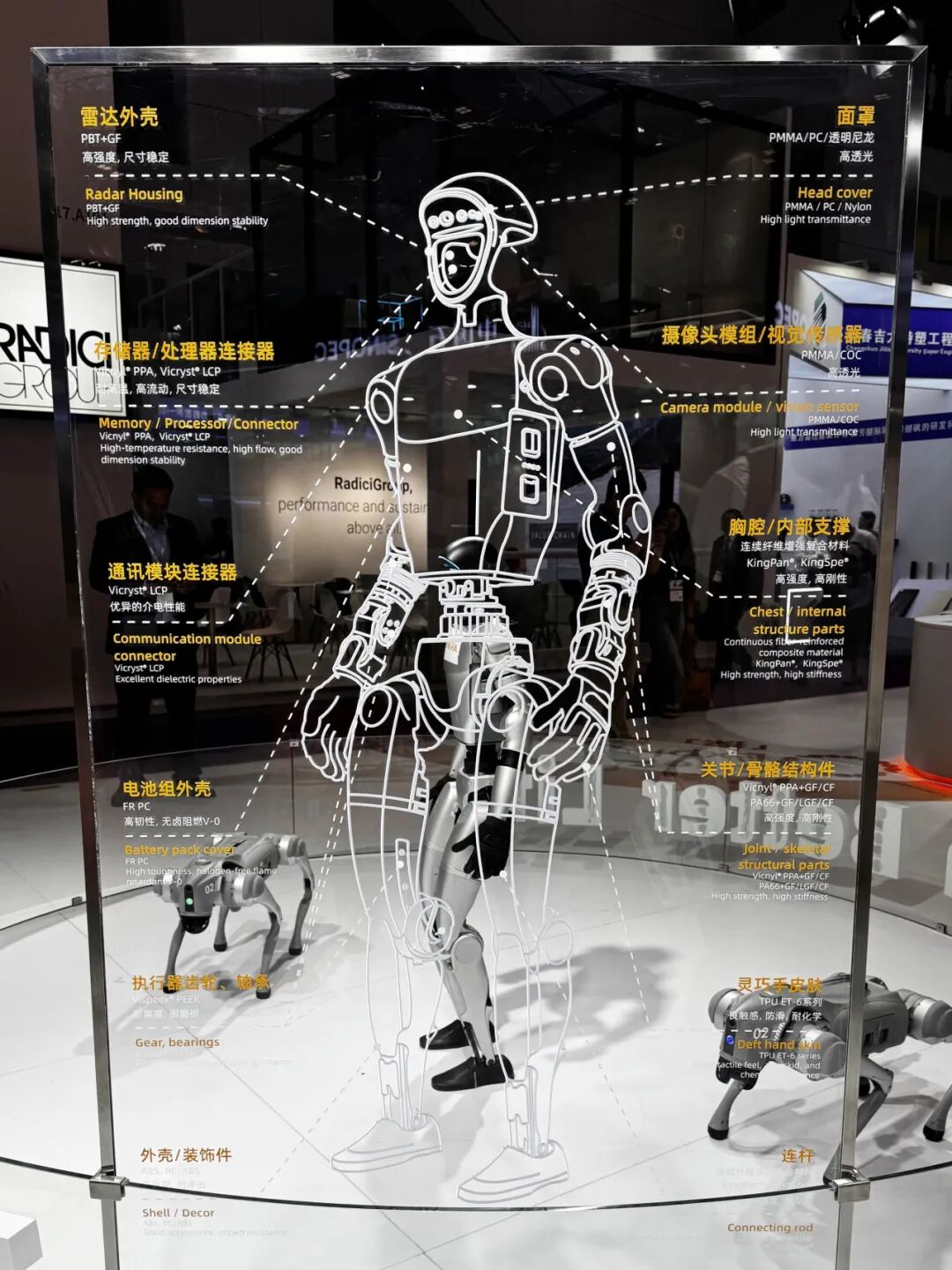

Upstream enterprises excel in synthesis and basic modification, while downstream enterprises possess a deeper understanding of the performance requirements for end products. The key to victory lies in who can more rapidly develop innovative formulas and products that meet specific scenario-based needs. For instance, Kingfa Sci. & Tech.'s PEEK material solutions for humanoid robot actuator gears and bearings, showcased at CHINAPLAS, exemplify this capability. The speed of technological iteration will ultimately determine market discourse power.

At the CHINAPLAS 2025 International Exhibition on Plastics and Rubber Industries, Jinfat Technology showcased a series of material solutions for humanoid robots on-site (Source: Chinaplas 2025).

2.Changes in the industrial ecosystem.

The traditional linear supply chain is being dismantled, replaced by an intricate, networked ecosystem. Relationships between companies are becoming unprecedentedly complex; they are both suppliers and customers, partners and competitors. Whether an open alliance similar to the "Huawei ecosystem" or a vertically closed system like "BYD" will emerge will be a key observation point in the coming years. This reshaping of the ecosystem will profoundly affect industry profit distribution and the pace of innovation.

3.Cost control remains important.

Enterprises possessing upstream DFBP resources undoubtedly have an inherent cost advantage. However, downstream companies can effectively dilute comprehensive costs through large-scale applications, integrated design, and efficient supply chain management. The future competition will depend on who can better achieve full-chain cost control from "molecular design" to "end-user application."

Undoubtedly, the PEEK industry is entering its "golden decade." Data shows that China's PEEK demand will exceed 5,000 tons by 2027, with a market capacity exceeding 16.7 billion yuan. The vast track is large enough to accommodate multiple business models in parallel.

In the short term, companies with advantages in raw materials or capital may scale up rapidly to seize market share. However, in the medium to long term, true core competitiveness will lie in the ability to build integrated solution capabilities—spanning from material innovation and process realization to cost optimization—centered around specific application scenarios, such as joint modules for humanoid robots or the "three-electric" systems of new energy vehicles.

The boom of the PEEK industry is not merely the triumph of a single material, but a microcosm of the upward breakthrough of China's high-end manufacturing and the enhancement of its collaborative innovation capabilities across the industrial chain. This competitive and cooperative interplay among upstream and downstream enterprises, though fraught with unknowns and challenges, will ultimately temper a group of world-class companies possessing technical depth, market breadth, and ecological synergy. It will lay a solid foundation for China to secure a vital position in the global field of high-end materials.

Editor: Lily

Source: Hanh New Material Announcement, CHINAPLAS 2025 International Rubber and Plastics Exhibition, DT New Material, High-Performance Resins and Applications, Lingxin Qiaoshou LINKERBOT, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

CBAM Officially Implemented In Its First Month: How Chinese Export Enterprises To Europe Complete Their First Compliance Declaration?

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

Vynova's UK Chlor-Alkali Business Enters Bankruptcy Administration!

-

100% Recycled Plastic Bricks: A New Tool to Replace Traditional Concrete and Combat Floods