[Daily POM Review] Slow Spot Circulation Puts Pressure on Market Sales

1. Today's Summary

1. The market sales are generally average. 。

②. The profit margin for businesses has increased.

2 Spot Overview

The price of Yun Tianhua M90 in Yuyao today is 11,000 RMB/ton, remaining stable compared to the previous period. Today, the POM market remained in a wait-and-see mode with limited support from the supply side. Petrochemical plants maintained a firm pricing attitude, but sales performance in various regions was weak. Traders showed a lack of enthusiasm in operations, and some quotations still had room for negotiation, with deals being discussed on a case-by-case basis. By the close, the domestic POM price in the Yuyao market (including tax) was 8,100–11,200 yuan/ton, while the cash price in the Dongguan market was 7,300–10,400 yuan/ton.

|

Figure 1 Domestic POM Price Trend Chart for 2024-2025 (Yuan/ton) |

Figure 2: 2024-2025 Domestic POM Regional Price Trend Chart (Yuan/Ton) |

|

|

|

|

Data Source: Longzhong Information |

Data source: Longzhong Information |

3 Production Dynamics

The domestic POM capacity utilization rate this week is 91.85%, a decrease of 1.30% compared to last week's operation rate. The 40,000-ton/year POM unit at Tianjin Bohua is shut down for maintenance, while POM units from other manufacturers are operating stably. The loss due to maintenance fluctuated little this week. Methanol prices are rising, while POM prices remain stable. The product gross margin slightly decreased, reducing the profit margin by 35 yuan per ton.

|

Figure 3 Trend of Domestic POM Capacity Utilization Rate in 2024-2025 |

Figure 4 Comparison of Domestic POM Profit and Price in 2024-2025 (Yuan/ton) |

![[POM日评]:市场出货存压 购销清淡(20250818) [POM日评]:市场出货存压 购销清淡(20250818)](https://oss.plastmatch.com/zx/image/890596c1788e4cafafb920ed9814a331.png) |

![[POM日评]:市场出货存压 购销清淡(20250818) [POM日评]:市场出货存压 购销清淡(20250818)](https://oss.plastmatch.com/zx/image/eeb205db86794ee6a35228f774d9d1e8.png)

|

|

Data source: Longzhong Information |

Data Source: Longzhong Information |

4. Price Forecast

There is currently no effective fundamental support, market sentiment is increasingly cautious across regions, and sales performance remains sluggish. Traders are under considerable pressure to move inventory, with some continuing to offer slight price concessions. End-user purchasing interest is weak, and the short-term focus is mainly on digesting in-plant inventories, resulting in a relatively flat trading atmosphere. As of market close, the tax-inclusive price of domestic POM in the Yuyao market was 8,100-11,200 RMB/ton, while the cash price in the Dongguan market was 7,300-10,400 RMB/ton.

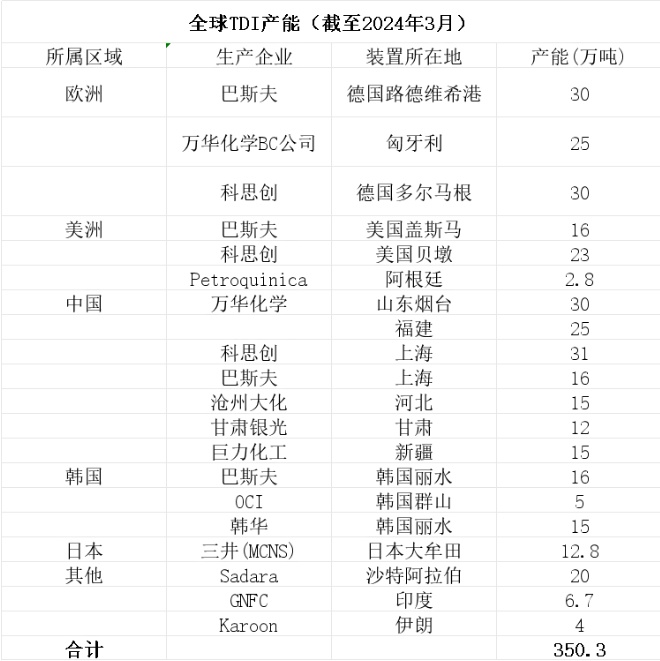

5 Relevant product information:

Methanol:Today's methanol spot price index is 2165.87, down by 3.17. The Taicang spot price is 2305, up by 25, and the Inner Mongolia north line price is 2070, unchanged. According to Longzhong's monitoring of prices in 20 major cities, prices in 8 cities have risen to varying degrees, with increases ranging from 8 to 25 yuan/ton. Today, the methanol market in Northwest China remains stable, with trading activity showing some recovery compared to yesterday. The market atmosphere in the morning still appeared sluggish, with some companies continuing to lower prices to clear stocks. However, with inquiries for external procurement from Ningxia olefins appearing, market buying interest was boosted, and the trading atmosphere improved, leading to a slight increase in transaction prices. The trade switching market followed the trend with a slight increase, but the buying attitude remained cautious, with mostly low-end just-in-need transactions. Overall, supported by external procurement of olefins, transactions in the market have improved, but the sustainability of demand remains to be observed. In the short term, the market may maintain a choppy consolidation pattern.

6 Data Calendar

Table 2 Overview of Domestic POM Data (Unit: 10,000 tons)

|

Data |

Publication Date |

Previous period data |

This period's trend is expected |

|

Capacity utilization rate |

Thursday 17:00 |

91.85% |

↘ |

|

Production Profit Margin |

Thursday 5:00 PM |

1.77% |

↘ |

|

Data Source: Longzhong Information Note: 1. ↓↑ is considered a significant fluctuation, highlighting data dimensions with a change of more than 3%. 2. ↗↘ are regarded as narrow fluctuations, highlighting data with a rise or fall within 0-3%. |

|||

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Covestro faces force majeure!

-

Covestro and Wanhua Chemical Carve Up the Industry’s No. 3 Player

-

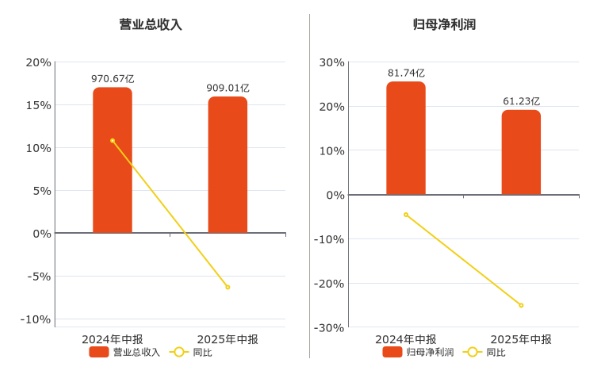

Wanhua chemical's net profit falls by 25.10%! is diversified layout the right move to counter industry cycles?

-

Breaking: 1 Dead, 1 Injured as Chemical Plant Explosion Occurs

-

Honda Plans To Implement Three Shifts At United States Factory To Mitigate Tariff Impact

![[POM日评]:市场出货存压 购销清淡(20250818) [POM日评]:市场出货存压 购销清淡(20250818)](https://oss.plastmatch.com/zx/image/cf33292139e04791ac314718a9b5c145.png)

![[POM日评]:市场出货存压 购销清淡(20250818) [POM日评]:市场出货存压 购销清淡(20250818)](https://oss.plastmatch.com/zx/image/cf9adf6de18a4157823ed5ec8210d3c1.png)