Car market in 2026: Even More Aggressive Price Cuts?

As 2026 began, the domestic passenger vehicle market did not seem to follow the rational development pace set since 2025. Instead, a more aggressive-than-expected price adjustment quietly arrived, kicking off a new round of price competition right from the start of the year.

Starting the year with a "bang," the price cuts in January were indeed significant.

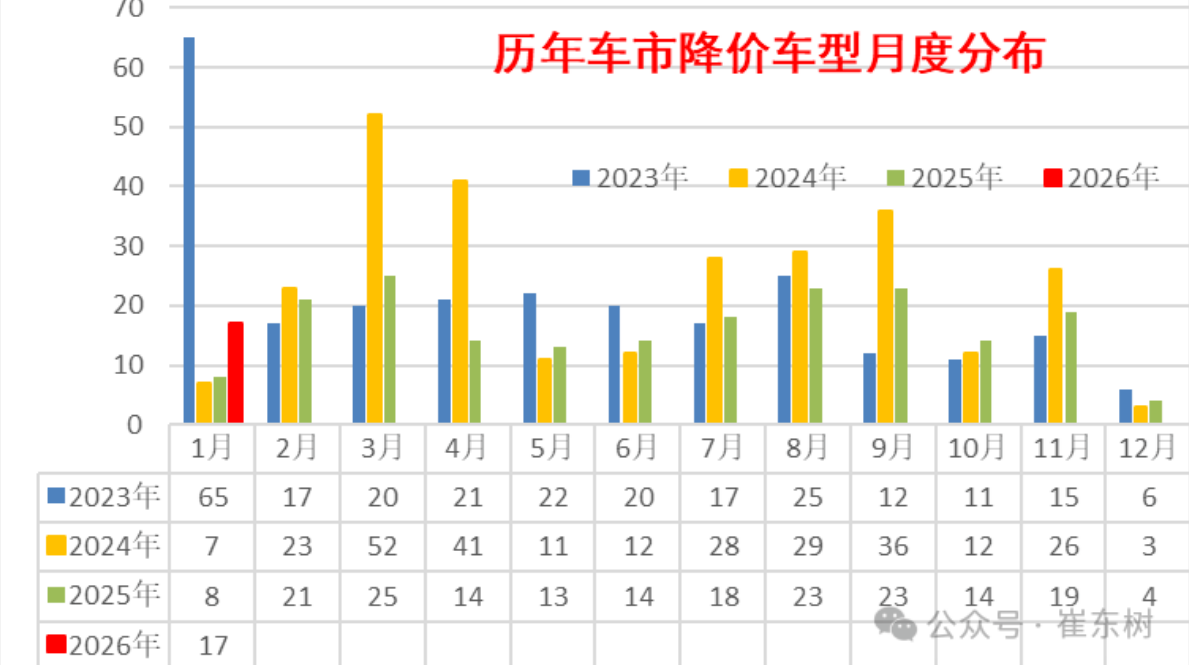

Reviewing the pace of price reductions over the past three years, 2023 saw a generally high frequency of price cuts. In 2024, the intensity of price reductions peaked in March-April. However, 2025 witnessed a significant cooling of industry promotions, with a sharp decrease in discounted models from April to October. The wave of price cuts at the start of 2026 directly disrupted this stable trend.

Cui Dongshu, Secretary-General of the China Passenger Car Association (CPCA), recently released data showing that in January 2026, a total of 17 passenger car models in the Chinese market experienced price reductions, an increase of 9 models compared to the 8 models in the same period of 2025, and a significant surge compared to the 4 models in December 2025. Considering the 177 price-reduced models throughout 2025, with an average of only 14.75 models per month, the scale of price reductions in January 2026 alone reached 115% of last year's monthly average, demonstrating an unprecedented momentum at the start of the year.

Image source: Cui Dongshu

From the perspective of power type segmentation, gasoline vehicles have become the absolute main force in this round of price cuts. In January, a total of 10 gasoline vehicles were discounted, an increase of 5 compared to the same period in 2025. It should be noted that only 52 gasoline vehicles were discounted throughout 2025, averaging less than 4.4 per month.

Regarding new energy vehicles, in January, 6 pure electric models experienced price reductions, an increase of 3 compared to the same period last year. One extended-range hybrid model saw a price reduction, a new occurrence compared to the same period last year. Regular hybrid models did not experience any price reductions. Notably, in the full year of 2025, 73 pure electric models experienced price reductions, averaging approximately 6.1 models per month.

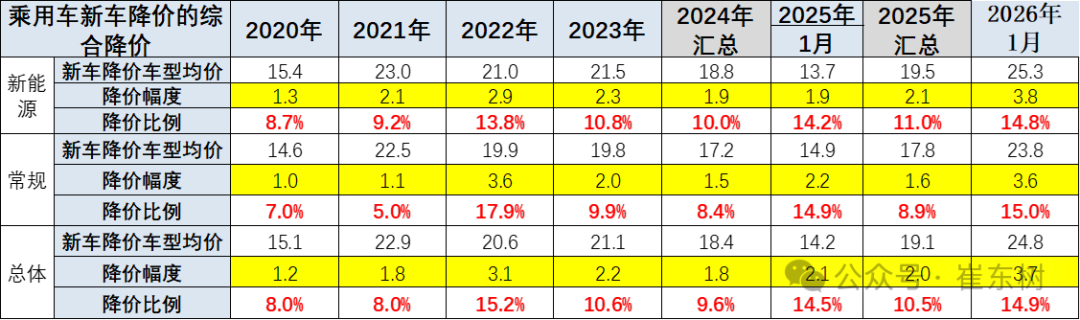

Consumers are more concerned with the actual price reduction than the scale of the price cut. Data shows that in January 2026, the arithmetic average price reduction for new passenger vehicles, with an average price of 248,000 yuan, reached 37,000 yuan, a decrease of 14.9%. In contrast, for the entire year of 2025, the arithmetic average price reduction for new passenger vehicles, with an average price of 191,000 yuan, reached 20,000 yuan, a decrease of 10.5%.

In terms of product categories, the price reduction efforts for gasoline vehicles and new energy vehicles are comparable, with gasoline vehicles even slightly outperforming. Specifically, the arithmetic average price reduction for new energy vehicles with an average price of 253,000 yuan was 38,000 yuan, representing a price reduction of 14.8%. The arithmetic average price reduction for conventional gasoline vehicles with an average price of 238,000 yuan was 36,000 yuan, representing a price reduction of 15%.

Image source: Cui Dongshu

Another major characteristic of this wave of price cuts is a significant shift in the structure of discounted models, with luxury brands replacing mid-to-low-end models as the core. Taking BMW as an example, in January, not only did multiple fuel-powered and new energy vehicles see simultaneous price reductions, but some models also introduced a "price cut with added features" strategy.

It should be noted that this price reduction statistic includes not only hidden price cuts where new car launches break the previous price floor, but also some "increase-then-decrease" models. For example, some new cars were initially launched at lower prices in the first two years, then increased in price due to rising lithium carbonate prices, and are now being reduced again. Even if they do not break the initial launch price, they are still included in the statistics. This statistical method more accurately reflects the current price easing trend in the car market, meaning that price reduction phenomena in the actual market are more prevalent than the data suggests.

Multiple factors are at play; the price reduction wave cannot be judged solely by its surface.

Since 2025, promotions and price reductions in the passenger car industry have returned to a rational level, and market order has significantly improved. Why, then, has such a fierce price reduction wave hit at the beginning of 2026? In fact, this price reduction is not a temporary promotional activity by car manufacturers, but a result of the superposition of multiple factors including policy adjustments, market competition, inventory pressure, and the reshaping of price systems.

Cui Dongshu stated in an interview with Gasgoo that the price reduction in the automotive market in January 2026 will appear significant, but in reality it will not be, mainly driven by factors such as the decline in new energy vehicle policies and the taxation of new energy vehicles.

Indeed, the adjustment of the new energy vehicle purchase tax policy is the most direct and core driving factor behind this wave of price reductions. According to the policy requirements of the Ministry of Finance, the State Taxation Administration, and the Ministry of Industry and Information Technology, starting from January 1, 2026, the new energy vehicle purchase tax exemption policy, which has been in place for more than ten years, will officially be phased out. Instead, a new regulation will be implemented, halving the tax exemption, and reducing the maximum tax reduction per vehicle from 30,000 yuan to 15,000 yuan, which will significantly increase the cost for consumers purchasing new energy vehicles.

Taking a new energy vehicle with a suggested retail price of 300,000 yuan as an example, consumers can enjoy a full purchase tax exemption in 2025, with no purchase tax payable. After the purchase tax is halved in 2026, consumers will need to pay approximately 13,300 yuan in purchase tax (Purchase tax = Suggested retail price ÷ 1.13 × 10% × 50%), directly increasing the cost of purchase. However, if the automaker reduces the suggested retail price by 30,000 yuan to 270,000 yuan, consumers will need to pay approximately 11,900 yuan in purchase tax, resulting in a total purchase cost of 281,900 yuan, which is lower than the 300,000 yuan in 2025. By doing so, the automaker not only absorbs the impact of policy adjustments but also maintains the market competitiveness of the model.

Cui Dongshu pointed out that in the face of the new energy vehicle purchase tax being levied, there has been a significant increase in models directly lowering prices in January 2026, with inflated list prices returning to normal, which is conducive to rationalizing consumers' tax costs.

In addition to policy factors, the drastic changes in the high-end market landscape have also driven the wave of price reductions. Another significant feature of this price reduction wave is that luxury brands are leading the way, which is backed by intense changes in the competitive landscape of the high-end market. In recent years, the acceleration of independent brands' high-end strategies, the continuous efforts of new energy luxury models, and intensified competition in the imported car market have severely squeezed the market share of traditional luxury brands, leading to a rapid deterioration of the market environment.

Image source: Mercedes-Benz

Data shows that the promotional discounts on luxury cars reached a high of 28.8% in January 2026, an increase of 2.5 percentage points compared to the same period. In fact, the promotional efforts for luxury cars have been steadily increasing since September 2025. Even with the consumer upgrade driving strong high-end demand, it is difficult to withstand the pressure of market competition.

The urgent need for traditional fuel vehicle companies to break through the deadlock is further accelerating the trend of price reductions. Although new energy vehicles are developing rapidly, fuel vehicles still occupy half of the domestic passenger car market. By January 2026, the number of fuel vehicle models with price cuts will far exceed those of new energy vehicles, driven by the pressing need of fuel vehicle companies to seek development breakthroughs.

Since 2025, the gasoline car market has exhibited a trend of "stable promotions and reduced price cuts," with only 52 gasoline car models experiencing price reductions throughout the year, a decrease of 26 models compared to the same period. However, due to the continuous pressure from new energy vehicles and intensified internal competition among gasoline car companies, many gasoline car models have experienced declining sales and high inventory levels, urgently requiring price reductions to break the development deadlock.

According to data released by Cui Dongshu, the promotion of traditional fuel vehicles in January 2026 decreased to 23.7%, a slight decrease of 0.5 percentage points from the previous month and an increase of 1.8 percentage points year-on-year. Fuel vehicle promotions have remained at around 24% for five consecutive months. While the promotion intensity tends to be stable, the price reduction has increased significantly. Essentially, fuel vehicle companies are shifting from "implicit promotions" to "explicit price cuts," breaking the original price system by directly lowering the list price to reverse the passive competitive situation.

Furthermore, the reshaping of the pricing system is also a significant trigger for this wave of price cuts. The car market price war from 2023 to 2024 was characterized by "disorderly involution," with automakers largely reducing terminal prices through implicit promotions and subsidies, leading to a severe disconnect between list prices and actual transaction prices and creating market chaos. In 2025, industry promotions and price reductions returned to rationality, significantly improving market order, but the reshaping of the pricing system remained incomplete. The price cut wave in January 2026 is precisely a continuation of this pricing system reshaping.

Previously, Cui Dongshu told Gasgoo that the price adjustments of some brands only adjusted the official guide prices, not the terminal retail prices. From the perspective of actual market performance, there was no significant fluctuation in terminal prices. The core of this price adjustment is to return the previously inflated pricing to a reasonable range, which essentially helps consumers reduce the purchase tax costs in the car buying process and does not have a substantial impact on the market competition pattern.

Price cut intensity will decrease, and "involution" (intense internal competition) is expected to become more rational.

This round of price cuts has also drawn close attention from all parties in the market: How long will this price war last? Will more models join the ranks of price cuts in the future?

In an interview with Gasgoo, Cui Dongshu stated that this wave of price cuts is mainly due to the adjustment of taxable prices at the beginning of the year. As inventory clears, new products are launched, and industry norms are guided, the intensity of price cuts will significantly decline, and the overall price trend for the year will be high in the beginning and then decline, returning to normal levels.

It is worth noting that the "anti-involution" process in the 2026 auto market will continue to advance, and the industry is expected to achieve three key transformations, gradually moving towards a higher-quality and rational development stage.

Firstly, the shift from "price involution" to "value competition." In the previous car market price war, some automakers fell into the trap of "blind price reductions," compressing profits to seize market share and even launching "low price, low quality" models, triggering disorderly competition in the industry. However, the price reductions in 2026 are automakers proactively adjusting their pricing systems to align prices with product value. The "price reduction with increased features" strategy launched by luxury brands, in particular, highlights the development concept of "value first." In the future, competition among automakers will move away from simple price comparisons and towards comprehensive competition in technology, quality, service, and experience. Automakers that blindly cut prices and ignore product value will eventually be eliminated by the market.

Image source: Chery Automobile

Secondly, a shift from "implicit promotions" to "transparent pricing." In 2023-2024, automakers heavily relied on implicit promotional methods such as substantial discounts, subsidies, and gifts, leading to a significant disconnect between the manufacturer's suggested retail price (MSRP) and the actual transaction price. This required consumers to negotiate repeatedly when purchasing a car, resulting in a poor experience and disrupting market order. In 2026, automakers are proactively lowering MSRPs and reducing implicit promotions, aiming to align MSRPs with actual transaction prices. This transition will not only enhance the consumer buying experience but also promote the healthy development of dealerships, foster a virtuous cycle in the industry, and steer the automotive market back onto a rational development path.

Thirdly, the shift from "policy-driven" to "market and technology-driven" is crucial. Previously, the rapid development of the new energy vehicle market relied mainly on policy drivers such as purchase tax exemptions and subsidies. However, after the phasing out of the new energy vehicle purchase tax policy in 2026, the driving force of policy will gradually weaken, and automakers need to rely on market demand orientation and core technological upgrades to promote the development of the new energy vehicle industry. The current efforts by automakers to absorb the impact of policy through price reductions while increasing investment in technological research and development and enhancing product core competitiveness are concrete manifestations of this shift. In the future, the development of the new energy vehicle market will depend more on the pull of market demand and technological innovation breakthroughs, leading to a healthier and more sustainable industry development.

For market participants, this wave of price cuts presents both opportunities and hidden risks. Only by viewing it rationally can they grasp the rhythm of development.

For consumers, 2026 is undoubtedly a favorable time to buy a car, especially for those planning to purchase luxury cars and new energy vehicles. The significant reduction in purchase costs due to price cuts by automakers makes the price-performance ratio of models more prominent. However, consumers should not blindly follow the trend of buying cars, but should combine their actual needs and choose models with excellent product quality and guaranteed after-sales service. Avoid buying "low-quality" products in pursuit of "low prices," and also pay attention to the residual value of the model to avoid the risk of significant depreciation in the future.

For automakers, this round of price cuts presents an opportunity for industry transformation. Rather than getting caught up in price wars, they should invest more in technological R&D, product upgrades, and service optimization, building core competitiveness to gain market advantage. This aligns with the industry's shift towards value-based competition and rational development, enabling them to establish a firm foothold in future market competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Sony Joins 13 Chemical Material Firms to Build World's First Renewable Plastic Supply Chain in Electronics

-

Breaking: EU Imposes 79% Anti-Dumping Tariff on Several China Products

-

Building an Asian Application R&D Center! Why Is DOMO Chemicals Firmly Betting on China's High-End Nylon Track?

-

"Fifteenth Five-Year Plan" Policy Winds Blow Strong, CHINAPLAS 2026 International Rubber & Plastics Exhibition Reimagines and Sets Sail!

-

Continental Plans to Begin Sale of ContiTech in Early 2026