Arkema "Dual-Line" Marriage with Enjie and Starwin! What Industry Trends Are Revealed by the Union of New Materials and Battery Giants?

From late 2025 to early 2026, Arkema, a global giant in specialty materials, has made a series of moves in the Chinese market, successively signing memorandums of understanding for strategic cooperation with two leading domestic battery separator manufacturers – Enjie shares and Xingyuan Materials. These actions are not isolated incidents but rather a concentrated manifestation of Arkema's "technology binding + capacity synergy + global expansion" three-in-one strategy. They profoundly reflect the critical trend of China's lithium battery industry upgrading from "cost-driven" to full-chain synergy of "materials-processes-systems."

Arkema and Senior Material Deepen Cooperation to Accelerate R&D of Next-Generation Battery Materials (Source: Arkema)

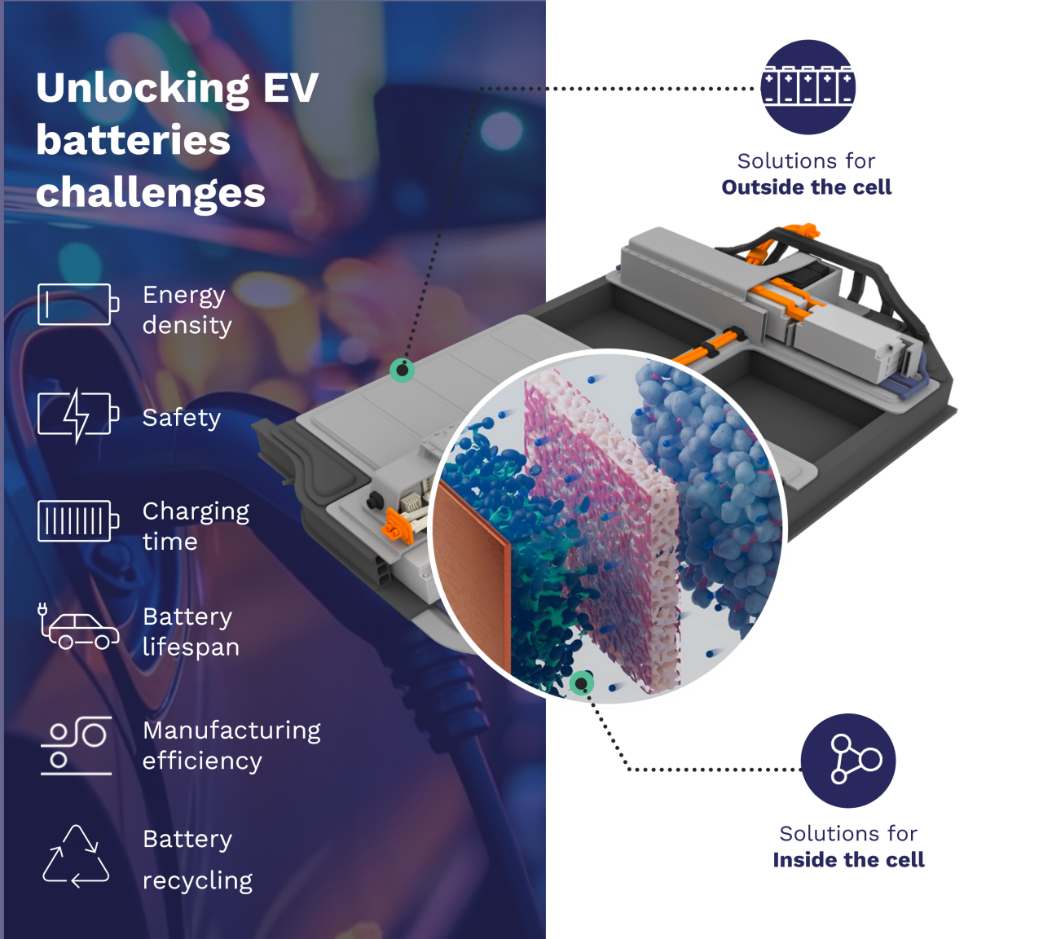

I. Unique Technologies of Arkema Battery Solutions

Arkema's core business is the supply of specialty chemicals, particularly in the field of battery materials.Kynar® PVDF(Polyvinylidene fluoride) andIncellion™ Acrylic adhesiveTwo major core technology platforms. These two types of materials are key components of separator coatings, directly affecting battery thermal stability, cycle life, and safety.

Image Source: Arkema

Arkema also offers a diverse portfolio of solutions for applications outside the battery cell.

Bostik smart adhesives help manufacturers efficiently assemble cells to cells and cells to modules, while also contributing to improved battery thermal management system performance.

To achieve optimal battery performance, temperature control is key. Arkema's OLERIS®The material is 100% bio-based, extracted from renewable castor oil, and enhances the performance of insulating liquids in direct liquid immersion cooling systems for batteries.

To ensure safe and efficient electrical insulation, RILSAN®Polyamide 11 offers excellent insulation for busbars, while polyimide film provides a reliable solution for thermal control and mitigating thermal runaway.®Solvent-free UV-curable specialty materials offer excellent insulation, adhesion, and flexibility, making battery insulation faster, more efficient, and lower in carbon emissions. Arkema also provides powder resin solutions for intumescent fire-resistant coatings.

Battery pack protection is key to battery safety and durability. Arkema's ELIUM®Thermoplastic resins are an ideal choice for composite shell design. Once coated with our resin and additive formulation, battery packs gain enhanced protection against corrosion, stone chipping, and even fire.

Arkema and the Chinese Battery IndustryTwo-way binding

In December 2025, Arkema finalized a deep strategic cooperation with Enjie Shares, the global leader in diaphragm shipments. The core of their collaboration lies in leveraging Arkema's high-performance material solutions to jointly develop high-performance diaphragms adapted for semi-solid and solid-state battery systems, aiming to overcome key metrics such as ion transport efficiency and extreme environmental adaptability.

This collaboration resonates with Enjie's aggressive layout in the solid-state battery field. In January 2026, Enjie signed strategic agreements with solid-state battery companies Enli Power and Guoxuan High-tech to jointly develop high-performance electrolyte separators. More crucially, Enjie has achieved the production of a 10-ton-level production line for sulfide solid-state electrolytes through its holding subsidiary and has planned a thousand-ton-level capacity. The key indicators of its products, such as ionic conductivity, have reached industry-leading levels. Arkema's Kynar ®Materials such as PVDF will be a significant boost for Enjie's high-end solid-state battery separators to enter the European and American markets.

Image source: Yunnan Energy New Material Co., Ltd.

In February 2026, Arkema and Xingyuan Materials further deepened their cooperation, signing a Memorandum of Understanding to expand their collaboration to multiple cutting-edge fields, including advanced bonding technologies, controllable deposition coating processes for electrodes, low-temperature battery assembly, and solid-state battery manufacturing technology.

As the world's sole diaphragm enterprise mastering dry, wet, and coating technologies simultaneously, Xingyuan Material's Hong Kong IPO fundraising will explicitly focus on overseas capacity expansion and solid-state battery material R&D. Arkema's Incellion™ binder technology can effectively optimize the electrode-diaphragm interface, enhancing the interfacial stability and production efficiency of semi-solid-state batteries. This aligns perfectly with Xingyuan Material's strategy of transitioning to high-energy-density systems and accelerating its global expansion.

III. From "Materials supplier

"Technical Partner"Arkema's China Strategy Upgrade

By deeply integrating with leading companies, Arkema's role in the Chinese market has evolved from a traditional material supplier to a "R&D-production-service" integrated technological partner.

Deep technological lock-in :Through joint R&D with Enjie and Xingyuan, Arkema's products are no longer "replaceable raw materials" but have become "key variables" for improving battery performance. For example, its Kynar®PVDF can reduce the thermal shrinkage of the separator by 40%, significantly increasing the thermal runaway threshold of batteries.

Capacity cooperation for overseas expansion. :Enjie is building 14 coating separator production lines (annual capacity of 700 million square meters) in the United States, and Starry Science & Technology is raising funds through its Hong Kong IPO for the construction of overseas factories. Arkema leverages its global sales network and brand influence to provide overseas certification, customer connection, and compliance support to its partners, achieving a "China capacity + global channel" synergy.

Product Matrix Extension:Beyond separator materials, Arkema has expanded into areas such as controlled electrode deposition and low-temperature assembly processes through collaborations with multiple manufacturers, progressively evolving from providing "individual materials" to "integrated system solutions."

IV. Reflecting Deep-Seated Transformations in China's Lithium Battery Industry: The Era of Ecosystem Co-construction Has Arrived

Arkema's dual collaboration is a microcosm of the restructuring of China's lithium battery industry chain since 2025.

Solid-state batteryAccelerate implementation. :Engie has signed a solid-state electrolyte cooperation agreement with Gotion High-tech and Enpower Energy. Gotion High-tech will launch a 2GWh all-solid-state battery production line in 2026. Cathode material companies such as Dynanonic and Xiamen Tungsten are also simultaneously advancing oxide/sulfide routes.

Leading enterprises Army group operation :CATL, BYD, Gotion High-tech, and others have secured upstream material companies through equity investments, long-term contracts, and joint R&D, forming a new industrial relationship characterized by "shared technology development, shared risks, and shared benefits."

Global competition has reached a fever pitch.:In 2025, China's power battery exports reached 24.1 GWh, a year-on-year increase of 38.3%. Companies such as Enjie and Senior are collaborating with international giants like Arkema to overcome technical barriers in the European and American markets, achieving a transition from "product exports" to "standard exports."

V. Conclusion: Material Synergy, Defining the Next Generation of BatteriesChina Height

Arkema's deep ties with Enjie and Xingyuan reveal a clear trend: future battery competition has moved beyond single-enterprise capacity races to a battle of ecological synergy across materials, processes, systems, and global supply chains. In this new phase where China's power battery industry holds a dominant global position, "strong-strong alliances" with top global material suppliers are becoming the core strategy for Chinese companies to break through technological ceilings and build an unreplicable industrial moat. Material-side collaborative innovation will ultimately determine the "Chinese height" of next-generation batteries.

Editor: Lily

Source: Wind, corporate public announcements, Arkema, Senior Technology Material, etc.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Sony Joins 13 Chemical Material Firms to Build World's First Renewable Plastic Supply Chain in Electronics

-

Breaking: EU Imposes 79% Anti-Dumping Tariff on Several China Products

-

Building an Asian Application R&D Center! Why Is DOMO Chemicals Firmly Betting on China's High-End Nylon Track?

-

Continental Plans to Begin Sale of ContiTech in Early 2026

-

"Fifteenth Five-Year Plan" Policy Winds Blow Strong, CHINAPLAS 2026 International Rubber & Plastics Exhibition Reimagines and Sets Sail!