1.44 million is just the ticket: Analyzing Oriental Yuhong's Strategy in Latin America and How Chinese Building Materials Navigate Challenges Abroad

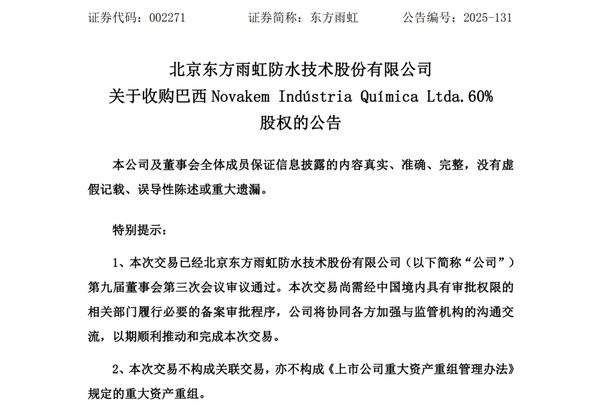

On December 19th, Oriental Yuhong announced plans to acquire a 60% stake in Brazilian chemical company Novakem for 144 million yuan. This move comes just one month after the commencement of its production, research, and logistics base in Mexico. This leading Chinese waterproof materials company is rapidly expanding its presence in the Latin American market.

Image source: Oriental Yuhong

Image source: Oriental Yuhong

According to the financial report of Oriental Yuhong, its operating income for 2024 decreased by 14.52% year-on-year, and the net profit attributable to the parent company dropped significantly by 95.24% year-on-year. Against the backdrop of a slowdown in the growth of the domestic building materials market, seeking new growth points overseas has become an inevitable choice for the company.

Oriental Yuhong is not an isolated case. As competition in the domestic market intensifies, a number of Chinese building materials companies are accelerating their international expansion through mergers, acquisitions, and setting up factories, with the Latin American market becoming their new battleground.

01 Dual-track Advance: Latin American Strategic Layout Emerges

The layout of Oriental Yuhong in Latin America showsA clear strategy of dual-track advancement.。

On November 19th this year, the construction of its Mexico production, research and development, and logistics base officially commenced. The base is planned to be constructed in two phases. The first phase will include the construction of a 100,000-ton annual capacity sand powder production line, a 20,000-ton water-based paint production line, and a supporting warehousing and logistics center, expected to be operational by 2026. The second phase will expand to include additive and coil production lines, creating a multifunctional, integrated regional production and service hub.

Just one month later, Oriental Yuhong made another move by announcing the acquisition of a 60% stake in Brazil's Novakem company. Founded in 2013, Novakem is a leading chemical additive enterprise in Brazil, primarily engaged in the research, production, and sales of cement additives and concrete admixtures. According to the information, the company has stable profits, with an estimated operating income of approximately 103.9 million yuan and a net profit of about 31.55 million yuan for the year 2024.

Xiang Jinming, Vice Chairman of Oriental Yuhong Holdings, stated that the launch of the Mexico base is a key step in the company's deepening of its global strategic layout. The acquisition in Brazil is regarded by the company as an important move to "establish a foothold in Brazil and expand into the Latin American market."

These two major actions echo each other, forming a...Strategic fulcrum covering the two major Latin American economies, Mexico and Brazil.。

02 Ingenious Design: M&A Transaction Structures Conceal Mysteries

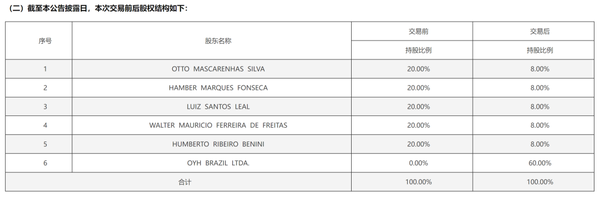

The transaction structure of the acquisition of Brazil's Novakem by Oriental Yuhong is ingeniously designed, reflecting the company's mature strategy in international mergers and acquisitions.

Image source: Novakem

Transaction adoptionInstallment payment and performance-linked option mechanismEffective control of merger and acquisition risks has been achieved. According to the arrangement, Oriental Yuhong will pay 80% of the amount (approximately 86.4 million Brazilian Reals) in the first installment, with the remaining 20% to be paid after adjustments based on the operating capital and net liabilities on the closing date.

What is even more ingenious is the arrangement for the remaining equity. The seller's 40% equity can be sold to Oriental Yuhong at an agreed price within five years after April 1, 2028. The exercise price is linked to the company's EBITDA growth rate; the better the performance growth, the higher the valuation multiple, which essentially forms a...“Performance VAM 。

For a civil lawsuit involving the target company, the transaction includes risk prevention measures: the seller's remaining equity must be pledged to the buyer, and a portion of the dividends and future exercise proceeds will be deposited into an escrow account as potential compensation security.

Source: Oriental Yuhong

This structure not only ensures that Oriental Yuhong obtains controlling rights but also retains the flexibility for a full acquisition in the future based on performance, while effectively mitigating potential risks. It demonstrates the increasingly sophisticated operational techniques of Chinese enterprises in cross-border mergers and acquisitions.

03 Synergy: The Art of Balancing Localization and Globalization

Oriental Yuhong's strategy in Latin America focuses not only on geographic expansion but also emphasizes the synergy of the industrial chain.

Relying on the locational advantages of Tula City, the comprehensive facilities of the QUMA Industrial Park, and the vast market space in central Mexico, the company is committed to achieving...Localized Production and Services。

The acquisition in Brazil has enabled the company to gain localized production capabilities in the fields of cement additives and concrete admixtures. Brazil is the largest economy in Latin America, with a rapidly developing construction and infrastructure market, leading to a continuous increase in demand for products such as cement additives and concrete admixtures. Novakem has already established a strong brand presence in Brazil's chemical additives sector, with clients including well-known enterprises such as the Brazilian state-owned steel company.

Oriental Yuhong stated that it will leverage Novakem's local brand, team, and customer resources, combined with its own technological research and development, product categories, and supply chain advantages, to achieve synergies and cultivate new growth points for its international business.

“Localization+GlobalizationThe dual-track strategy enables Oriental Yuhong to quickly adapt to the characteristics of the Latin American market while leveraging its scale advantages as a multinational company.

Oriental Yuhong's expansion in Latin America is a highly representative example of the wave of Chinese building material companies going abroad. Its overseas layout is accelerating significantly: from the trial production at the Malaysian base in early 2025, to the announcement of a new base in Canada in the spring of the same year, and then to the end of the year with the successive launch of the Mexican factory and the acquisition of a Brazilian company—a network covering Southeast Asia, North America, and Latin America.Global Production NetworkThis diversified and multi-regional layout is not only aimed at dispersing market risks but also actively capturing growth opportunities in different regions.

Looking at the entire industry, Oriental Yuhong is not an isolated case; a trend of collective expansion overseas has already taken shape.

Keshun Co., Ltd.In July 2025, two major modern bases will be put into operation in Malaysia, covering product lines of coatings, waterproof building materials, and chemicals, showcasing a systematic capacity output.

Gongyuan Co., Ltd.Vietnam's smart factory officially commenced operations in October as its fifth overseas base, focusing on pipeline products and targeting the vast infrastructure and home decoration market in Southeast Asia.

China LessoIn November, the Uzbekistan production base was put into operation, with a first-phase capacity of approximately 23,000 tons, aiming to cover the entire Central Asian market.

These cases collectively paint a clear picture: leading companies in China's building materials industry are making significant strides from past product trade to a new stage of localized production and branded operations. They are establishing production bases globally, not only to be closer to the market and respond to demand but also to accumulate valuable experience in multinational operations through practice.

As the domestic market competition intensifies and global experience accumulates, it is foreseeable that more Chinese building materials brands will make their mark in the global market in the future. This profound transformation from "product going abroad" to "capacity going abroad" and even "brand going abroad" is reshaping the competitive landscape of the global building materials industry.

Edited by: Lily

Sources: Caiyan News Agency, Radar Finance, CHINAPLAS, Special Plastics World, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant Unveils Cost-Cutting Plan Details, Plans to Shut Down Multiple Plants

-

Mexico officially imposes tariffs on 1,400 chinese products, with rates up to 50%

-

Nissan Cuts Production of New Leaf EV in Half Due to Battery Shortage