Zeekr Advances M Plan: Optimizes Direct Sales System, Transfers Some Stores

Zeekr, the brand undergoing transformation, continues to lighten its load.

Yiou Auto has learned from multiple independent sources that Zeekr is currently implementing a channel reform plan codenamed "M". According to this plan, without changing the direct sales model, some Zeekr direct sales stores and Zeekr home stores will be transferred to investors. Among them, the latter will be switched in greater numbers, while the former will be fewer.

In the current sales system of Zeekr, there are mainly two types: Zeekr-owned direct-operated stores and Zeekr Homes owned by investors. Zeekr-owned stores primarily lease properties in popular commercial areas of first- and second-tier cities. Zeekr Homes are relatively more complex; the ownership of the stores belongs to investors, but Zeekr leases their sales showrooms and dispatches sales teams to maintain the stability of the Zeekr direct sales system. Zeekr Home investors are mainly responsible for the after-sales business of the stores.

According to the "M Plan," some Zeekr direct lease stores and leased Zeekr Home showrooms will be transferred to Zeekr Home investors. Correspondingly, the sales personnel will no longer be Zeekr employees but will become employees of enterprises under the investors.

While transferring existing stores, Zeekr will not relax its direct sales system internally.

An investor told Yiou Auto that the number of stores being transferred this time is uncertain. "This year, Zeekr will maintain the total number of stores at a stable level, roughly around 500 nationwide. Therefore, Zeekr will retain a considerable number of self-owned direct-sale stores to directly control the terminal sales price and ensure the stability of the direct sales system."

In response to the above news, Zeekr told EO Auto: With the deep strategic integration of Zeekr and Lynk & Co, and the deepening of channel collaboration, Lynk & Co's advantageous resources will deeply empower Zeekr's expansion into the lower-tier markets. Zeekr will introduce a partnership model, adopting a "direct operation as the main approach, supplemented by the partnership model" to penetrate and strengthen the lower-tier markets, aiding channel development.

In the past July, Lin Jie publicly stated that Zeekr's channels would be adjusted.

At that time, Lin Jie stated that Zeekr would adhere to a direct sales model in first-tier and second-tier cities. In third-tier cities where direct sales outlets have already been established, Zeekr would continue to use direct sales in areas with better profitability. In third-tier and fourth-tier cities where there are no outlets, Zeekr would adopt an agency model. In even lower-tier fifth and sixth-tier cities, due to the limited market capacity, Zeekr would collaborate with the Lynk & Co brand to establish channels, reducing overall channel investment costs.

However, Lin Jie emphasized that regardless of the city or the channel, Zeekr's direct sales model and policies will not change.

“It’s understandable to insist on direct operation, but as for this store transfer—how should I put it? It’s a bit puzzling.”

According to the aforementioned investors who spoke to Yiou Auto, they are aware that Zeekr's M Plan had already started in the second quarter, but investors showed little interest in the stores being transferred by Zeekr. "At that time, there was only one store in a provincial capital city, Urumqi. The rest were basically in cities like Huai'an and Linyi."

"Dealerships with high foot traffic are not something car companies want to let go of; and for those with low foot traffic, why would investors take over?" a dealer told Yiou Auto. They mentioned that after Tesla started the direct sales model, many car companies followed suit, but later, quite a few companies transferred their direct-sale stores. "Some companies are relatively fair, like with Beijing's Blue Harbor, a store with very high foot traffic, which they would also transfer."

With the integration of Zeekr and Lynk & Co, as well as Zeekr's privatization, the company has been continuously adjusting its sales strategy.

In April this year, it was exclusively learned by EO Auto that Zeekr has established two new sales regions, the Northern Battle Group and the Southern Battle Group, in addition to the original twelve sales zones.

Zheng Zhifeng (nickname: Aaron) serves as the Regional Retail General Manager of the Northern Battle Group, overseeing six battle zones: Su-Lu, Su-Nan, Northwest, North, Central, and Shanghai. In the Southern Battle Group, Xu Yao (nickname: Xu Yao) serves as the Regional Retail General Manager of the Southern Battle Group, overseeing Guangzhou, Shenzhen, Northern Zhejiang, Southern Zhejiang, Southwest, and Central South, also consisting of six battle zones.

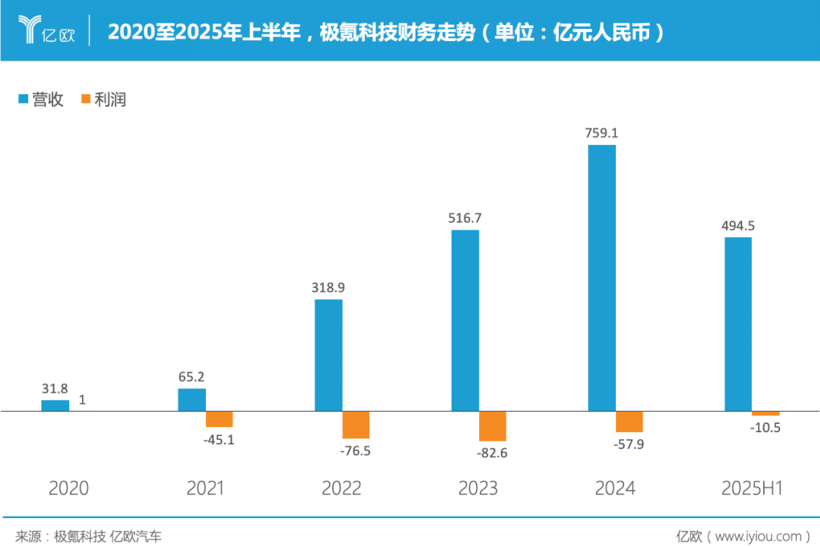

Notably, the selling, general, and administrative expenses of Zeekr Technology Group (hereinafter referred to as Zeekr Group) showed a significant decrease in the second quarter.

The financial report shows that Zeekr Group's sales, general, and administrative expenses for the second quarter were RMB 3.364 billion, a decrease of 9.7% from RMB 3.725 billion in the second quarter of 2024. Zeekr Group stated that the year-on-year decrease was mainly due to economies of scale resulting from the integration of Zeekr and Lynk & Co businesses.

Currently, with the merger of Zeekr and Lynk & Co into Zeekr Group, the company's market performance has significantly improved. In the first half of 2025, Zeekr Group's new car deliveries reached 244,000 units, a year-on-year increase of 14.5%.

The net loss in the second quarter was only 1.05 billion yuan, a year-on-year decrease of over 70%. The vehicle gross margin for the quarter reached a record high of 17.3%, up 5.8 percentage points year-on-year.

However, Zeekr Group's revenue remained flat compared to the same period last year, staying at 49.45 billion yuan.

Some analyses suggest that the reason for the sales growth in the first half of the year while revenue remained flat may be due to the ebb and flow between the Zeekr and Lynk & Co brands.

The financial report of Zeekr Group also supports this view.

In its second-quarter financial report, Zeekr Group stated that the automotive sales revenue for the second quarter was 22.91 billion yuan, representing a year-on-year increase of 2.2%. The year-on-year growth was mainly due to an increase in Lynk & Co sales, which was partially offset by a decline in Zeekr sales.

Reportedly, Zeekr and Lynk & Co had automobile sales revenues of 10.92 billion and 11.99 billion RMB respectively in the second quarter. The former saw a year-on-year decrease of 18.7%, while the latter experienced a year-on-year increase of 33.3%.

To boost market performance, Zeekr will launch a full-size flagship SUV and a medium-to-large luxury SUV in the third and fourth quarters of this year.

In addition, Zeekr has released a super electric hybrid system, with the aforementioned two new SUV models adopting both pure electric and super electric hybrid power forms to meet different consumers' energy preferences.

"After the integration of Zeekr and Lynk & Co, Zeekr's mission is to continue to develop upwards, with Lynk & Co expanding broadly and Zeekr moving upwards," Lin Jie stated to the media, including EO Auto. He mentioned that within the entire Geely system, they aim to build a brand pyramid, with Zeekr at the apex. Zeekr has the capability to set a luxury benchmark because the company already has the successful experience of the Zeekr 009 and the technical support of the SEA architecture. "To build luxury, you inevitably need to befriend time. If you always focus on monthly fluctuations, it's difficult to settle down and build luxury."

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track