Yongtai Technology 150,000 Tons/Year Electrolyte Production Capacity Continues To Release Lithium Battery "Injection Restoration" Black Technology Opens Up Billion Market Space

In September, with the lithium battery production peak season arriving, the demand-side benefits have led to a firm and slightly upward trend in electrolyte prices. On September 23, Yongtai Technology (002326.SZ) responded to investor inquiries on the Interactive Easy platform, stating that the company's commissioned electrolyte production capacity is 150,000 tons per year, and the capacity is gradually being released. The production and sales scale has increased year-on-year, with downstream customers mainly being leading lithium battery companies. The company's liquid lithium bis(fluorosulfonyl)imide production capacity is 67,000 tons per year, and the capacity utilization rate is steadily improving.

Data shows that in the first half of 2025, the company's lithium battery and other materials segment achieved revenue of 871 million yuan, accounting for 33.38% of total revenue, with a year-on-year growth of 105.74%. Among them, the subsidiary Yongtai New Energy's electrolyte production capacity is gradually being released, with operating revenue and net profit increasing by 131.19% and 389.45% year-on-year, respectively. The company has formed an integrated industrial chain by laying out lithium salt raw materials, lithium salts, additives, and electrolytes, which effectively enhances cost control capabilities and market response speed, becoming an important driver of performance growth.

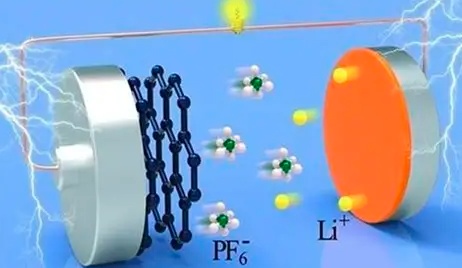

As the global energy transition progresses, the market demand for lithium batteries in key areas such as new energy vehicles and energy storage systems has shown an explosive growth trend, which in turn has driven the prosperity of the electrolyte market, one of the four major materials of lithium batteries. As the world's largest producer and consumer of electrolytes, China has developed a production capacity exceeding 5 million tons per year, accounting for more than 90% of the global total.

Currently, amidst the wave of the global new energy revolution, new energy vehicles have entered a rapid development phase as an important means for countries to achieve carbon neutrality. According to statistical data, the sales of new energy vehicles in China have consistently maintained a year-on-year growth trend. From January to June 2025, the production and sales of new energy vehicles reached 6.968 million and 6.937 million units respectively, representing year-on-year increases of 41.4% and 40.3%. Meanwhile, driven by energy transition and the "dual carbon" goals, the development of energy storage is progressing rapidly. Additionally, the low-altitude economy, as the next trillion-dollar blue ocean, with drones and eVTOLs as representatives, is forming a new engine driving growth in the demand for new energy batteries, thereby further boosting the demand for battery raw materials.

Lungzhong Information analysts believe that from the demand side in September, the trend of growth in end-market demand is clear. The energy storage sector benefits from the dual advantages of long-term favorable domestic orders and the extension of U.S. tariffs, leading to a continuous rise in demand. In the power sector, the expectation of the "Golden September and Silver October" peak season for car sales drives battery cell companies to start stocking up in advance. Under the synergistic effect of both energy storage and power sectors, overall demand is growing significantly, and it is expected that there will be a peak in production at the end of the year in October and November.

Shanxi Securities believes that the company will turn a profit in the first half of 2025. Recently, with the rise in prices of lithium hexafluorophosphate/electrolyte, the company's profitability is expected to continue to improve. In addition, the establishment of a joint venture with the core team from Fudan University, focusing on the "injection recovery" black technology for lithium batteries, further consolidates Yongtai Technology's market position in the new materials sector for lithium batteries.

According to the disclosure from Fudan University’s official account, trifluoromethylsulfonic lithium can extend battery life by 1-2 orders of magnitude. Yongtai Technology has already begun small-scale production and continues to supply samples to leading lithium battery companies. The material can be directly added to new batteries and is compatible with existing production lines. Shanxi Securities estimates that based on the projected global demand for lithium battery electrolytes of over 2 million tons in 2025, if 50% of batteries require the addition of 3-5% of this new lithium supplement, the demand would be approximately 30,000 to 50,000 tons. With the reference price of conventional lithium supplements ranging from 300,000 to 500,000 yuan per ton, the market potential exceeds 10 billion yuan.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics