Xpeng to Operate Robotaxi Next Year, Leapmotor Challenges One Million Sales

On August 18 and August 19, 2025, Leapmotor and XPeng respectively released their semi-annual financial reports. Judging from the financial data, both companies delivered positive signals to the market.

Leapmotor has made significant progress on the road to profitability, successfully achieving positive net profit as early as the fourth quarter of 2024, reaching its single-quarter profitability target one year ahead of schedule.

Although Leapmotor had a net profit loss of 130 million yuan in the first quarter of 2025, it made a profit of 160 million yuan in the second quarter. The company achieved its first-ever half-yearly profit, amounting to 30 million yuan.

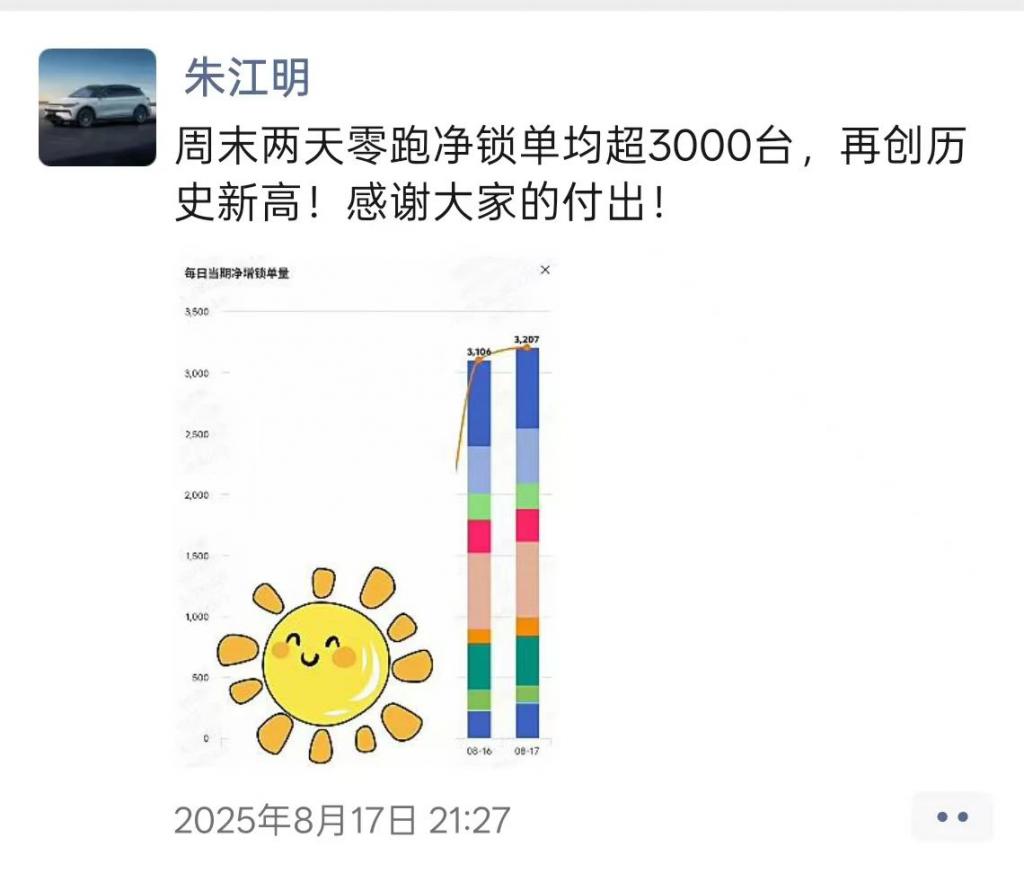

In the first six months of 2025, Leapmotor delivered over 220,000 vehicles, surpassing Li Auto's 203,000 and XPeng's 197,000 deliveries, ranking first among new energy vehicle startups. In July alone, Leapmotor became the only new energy vehicle startup to achieve monthly sales of over 50,000 vehicles.

Meanwhile, Leapmotor's revenue increased by 174% year-on-year to 24.25 billion yuan; gross profit margin rose by 11 percentage points year-on-year to 14.1%.

Specifically, Leapmotor's revenue for the second quarter was 14.2 billion yuan, basically in line with market expectations. The delivery volume for the second quarter was 134,000 vehicles, representing a 53% increase quarter-on-quarter.

Meanwhile, the gross margin for the second quarter was 13.6%, exceeding the market expectation of 12%. Although there was a quarter-on-quarter decline, excluding the impact of FAW technical licensing income, the vehicle sales gross margin last quarter was 13%. Therefore, in fact, this quarter achieved a quarter-on-quarter increase in gross margin.

According to Leapmotor's financial report, the growth was due to an increase in the delivery of complete vehicles and spare parts, strategic cooperation, and an increase in carbon credit income. The increase in gross profit margin was attributed to sales growth, cost management, and product mix optimization.

Leapmotor currently has 29.58 billion yuan in hand.

Leapmotor is optimistic about the future, raising its delivery guidance for 2025 from 500,000 to 600,000 vehicles to 580,000 to 650,000 vehicles. It expects a net profit of 500 million to 1 billion yuan for the full year of 2025. They aim to achieve annual sales of 1 million vehicles in 2026.

Xpeng continues to perform well.

As of June 30, 2025, vehicle deliveries reached 197,000 units, representing a year-on-year increase of 279%. In the second quarter alone, total deliveries amounted to 103,000 units, a remarkable year-on-year growth of 241.6% and a quarter-on-quarter increase of 9.8%, setting a new historical record.

In the first half of 2025, XPeng's total revenue reached 34.09 billion yuan, representing a year-on-year increase of 132.5%. Among this, automobile sales revenue was 31.25 billion yuan, up 152.8% year-on-year, while service and other revenue amounted to 2.83 billion yuan, an increase of 23.3% year-on-year.

In the second quarter, XPeng Motors achieved a total revenue of 18.27 billion yuan, marking a significant increase of 125.3% compared to the same period in 2024, and a 15.6% rise compared to the first quarter of 2025, once again setting a new record for quarterly revenue.

Xpeng’s gross margin for the first half of the year was 16.5%, compared with 13.5% in the same period last year; vehicle gross margin was 12.6%, compared with 6.0% in the same period last year; services and other profit margin was 60.1%, compared with 54.1% in the same period last year.

Specifically, in the second quarter, XPeng Motors’ gross margin reached 17.3%, representing a year-on-year increase of 3.3 percentage points and a quarter-on-quarter increase of 1.7 percentage points. Among them, the automotive gross margin was 14.3%, up 7.9 percentage points compared to the same period in 2024, marking eight consecutive quarters of growth.

R&D expenses were 4.19 billion yuan, representing a year-on-year increase of 48.6%; selling, general and administrative expenses were 4.11 billion yuan, up 38.9% year-on-year. Net other income was 780 million yuan, an increase of 121.4% compared with the same period last year.

In the first half of 2025, XPeng reported an operating loss of 1.98 billion yuan, compared to 3.26 billion yuan in the same period last year; net loss was 1.14 billion yuan, down from 2.65 billion yuan in the same period last year. However, the net loss in the second quarter narrowed to 480 million yuan, a 63% decrease compared to the 1.28 billion yuan net loss in the second quarter of 2024.

As of June 30, 2025, XPeng Motors' total amount of cash and cash equivalents, restricted cash, short-term investments, and term deposits reached RMB 47.57 billion, an increase of over RMB 2.29 billion compared to March 31, 2025, setting a record high in cash reserves.

XPeng expects vehicle deliveries in the third quarter of 2025 to reach between 113,400 and 118,000 units, representing a year-on-year increase of 142.8% to 153.6%. Revenue is expected to be between 19.6 billion and 21.0 billion yuan, a year-on-year increase of 94% to 107.9%.

Chairman He Xiaopeng clearly stated at the earnings conference that profitability will be achieved in the fourth quarter of 2025.

Xpeng will launch Robotaxi next year.

During the investor Q&A session, He Xiaopeng focused on addressing strategic issues in five key areas.

The first Robotaxi, He Xiaopeng confirmed that a model with L4 capabilities will be launched in 2026, and trial operations of Robotaxi will be conducted in certain regions within the country.

These vehicle models will share the same source code and model as the mass-produced vehicles. The difference is that Robotaxi vehicles will be equipped with hardware redundancy and cloud takeover functions, while the mass-produced vehicles focus on daily user use.

He Xiaopeng emphasized that the differentiation of XPeng Motors lies in not relying on high-precision maps, enabling "map-free mode" to provide intelligent driving services over a wider area. They plan to operate Robotaxi themselves in the early stages, and once the solution is proven mature, they will seek partners to jointly advance commercialization.

The second aspect is product technology. In the fourth quarter, XPeng will release its first "Kunpeng Super Electric" model, the X9, which is an extended-range version. This car uses a dual-energy system, with a pure electric range of over 450 kilometers and a combined range of over 1500 kilometers, and it supports 5C supercharging. In the coming years, XPeng will launch multiple models based on the Kunpeng platform, aiming to drive an overall increase in gross profit margin through technological advantages.

The collaboration with Volkswagen has been further expanded. On August 15th, both parties jointly announced the expansion of the electronic and electrical architecture agreement signed on July 22, 2024, extending it from originally covering electric vehicles to include plug-in hybrids and fuel vehicles.

He Xiaopeng emphasized that their self-developed Turing chips and algorithms will create a "generational gap" with competitors in intelligent driving by the end of 2025.

Xpeng's revenue has grown, but the profit per vehicle still needs to improve. According to estimates by "Automotive Business Review," in the first quarter of 2025, Xpeng's average vehicle price is 153,000 RMB, and in the second quarter, the average vehicle price is approximately 163,300 RMB, indicating it has started to rise.

When answering how to increase per-vehicle profit, He Xiaopeng proposed four directions.

First, in terms of product portfolio, we will launch more high-end models, such as the P7 priced around 300,000 RMB and the X9 super electric model priced around 400,000 RMB, gradually increasing the average selling price.

Second, in terms of technology premium, the company continues to increase investment in cutting-edge technologies such as autonomous driving and large models to enhance product differentiation capabilities.

Thirdly, design and user experience have been elevated to a strategic level. Starting from 2024, XPeng has classified design as a core "strength" alongside autonomous driving. Styling centers have been established in Guangzhou and Shanghai to ensure the competitiveness of future models in terms of visual appeal and user experience.

Fourth, brand and globalization. The company plans to support long-term profitability starting from 2026 by enhancing brand value.

In overseas markets, XPeng delivered over 18,000 vehicles in the first half of 2025, representing a year-on-year increase of more than 200%. The company entered 10 countries, including Norway, France, Singapore, and Israel, and ranked first in the mid-to-high-end pure electric market in Europe.

In July 2025, XPeng delivered its first locally produced X9 in Indonesia, making Indonesia the first country where XPeng has localized production globally. In the second half of 2026, models based on the "Kunpeng Super Electric" and "Ultra Version" will simultaneously enter overseas markets, further expanding international market share.

When asked about long-term strategy, He Xiaopeng made it clear that in the coming years, the company will focus simultaneously on four areas: technology, design, brand, and internationalization. In the short term, the goal is to maintain continuous growth in delivery volume and gross margin. In the medium to long term, the objective is to achieve sustainable profitability and secure a position in the Robotaxi and global markets.

Leapmotor aims to challenge 1 million units next year.

Leapmotor disclosed in this financial report that the first model project jointly developed with China FAW has been launched. The two parties will further explore the feasibility of deepening capital cooperation.

As of now, Leapmotor has seven models available for sale, primarily covering the market range of 100,000 to 200,000 RMB. Since 2025, Leapmotor has frequently launched new products with intensive offensives.

The company's current core product lineup includes four series of models: A, B, C, and D, with increasing sizes and prices. The two models from the B platform, to be launched in 2025, have gained market popularity for their cost-effectiveness. Among them, the pure electric SUV model B10 was launched on April 10th with a starting price of only 99,800 yuan, and over 10,000 units were delivered in the month following its launch.

The challenge for Leapmotor is whether its D-segment car, which will make its public debut in October 2025 and go on sale in the first quarter of 2026, can achieve success.

The Leapmotor D series will include two models: a full-size SUV and an MPV. The MPV is codenamed D21, and the SUV is codenamed D19.

At the Shanghai Auto Show in April 2025, Leaper Auto's Senior Vice President, Cao Li, stated that the Leaper D Series, as the flagship series, focuses on high-end luxury with a price range of around 250,000 to 300,000 yuan. However, it offers configurations that are only available in competitor models priced above 500,000 yuan. Nevertheless, Leaper Auto's founder, Zhu Jiangming, also mentioned that the price of the D Series models would not be below 300,000 yuan.

According to "Automotive Business Review," it is expected that the official price of Leapmotor's D-segment car will exceed 250,000 yuan regardless. However, in the second quarter of 2025, Leapmotor's average selling price per car was 106,000 yuan, a decrease of 8,000 yuan compared to the previous quarter. Excluding the impact of technology licensing income from FAW in the previous quarter, the actual decline in selling price per car this quarter was 3,000 yuan.

Although this is primarily the result of a downward shift in the vehicle model structure and offering cash discounts on existing models, brand elevation has always been a challenge in the industry.

Regarding the overseas market, Leapmotor maintains its original sales target of 50,000 vehicles for 2025. In the first half of 2025, Leapmotor exported over 20,000 vehicles, ranking first among new energy vehicle startups.

With the collaboration with the multinational automotive company Stellantis, Leapmotor has established over 600 sales and after-sales outlets in overseas markets, with more than 550 located in the European market. The company intends to accelerate its expansion in overseas markets and plans to establish a production base in Europe by the end of 2026.

On July 10, 2025, at the Leapmotor C11 IPO launch communication meeting in Hangzhou, Zhu Jiangming stated that Leapmotor, which was initially underestimated, has now achieved a significant increase in sales and reached a profitability turning point in the first half of 2025, relying on "full-domain self-research" and "systematic capabilities."

He emphasized that Leapmotor's positioning is not to become a short-term "sales champion," but to popularize the most advanced technology as quickly as possible, allowing more users to enjoy luxury and intelligent equality at a reasonable price.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track