XPeng Expects to Turn a Profit in the Fourth Quarter

As XPeng Motors' revenue, gross margin, and delivery volume gradually increase, XPeng Motors Chairman and CEO He Xiaopeng stated that XPeng Motors is confident in achieving a leading scale and that its operations will enter a new stage of profitable self-sustenance.

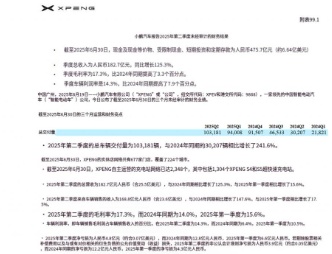

XPENG Motors' latest Q2 2025 financial report shows that XPENG Motors' total revenue for the second quarter was 18.27 billion yuan, an increase of 125.3% compared to the same period in 2024, and a 15.6% increase compared to the first quarter of this year. Deliveries in the second quarter were 103,100 units, a year-on-year increase of 241.6%; compared to 30,200 units in the same period of 2024, an increase of 241.6%. Currently, XPENG Motors has 677 physical dealership stores covering 224 cities, with a self-operated charging network of 2,348, including 1,304 XPENGS4 and S5 ultra-fast charging stations.

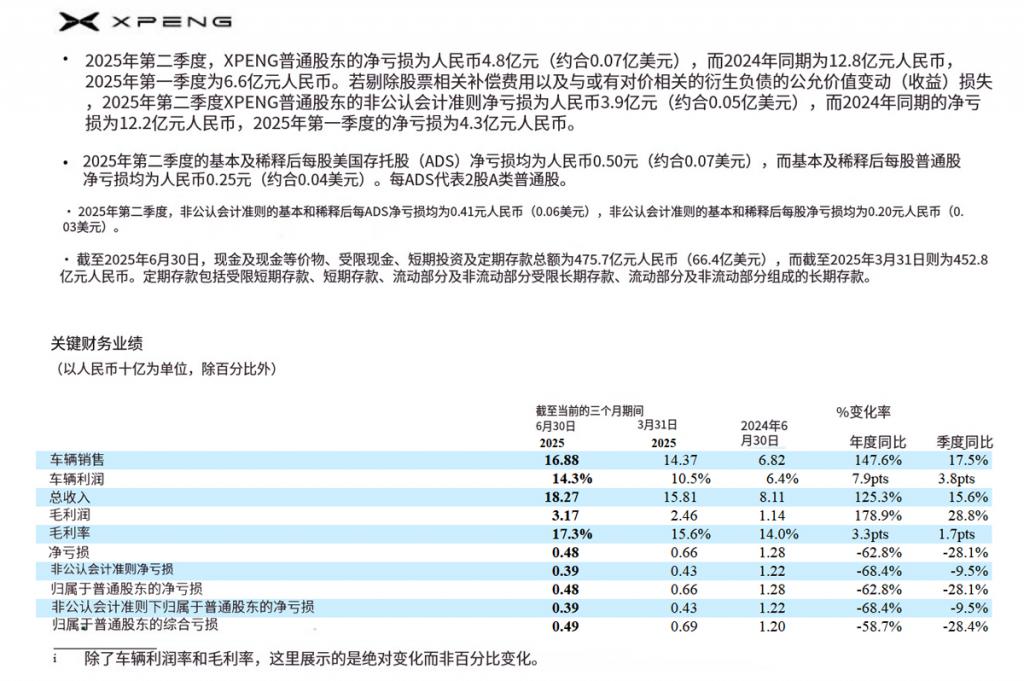

The company’s profitability has improved, with automobile sales revenue reaching 16.88 billion yuan in 2025, an increase of 147.6% compared to the same period last year. In the second quarter, the company’s overall gross margin rose to 17.3%, up 3.3% year-on-year; automobile gross margin reached 14.3%, an increase of 7.9% year-on-year. Net loss was 480 million yuan, narrowing from a net loss of 1.28 billion yuan in the same period of 2024 and a net loss of 660 million yuan in the first quarter.

XPeng Motors is expected to achieve single-quarter profitability in the fourth quarter of this year.

As of press time, XPeng Motors closed at $20.37 per share, down 1.78% from the previous day, with a total market capitalization of $19.377 billion.

He Xiaopeng, Chairman and CEO of XPeng Motors, stated that in the second quarter of 2025, XPeng Motors achieved record-high performance in key operational and financial indicators, including vehicle deliveries, revenue, gross margin, and cash position. By 2025, XPeng Motors has completed the upgrade of its next-generation smart and electrification technology platform, which will further enhance XPeng's technological leadership in the industry.

In the second quarter of 2025, XPeng Motors delivered 103,100 vehicles, representing a year-on-year growth of 241.6% and a quarter-on-quarter growth of 9.8%, setting a new record for single-quarter deliveries. As of July this year, XPeng Motors has delivered a total of 233,900 vehicles.

The increase in sales and delivery volumes is attributed to the continuous improvement of product layout. The launch of the 2025 XPeng X9, the all-new MONAM03Max, and the P7+ long-range Max version has driven the overall quarterly delivery volume. The introduction of the new XPeng G6 and G9, one targeting the young consumer market and the other solidifying its position in the mid-to-high-end market, along with the launch of the XPeng G7 in July and the pre-sale of the new XPeng P7, has further enriched XPeng's product matrix and market competitiveness. In July, XPeng delivered 36,700 vehicles. XPeng expects the market delivery volume in September to remain around 40,000 units. On the other hand, XPeng's sales network is continuously expanding, with an increase in the number of stores and the range of covered cities, effectively enhancing the brand awareness of XPeng.

One noteworthy point is that the gross margin of XPeng Motors rose from 6.4% in the same period last year to 14.3%, with a quarter-on-quarter increase of 3.8 percentage points, exceeding market expectations. The improvement in gross margin indicates that XPeng Motors' market sales scale is improving. Especially in the fiercely competitive new energy vehicle market, XPeng Motors is gradually stabilizing its downward trend and achieving a turnaround through product iteration, technology upgrades, and new product deployment.

Dr. Hongdi Brian Gu, Vice Chairman and Co-President of XPeng Motors, stated that in the face of fierce industry-wide price competition, XPeng Motors is committed to implementing a long-term and sustainable growth strategy. In the second quarter, the vehicle profit margin increased by 3.8 percentage points quarter-on-quarter to 14.3%, while the company's overall gross margin rose to 17.3%, reaching a new historical high. We are confident that we can not only accelerate scale growth but also continue to enhance the company's profitability. Thanks to the current improvement in gross margin, Wu Jiaming, XPeng's Vice President of Finance, stated that XPeng Motors aims to achieve an overall profitability target of 17% to 19% in the fourth quarter.

Moreover, the improvement in gross margin also benefited from the technical revenue brought by the expanded cooperation between XPeng Motors and the Volkswagen Group in electronic and electrical architecture technology. In the second quarter of 2025, XPeng's "technical revenue" amounted to 390 million yuan, an increase of 7.6% year-on-year; for the first half of the year, it reached 2.83 billion yuan, a year-on-year increase of 23.3%, accounting for 8% of the total revenue, which also boosted the gross margin for the first half of the year to 16.3%.

On August 15, XPeng Motors and Volkswagen Group announced that the regional control electronic and electrical architecture CEA, jointly developed by XPeng and Volkswagen, will expand its application scope. Starting from 2027, the CEA architecture will be extended from Volkswagen's locally developed pure electric vehicle models to include fuel and hybrid models manufactured in China. This development is expected to bring more continuous technical revenue to XPeng Motors and help improve its gross profit margin.

According to He Xiaopeng, in the fourth quarter of this year, XPENG Motors will launch its first Kunpeng Super Electric Vehicle model, the XPENG X9 Extended Range version. Afterwards, several more super electric vehicle models will be released, achieving a dual power layout of electric and hybrid vehicles. At the same time, the company plans to mass-produce vehicles supporting L4-level assisted driving functions by 2026, further improve the launch of hybrid models both domestically and overseas, and enhance the capabilities of the Turing AI intelligent driving system.

XPeng Motors expects that in the third quarter of 2025, new car deliveries are projected to reach 113,000 to 118,000 units, representing a year-over-year increase of 142.8% to 153.6%. The total revenue is expected to be between 19.6 billion to 21.0 billion yuan, reflecting a year-over-year growth of 94.0% to 107.9%.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track