Wm's return: Set a Goal to Challenge Selling 1 Million Units in 5 Years

After two and a half years, WM Motor's official WeChat account released a post titled "White Paper to Suppliers" on September 6, bringing the long-silent WM back into the public eye.

In the "White Paper to Suppliers," the new shareholder Shenzhen Xiangfei Auto Sales Co., Ltd. has become the decision-maker for WM Motor, systematically outlining its solutions to WM Motor's debt issues and future development plans. This move is seen as a key step in WM Motor's official path towards "revival."

Debt settlement, resumption of production&

According to public information, the four companies of WM Motor—WM Motor Technology Group Co., Ltd., WM Smart Mobility Technology Shanghai Co., Ltd., Suzhou WM Smart Mobility Technology Co., Ltd., and WM Motor Manufacturing Wenzhou Co., Ltd.—had their restructuring plan approved by the court on April 3, 2025, and have been officially taken over by Shenzhen Xiangfei.

Image Source: WM Motor

The new shareholder stated that they are currently making every effort to resume production of the WM Motor EX5 and E5 models at the Wenzhou production base, with the first batch of vehicles expected to roll off the assembly line within this month. This specific timeline has become an initial benchmark for observation.

In addressing the debt issues that are of general concern to suppliers, WM Motor has proposed a clear tiered settlement plan. For small claims of 150,000 yuan or less, the company will settle in full with cash. For the portion exceeding this amount, settlement will be made through "150,000 yuan in cash + trust beneficiary rights shares." Additionally, the court has clearly determined that all assets within the original WM system, such as molds, inventory, production facilities, and intellectual property, even if currently stored with suppliers, remain the property of WM Motor. Suppliers are required to properly safeguard these assets and cooperate with WM Motor in resuming work and production.

As for how to revive, WM has adopted a rather aggressive attitude and provided a three-stage plan.

The first phase focuses on resuming production and restoring sales (2025-2026). The plan is to resume production of the EX5 and E5 models in September 2025, with an annual sales target of 10,000 units and striving to reach 20,000 units. Meanwhile, overseas market expansion has been put on the agenda, with plans to establish a KD factory in Thailand to explore the Southeast Asian and Middle Eastern markets. In the future, WM Motor will further explore Central Asian and European markets, stating that by 2026, exports will account for 30% of total sales.

The second phase is set for 2027-2028, with the goal of increasing annual sales to between 250,000 and 400,000 vehicles. It includes the mass production of advanced assisted driving models, strengthening AI technology research and development, and initiating IPO preparations.

In the third phase (2029-2030), WM Motor intends to challenge a target of 1 million units in annual sales and 120 billion yuan in revenue by 2030.

At the product level, WM Motor plans to cover both pure electric and range-extended technology routes and launch over 10 new models in the next five years, including sedans, SUVs, and MPVs.

In terms of financial support, it is reported that Xiangfei is actively engaging with financial institutions to provide guarantees for the upgrade of WM equipment, the recovery of the supply chain, and the expansion of operations. Xiangfei initially plans to invest 1 billion yuan in the restart of related areas.

In terms of team building, a professional team of 143 people has been established, and recruitment is being accelerated to form a core team of 400 people. On a certain recruitment platform, Xiangfei has posted 84 positions under the name "Xiangfei New Energy Vehicle Group." The group's headquarters is located in Shanghai, and the office locations for the recruitment positions are mainly in Shanghai and Wenzhou.

According to relevant information, WM Motor's design and procurement center has shown signs of gradually resuming work since June, but the original headquarters of WM Motor is still vacant with no signs of resumption yet. Moreover, WM Motor's official app, website, and customer service channels have not yet returned to normal operation. These details seem to suggest that a full recovery will still take some time.

It seems that WM Motor's "revival" path has been initially outlined, with systematic arrangements from debt management and production restart to strategic planning. However, whether it can gradually achieve the set goals at each stage still needs time to be verified, given the fierce market competition and the not yet fully restored operational system.

Once on par with "NIO, XPeng, and Li Auto," but couldn't escape financial difficulties.

In October 2023, WM Motor founder Shen Hui took the opportunity of attending the Munich Auto Show to travel to the United States via Germany, leaving behind WM Motor, which was mired in bankruptcy.

WM Motor, founded in 2015, is one of the earliest new energy vehicle companies and was once as renowned as "NIO, Xpeng, and Li Auto," with a valuation once reaching 47 billion yuan.

Shen Hui has served as an executive at companies such as BorgWarner, Fiat, Geely, and Volvo, and was the leader of Geely's acquisition of the Volvo project.

Compared to the founders of "NIO, Xpeng, and Li Auto" who transitioned from the internet industry to car manufacturing, the founder of WM Motor, Shen Hui, is an accomplished professional from the traditional automotive sector. This injects WM Motor with a unique gene distinct from other new car-making forces.

At that time, the capital market showed great enthusiasm and confidence in WM Motor. Public information shows that WM Motor completed a total of 12 rounds of financing from Series A to D, with a cumulative financing amount exceeding 41 billion yuan. The investors included well-known investment entities such as Shanghai State-owned Capital Investment Platform, SAIC Motor Corporation, Baidu, Tencent Investment, Sequoia China, and Hongta Group. The injection of funds provided strong support for WM Motor's initial research and development, production layout, and market expansion.

In April 2018, WM Motor launched its first mass-produced model, the EX5. This car was one of the few pure electric models at the time with a range exceeding 400 kilometers, priced from 179,800 yuan. According to statistics, since deliveries began in September 2018, the EX5 sold 3,850 units that year.

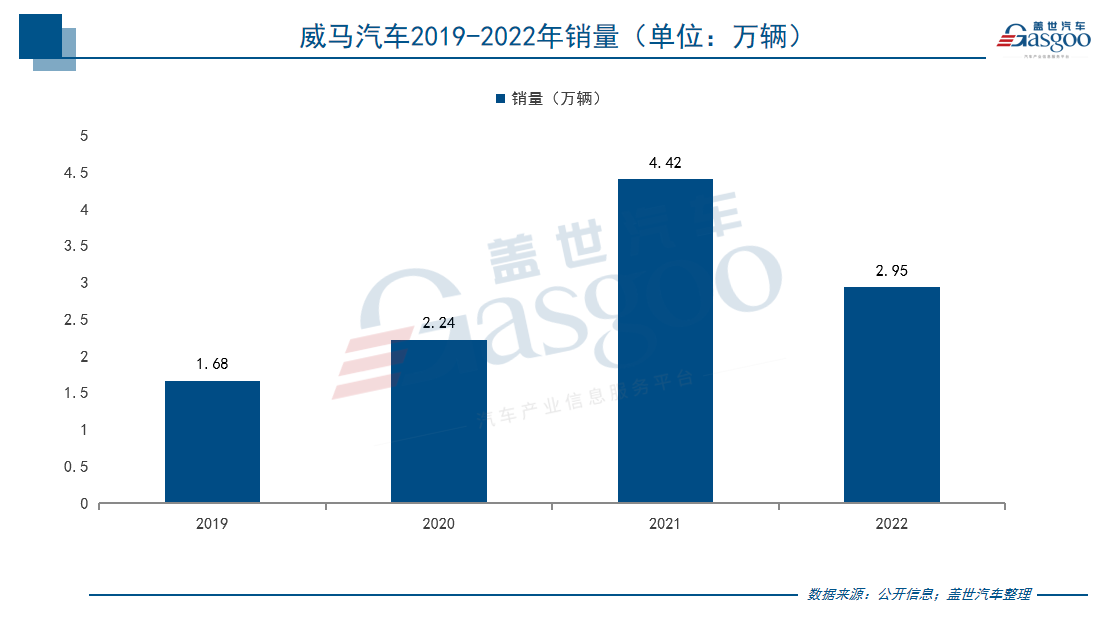

From 2018 to 2021, WM Motor's sales showed a continuous growth trend: in 2019, WM Motor's total sales reached 16,800 vehicles; in 2020, it increased to 22,400 vehicles; and in 2021, it peaked at 44,200 vehicles. This period can be described as the golden age of WM Motor's development.

However, the business world is like a battlefield, and the turning point from prosperity to decline can come unexpectedly. Starting from the second half of 2022, WM Motor began to report negative news such as production halts and delayed payments to suppliers, indicating that the company was experiencing severe operational difficulties. That year, sales plummeted to 29,500 vehicles, and the factory's annual production capacity of 250,000 was only utilized at 12%.

According to subsequent restructuring documents, WM Motor owes over 40 million yuan in employee salaries, compensation, and benefits, and the amount owed to supply chain, market services, sales, and other service partners is as high as 1.734 billion yuan.

The reasons for WM's decline can be attributed to nothing more than technological lag, a limited product range, and strategic market errors.

In terms of technological research and development, WM Motor's core technology update pace lags behind the industry's iteration speed. For example, the 2022 XPeng P7 has a range of 670 kilometers, and XPeng also began offering urban assisted driving features to some users in Guangzhou that year. In contrast, the 2022 EX5 has a maximum range of 460 kilometers and lags in smart features. WM Motor's product competitiveness is gradually weakening, making it difficult to meet market demands.

One of WM Motor's major weaknesses is its reliance on a narrow product range. The company has long depended on a few models, such as the EX5, and has limited upgrades for older models. In April 2022, WM Motor launched the pure electric sedan WM E5, which was initially aimed at the ride-hailing market and later gradually opened up to the general consumer market.

To boost sales, WM Motor is accelerating its layout in the B-end mobility market. In January 2019, WM Motor announced a strategic partnership with Meituan Ride-Hailing to explore a new model of "new retail + ride-hailing." In June of the same year, the business scope of WM Motor's subsidiary, Zhejiang Conos Data Technology Co., Ltd., was changed to include "ride-hailing operation services."

This strategy of leaning towards the B-end market, while boosting sales in the short term and meeting cash flow needs, has caused irreversible damage to its brand in the long run, further blurring the positioning of the WM Motor brand.

Strategic missteps in the market have further exacerbated WM Motor's difficult situation. The disorderly expansion of offline stores and chaotic management, along with unstable dealership networks in certain regions, have directly impacted product sales and user experience. At the same time, WM Motor's insufficient investment in brand building has failed to create a differentiated perception. In contrast to the continuous strengthening of brand influence by car companies like NIO, Xpeng, and Li Auto, WM Motor's market presence has been steadily declining, and its brand influence has further weakened.

All of this ultimately points to financial difficulties, with the break in the capital chain becoming the last straw that breaks WM Motor.

Facing continuous widening losses, WM Motor actively sought to raise funds through public listing. In 2020, it attempted to list on the STAR Market, in 2022 it shifted to the Hong Kong Stock Exchange, and in 2023 it tried to go public by merging with Apollo Mobility. However, all three IPO attempts ended in failure.

According to the prospectus, from 2019 to 2021, WM Motor accumulated losses of 17.435 billion yuan, with a net asset of -20.5 billion yuan at the end of the year. Shen Hui's remark, "live like a beast of burden," reflects the extreme situation of WM Motor's insolvency predicament.

In October 2023, WM Motor officially submitted a pre-restructuring application to the Shanghai No. 3 Intermediate People's Court. According to the audit assessment, WM Motor has liabilities of 25 billion yuan and assets valued at 9.6 billion yuan.

Previously, there were numerous rumors about WM Motor's "resurrection," but the company did not respond. Now, from debt settlement to resuming production and specific strategic planning, WM Motor seems ready to re-enter the fierce market competition.

Will WM Motor succeed in its "revival" this time?

Opportunities exist but are not easy.

The market is never short of turnaround stories, and with the takeover by Shenzhen Xiangfei Auto, WM Motor may usher in a new opportunity. First, let's take a look at what kind of company the new shareholder Shenzhen Xiangfei is.

Shenzhen Xiangfei was established in September 2023 with a registered capital of 100 million yuan, and its legal representative is Huang Jing. The company's business scope not only includes rental services for small and micro passenger vehicles but also covers information consulting services, corporate management consulting, and marketing planning, among other fields.

It is noteworthy that the equity structure associated with Huang Jing is quite complex. Through the analysis of multiple layers of equity relationships, he is actually the ultimate controller of Kunshan Baoneng Automobile Co., Ltd. In addition, Xiangfei holds 99% of the equity of Shenzhen Youbojia Automobile Sales Co., Ltd., whose legal representative, Zhang Xiao, also serves as a director at Baoneng New Energy Automobile Group Co., Ltd., and holds positions in multiple affiliated enterprises such as Baoneng Automobile Sales Co., Ltd. and Kunshan Baoneng Automobile Sales Co., Ltd.

Image source: Baoneng Auto BAO

On the day WM Motor released the "White Paper to Suppliers," Baoneng Auto's WeChat public account simultaneously published a post titled "WM Motor: White Paper to Suppliers." This indicates the connection between WM Motor's new shareholder, Shenzhen Xiangfei, and the "Baoneng Group."

In addition, according to relevant information, as early as June this year, two WM Motor vehicles were already parked in the Baoneng Auto Exhibition Center on Liyuan Road, Luohu District, Shenzhen. Moreover, an insider revealed that Baoneng Auto is in the process of transferring production qualifications and other assets with WM Motor.

In fact, Baoneng Group has long been involved in the automotive industry. In December 2017, Baoneng Group acquired a 51% stake in Qoros Auto, a subsidiary of Chery, for 6.63 billion yuan, officially taking over Qoros Auto. Subsequently, it increased its holdings to a 63% stake, becoming the controlling shareholder of Qoros Auto. The dual qualification for the production of traditional fuel vehicles and new energy vehicles that Qoros Auto possesses is an important resource for Baoneng Group.

However, Qoros Automotive has been in a state of long-term production suspension since 2021, and its qualifications may be at risk of being revoked. According to the "Regulations on the Administration of Access to New Energy Vehicle Manufacturers and Products," if an automobile manufacturer is in long-term suspension of production, its production qualifications may be suspended or revoked.

In contrast, WM Motor's new energy production qualification is more valuable. WM Motor officially ceased production in 2023, and its production bases in Huanggang, Hubei, and Wenzhou, Zhejiang, have an annual production capacity of 150,000 and 100,000 vehicles, respectively.

It can be seen that Baoneng Group's potential involvement with WM Motor is quite reasonable.

Moreover, the current automotive market environment is no longer what it used to be, and WM Motor's "resurrection" journey still faces fierce market competition challenges.

Building cars is an extremely capital-intensive endeavor. Li Bin once stated, "The funding threshold needed for car manufacturing, a few years ago I said it was 20 billion, now it might not even be possible without 40 billion." I believe that WM Motor, as another emerging force in car manufacturing, deeply understands the "burning money" aspect of this business. Currently, while WM Motor still has support from relevant departments, its financial backing remains unclear.

Even with sufficient funding, the technological competitiveness in the industry, built by the rising annual R&D investments of new forces, cannot be immediately replicated in just one or two years. Take XPeng for example, from 2019 to the first half of 2025, its R&D investment is close to 30 billion yuan, which enables it to maintain its current position in the field of intelligence.

Image source: @Lei Jun

Moreover, in addition to the contemporary new forces like "NIO, Xpeng, and Li Auto," companies such as Xiaomi and Huawei have entered the smart car industry, directly elevating the competitive landscape of the intelligent connected new energy vehicle industry to a higher level.

According to WM Motor's "White Paper for Suppliers," WM Motor plans to mass-produce advanced driver-assistance vehicles between 2027 and 2028. Although this plan is a mid-term strategy with a 2-3 year time window, WM Motor still needs to invest significant effort and resources to reach a leading position in intelligent technology.

In the revival phase set by WM Motor, the company indicated that the production of the EX5 and E5 models will resume in September 2025. Both models are focused on a cost-effective strategy, with prices ranging from 150,000 to 200,000 RMB. According to relevant information, personnel have already been stationed at the Wenzhou factory, and related equipment is currently in the adjustment phase.

Additionally, WM Motor plans to achieve annual sales of 10,000 units, aiming for 20,000 units. This means that in the remaining days of 2025, WM Motor will need to achieve a minimum monthly sales volume of around 2,500 vehicles. According to WM Motor's "White Paper to Suppliers," under conditions that comply with relevant policies and regulations, relevant departments are considering prioritizing the inclusion of new WM Motor vehicles in local public procurement to support WM Motor's resumption of work and production. Therefore, in the short term, achieving monthly sales of 2,500 vehicles does not seem difficult for WM Motor.

However, within this price range, the market has already seen the emergence of several strong competitors such as the Xpeng P7+, Leapmotor C11, and the Sangjie H5. These products, whether in terms of intelligence level or overall vehicle performance, are not something the three-year-old WM Motor EX5 can compete with. The new forces have now established a product rhythm of "renewal every year," and the launch of new cars is like "dumplings being made." In comparison, WM Motor's models are lagging behind by more than one generation, and building long-term competitiveness for the EX5 and E5 models is not easy for WM Motor.

The image source: Screenshot from the comment section of WM Motor.

Despite the comments on WM Motor's official image and text recognizing the brand's quality by many consumers, stating "The EX5 has been very stable after years of use" and "The car's quality is very good, hoping the app will be restored soon"...

However, the brand trust crisis caused by long-term arrears to suppliers and the paralysis of after-sales service still exists. Brand strength is especially important in today's increasingly competitive new energy vehicle market. From numerous past cases, it can be seen that the reputation of a brand or a car can even determine the company's ranking in market competition. For example, Xiaomi Auto, leveraging the brand strength accumulated in the consumer electronics industry, has seen each of its cars become a hit despite entering the automotive industry not long ago. In contrast, the Ideal MEGA's market performance was affected by negative public opinion due to controversial design.

To rebuild consumer reputation, WM Motor still needs to make more efforts.

In the initial plan, WM Motor aimed to establish a KD factory in Thailand and expand into the Southeast Asian and Middle Eastern markets. They set a goal to achieve annual sales of 100,000 units by 2026. However, before announcing the restructuring, WM Motor mainly focused on the domestic market and did not release much information about entering the Southeast Asian and Middle Eastern markets. Additionally, with the domestic market becoming increasingly competitive, overseas markets have become crucial battlegrounds for domestic car manufacturers, especially the Southeast Asian market. Currently, companies like Xpeng and Leapmotor have already established production bases in Southeast Asia. It is evident that WM Motor will face a competitive landscape in the overseas market.

Summary: Translate the above content into English and output the translation directly without any explanation.

WM Motor's "resurrection" journey is fraught with challenges, but there are also numerous opportunities. Firstly, the new shareholder, Xiangfei, can provide financial and resource support. Secondly, WM Motor still holds the production qualification and production facilities for new energy vehicles, which are essential foundations for restarting. Moreover, the support from relevant local departments also creates favorable conditions for WM Motor's resumption of work and production.

However, to achieve the goals of the three phases, WM Motor still needs to address several key issues. The first is the issue of product competitiveness. In the rapidly evolving new energy vehicle market, WM Motor needs to accelerate the pace of new product development and quickly launch products that meet current market demands. The second is the issue of brand image restoration. WM Motor needs to gradually rebuild consumer trust through stable product quality, comprehensive after-sales service, and a transparent communication mechanism. Lastly, there is the issue of financial assurance. WM Motor needs to ensure continuous and stable financial input to support various aspects such as research and development, production, and marketing.

In conclusion, WM Motor's "road to return" is destined to be challenging. However, if WM Motor's plans can progress steadily, fully leverage its advantages, and cleverly draw support from external sources, it may hope to secure a place in the fierce competition.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track