Will Japanese Cars Still Have a Future in China?

The decline of Japanese cars in the Chinese market is inevitable and has been showing signs for a long time.

In 2018, Suzuki, a "national brand" built on the success of models like the Alto and Swift, exited its 34-year journey in China by transferring its stake in Changan Suzuki for just 1 yuan. In 2023, Mitsubishi terminated its joint venture with GAC, becoming another Japanese automaker to falter in the Chinese market. The withdrawal of both companies was the result of a misjudgment of market transformation.

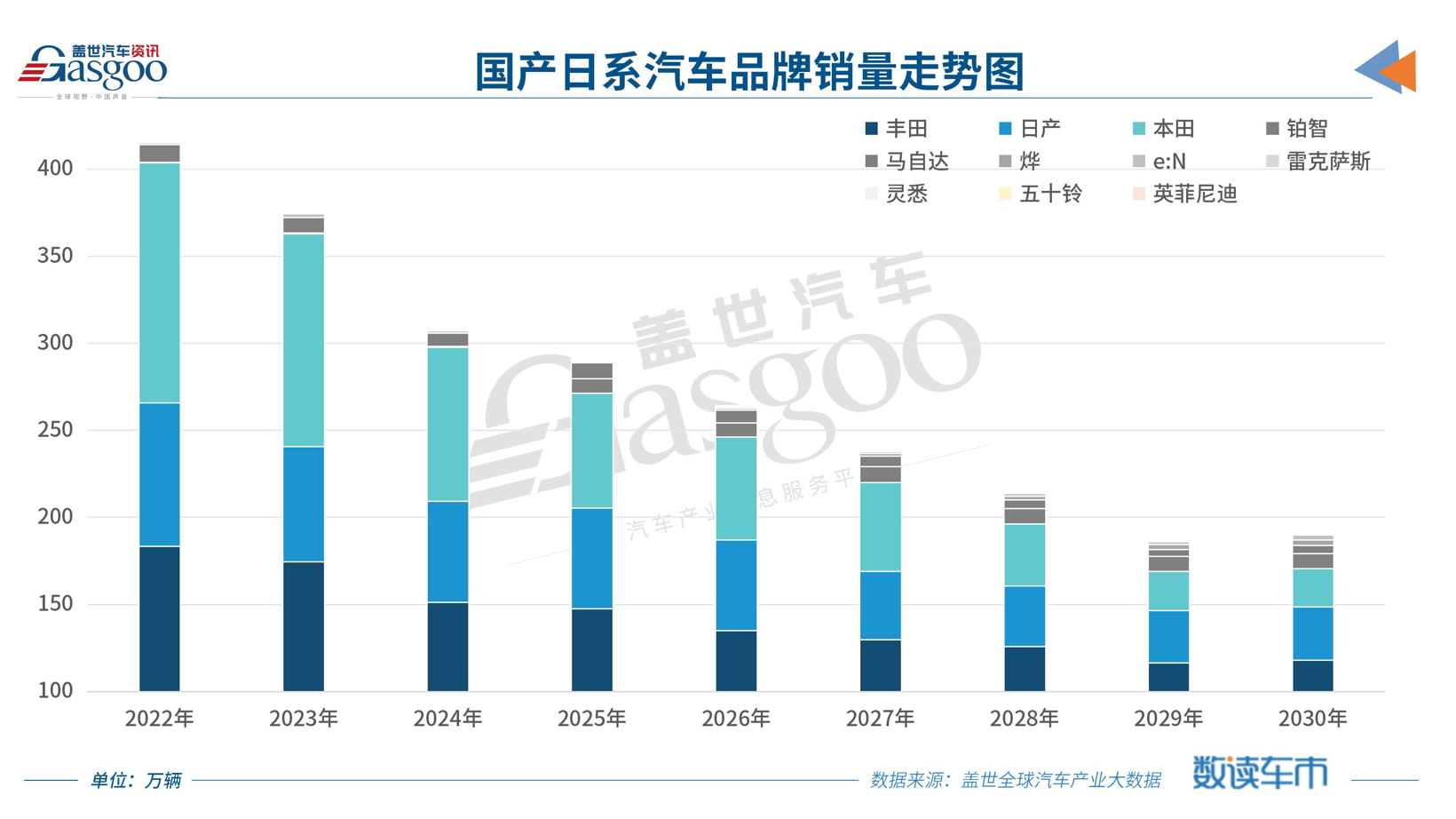

Leaving aside Subaru, whose annual sales in China are far less than its recall numbers, and Mazda, which has almost no presence, data from Gasgoo Global Industry Big Data shows that Honda's and Nissan's sales decreased by over 40% compared to 2022. Although Toyota still sells nearly 1.5 million vehicles a year, its sales have shrunk by a fifth compared to its own past performance.

Japanese brands are indeed having a tough time in China.

Market share collapse

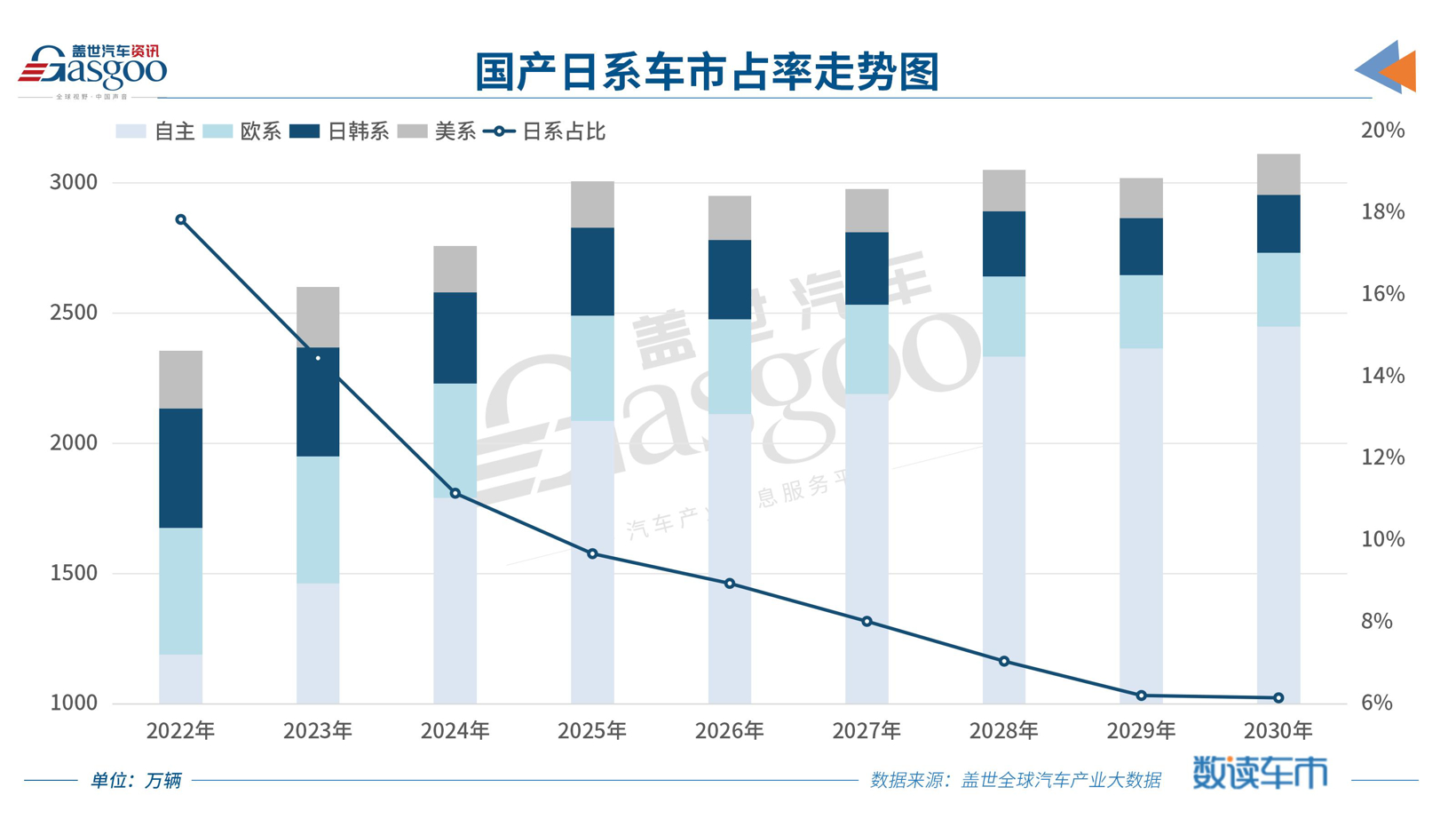

Back in 2020, Japanese car brands still held a 23.1% market share in China, and an even higher 35% in the fuel vehicle market. In a mere five years, according to Gaishi Global Industry Big Data, the market share of Japanese cars in China has shrunk to a perilous 9.67% by 2025.

According to market feedback in early 2026, this downward trend has not been effectively contained.

Under the impact of the electrification wave, joint venture brands as a whole are facing a "triple predicament of declining gasoline car dominance, lagging behind in new energy vehicles, and falling behind in intelligence." Japanese brands' gasoline car base is losing ground, and even with price cuts of 8.2% to promote sales, it is difficult to resist the downward trend in market share.

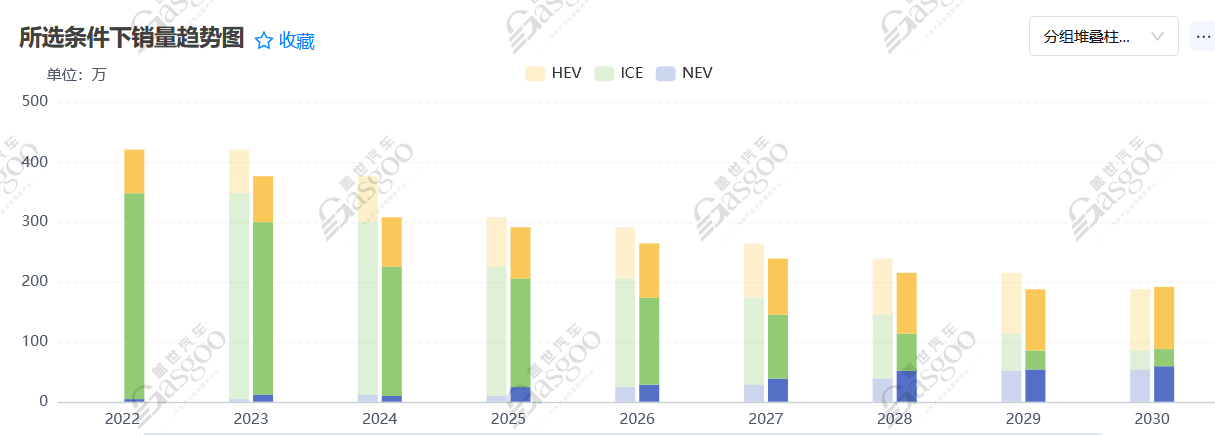

What's more fatal is the slow transition to electric vehicles. During the boom in China's new energy vehicle market from 2020 to 2023, most Japanese car companies hesitated, observed, and adopted misguided strategies. According to Gasgoo Global Industry Big Data, the penetration rate of new energy vehicles for Japanese brands in China barely exceeded 1% in 2022. By the time they finally realized it, Chinese independent car companies had already built technological and ecological barriers, leaving little room for Japanese car companies.

The Japanese auto brands, which once firmly held a quarter of the Chinese auto market, are currently experiencing unprecedented transformation pains.

The deeper issue lies in insufficient localization. Most Japanese automakers adhere to a "centralized headquarters" model, where Chinese teams lack the autonomy for R&D and decision-making, making it difficult to respond to market shifts. Honda, for instance, relies heavily on imported core components, resulting in car models that are out of sync with the needs of Chinese consumers.

Recall that during the 2023 Shanghai Auto Show, a top executive from a leading Japanese automaker confided to Gasgoo that he had invited his company's headquarters leaders to visit China more than once to witness the booming new energy vehicle scene and accelerate their strategic adjustments. However, these visits ultimately could not be arranged.

Perhaps those who remember might recall that at that auto show, it was the first time such a large number of European automotive executives visited and inspected an event in the history of China's automotive industry, while Japanese executives were rarely seen.

According to Gasgoo Global Automotive Big Data, the NEV (New Energy Vehicle) penetration rate of Japanese passenger car brands in China is less than 9% in 2025, forming a sharp contrast with the over 60% penetration rate of Chinese brands. In the critical race of electrification transformation, Japanese automakers seem to have missed the optimal window of opportunity.

The harsh realities of the market are reflected not only in sales figures but also in consumer perception. Once-held reputations like "Toyota, the unbreakable" and "Honda, the technology leader" seem to have lost their former glory in the new context of electrification and intelligentization.

After visiting several Japanese brand dealerships, sales staff generally reported that Japanese cars are facing the dual challenges of product intelligence shortcomings and weak channel layout, leading to sustained pressure on market competitiveness.

Especially in the current environment where many brands gain familiarity with ordinary consumers through direct-operated stores in commercial areas, Japanese brands still adhere to the 4S store model. A Japanese sales representative from the Yangtze River Delta frankly told Gasgoo that customer traffic is mainly from repeat customers for maintenance and repair, with low reach to new customers. "Except for old customers who specifically introduce people to come and see the cars, almost no one else comes, which is a huge gap compared to the experience stores in city malls."

The Diverging Paths of Three Major Brands

The Japanese "Big Three" are experiencing an unprecedented and dramatic divergence in the Chinese market. Toyota is poised to be the only Japanese automaker to maintain growth in China in 2025, while Honda and Nissan are mired in a slump of consecutive years of decline.

As the only one of the "Big Three" Japanese automakers to achieve growth, Toyota's sales in China reached 1.78 million vehicles in 2025, a slight year-on-year increase of 0.225%, successfully ending its continuous decline since 2022. This was mainly attributed to its strong brand reputation and joint venture system, as well as its pricing strategy for gasoline and mild-hybrid vehicles.

Its two joint ventures performed particularly well: FAW Toyota sold 377,800 new cars in the first half of the year, a year-on-year increase of 16%; GAC Toyota's sales reached 344,800 units, a year-on-year increase of 2.58%. GAC Toyota's pure electric SUV, the bZ3X, made an impressive debut, with over 70,000 units delivered throughout the year, firmly ranking first in sales among new energy vehicles from joint venture brands, becoming the first highlight of Japanese brands' electric transformation.

Additionally, Lexus contributed 183,800 units, continuing its positive growth and remaining the only imported luxury car brand with sales growth.

Image source: GAC Honda

Honda's situation is quite different. Its sales in China in 2025 were only 645,300 units, a sharp drop of 24.28% year-on-year, marking its fifth consecutive year of decline. Although its mainstream gasoline models like the CR-V and Accord still maintain certain sales volumes, and it has launched multiple new energy vehicle models, its overall market performance has not met expectations due to a lack of localized intelligent configurations and adaptive designs, failing to cater to Chinese consumers' core demands for driving experience, comfort, and intelligence.

Honda's electrification efforts are faltering, with all seven of its pure electric models facing a cold reception due to obvious "re-engineering from gasoline vehicles," lagging intelligence, and inflated pricing. The company is cutting its electrification investment by 30% in 2025 and has terminated its large pure electric SUV project, revealing strategic wavering.

Nissan's situation is even more serious. In 2025, cumulative sales were approximately 653,000 units, a year-on-year decrease of 6.26%. For a long time, Nissan has relied on a "price-for-volume" strategy to maintain some market share, but this has also led to a continuous decline in brand premium capability.

Image source: Dongfeng Nissan

As an early pioneer in electric vehicles, Nissan's Leaf enjoyed global success but remained largely unnoticed in China for over a decade. While its 2025 all-electric sedan, the N7, sold 45,382 units thanks to localized features, a single model struggles to fill a fragmented product lineup. Its monthly sales have fluctuated wildly, with December sales dropping below 2,000 units. This has also contributed to Nissan's sales in China plummeting from 1.564 million units in 2018 to 653,000 units, a nearly 60% decline, with its market share continuously shrinking.

From a profit perspective, the differentiation among the three is equally stark. According to its latest financial report, Toyota's net profit for the second quarter of fiscal year 2026 (ending September 30, 2025) reached 932.08 billion yen, a year-on-year increase of 62%. The Chinese market contributed 67.1 billion yen in operating profit, becoming a significant source of profit.

Nissan expects an operating loss of 275 billion yen, its worst financial crisis in over two decades. Honda previously projected a 70% profit drop to 250 billion yen, later revising its forecast upwards to 550 billion yen for November 2025, but still faces significant challenges.

2026: A Critical Year for Survival

Looking ahead, the Japanese automotive brands in the Chinese market will experience a more pronounced divergence. According to the forecast from Gasgoo Automotive Research Institute, by 2030, Japanese brands will still retain approximately 6% of the market share in China, but this will be highly concentrated among a few brands.

With 2026 regarded as the critical year for Japanese automakers to make their "last stand" in China, the strategic planning of each company will determine its future trajectory in the Chinese market.

Toyota has written "China First" into its global KPIs.

Image source: GAC Toyota

Over the past two years, Toyota has quietly merged its three R&D institutions – FAW Toyota, GAC Toyota, and BYD Toyota – into "ONE R&D." For the first time, the Chinese team has full decision-making authority over styling, configuration, and pricing. The development cycle has been compressed from 48 months to 28 months, with localization rates for parts exceeding 95% and costs reduced by an additional 15%-20%.

This is also a key factor supporting bZ3X to win the sales champion of joint venture pure electric vehicles in 2025, allowing Toyota to see the feasibility of "oil and electricity co-prosperity". Next, the flagship pure electric sedan bZ7, the extended-range Highlander, and the extended-range Sienna will form a new niche matrix, covering the core price range of 200,000 to 400,000 yuan.

More crucially, Lexus's wholly-owned factory in Shanghai will be completed by mid-2026 and begin production in 2027, focusing on high-end electric vehicles. The R&D staff will expand to 2,000 people, with localized R&D accounting for 60%. This marks the first time Toyota has placed the "brain" for its global high-end electric vehicles in China, meaning future Lexus global models will reverse-import technologies and supply chains defined in China.

Toyota's strategy is clear: maintain scale through extreme localization, secure profits through high-end electrification, and advance both fronts simultaneously, leaving no room for competitors to "trade price for market share."

Nissan is going all-in. By the end of 2026, Dongfeng Nissan must launch five new energy vehicle models, covering pure electric, plug-in hybrid, and range-extended technologies. They must achieve a net increase of 200,000 units in annual sales, targeting a total sales volume of 1 million units, and return the operating profit margin to over 6%. These are the "hard targets" that the Nissan China board of directors has written into their 2026 OKRs.

Trends of domestic Japanese cars by fuel type; Data source: Gasgoo Global Automotive Industry Big Data Platform

To fulfill its objectives, Nissan has launched the largest "GLOCAL" transformation in its history: the Chinese team has complete control over the entire closed-loop process, from initial market research, styling design, and intelligent cockpit definition to final pricing, with the Japanese headquarters only retaining platform safety and regulatory review authority. An additional 10 billion RMB will be invested before 2026, expanding the R&D team to 4,000 people, equivalent to the total over the past decade.

Nissan's path is "hit product validation + rapid iteration": first, address range anxiety with PHEV and EREV, then leverage Huawei's advanced intelligent driving to establish a competitive edge in intelligence, and finally, capture a broad user base with pure electric vehicles priced under 150,000 yuan as costs decrease.

In 2026, Nissan will have no room for retreat. Only by achieving simultaneous growth in sales and profits can it safeguard its joint venture equity ratio and dealer network confidence; otherwise, it will face the systemic risk of being marginalized.

Comparatively, Honda's strategy appears the most passive. Three years of exploration have led Honda to a strategic crossroads of ambiguity in China. While Dongfeng Honda Executive Vice President Pan Jianxin stated "adhering to gasoline and hybrid, accelerating pure electric layout," the lack of substantial measures ultimately resulted in gasoline-powered vehicles struggling to maintain their position, while new energy vehicles consistently failed to effectively break through.

The company is attempting to fight on two fronts in both the internal combustion engine vehicle and new energy vehicle markets, but the results have been less than ideal. In the ICE vehicle market, once-dominant models are now barely sustained by the CR-V and Accord. In the new energy vehicle sector, although Honda has launched pure electric models like the S7 and P7, market reception has been cold due to factors such as pricing, design, and intelligent features, failing to effectively gain traction.

Honda has recognized the seriousness of the issue and opted to expand its "circle of friends in China." The company stated, "We will further deepen strategic cooperation in electrification. Regarding technological innovation, we will actively engage in strategic cooperation with local enterprises such as Momenta and DeepSeek to jointly promote the development and progress of the new energy vehicle industry."

However, the Chinese auto market in 2026 will not offer any company an "observation period." The penetration rate of electrification has surpassed 55%, the penetration rate of intelligence is heading straight for 40%, supply chain costs fluctuate intensely on a quarterly basis, and user tastes iterate rapidly on a monthly basis.

Toyota is building a dual-engine strategy with "global technology + China speed," Nissan is betting on a comeback with "10 billion yuan to define China," and Honda must pinpoint its position to start anew.

It is a matter of life and death, and the outcome will be decided this year.

Conclusion:

With Lexus's Shanghai pure electric vehicle factory slated to begin production in 2027, Toyota's presence in the Chinese market is becoming increasingly comprehensive. Meanwhile, Dongfeng Honda is beginning to rethink its electrification strategy, and Nissan is seeking a breakthrough by deeply integrating with the Chinese market.

Walking into any Japanese car dealership, the salespeople always emphasize the vehicle's reliability and resale value, but younger consumers are more concerned with whether the car's infotainment screen is smooth, what level of autonomous driving it has achieved, and whether it can receive continuous updates via OTA.

The answers to these questions will determine whether Japanese cars can find a new foothold in China, the world's largest automotive market.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

New 3D Printing Extrusion System Arrives, May Replace Traditional Extruders, Already Producing Car Bumpers