Why Is the UAE Bucking the Trend When PE Imports Are Receding?

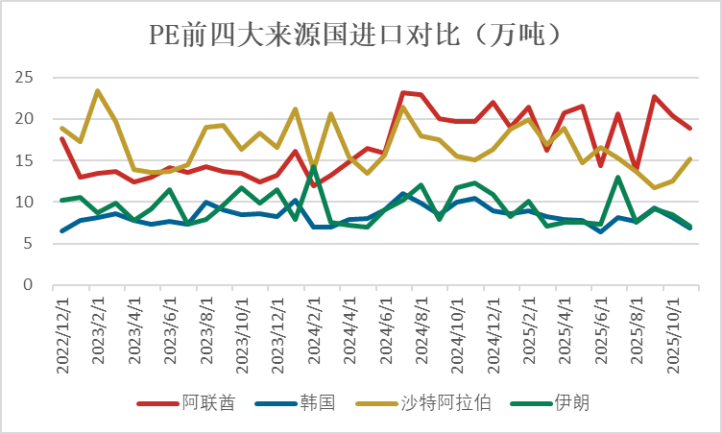

From 2024 to 2025, China's total imports of polyethylene (PE) will shift from an increase to a decrease, with the overall dependency rate falling from 33.5% to 29.1%, reflecting the substitution effect of domestic capacity expansion on imports. However, amidst this general downtrend, UAE's PE exports to China have increased for two consecutive years, with an increase of over 540,000 tons in 2024 and an additional 150,000 tons in 2025, maintaining its position as the top source of imports. In contrast, the export volumes from traditional suppliers such as Saudi Arabia and Iran have declined significantly during the same period. This discrepancy is not due to resource endowments or macro-geopolitical advantages—after all, both Saudi Arabia and Iran also have very low raw material costs. The key driving factors behind this phenomenon are the precise deployment of new capacity in the UAE, the high adaptability of product structure, and flexible trade arrangements.

Firstly, the UAE's large-scale expansion in recent years comes at an opportune time. By the end of 2023 to 2024, the Borouge Phase 4 project under the Abu Dhabi National Oil Company (ADNOC) will achieve full production, adding 1.5 million tons/year of PE capacity, focusing on high-value-added metallocene LLDPE and high-performance HDPE pipe materials. These products correspond perfectly to China's demand gap in high-end packaging and gas pipe materials. In contrast, although Saudi Arabia has new facilities from SABIC, its 800,000-ton HDPE project scheduled for 2025 has been delayed due to technical debugging and will only gradually ramp up in the second quarter. Iran, constrained by aging equipment and sanctions, struggles to supply high-quality products stably. Therefore, the UAE stands out as one of the few exporters capable of providing a large, stable supply of high-end PE products in 2024-2025.

Secondly, the trade mechanism is more flexible. The UAE's exports to China mostly adopt a "long-term contract + spot" mixed model, with flexible settlement methods (partially accepting RMB). In the context of RMB exchange rate fluctuations and tightened letters of credit in 2024, its transaction convenience is significantly superior to other suppliers relying on USD settlement with stringent payment terms. Moreover, the UAE National Oil Company has established deep strategic cooperation with major Chinese refining enterprises (such as Sinopec and Hengli) through "resource-for-market" to secure long-term shares. Even in the overall import contraction of 2025, they can still ensure their incremental volumes are not reduced.

Furthermore, the product structure is highly aligned with China's structural demand. From 2024 to 2025, China's imports of low-density polyethylene (HDPE) will continue to grow, while imports of linear low-density polyethylene (LLDPE) and low-density polyethylene (LDPE) will decline due to accelerated domestic substitution. In the UAE's newly added production capacity, HDPE accounts for over 60%, with much of it being high-margin varieties like bimodal pipe materials and rotational molding materials, which precisely fill the gap in domestic high-end HDPE supply. In contrast, Saudi Arabia and Iran still primarily export general-purpose injection and film materials. With the significant increase in domestic general-purpose material production capacity, their market share is naturally being eroded.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories