Why Does Tesla Dare to Sell "Bare Houses"?

In the new energy arena, where increasing features and reducing prices have become the main theme of the industry, Tesla has gone against the trend by boldly launching the "standard version" of the Model 3 and Model Y with simpler configurations and lower prices, humorously referred to by the market as "bare" houses.

This seemingly counterintuitive move has sparked widespread discussion: why is it that only Tesla dares to and is able to "reduce configurations" and not be abandoned by consumers?

Tesla's Moat

In the global automotive industry's wave of electrification, Tesla has built a moat that is distinctly different from traditional automakers through its unique business model and technological approach. This moat is not rooted in luxurious materials or exquisite craftsmanship, but rather in a brand belief that is almost "technological fundamentalism," creating a unique value judgment system.

The brand allure of Tesla is largely inseparable from the powerful endorsement of its founder, Elon Musk. His Iron Man-like image as an innovator and disruptor injects a strong sense of technological vision and futurism into Tesla.

Purchasing a Tesla, therefore, goes beyond merely consuming a means of transportation. In the eyes of a considerable number of consumers, it becomes a recognition of a cutting-edge technological lifestyle and a credential for a future-oriented identity. This brand halo is a soft power that traditional car manufacturers find difficult to replicate in the short term.

Tesla's long-standing pride in its hardware moat lies in its "three electric system"—the deep integration and leadership in battery, motor, and electronic control. Its technological advantages in battery energy management and motor efficiency directly translate into the most noticeable product characteristics perceived by users: solid and reliable actual range and outstanding acceleration performance.

For Tesla's core user group, slight advantages in core electrification performance are often far more important than the lack of certain comfort features.

Image source: Tesla

At the same time, the intelligent assisted driving FSD forms the core pillar of Tesla's "market dream rate." The fees paid by users for FSD can, to some extent, be seen as purchasing a "technology future" or option, which not only includes the current L2+ level assisted driving capabilities but also carries great expectations for the disruptive future of "achieving fully autonomous driving one day."

As long as the story about the technological endgame is credible enough, the "unfinished" feel of Tesla's hardware in pursuit of extreme cost-effectiveness becomes acceptable to many loyal fans, because the core value of the product is anchored in the continuously iterative and value-adding software potential.

It is this redefinition of product value that explains the business logic behind Tesla's "bare-bones" interior. Tesla actively guides the market through its products and marketing, redefining intelligence as the new luxury of the century, successfully shifting consumer attention from traditional value symbols such as leather seats and physical buttons to the smoothness of the central control screen, OTA upgrade experience, and the maturity of autonomous driving.

The key is that Tesla's "subtraction" is precise and selective. It has not compromised on its core driving experience and electric powertrain systems but has instead reduced comfort and decorative features, which hold lower value weight for target users. This approach allows Tesla to control costs while preserving the core of its products.

However, the moat built on the halo of technology and brand faith also requires solid market performance as support. Operating data shows that Tesla is facing severe challenges. The financial report for the second quarter of 2025 shows that its revenue was $22.5 billion, a year-on-year decline of 12%, marking the largest single-quarter drop in more than a decade. Net profit decreased by 16% year-on-year to $1.172 billion, and global deliveries for the quarter also fell by 13.5% year-on-year, reflecting the dual pressures of slowing demand and intensified competition.

Particularly competitors from the Chinese market have shaken its leading position, with BYD surpassing Tesla in global new energy vehicle sales in the first half of 2025 with approximately 2.146 million units sold. Among them, sales of pure electric models exceeded 1.02 million units, marking a year-on-year increase of 41%, while Tesla's cumulative sales for the same period were 720,000 units, representing a year-on-year decline of 13%.

To achieve the ambitious goal of delivering 20 million vehicles annually, Tesla needs to increase its current scale by about 13 times, a figure that even far exceeds the annual sales level of the global sales champion, Toyota.

To cope with pressure, Tesla has implemented a series of strategic adjustments, among which the launch of "affordable models" is a key measure. For example, for the Model Y/Model 3, it has eliminated non-core features such as the glass roof and electric folding mirrors, and has made price cuts of over $5,000 to strengthen its "technology belief" moat through a differentiated competition strategy.

The "wolf" in car company's clothing?

Tesla's uniqueness lies in the fact that it is essentially a technology and data company that uses vehicle hardware as its entry point.

This core positioning determines that its business model fundamentally differs from that of traditional car manufacturers. It not only profits from hardware sales but is also committed to building a tech ecosystem centered on software and continuous services. This is widely seen as a "dimensionality reduction attack" on the logic of traditional industries.

The strategic intent of this business model is quite clear, and its goal is not merely to rely on the hardware profits from vehicle sales. By launching a minimalist design and controlling hardware costs with "bare-bones" models, one of Tesla's core objectives is to lower the entry threshold for consumers, thereby maximizing market share.

This strategy is similar to the approach commonly adopted by internet companies in their early stages, which involves using subsidies to boost traffic or distributing hardware.

Under this logic, the vehicle itself can be sold at a small profit or at cost, with its strategic value lying in becoming a platform for a subsequent series of high-profit software and services. Every Tesla that rolls off the production line is no longer just a means of transportation, but a mobile, continuously connected smart terminal capable of generating and processing data.

Without this vast, globally distributed hardware infrastructure, all subsequent software services and data monetization will become a source-less water.

The successful operation of this business model relies on a powerful "flywheel effect." One of the core driving forces of this flywheel is Tesla's "data moat" built through its large fleet.

Currently, Tesla possesses the world's largest fleet of autonomous driving data, with the most real-world scenarios. During daily driving, every manual intervention by the driver and every complex or rare traffic scenario encountered are continuously "feeding" its autonomous driving neural network in real time.

This advantage of having vast and diverse data based on real roads is something that companies like Waymo, which primarily rely on simulation testing and operate in limited areas, find difficult to match. It also creates a gap that other car manufacturers, including many Chinese competitors, will struggle to overcome in the short term.

In the field of autonomous driving technology research and development, data is regarded as the "oil" for training artificial intelligence models, and Tesla undoubtedly holds one of the largest and most active oil fields in the world.

With the continuous rotation of the data flywheel, Tesla's profit model is also showing disruptive characteristics compared to traditional models. Once users choose to subscribe to its FSD suite or pay a monthly service fee, the car owner transforms from a one-time car buyer into a "subscribing user" who continuously contributes stable cash flow to Tesla.

The gross profit margin of this type of service revenue is typically very high, and due to its predictability and repeatability, it can significantly enhance the company's valuation level, bringing it closer to the valuation model of a software technology company.

In addition to the core product FSD, Tesla has gradually built a diversified software service matrix that includes advanced in-car connectivity services, online entertainment packages, and more. These services together form Tesla's second potential profit center, aside from hardware sales, which may be even more promising.

In addition, Tesla has extended its business model innovation to the energy sector by creating new revenue streams through energy subscription services and vehicle-to-grid (V2G) technology. For example, owners can earn several hundred dollars annually through V2G technology.

Tesla's ecological boundaries have far surpassed automobile manufacturing, evolving into a "car + energy + AI" super platform. Through vertical integration and horizontal expansion, its business has developed a strong system integration capability, including self-developed battery cells and supercomputers. Ultimately, Tesla aims to form a closed-loop intelligent ecosystem that seamlessly connects electric vehicles, home energy storage, photovoltaic power generation, and grid transactions through a digital platform, achieving an efficient cycle of energy generation, storage, usage, and trading.

This evolution path, from hardware foundation to software value addition, and then to platform aggregation and ecological closure, clearly demonstrates how Tesla has achieved the transformation from an automotive company to an energy ecosystem operator through the synergy of technological innovation and business model iteration.

Cost Leadership

The core confidence that Tesla has to implement an aggressive pricing strategy stems from its industry-leading cost structure built through engineering revolution, which allows it to maintain considerable profits while still having significant room for price reductions.

Tesla applies "first principles" thinking deeply throughout the manufacturing process, breaking the traditional cost model of the automotive industry and achieving a leap from linear optimization to exponential cost reduction.

However, these cost controls do not rely on simple supply chain price reductions or material downgrades; instead, they reshape the value engineering system of electric vehicles through technological disruption, vertical integration, and manufacturing innovation.

Mastering the core supply chain is the primary principle for Tesla to achieve cost breakthroughs. This vertical integration strategy has largely freed it from absolute dependence on the traditional supplier system.

In the critical field of autonomous driving, Tesla has chosen the path of developing its own chips. The FSD chip it launched not only theoretically provides continuous performance improvements but also significantly reduces procurement costs for external chip suppliers from a commercial perspective. In the long run, keeping core technology in-house ensures the autonomy and controllability of its technological iterations.

Similarly, in the battery sector, which constitutes the largest proportion of electric vehicle costs, Tesla's vertical integration is more profound. From innovations in the cells themselves—such as the design of the 4680 large cylindrical cells, aimed at increasing energy density and reducing production costs—to fundamental changes in battery pack structure—adopting CTC technology to integrate cells directly into the vehicle chassis, this series of actions significantly reduces the number of components and greatly simplifies the previously complex battery packaging and assembly process. This structural reshaping of the "cost center" from the source results in cost reduction effects that are profound and long-lasting.

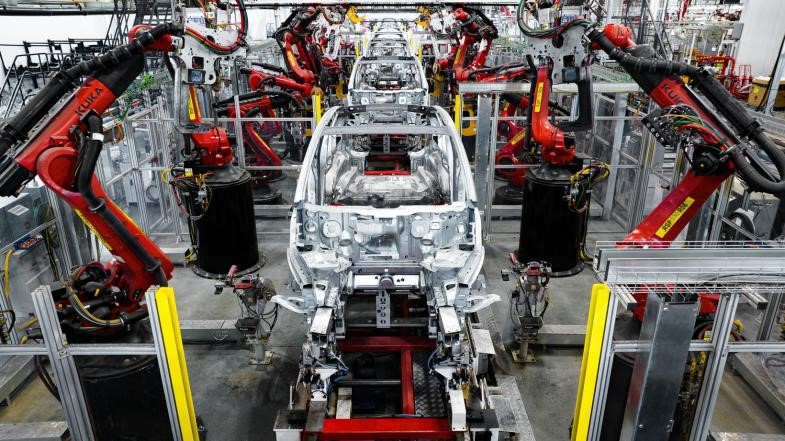

Furthermore, Tesla has extended engineering innovation to the fundamental manufacturing process level. The application of integrated die-casting technology is one of the most representative examples.

In traditional automobile manufacturing, large components such as the rear floor panel are usually assembled from dozens or even hundreds of independent stamped and welded parts. This process not only takes a long time but also requires a lot of production line equipment, skilled welding workers, and spacious factory space.

Tesla's introduction of large casting machines can replace all the aforementioned complex processes with a single casting, reducing manufacturing time to mere seconds, while achieving significant savings in production land, labor costs, and equipment investment.

Vertical integration and technological innovation lay the foundation for low costs, while economies of scale and the pursuit of manufacturing efficiency solidify and amplify these advantages into insurmountable competitive barriers.

Image source: Tesla

The Gigafactory located in Shanghai serves as a vivid example. Its speed from groundbreaking to achieving large-scale production, along with the subsequent operational efficiency it has demonstrated, has become a benchmark for the global manufacturing industry. This factory embodies a high degree of automation, lean production process management, and a supply chain layout that aligns with a vertical integration strategy. This robust manufacturing system capability directly translates into astonishing production ramp-up speed and remarkable vehicle cost control that draws the attention of industry peers.

Fundamentally, the concept of cost control at Tesla is not merely a task for the manufacturing phase; it has long been integrated into the initial stages of product design. Engineers consider manufacturability, ease of assembly, and material costs as core factors when designing products.

For example, the highly controversial yet iconic minimalist interior of the Model 3 and Model Y, beyond being an aesthetic choice, objectively results in significantly reduced material complexity for interior components and lowers the assembly difficulty and cost of the vehicle's wiring harness. This cost-awareness embedded from the very beginning of product definition is something that many traditional car manufacturers, constrained by conventional design processes and supplier systems, find difficult to quickly imitate and follow in the short term.

Insights from Autonomous Vehicle Enterprises

Tesla's "downgrade" strategy is a unique case resulting from the interplay of its brand power, business model, and cost control capabilities, and it cannot be easily replicated. However, the logic it reveals about defining product value through future expectations holds profound significance for domestic car manufacturers seeking to break through the current intense competition.

Tesla's "privilege" is built on its strong brand momentum, which stems from the market's strong expectations for its FSD (Full Self-Driving). Therefore, even with reduced configurations, some consumers still interpret it as "lowering the threshold for technological experience." This pricing power, based on brand belief, gives Tesla the autonomy to flexibly adjust between price and configuration.

In contrast, domestic car manufacturers are currently mired in a configuration arms race. The entire industry is facing severe challenges of "increased volume, falling prices, and difficulty in profitability," with over 80% of dealers experiencing price inversions, and industry profits remain under pressure.

The root cause lies in the imbalance between supply and demand as well as long-term involution-style competition. Many brands are forced into a vicious cycle of "increased features and reduced prices," attempting to attract consumers by piling up hardware configurations. However, this erodes the company's ability to invest in long-term research and development and makes it difficult to create genuine brand differentiation.

The core of this breakthrough lies in building an irreplicable "experience moat." For example, the success of Li Auto largely stems from its precise capture and definition of the core user scenario of a "mobile home." It has created a complete product experience around the needs of family users, rather than merely stacking functions. Its future challenge will be how to continuously deepen and iterate this scenario-based experience, ultimately transforming it into a solid technological barrier to withstand the impact from other brands.

Image source: Huawei

Another typical example is the AITO series empowered by Huawei, which, through its HarmonyOS cockpit, achieves seamless connection and collaboration between the vehicle and devices such as phones, watches, and smart home equipment, deeply integrating the car into the entire Harmony ecosystem. This represents a higher-dimensional competition of intelligent experience based on software and ecosystem capabilities, with barriers far exceeding the mere accumulation of hardware configurations.

At the same time, exploring sustainable software monetization models is another key for domestic car manufacturers to achieve high-quality development. The model used by Tesla to realize long-term value through software services like FSD is worth emulating. Domestic car manufacturers need to consider how to develop more attractive software products based on China's complex road conditions and user habits, such as more advanced intelligent driving assistance systems and personalized in-car service subscriptions.

In brand building, adhering to a value-oriented approach is more important than simply sticking to a price range. Brands like Ideal, NIO, and Dengsi have chosen to stay in the high-end luxury market, which reflects their determination to elevate their brand and is the correct strategic direction. The key lies in whether the experiences they provide are strong and unique enough to effectively withstand competition from other strong brands in similar price segments. They must demonstrate to the market that the comprehensive user experience brought by their products, services, and ecosystem is a sufficient reason for users to choose them over lower-priced alternatives.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track