Why Did Pret Shift from a Billion-Dollar Battery Project to Robotics and Low-Altitude Economy?

Recently, two pieces of news about Plite have attracted the attention of the plastic industry.

On June 30, Prit announced that the company has signed an investment cooperation agreement with the Investment Promotion Bureau of the Guangzhou Nansha Economic and Technological Development Zone to invest in the construction of the Prit plastic modified materials South China headquarters and R&D manufacturing base project in Nansha District, Guangzhou. The total investment for the project is 1 billion yuan, with an expected annual capacity of 400,000 tons, to be constructed in two phases.Phase 1 focuses on automotive wire modified plastic products.The second phase will focus on the layout of high-end new materials, including modified polyetheretherketone (PEEK), polyphenylene sulfide (PPS), liquid crystal polymer (LCP), and carbon fiber reinforced materials, etc.Mainly focused on emerging fields such as low-altitude economy and humanoid robots.。

Image source: Doubao AI

On the same day, Pullet announced that its controlling subsidiary, Jiangsu Haisida Power Co., Ltd. (hereinafter referred to as Haisida), signed the "Termination Contract of the Investment Project Cooperation Contract" with Liuyang Economic and Technological Development Zone Management Committee (hereinafter referred to as Liuyang ETDZ) in June this year. It is reported that the project was once a hundred-billion-level investment that attracted much attention in the industry.

On one hand, investing heavily in modified plastics for the automotive, low-altitude economy, and humanoid robot sectors, while on the other hand cutting previously prioritized new energy battery projects—what's behind Polyte's move? Let's analyze together with Insight Plastic.

The Hundred Billion Battery Project Stalls: The ""Emergency brake"

In June 2023, Preter Holdings' subsidiary Haisida announced an investment of 10.2 billion yuan to build a 30 GWh sodium-ion and lithium-ion battery production base, aiming to enter the new energy sector. The main products planned are sodium-ion and lithium-ion batteries, covering both square and cylindrical forms. The project is planned to be built in three phases: Phase I involves an investment of about 3 billion yuan to build a 12 GWh square battery project; Phase II involves an investment of about 3 billion yuan to build a 6 GWh cylindrical battery project; Phase III involves an investment of about 4.2 billion yuan to build a 12 GWh square battery project.

However, just two years later, this project was urgently suspended. Polytech pointed out that due to changes in the macro environment of the new energy industry, its strategic direction in the new energy field was continuously optimized. Behind this lies the harsh reality of overcapacity and price wars in the lithium battery industry.

According to data from BloombergNEF, the global average price of lithium-ion battery packs fell 20% year-on-year to $115 per kilowatt-hour in 2024, the biggest drop in seven years; the cost of sodium-ion batteries also plummeted from 0.8 yuan/Wh to 0.45 yuan/Wh, approaching the cost level of lithium iron phosphate batteries.

The announcement shows that the above-mentioned project has not carried out substantial construction. After consultation with Liuyang Economic Development Zone, both parties agreed to terminate the investment in this project, and the Management Committee of Liuyang Economic Development Zone will reclaim the land use rights.

Two, 10Yijia's robot materials: precise positioning for business extension

While giving up on cross-border ventures, Prile quickly focused its resources on its core business - high molecular modified materials, investing 1 billion yuan to build a South China R&D and manufacturing base in Nansha, Guangzhou. This project is divided into two phases: Phase I: continuing the traditional advantages of automotive modified plastics, producing PP, PA, ABS and other products to meet the lightweight needs of new energy vehicles; Phase II: targeting humanoid robots and low-altitude economy, laying out high value-added products such as PEEK, PPS, LCP and carbon fiber reinforced materials.

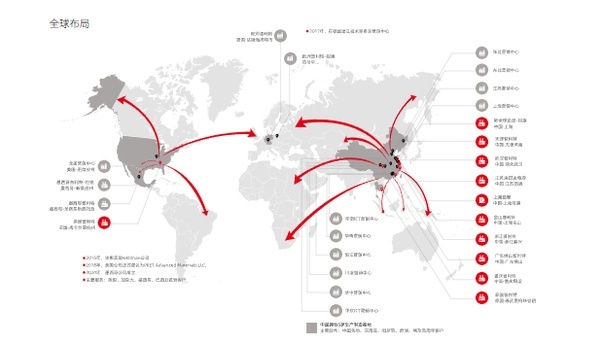

Pret's global layout (Image source: Pret's official website)

Taking robot applications as an example, PEEK has characteristics such as high temperature resistance and self-lubrication, making it suitable for harmonic reducers and actuators; LCP is an ideal material for high-frequency signal connectors; carbon fiber can reduce weight by more than 30%, optimizing the structure of robotic arms...

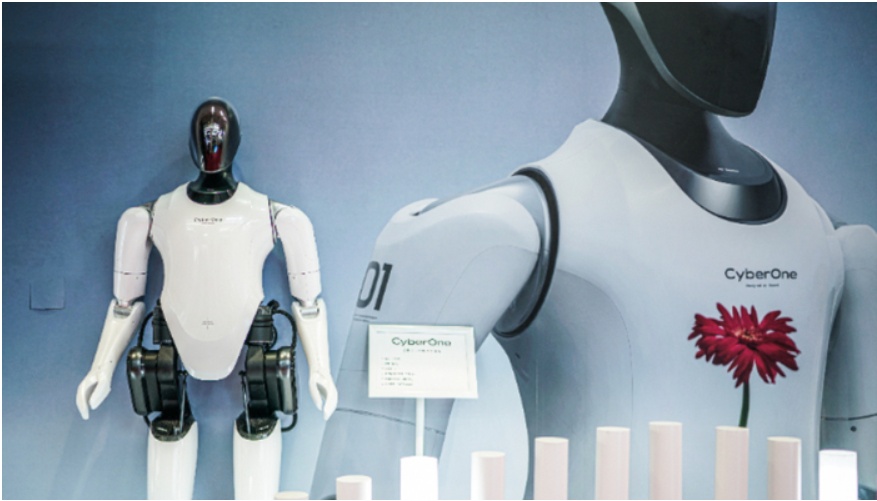

Image source: Interface

Pulit stated that with the rapid development of the global new energy vehicle industry, its main products have seen a swift increase in supply within this sector. Due to the continuous expansion of new customers and the growing volume of product orders, there is a need to enhance its production scale and supply capacity. Currently, the company's existing production capacity is at full capacity, and there is still a capacity gap during peak industry seasons. The location of the Nansha base highlights strategic intentions—leveraging the industrial chain cluster of the Guangdong-Hong Kong-Macao Greater Bay Area to quickly respond to the potential demands of humanoid robot manufacturers and low-altitude field manufacturers in South China.

Nansha is located at the geometric center of the Guangdong-Hong Kong-Macao Greater Bay Area. It is the only national new area in Guangdong Province, the largest==== of the Guangdong Free Trade Zone, and a demonstration zone for comprehensive cooperation between Guangdong, Hong Kong, and Macao. It has successively been approved as a national demonstration zone for promoting and innovating import trade, a comprehensive bonded area, and a major national platform policy for relaxing market access and strengthening regulatory system reform.

Pritech stated that due to its convenient geographical and transportation location, Nansha is its preferred location for radiating the South China market, facilitating the development of new customers, and meeting the needs of major clients nearby.

III. Strategic Adjustment Motivations: From ""Chasing the Trend" can be translated as "trend" or "hotspot" depending on context. Here, "Chasing the Trend" captures the essence of pursuing popular or emerging opportunities. Defend Changpo

Puruite's shift is not a blind chase after trends, but rather based on a materials company's understanding of the cycles of downstream application industries.

Since 2023, the concentrated release of power battery production capacity, coupled with the slowing growth of new energy vehicles, has led to an imbalance between supply and demand. It can be said that the lithium battery industry has shifted from "short supply" to "structural overcapacity." As a cross-industry player, Preter's subsidiary Hildred mainly focuses on niche markets such as electric tools, making it difficult to compete with industry leaders like CATL in the power battery sector.

Pritchard has chosen to increase its investment in humanoid robot materials, with one of the core driving forces being the structural opportunities presented by explosive growth in the industry. According to the "2025 Humanoid Robot Industry Report," the market size for humanoid robots in China is expected to reach 8.2 billion yuan by 2025, with a compound annual growth rate exceeding 50%. This growth rate far surpasses that of traditional downstream industries like automotive and home appliances for modified plastics, providing new growth opportunities for material companies. Another consideration may be that Pritchard has been deeply involved in the automotive modified plastics sector for 30 years, allowing them to quickly adapt their modified plastics technology accumulated in the automotive field to robot scenarios, thereby forming a differentiated competitive edge. Furthermore, there is an overlap in the supply chain between the automotive and robotics industries, which makes it very convenient for Pritchard to enter the supply chain of leading robot manufacturers.

The low-altitude economy is similar to the situation with humanoid robots. According to data from the Ministry of Industry and Information Technology (MIIT), China's low-altitude economy reached over 500 billion yuan in 2023, with the scale expected to exceed 1.5 trillion yuan by 2025, representing a compound annual growth rate of 44%. Among this, the drone industry alone reached 117 billion yuan in 2023 (data from CCID Think Tank), and emerging areas such as flying cars are accelerating their commercialization. In terms of policy support, in 2024, the state included the low-altitude economy in the Government Work Report, and 13 provinces and cities, including Shenzhen and Guangzhou, have introduced special supportive policies. The significant market growth combined with policy support makes the low-altitude economy a highly certain growth area.

These two emerging tracks place high demands on materials, which aligns perfectly with the technical expertise that PRET has developed over the years in the modified plastics (polymer new material products and composite materials) industry. Since its establishment in 1993, PRET has been deeply engaged in the field of modified composite materials for over three decades. As a leading enterprise in the modified materials industry, PRET's materials are widely used by major OEMs, home appliance manufacturers, and more, particularly in the automotive sector, where PRET has become a core material supplier for numerous OEMs.

Modified plastics refer to plastic products that are processed by methods such as filling, blending, and reinforcement to improve properties like flame retardancy, strength, impact resistance, and toughness, based on general-purpose plastics and engineering plastics. The main downstream applications are in the automotive and home appliance industries.

According to a research report from Donghai Securities Research Institute, China's modified plastics output surpassed 30 million tons in 2024, with the modification rate increasing from 16.2% in 2010 to nearly 30% in 2024.

Donghai Securities Research Institute stated that the modified plastics industry is still in the critical period of domestic substitution. After experiencing a peak in capital investment from 2021 to 2022, the modified plastics sector has returned to rationality in the past two years. With the support of domestic demand policies such as lightweighting of new energy vehicles and subsidies and promotions for automobiles and home appliances, downstream demand has improved. The performance of most modified plastics companies, such as Kingfa Sci. & Tech., Prejean, and Dahe Co., Ltd., has shown improvement.

IV. Not only Plastics, these modified enterprises are also accelerating into new fields

In addition to Pulit, several leading companies have also positioned themselves in the robotics and low-altitude economy materials sector.

Golden Sun Technology

In the field of humanoid robots: providing material solutions for components such as face-mounted decorative shells, actuator gears/bearings, and processor connectors; In the low-altitude economy field: developed key components such as high-strength blades, arms, and fuselage, achieving a weight reduction of 25%-40% for the entire drone through structural optimization, and improving the endurance range by over 30%, promoting the transformation of the low-altitude economy towards a resource-saving development model.

Nanjing Julong

In the field of humanoid robotics: The company has established a dedicated "Robotics Materials Project Team" focused on developing high-performance polymer materials tailored to the needs of the robotics sector. The team is prioritizing the application of advanced materials in critical components such as humanoid robot joints, bearings, gears, and limbs.

In the low-altitude economy sector: Focus on carbon fiber composite structural components, parts, and whole aircraft assembly, achieving high-quality product delivery.

Huitong Stock

Robotics Field: Launching an integrated material solution, with a comprehensive layout in the core structural areas of humanoid robots, and has introduced material solutions such as PC ternary alloys, PPA/CF materials, and PEEK.

In the low-altitude economy sector: focusing on the trends of lightweight, high strength, and substituting plastic for steel in the actual use scenarios of drones, we have launched lightweight PC materials, ultra-high modulus carbon fiber reinforced composite materials, and other material solutions. The related products have been designated for the Xiaopeng Huitian flying car project.

Wote Co., Ltd.

In the field of robotics: In the field of robot structural components, the company has developed lightweight and high-strength materials that have been successfully applied to floor-sweeping and grass-removal robots. The dedicated materials for their skeletons and robotic arms achieve a balance in strength, heat resistance, and fatigue resistance. For functional components, PEEK materials are currently undergoing multi-customer testing.

In the low-altitude economy sector: the provided drone material solutions have been successfully applied to key components of drones in various fields, including propellers, fuselage, gimbals, motors, and remote control handles. Its carbon fiber composite production line can directly supply customers with molded products such as propellers, arms, and fuselage frames.

5. Conclusion

Pret has clearly mentioned in its financial report "optimizing the strategic direction in the new energy field" and emphasized "returning to the core business of high molecular new materials." This case also reflects the long-term strategic considerations of materials companies: against the backdrop of industrial upgrading and domestic substitution, the core competitiveness of materials companies is shifting from "scale expansion" to "technological deep cultivation." Pret's strategic shift provides important insights for the industry: only tracks with certain technical barriers and clear market growth (such as the domestication rate of robot materials being less than 30%) can build their own moat amidst cyclical fluctuations.

Editor: Lily

Source of materials: Pret, Interface, DT New Materials, DouBao AI, etc.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track