While Rivals Rush to Expand Production, This Electrolyte Leader Splurges 3.9 Billion Yuan on Wealth Management

There is a popular saying online: your enemy is sharpening their knife, your best friend is losing weight, and the neighbor Old Wang is training his waist—you must keep working hard continuously so that your opponents have no opportunity to take advantage of you. This saying is equally applicable in business competition.

In the lithium battery materials industry, there is a company that frequently chooses to invest its funds in financial products to earn stable returns, while its competitors are accelerating their expansion.

Huaxia Energy Network & Huaxia Energy Storage (WeChat official account hxcn3060) has learned that on August 6th,Ruitai New Material(SZ:301238) released a progress announcement on the use of temporarily idle raised funds for cash management, investing 200 million yuan to subscribe to CITIC Securities income certificates, with an expected annualized return of 0.1% or 2.5%.

Ruitai New Materials was established in 2017, with core products including lithium battery electrolytes, additives, and silane coupling agents. In the electrolyte sector, Ruitai New Materials ranks among the top three globally in terms of sales, and its downstream customers includeCATL (Contemporary Amperex Technology Co., Limited)(SZ:300750), LG New Energy,EVE Energy(SZ:300014), and leading battery manufacturers such as New Energy Technology.

It is worth noting that this is not the first time Ruitai New Materials has allocated funds to wealth management. Since 2025, Ruitai New Materials has purchased wealth management products totaling as much as 3.884 billion yuan (including cash that has matured and been rolled over), with the balance of wealth management products not yet matured reaching as high as 1.681 billion yuan.

Ruitai New Material does not seem to be moved by its competitors' accelerated expansion to capture more market share. Ruitai New Material's conservative choice may very likely be missing out on opportunities for market growth.

While others spend money on expanding production, it spends money on financial investments.

In the past two years, the global power battery and energy storage markets have continued to heat up, driving rapid growth in the upstream lithium battery electrolyte industry. According to research by the Gogo Industry Research Institute (GGII), China's electrolyte shipments reached 870,000 tons in the first half of 2025, a year-on-year increase of 45%.

In this context,Heaven-sent Materials、New Universe BondLeading electrolyte manufacturers are investing heavily to expand production capacity and accelerate overseas deployment in order to meet the needs of international customers. By supplying localized production, they aim to capture incremental growth in overseas markets.

For example, "electrolyte leader" Tinci Materials has reduced costs through integrated operations since 2024, while actively expanding overseas. Its OEM factory in Germany has successfully started production, and its electrolyte project in the United States is also progressing steadily. In June this year, Tinci Materials signed an investment agreement with the Kingdom of Morocco, planning to invest in building an integrated production base for electrolytes and raw materials in Morocco, with an annual production capacity of 150,000 tons of electrolyte products and key raw materials.

In 2023, Capchem planned a battery chemical project in Ohio, USA, and in 2024, it plans to build a battery chemical project in Louisiana, USA. In April this year, Capchem also disclosed plans to establish an electronic chemical production base in Malaysia.

However, while competitors were sharpening their knives and staking out territories, Ruitai New Materials chose to "rest and recuperate," with an overall strategy leaning towards conservatism. In a word, it can be summed up as "stability."

During its IPO in 2022, Reetech New Material planned approximately 1.5 million tons of new production capacity. However, in actual implementation, these planned capacities experienced significant delays or adjustments. For instance, two major projects planned for construction in 2022, namely the Ningde Huarong annual 400,000-ton lithium-ion battery electrolyte project and the Poland Huarong annual 260,000-ton lithium-ion battery electrolyte project, have not yet commenced construction as of the end of 2024.

Currently, Ruitai New Materials has only three projects in operation, all of which were put into production in 2022. These include the Huarong Chemical 70,000 tons/year electrolyte expansion and renovation project, the Ningde Huarong 80,000 tons/year new materials project, and the Poland Huarong newly built Prusice 40,000 tons/year lithium-ion power battery electrolyte project. Among them, as the only overseas production capacity, the Poland project has experienced low capacity utilization since its completion due to customer orders falling short of expectations.

Since its listing, apart from the aforementioned three commissioned projects and two trial production projects, Ruitai New Materials has not commenced the construction of new production capacity in the past three years.

Seeking "stability," Ruitai New Materials did not spend money on expanding production, but chose to invest the funds in financial products instead.

According to Huaxia Energy Network & Huaxia Energy Storage statistics, since May 2024, Ruitai New Materials has issued a total of 25 wealth management announcements, with 15 of them in 2025 alone. This year, the company has purchased wealth management products totaling as much as 3.884 billion yuan (including cash that has matured and been reinvested), with 1.681 billion yuan still not matured. These funds are mainly invested in stable wealth management products such as broker income certificates and bank structured deposits.

Among the not-yet-matured wealth management products of Ruitai New Materials, two have yields of 1% or 2.6%, while the majority of the others have yields of 0.1% or 2.5%. Most of these are short-term wealth management products with durations ranging from 3 months to 1 year, and they can be called early (meaning the investment can be ended early to lock in returns).

From September 2024 to May 2025, Ruitai New Materials earned approximately 18.34 million yuan in investment income. The company’s net profit for the entire year of 2024 was 84.6 million yuan, so this investment income is equivalent to one-fifth of last year’s net profit. Perhaps what the company values is precisely this “steady happiness.”

How far can the "lying flat strategy" go?

Ruitai New Material has achieved a steady cash flow through financial management. However, paradoxically, while Ruitai New Material invests a large amount of funds in financial management, it still owes more than one billion yuan in bank loans.

As of the end of the first quarter of 2025, the total liabilities of Ruitai New Materials amounted to 2.348 billion yuan, including total bank loans of 1.079 billion yuan, which comprised 575 million yuan in short-term loans and 504 million yuan in long-term loans. Compared with the end of 2024, short-term loans increased significantly by 200.69%, while long-term loans decreased by 52.86%.

In the case of a surge in short-term debt, Ruitai New Material can only use the over-raised funds to repay the debt.

On June 17, the board of directors of Ruitai New Materials approved the use of 300 million yuan from previously over-raised funds to repay bank loans, and 70 million yuan for two subsidiaries to repay their bank loans. Ruitai New Materials stated that this move is to meet the needs of the company's healthy development, while also improving the efficiency of the use of raised funds and reducing financial costs.

The reason why Ruitai New Materials dares to manage its finances while remaining in debt may be because its asset-liability ratio is not high and the pressure is not significant. At the end of the first quarter this year, Ruitai New Materials’ asset-liability ratio was only 23.87%, much lower than that of Tianci Materials at 44.89% and Capchem at 40.47%.

As a manufacturing enterprise, maintaining an "ultra-low" debt-to-asset ratio naturally makes it easier to control risks. However, "lying flat" also means giving up rare expansion opportunities, potentially missing the industry growth window and thus losing market competitiveness.

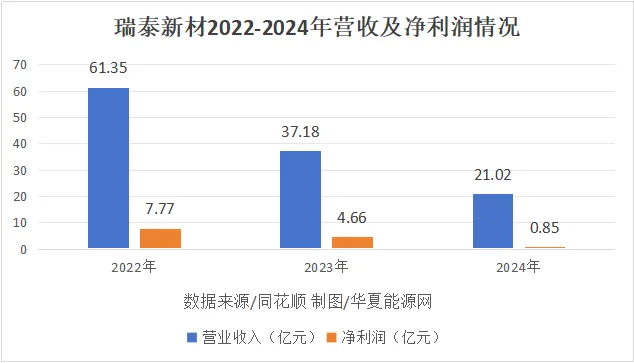

It is worth noting that in recent years, Ruitai New Materials' profitability has been gradually weakening. From 2022 to 2024, the company's revenue and profits have declined for three consecutive years, with net profit dropping by nearly 90%.

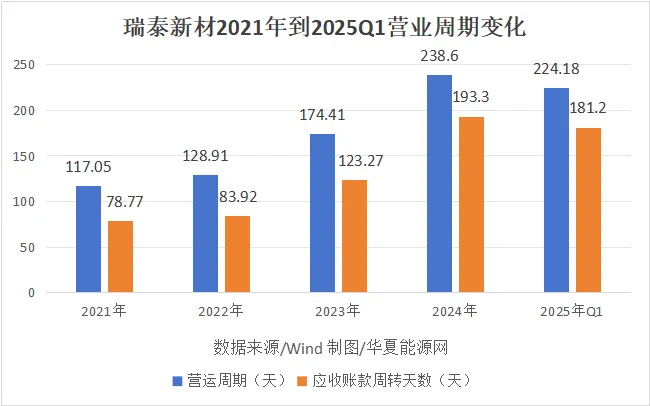

Moreover, Ruitai New Materials also faces pressure in sales collections. From 2021 to 2024, its accounts receivable turnover days have significantly extended from 77.87 days to 193.3 days.

In the context of insufficient profitability, Ruitai New Materials still adopts a conservative strategy. If this continues, as the industry becomes more competitive, how long can the company remain at the "table"?

Market concerns have already been reflected in the share price—Ruitai New Materials’ stock price reached its peak of 41.48 yuan per share in July 2022 and hit a low of 11.13 yuan per share in February 2024, with its market value evaporating by 22.2 billion yuan. As of the close on August 13, Ruitai New Materials’ stock price stood at 18.96 yuan per share, still fluctuating sideways.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics