What Does SAIC-GM Rely on for Renewal and Comeback?

Today, we are discussing the topic of how SAIC-GM makes a comeback, which is closely related to the changes in the overall landscape of the automotive industry.

You can hardly imagine that an event like Xiaomi's launch, where over 200,000 units are ordered overnight, would have caused such a sensation in the past. After all, back then, everyone was working hard, and selling over a million units was an occasion for the entire company to open champagne, with all employees walking with a spring in their step, and their heads held high at a 45-degree angle.

SAIC-GM was once such a company.

In fact, for a long period after its official establishment, SAIC-GM was a leading automaker in the Chinese market, and in the global market, it was the only ray of hope for General Motors, which had been suffering losses for years. It is no exaggeration to say that SAIC-GM kept General Motors alive.

However, no reign lasts forever, and even the most prosperous enterprises will eventually face difficult times.

General Motors' revenue for the entire last year increased by 9.1% year-on-year, reaching 187.44 billion USD, with a net profit of 6 billion USD. However, the company incurred a loss of 2.961 billion USD in the fourth quarter. One significant reason for the loss was the restructuring of General Motors' business in China, including asset impairments and factory closures, resulting in the recognition of special losses exceeding 5 billion USD.

Does this mean that SAIC-GM's business will face challenges?

The answer is negative. Since GM is willing to spend a significant amount of money to restructure its business in China, it is clear that they still do not want to give up the desire to grab a share of the passenger car market, which grows by nearly 30 million vehicles annually.

According to insider sources, SAIC-GM has recently successfully renewed a ten-year contract. This is the most significant agreement in China's joint venture automobile sector following Volkswagen's renewal. Of course, the goal is profitability, and the purpose is also profitability.

If you want to be profitable, you naturally can't continue to use product logic, marketing logic, or the entire supply chain logic that have already been proven no longer viable.

Local Promotion and 2.0 Reconstruction

The trend of contraction and localization at SAIC General Motors has actually been gradually taking shape since last year.

At the end of 2024, SAIC-GM will begin advancing a 100% localization process. Starting from 2025, the product definition of SAIC-GM's new models will be primarily led by SAIC-GM and PATAC themselves, with a 100% focus on the needs of Chinese customers.

This means that the overall development logic of SAIC-GM’s products will be entirely based on the automotive R&D and evolution trends of the Chinese market. As a joint venture, SAIC-GM has now fully acquired independent leadership in product development.

All digital functions of SAIC-GM vehicles are now 100% developed by SAIC-GM’s local software and digitalization center. This means that in the future, SAIC-GM products will offer an experience that Chinese users find very familiar and intuitive.

Before this, joint venture car companies, including SAIC-GM, still followed the traditional model of foreign R&D and domestic manufacturing and sales. As a result, many aspects such as R&D, engineering changes, function upgrades, and even OTA updates needed to be led or authorized by foreign companies. The entire process was very cumbersome and took a longer cycle. In addition to increased costs, it also significantly missed the golden time point for launching product technologies.

Therefore, being 100% led by SAIC-GM is indeed an important and correct strategic transformation. In fact, the concept of being market-led in China today is already a very mature one. Several major Japanese joint venture car companies have also fully advanced this new joint venture model, including GAC Toyota and Dongfeng Nissan.

In terms of performance, GAC Toyota's bZ3X model has already achieved comprehensive competitiveness within the price range of 150,000 to 200,000 RMB. This competitiveness not only refers to Toyota's brand influence but also includes cost reductions brought about by the localization of the supply chain, configuration upgrades, and GAC's product manufacturing capability and quality.

Similarly, Dongfeng Nissan's N7 also achieved 20,000 pre-orders by mid-June. To be honest, this is not an outstanding result within the new energy vehicle sector, but for Dongfeng Nissan, whose sales have been compressed for years and relied solely on the Sylphy to support its numbers, this is a successful case.

The emergence of such products and the achievement of such results are without exception the outcomes of Toyota and Nissan completely handing over the control of their products to Chinese operators and engineers.

The same thing happens to General Motors, whose capabilities and outcomes may become stronger.

For example, Pan Asia, which originally belonged to the SAIC system, will once again lead the product development and design of SAIC-GM, greatly enhancing the value of the entire functional block.

More importantly, relying on SAIC, which has held the top position in the Chinese automotive market for decades as a joint venture partner, SAIC-GM will undoubtedly hold a highly advantageous position in the entire supply chain of both traditional energy products and electrified products.

Of course, this is a path that was already determined before. After half a year, can such a path still meet the original expectations?

Sales Increase and Scale Reduction

With the localization path determined, what inevitably follows is the establishment of product development thinking and strategy.

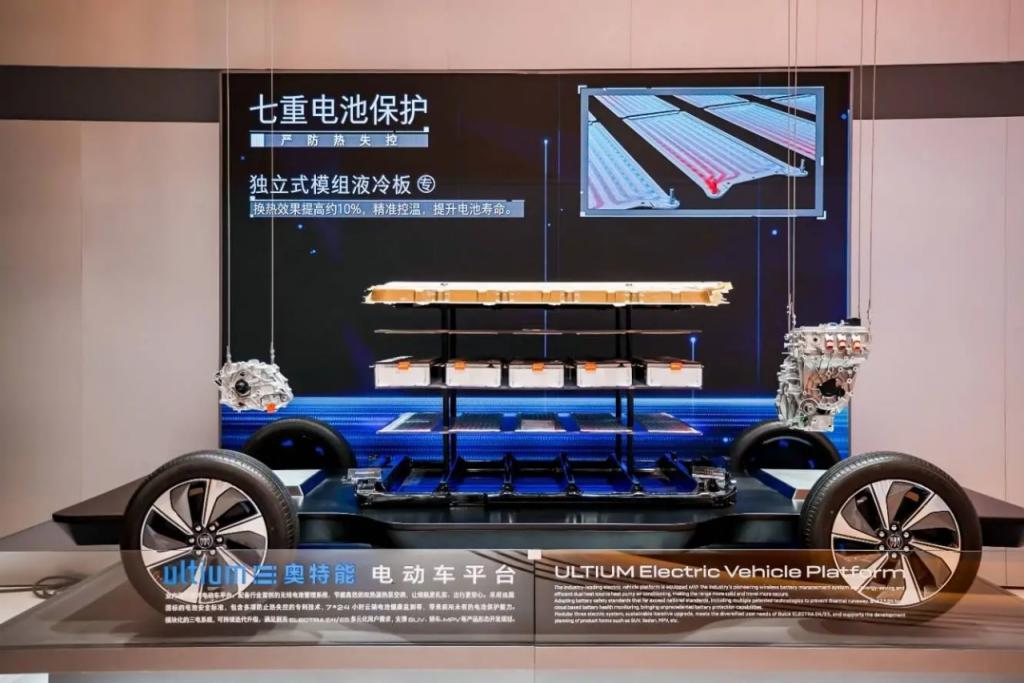

In fact, according to SAIC General Motors' plans, by 2025, it will achieve iterative upgrades in three major technology domains, including the Ultium 2.0 multi-energy drive platform, a new generation of intelligent cockpit platform, and a new generation of intelligent driving platform.

Starting from 2025, SAIC-GM plans to launch 12 brand new models over the next three years, all of which will be new energy vehicles. These models will include pure electric, plug-in hybrid, and range-extended vehicles, covering various body types such as sedans, SUVs, and MPVs.

Certainly, from the current state, the overall progress in launching new cars cannot be considered very vigorous. SAIC-GM has chosen a more steady and solid approach, first stabilizing its foundational market. By initially achieving an increase in sales to reach a break-even or profitable status, they aim to lay a foundation for sustained progress in the future.

This approach and strategy are undoubtedly correct. By the end of 2024, SAIC-GM had achieved six consecutive months of sales growth, and in the first half of 2025, this upward trend has actually continued in a healthy manner.

In the first half of this year, the Buick GL8 family saw a 37.4% year-on-year increase, becoming the MPV sales champion for the first half of the year. The Envision family also experienced a nearly 200% year-on-year growth. Meanwhile, the sales of the LaCrosse doubled year-on-year.

These products are still the flagship offerings from SAIC-GM that we are very familiar with. During a period when no new products have emerged to take up the mantle of driving sales, achieving such growth clearly shows that the logic behind product development and pricing has once again become competitive.

For example, in the field of intelligence, SAIC-GM Buick has initiated cooperation with Momenta. Of course, in the more crucial area of the supply chain, more localized procurement and the supply chain system provided by SAIC Group itself will, to a large extent, enable a new way of car manufacturing that is more localized for China, smarter, and offers better value for money.

This also includes the highly competitive "fixed price" policy that SAIC-GM Buick introduced in the past period. Through this policy, SAIC-GM Buick was the first to address the issue of sluggish sales growth. More importantly, it streamlined the price wars among dealers and restructured its sales channels and system.

Try to earn money as much as possible, and quickly shrink and adjust those that really do not make money.

In fact, since last year, we have already noticed that another brand under SAIC-GM—Chevrolet—has almost lost its presence. If a brand doesn’t sell, it’s a reasonable choice to stop investing in it. Another brand that has faced the same decision is Dorang, which was once heavily promoted as SAIC-GM’s high-end imported car channel.

In the current overall environment, continuously promoting advantageous products, reasonably allocating excess capacity, and precisely deploying funds on the books will inevitably become a new trend. The integration and adjustment of SAIC General Motors precisely respond to this trend. After all, whether it ultimately succeeds or not must be reflected in the financial statements.

The remaining question is whether SAIC-GM still has any way to turn things around at this point in time.

Expected Profit and Global Strategy

In fact, SAIC-GM still has many opportunities for an overall turnaround in the next decade.

First is the competitiveness of the new product.

The two key points we just mentioned are that the sales growth of SAIC-GM is mainly reflected in the rejuvenation of classic models and price advantages. However, the core focus is on whether the three-year new product plan starting in 2025 and the subsequent establishment of a brand-new new energy product system can be successful.

In fact, at present, SAIC's new energy vehicle products and supply chain system have become very mature, and sales are also increasing rapidly. Therefore, we have every reason to believe that the new energy products developed by SAIC-GM under Chinese leadership can compete with anyone in terms of product strength.

Secondly, there is a strong capital system.

This capital is firstly reflected in General Motors, which has already turned a profit and is willing to invest funds to restructure SAIC-GM’s assets and capital structure. At the same time, the other joint venture partner, SAIC Motor, has achieved wholesale sales of 2.053 million vehicles in the first half of this year, a year-on-year increase of 12.4%, with a comprehensive recovery in its independent brands, new energy vehicles, and overseas markets. Therefore, as a very important joint venture segment for the enterprise, both SAIC Volkswagen and SAIC General Motors clearly have the capacity to be revitalized and continuously supported.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track