Under the pressure of involution, Ruipulan Jun has delivered impressive results with a significant increase in revenue.

Despite the intense competition and fierce price wars in the entire new energy vehicle and battery market in 2024, with battery prices continually declining, some companies are still delivering impressive results. Their products, orders, and customer structures are constantly improving, and they are expected to be among the first to "reach shore" in the competitive landscape of "survival of the fittest."

On March 26, Ruipu Lanjun announced that its operating revenue for 2024 reached 17.796 billion yuan, a year-on-year increase of 29.4%, setting a historical high; the net loss significantly narrowed to 1.353 billion yuan, a year-on-year reduction of 30.4%, showing a clear improvement in performance.

According to Battery China, Ruipu Lanjun's lithium battery sales are expected to reach 43.71 GWh in 2024, a year-on-year increase of 124.4%.

In terms of product revenue, Ruipulan Jun's revenue from power battery products reached 7.384 billion yuan in 2024, a year-on-year increase of 71.4%; revenue from energy storage battery products reached 7.259 billion yuan.

In 2024, Ruipu Lan Jun's lithium battery sales doubled, mainly due to the company's continuous investment in R&D and product innovation, which received widespread recognition from downstream customers.

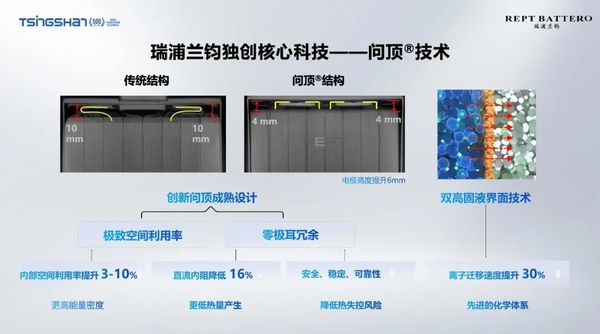

According to Battery China, in 2024, Ruipu Lanjun's R&D investment reached 779 million yuan, fully promoting the "WenDing" upgrade of battery cells. The new generation of "WenDing" series battery products has been industrialized.

Among them, the "WenDing" series of lithium iron phosphate battery products have improved energy density to 180-200 Wh/kg, significantly enhancing safety and further consolidating Ruipu Lanjun's competitive advantage in the new energy vehicle and energy storage markets.

In the field of ternary batteries, Ruipu Lanjun has completed the coverage of both super-fast charging and high energy density systems. Among them, the super-fast charging ternary products have been developed with a 6C~8C ultra-fast charging system, achieving an energy density of over 240Wh/kg, and the related products are currently in the customer verification stage; in terms of high energy density, the energy density has surpassed 300Wh/kg, and the company is actively exploring its application potential in emerging fields such as low-altitude aircraft and robotics.

In the field of semi-solid/full-solid batteries, Ruipulan Jun completed the development of its second-generation semi-solid cell in 2024, achieving an energy density of over 310Wh/kg, which has been delivered for testing in vehicles. In the same year, the company also initiated the production of all-solid square cells and successfully became part of the key project "Pioneering Leaders" in Zhejiang Province, and is currently actively exploring the commercialization pathway for all-solid batteries.

Due to the characteristics of manganese iron lithium phosphate batteries, which have high voltage and low cost, and the abundant supply of manganese materials, manganese iron lithium phosphate batteries can achieve higher energy density, lower cost per watt-hour, and better performance in low-temperature environments compared to lithium iron phosphate batteries. In contrast to ternary batteries, they also offer better safety performance, making their advantages clear. Therefore, many companies are currently focusing on this battery technology route.

It is reported that Ruipulan Jun has completed the relevant development work on lithium iron manganese phosphate in 2024, achieving a cell energy density of 210-240 Wh/kg and a cycle life of over 3,000 weeks at room temperature. Samples have been sent for testing to multiple domestic and international customers.

Thanks to its forward-looking R&D layout and strong product capability, Ruipu Lanjun achieved fruitful results in the power and energy storage markets in 2024.

In the field of new energy passenger vehicles, in 2024, Ruipu Lanjun will continue to maintain stable deliveries to multiple domestic and international clients, including SAIC Passenger Cars (Roewe, MG brands), SAIC-GM Wuling (Baojun, Wuling brands), FAW Bestune, Zeekr, Smart, Volvo, and Stellantis.

At the same time, it has also expanded new strategic clients such as Renault EasyJet, and successively secured project designations for new electric vehicle models from Stellantis and leading Indian automakers, as well as hybrid vehicle projects from multiple automakers including Geely (Galaxy brand), Dongfeng Nissan (NISSAN brand), and joint ventures with German and American companies.

In the commercial vehicle and construction machinery business sector, Ruipulanjun has achieved comprehensive coverage and bulk delivery of mainstream market products through its "large battery" strategy and technological advantages.

In the commercial vehicle sector, it has established deep cooperative relationships with companies such as Qiyuan Xindongli, Qingtou Heavy Industry, Sany Group, Xugong Group, Yutong Bus, and Geely Commercial Vehicles. During the reporting period, the number of new models equipped with Ruipu Lanjun power battery systems reached 122, and the company successfully won multiple commercial vehicle projects. Notably, in the field of new energy heavy trucks, the Ruipu Lanjun "BIGBANK" battery system has an energy density exceeding 210Wh/kg, supports a range of over 500km for heavy-duty vehicles, and features 2C fast charging capability.

With its industry-leading technology and market channel capabilities, Ruipu Lanjun New Energy's heavy-duty truck installation volume has performed impressively. Data from the Power Battery Application Association shows that in 2024, Ruipu Lanjun's heavy-duty truck installation volume has surged to third place in the Chinese market.

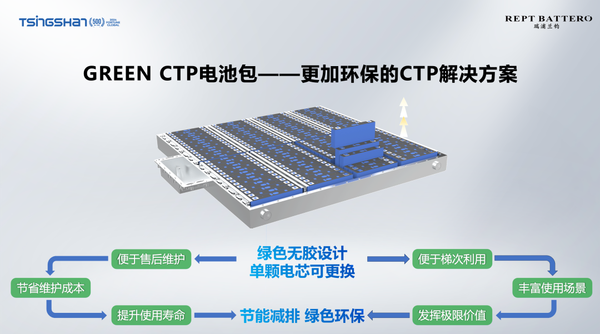

In the energy storage business sector, Ruipu Lanjun leads the trend of large-capacity systems and long-duration energy storage through its large cell technology. According to Battery China, in 2024, Ruipu Lanjun will empower its entire product matrix of energy storage cells through the "Wending" technology, achieving an ultimate enhancement in the performance, cost reduction, and safety of energy storage cells.

During the reporting period, Ruipulan Jun successfully signed strategic cooperation agreements with enterprises such as Leyitong, Liugong, Hongyang Group, China State Construction Engineering Corporation Sixth Bureau, and Far East Holding. It won the annual procurement demand for energy storage cells from central/state-owned enterprises such as Guoneng Xinkong and China National Petroleum Corporation. Additionally, it signed energy storage orders with overseas clients including Powin and Vena Energy.

According to statistics from the Zhongguancun Energy Storage Industry Technology Alliance, in terms of market performance, Ruipu Lanjun's energy storage battery shipments ranked among the top five globally in 2024, while small energy storage cell shipments ranked second globally.

Currently, the electrification of automobiles and the transformation towards clean energy have become trends. Major Chinese battery companies with advantages in technology, manufacturing, and industrial chains are planning to expand overseas in order to achieve a transformation into international and global enterprises.

It is important to point out that although there are significant opportunities in overseas markets, if a company has not fully considered the implications before going abroad, it may fall into a greater predicament. Whether a company should go abroad should depend on its market positioning. If the main market is domestic, rushing to go abroad may not be wise, as overseas investments are substantial and the risks are high. Currently, overseas markets account for more than 50% of Ruipu Lanjun's lithium battery shipments, with power and energy storage customers spread across major global markets. To meet local industrial support, Ruipu Lanjun's efforts to go abroad have also achieved positive results in 2024.

Currently, Ruipulan Jun has established its European subsidiary in Germany and its North American subsidiary in the United States, completing its business coverage in Europe, North America, and other regions.

In terms of building factories overseas, Ruipulan Jun is accelerating its globalization layout and plans to invest in the construction of a battery plant in Indonesia, leveraging local resource advantages to reduce procurement costs and improve production efficiency.

Leveraging the solid global foundation of Qingshan Industry, combined with its extensive large-scale manufacturing experience, brand effect, and broad布局 in resource allocation, will undoubtedly enhance Ruipu Lanjun's competitive advantage in the global新能源 arena.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track