Two Chemical Giants Undergo Restructuring! U.S. Plans to Extend Auto Tariff Relief! Braskem Halts Production

International News Overview

Raw Material News: 460,000 tons/year! Braskem ceases chlor-alkali production in Brazil

Auto News: Chemical giants restructure to integrate engineering plastics segment

Electronics News: Venator sells UK plant and related titanium dioxide assets to LB Group

Recycling News: 130 million RMB-funded project at risk? U.S. chemical recycling plant faces strong opposition from residents

Medical News: Coveris joins hands with SABIC to launch medical plastic recycling project, achieving closed-loop for medical packaging

Macroeconomic News: Report says Trump administration to announce auto tariff relief plan

Here are the details of international news.:

1.Chemical Giants Restructure to Integrate Engineering Plastics Segment

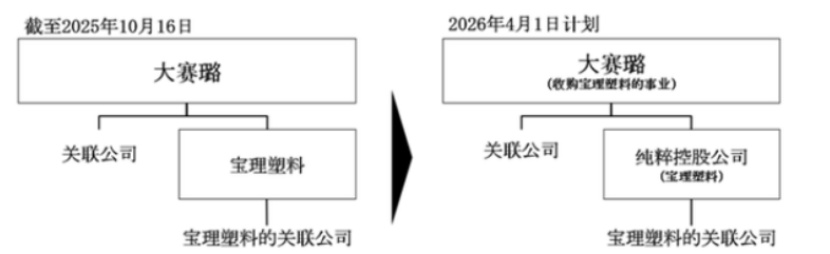

On October 16, Daicel Corporation (hereinafter referred to as "Daicel") and its wholly-owned subsidiary Polyplastics Co., Ltd. (hereinafter referred to as "Polyplastics") announced a group corporate restructuring plan, with the core being the full integration of Polyplastics' engineering plastics segment.Business Split: Polyplastics will divide its business into two segments: 1) Engineering plastics business (covering the entire chain of R&D, production, sales, and supporting related businesses); 2) Equity holding and management business of affiliated companies.Business Undertaking: Daicel will fully undertake the engineering plastics business split from Polyplastics. Polyplastics' technical patents, production bases, customer resources, and sales teams in this field will be incorporated into Daicel's system.

After the spin-off, Polyplastics Co., Ltd. will retain its legal personality. Daicel is currently advancing research on renaming Polyplastics, including its domestic and overseas affiliated companies. The new name and renaming time will be announced later.

2.130 Million RMB-funded Project at Risk? U.S. Chemical Recycling Plant Faces Strong Opposition from Residents

Recently, Resynergi, a U.S. chemical recycling startup, originally planned to build a waste plastic chemical recycling project in Rohnert Park, California. However, the project has encountered strong opposition from local residents, resulting in extremely strict project review and potential forced relocation.

3.Coveris Joins Hands with SABIC to Launch Medical Plastic Recycling Project, Achieving Closed-Loop for Medical Packaging

Coveris recently launched a circular economy project in the medical field, aiming to successfully recycle waste medical plastic packaging and convert it into new contact-sensitive packaging.Coveris has collaborated with SABIC, Zuyderland Medical Centre, medical brand Artivion, and other partners.

4.460,000 Tons/Year! Braskem Ceases Chlor-Alkali Production in Brazil

Braskem SA, based in São Paulo, Brazil, has fully shut down its chlor-alkali plant (producing chlorine and caustic soda) in Maceió, Brazil, and is currently dismantling the plant to recycle scrap metal.

On October 16, Freitas stated that this shutdown marks Braskem's withdrawal from the chlor-alkali production sector in Brazil. However, the company will continue to operate its downstream polyvinyl chloride (PVC) and vinyl chloride monomer production lines, with raw materials to be imported ethylene dichloride from the United States.

5.Venator Sells UK Plant and Related Titanium Dioxide Assets to LB Group

According to news from Plastics Vision on October 17, pursuant to a statement released by Venator on October 16, its main UK trading subsidiary, Venator Materials UK Ltd., has signed an agreement to sell its Greatham plant and related titanium dioxide (TiO₂) pigment assets to China-based LB Group Co., Ltd. (headquartered in Jiaozuo, China).

Venator is a leading global manufacturer of titanium dioxide and high-performance additives. Formerly a subsidiary of Huntsman Corporation, it was spun off from Huntsman in 2017 and listed on the New York Stock Exchange. Headquartered in the UK, the company has approximately 2,800 employees, sells products to over 110 countries, and has an annual titanium dioxide production capacity of 650,000 tons. It once ranked as the world's third-largest producer.

6.India Launches First Biodegradable Billboard to Promote 100% Biodegradable Slippers

Recently, Chupps Footwear, a local Indian open-toe footwear brand, unveiled India's first biodegradable billboard in Bandra, Mumbai—a pioneering initiative in the field of sustainable fashion.

Conceived by INTO Creative, the billboard symbolizes Chupps' bold commitment to reducing fashion waste, both in its products and promotional activities.

The new billboard in Bandra, Mumbai, took four days to install and measures 20 feet x 10 feet. It is entirely made of biodegradable materials, using a large bamboo structure instead of the common iron sheet and tin structures. A mixture of soil, clay, cow dung, hay, and sawdust is used to make large sliders and the background. The title is written with fresh limestone instead of ordinary white paint.

Overseas Macroeconomic Market Information

Stellantis Rises Over 4% After Hours; Report Says Trump Administration to Announce Auto Tariff Relief Plan: Shares of Stellantis Group's ADR rose 4.3% in after-hours trading on U.S. stocks. General Motors gained 1.67%, Ford Motor rose 0.51%, and Tesla fell 0.27%.

Citing people familiar with the matter, media reported that the U.S. is close to introducing a tariff relief plan for the auto industry, with the Commerce Department expected to announce it as early as Friday. The plan will extend for five years an arrangement allowing automakers to reduce tariffs on imported auto parts.

Previously, automakers including Ford Motor Company and General Motors lobbied for months to secure exemption from President Trump's tariffs.

Ueda Kazuo: BOJ Will Tighten Policy if Certainty of Economic Outlook Improves: Bank of Japan Governor Ueda Kazuo stated that if the certainty of the expected economic outlook improves, the Bank of Japan will tighten monetary policy.

U.S. EIA Crude Oil Production Hits Record High of 13.64 Million Barrels/Day: Data from the U.S. Energy Information Administration (EIA) showed that U.S. EIA crude oil inventories increased by 3.52 million barrels last week. Bloomberg users expected an increase of 2.3 million barrels, while analysts expected a decrease of 136,200 barrels. Inventories increased by 3.715 million barrels in the previous week.

U.S.-Russia Presidential Call Ends; Trump Says He Will Meet Putin in Budapest: U.S. President Trump posted on his social platform "Truth Social" that he had just concluded a phone call with Russian President Putin, describing the call as very productive.

Trump said he remains committed to helping resolve the Ukraine conflict, and the two sides spent a lot of time discussing trade issues between the U.S. and Russia after the end of the Ukraine conflict.

Trump announced that U.S. Secretary of State Rubio will represent the U.S. at the upcoming meeting with Russia. The meeting location and delegation members have not yet been determined.

Trump said he will meet with Putin in Budapest, Hungary, after the advisor meeting to explore ways to end the conflict between Russia and Ukraine.

Price Information

RMB/USD Central Parity Rate Rises 19 Pips to 7.0949: The central parity rate of RMB against USD was reported at 7.0949, an increase of 19 pips. The central parity rate of the previous trading day was 7.0968, the official closing price of the previous trading day was 7.1249, and the overnight trading price was 7.1230.

Upstream Raw Material USD Market Prices

Ethylene (Asia): CFR Northeast Asia 785 USD/ton; CFR Southeast Asia 780 USD/ton.

Propylene (Northeast Asia): FOB South Korea average 750 USD/ton; CFR China average 775 USD/ton.

Frozen cargo CIF North Asia: Propane 453-458 USD/ton; Butane 489-494 USD/ton.

Frozen cargo CIF South China (China), early November: Propane 525-535 USD/ton; Butane 525-535 USD/ton.

Frozen cargo CIF Taiwan (China): Propane 453-458 USD/ton; Butane 489-494 USD/ton.

LLDPE USD Market Prices

Film: 830-890 USD/ton (CFR Huangpu).

Injection Molding: 935 USD/ton (CFR Huangpu).

HDPE USD Market Prices

Film: 870-900 USD/ton (CFR Huangpu).

Blow Molding: 850 USD/ton (CFR Huangpu).

Injection Molding: 850 USD/ton (CFR Huangpu).

Pipes: 1010 USD/ton (CFR Huangpu).

LDPE USD Market Prices

Film: 1050-1095 USD/ton (CFR Huangpu).

Coating: 1100-1280 USD/ton (CFR Huangpu).

PP USD Market Prices

Injection Molding: 860-915 USD/ton (CFR Huangpu).

Copolymer: 850 USD/ton (CFR Nansha).

Film Grade: 1020 USD/ton (CFR Huangpu).

Transparent Grade: 1005-1125 USD/ton (CFR Huangpu).

Pipes: 1100 USD/ton (CFR Shanghai).

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track