Trump Imposes Tariff on China, China's PVC Exports Unaffected, End-Product Exports Restricted

According to Lianhe Zaobao, U.S. President Trump decided to...11 1Impose additional tariffs on Chinese products starting from the above date.100%Tariff, and to“All key software”Implement export controls. This policy adjustment will have various impacts on the export pattern and market price of China's PVC industry. The specific analysis is as follows.

I. Regarding ChinaPVCThe direct impact of exports is limited, but the indirect transmission effects are significant.

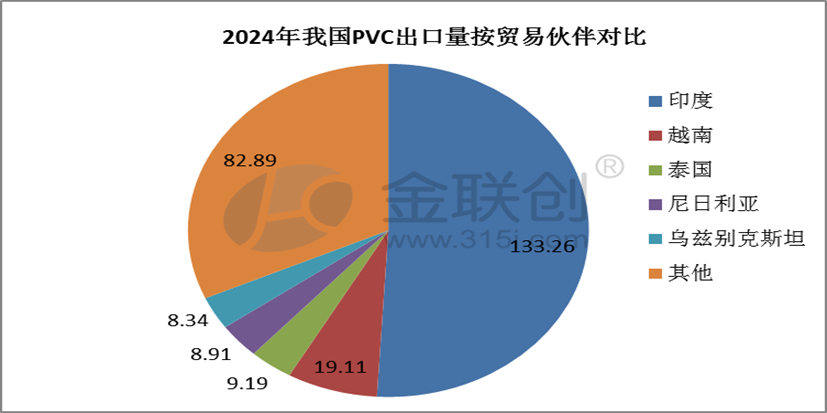

Data source: Jinlianchuan, Customs Statistics Bureau

2024Based on annual data, China's top five export countries are India, Vietnam, Thailand, Nigeria, and Uzbekistan.PVCThe direct export volume of powder to the United States is very low.2024 0.007310,000 tons.2024China this year.PVCTotal export volume in261.1810,000 tons, while exports to the United States are only0.0073ten thousand tons, accounting for our country's total export volume of0.028%Regarding our countryPVCThe direct impact of powder exports is limited. However, from an indirect perspective, China's exports of end products such as PVC flooring, gloves, waterproof materials, and toys to the U.S. account for a relatively high proportion.PVCFloor coverings as an example,2024Export to the US in the year147.38Metric tons, accounting for the overall exports of31.12%After the increase in tariffs, it is expected that export costs will rise significantly, and a large number of orders may be lost in the short term. The reduction in downstream product orders will drag down...PVCPrice, in the short term,PVCThe market is unfavorable.

Section Two: Regarding ChinaPVCShort-term pressure on market prices and medium- to long-term differentiation risks.

In the short term, if the policy of imposing additional tariffs is officially implemented, the obstruction of PVC downstream product exports will directly affect market expectations for PVC demand. The uncertainty in the transmission of terminal demand, coupled with concerns about future demand, will exert downward pressure on PVC market prices in the short term, and market trading sentiment may cool accordingly. In the medium to long term, if PVC manufacturers can actively expand into non-US overseas markets such as Southeast Asia and the Middle East, and simultaneously upgrade technology and optimize product structures to absorb potential domestic overcapacity, and if domestic demand in infrastructure, real estate, and other fields improves, then the price pressure caused by export concerns in the earlier period will gradually ease, and market prices are expected to return to a stable range dominated by supply and demand fundamentals. Conversely, if the scale of newly developed overseas markets is insufficient to compensate for the loss of the US market share, and domestic demand growth falls short of expectations, it will exacerbate the imbalance between domestic and international PVC supply and demand. The market may fall into a cycle of "demand contraction-price decline-capacity clearance," and PVC prices may face long-term downward risk.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track