Traditional New Power: Can We Join the Table Now?

One of the hottest booths at this year's Chengdu Auto Show is undoubtedly the Hongmeng Zhixing brand. After all, in previous auto shows, Hongmeng Zhixing, known as the "Four Realms", has always been a major attraction. Now, with the addition of the Shangjie, both in terms of scale and appeal, the popularity of Hongmeng Zhixing has reached a new level.

When the five car logos with the "Jie" character are hung together, the level of impact will make everyone passing by exclaim. In fact, it's not just HarmonyOS Smart Car; after Huawei's collaboration with several traditional car manufacturers, these traditional car companies have quickly made up for the shortcomings in intelligence during the new energy era. A new round of battles is about to begin.

The emerging car manufacturers have always been the absolute mainstream in China's new energy sector. However, as time has passed and after rounds of competition, the number of these emerging car manufacturers has dwindled from over a hundred to just a few. This is an inevitable development in the automotive industry; introducing a catfish into a school of fish is not meant to nurture the catfish but to stimulate the vitality of the other fish.

Now, these new energy brands incubated by traditional car manufacturers have grown robustly. Brands like Geely Galaxy, Changan Qiyuan, and YiPai Technology have started making their mark in terms of sales. Meanwhile, even among the remaining new car-making forces, some are still struggling to find ways to "survive."

01Use data to dispel doubts.

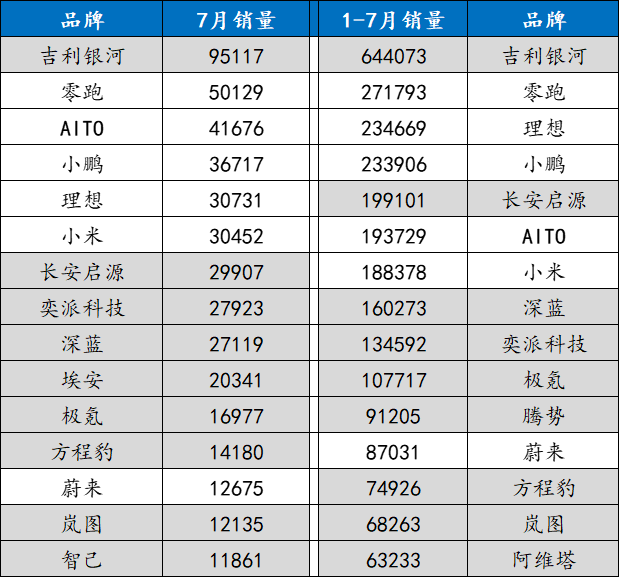

From the latest sales data of new energy vehicles for July and the January-to-July period, we can clearly see a trend: new energy brands incubated by traditional automakers are gradually entering the main stage and becoming a force that cannot be ignored in the market.

The brands Geely Galaxy, Changan Qiyuan, Deepal, YiPai Technology, Aion, Zeekr, and Lantu, mostly affiliated with traditional automotive groups, not only have stable sales but have even surpassed some new emerging brands, indicating that the competitive landscape of China's new energy vehicle market is undergoing profound changes.

According to specific data, new energy brands with traditional car company backgrounds performed impressively. Geely Galaxy topped the list with sales of 95,117 vehicles in July and a cumulative total of 644,073 vehicles from January to July, far surpassing many emerging brands. Changan Automobile's Deep Blue and Changan Qiyuan achieved monthly sales of 27,119 and 29,907 vehicles, respectively, with cumulative sales exceeding 130,000 vehicles each. Additionally, Dongfeng Motor's Yipai Technology, GAC Group's Aion, and Geely's Zeekr also ranked among the top in sales.

It is particularly noteworthy that these brands have strong sales stability. For example, Geely Galaxy's cumulative sales from January to July have exceeded 640,000 units, and Yipei Technology has reached 160,000 units, demonstrating continuous market penetration capabilities. In contrast, some emerging brands like NIO and Xpeng, despite having significant buzz, have seen their sales surpassed by several traditional car companies' new energy vehicle brands.

Once upon a time, China's new energy vehicle market was almost dominated by new power brands such as NIO, XPeng, and Li Auto. However, with the full efforts of traditional car companies, the market landscape has gradually shifted from being dominated by new forces to a competitive arena with multiple players.

On one hand, new power brands are facing increasing pressure. For example, Li Auto's sales in July were 30,731 units, still among the top, but surpassed by Geely Galaxy, Leapmotor, and others. NIO and XPeng's sales are relatively lagging, showing a lack of growth momentum. On the other hand, the market share of traditional car manufacturers' new energy brands continues to rise, even starting to encroach on the market of new power brands.

This competitive landscape is reflected not only in sales but also in product portfolio and technological routes. Traditional automakers' new energy brands typically adopt a multi-brand, multi-model strategy to cover various market segments from entry-level to high-end. For example, Geely Group owns multiple brands such as Zeekr and Galaxy, each targeting different consumer groups; Changan Automobile achieves market segmentation through brands like Deep Blue and Qiyuan.

The rapid rise of new energy brands from traditional car manufacturers is not a coincidence; it is supported by multiple factors.

Traditional car manufacturers such as Geely, Changan, and GAC have years of experience in automobile manufacturing, mature supply chain systems, and large-scale production capabilities. This gives them a natural advantage in ramping up production capacity, cost control, and quality management. For example, Geely Galaxy, relying on the vast architecture and global supply chain of the Geely Group, can quickly launch competitive products.

In fact, traditional car manufacturers did not start from scratch in the fields of electrification and intelligence. Through years of technological accumulation, they have gradually closed the gap with leaders like Tesla in areas such as the three-electric system (battery, motor, electric control), smart cockpits, and autonomous driving. In addition to their own research and development, Huawei's assistance to these car manufacturers has also been significant.

Of course, one of the most lacking aspects for new car manufacturers is that traditional automakers usually have extensive and mature dealer networks and after-sales service systems, enabling them to achieve market penetration and user reach more quickly. This is especially important for the promotion of new energy vehicles and the establishment of user trust. For example, Changan Qiyuan and Deep Blue have quickly covered second- and third-tier markets through Changan Automobile's channel resources.

Compared to new power brands, traditional car companies have a higher brand recognition and customer trust due to their long-term accumulation, especially among consumer groups that value reliability and after-sales service. This makes it easier for their new energy products to gain market acceptance.

From sales data to market dynamics, the rise of traditional car companies' new energy brands is an undeniable fact. They are steadily stepping up to the table, becoming important players in the new energy vehicle market. This transformation not only reflects the maturity and evolution of China's automotive industry but also indicates that future competition will be more diverse and intense.

02Joint venture brands are also catching up.

At this year's bustling Chengdu Auto Show, there was a notable change as Toyota's bZ series had its own separate booth.

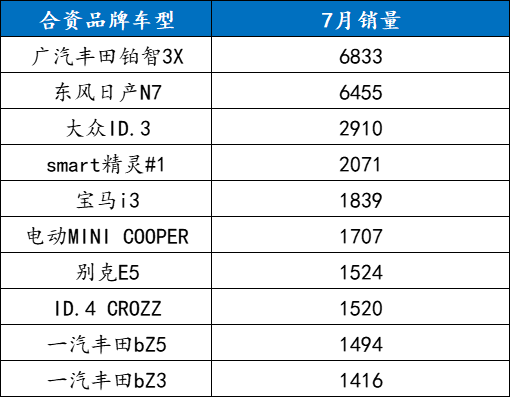

Behind this adjustment lies a profound market truth. According to sales data, in July of this year, the GAC Toyota bZ3X stood out among joint venture brand pure electric models and won the sales championship. Moreover, the subsequent models of the bZ series are about to make their debut, which is highly anticipated.

After the GAC Toyota bZ3X, the performance of the Dongfeng Nissan N7 is also noteworthy, with July sales reaching 6,455 units, a gap of less than 400 units compared to the bZ3X. A significant commonality between these two popular models is that they are entirely developed under the leadership of Chinese teams. They leverage the advantages of localized supply chains and accurately grasp the needs of Chinese consumers, thereby creating models that are well-received in the market.

This year, the new energy vehicle market is showing a brand-new pattern. Traditional car manufacturers among independent brands are gradually becoming mainstream with their own strengths. Meanwhile, traditional joint venture brands are also making vigorous efforts. Previously, the Volkswagen brand took the lead, and its ID series achieved good results in the market with outstanding performance and quality.

In the new wave of competition, with the entry of independent local new energy brands such as Buick's Zijing and the AUDI brand, the market is becoming increasingly lively. It is foreseeable that in the future new energy vehicle market, the competition between joint venture brands and independent brands will become more intense.

In the thriving new energy vehicle market, we have seen the impressive performance of numerous brands actively advancing and striving to expand. At the same time, we should also focus on those traditional car companies that have not yet developed the capability to operate as independent brands.

Taking Great Wall Motors as an example, in a situation where many brands are launching multiple independent new energy brands to comprehensively layout the market, Great Wall Motors' single WEY brand in new energy may gradually show deficiencies in terms of product line richness and market coverage. This will undoubtedly affect its long-term development in the new energy market.

SAIC Motor Corporation, as a giant in the domestic automotive industry, has had remarkable achievements in the traditional fuel vehicle sector. However, its lack of an independent new energy vehicle (NEV) brand in the new energy sector raises questions. In today's rapidly expanding new energy market, not having an independent and influential NEV brand makes it difficult to fully benefit from the growth dividends of the new energy market.

Chery Automobile, with its Chery Fengyun carrying many expectations, has yet to independently make the list. In the increasingly fierce brand competition in the new energy market, if Chery Fengyun cannot quickly become independent and stand out, Chery's development pace in the new energy field may be limited.

For these traditional car manufacturers, creating independent new energy brands is not only an inevitable choice in line with market development trends but also a crucial measure for the long-term future development of the enterprise. Only by accelerating their layout and launching competitive independent new energy brands can they secure a place in the market competition of the new era.

Of course, on the other hand, it's fortunate that these brands at least have new energy plans. For example, Great Wall has WEY, SAIC has Shangjie, and Chery has iCar, which fully demonstrates that large groups have relatively comprehensive considerations. The most difficult situation now is for small brands like Haima, Skyworth, and LanDian. Their fate is predictable amid the accelerating market differentiation.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track