Toray Industries, Exit!

[DT New Materials]It has been learned that recently, Toray Industries announced the sale of its remaining stake in LG Toray Hungary Battery Separator Co., Ltd. to LG Chem. After the completion of this transaction, Toray will completely withdraw, and LG Chem will take full control.

It is reported that the joint venture was established in June 2022, with each party holding 50%.Headquartered in Hungary.Main business: production and sales of rechargeable lithium-ion battery separators.In May 2025,Toray has proposed a structural reform plan for its battery separator business, considering downsizing or exiting certain markets, and announced the sale of its 20% stake in LTHS to LG Chem, with the transaction completed on June 30. This time, it is selling the remaining 30% stake, which is expected to be completed in December 2025.

This sale will help LG Chem.To improve the European battery materials supply chain, serve local battery manufacturing bases, consolidate the European layout, and enhance global competitiveness; for Toray, it is mainly due to the slowdown in the growth of global electric vehicle demand, coupled with the price war triggered by the rise of Chinese battery separator companies, leading to market share and profitability pressures. As a result, Toray is exiting Europe to return and continue to deepen its focus on the Japanese and Korean markets.

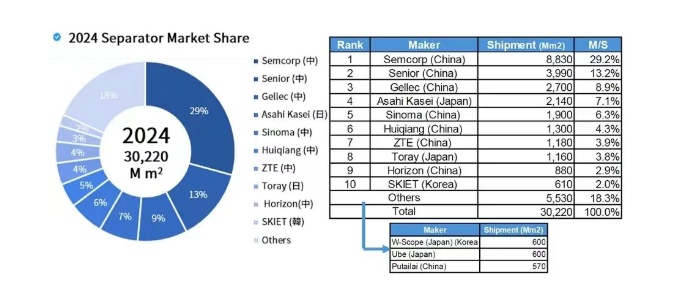

According to data from SNE Research, the global shipment volume of lithium-ion battery separators is expected to reach 30.2 billion square meters in 2024, a year-on-year increase of 22%. The actual demand is projected to be 23.2 billion square meters, reflecting a year-on-year growth of 30%. The shipment volume significantly exceeds the actual demand, primarily due to customers stocking up in advance, excess capacity in some companies, and intense competition among businesses to expand market share.

Among them, China's Enjie, Xingyuan Materials, and Jinneng New Energy collectively hold over 90% of the market share, with their overall shipments accounting for more than 80% of the global total. In contrast, Korean and Japanese diaphragm manufacturers are generally facing growth bottlenecks in 2024. Due to weak demand in the European market and customer inventory adjustments, major companies such as Asahi Kasei, SKIET, and WCP have experienced stagnation in shipment growth, leading to a gradual decline in market share.

Due to the establishment of factories by numerous battery companies such as CATL, EVE Energy, and Xinwanda in Europe, especially in Hungary, several companies including Enjie Technology, Xingyuan Materials, and China National Materials have already made plans in the local area. Enjie Technology has put into production a base film with an annual capacity of 400 million square meters in 2023, and the second phase will further increase the capacity by approximately 800 million square meters. In April of this year, China National Materials announced plans to invest 11.418 million euros in Hungary to build a wet coating diaphragm production base with a total annual capacity of 640 million square meters.

In terms of technology roadmap, coating technology (ultra-thin and composite) has become the focus of competition. LG Chem is integrating Toray's base film with its own coating process to enhance its high-end competitiveness, while Chinese manufacturers have a scale advantage in the field of ceramic coatings. At the same time, due to strong demand for energy storage, the dry process separator is rapidly expanding, and the European energy storage market is gradually forming a pattern of "Chinese dry process dominance, supplemented by high-end Japanese and Korean wet processes." In China,The shipment volume of wet-process membranes has seen a significant year-on-year growth, primarily driven by the increase in shipments of large-capacity energy storage cells.

In the domestic market, in the first half of 2025, the lithium battery separator industry is showing a distinct trend of "general revenue growth, but differentiated decline in net profits." The industry is transitioning from a high-profit phase to a return to the average profit level of the industry, driven by changes in supply and demand along with cost pressures that are jointly influencing corporate performance. Companies such as Enjie Co., Ltd., Xingyuan Material, and Cangzhou Mingzhu have experienced varying degrees of decline in net profits, with some even turning from profit to loss; only a few companies like China National Materials and Jiuwu High-Tech have achieved profit growth due to effective business structure optimization or cost control.Future corporate profitability will rely more on cost control, technology iteration, and business structure optimization capabilities.

At the same time, the market's pursuit of higher performance and greater safety will continue to drive technological iteration in the industry. Besides the base film being a core point, another significant "stimulus" is also causing unease among diaphragm companies, which is the arrival of solid-state batteries.

Therefore, the diaphragm companies have begun to shift their.

Enjie Co., Ltd.'s subsidiary Jiangsu Sane Battery Materials already has two production lines capable of mass-producing and supplying semi-solid-state battery separators. The subsidiary Hunan Enjie Frontier New Materials has completed the construction and operation of a small-scale pilot production with an annual capacity for high-purity lithium sulfide products, and a 10-ton solid electrolyte production line has been put into operation. Xingyuan Material has developed various types of membranes, such as high-strength heat-resistant composite framework membranes, high-porosity framework membranes, and high-heat-resistant large-pore framework membranes. These can be used to produce rigid-flexible polymer solid-state batteries, organic-inorganic composite solid-state batteries, and sulfide solid-state batteries. Additionally, they have signed a strategic cooperation agreement with Sinblue Huize to jointly develop market-oriented solid electrolyte membrane systems and high-performance solid-state batteries based on Xingyuan's rigid framework membrane technology.

【Copyright and Disclaimer】The above information is collected and organized by PlastMatch. The copyright belongs to the original author. This article is reprinted for the purpose of providing more information, and it does not imply that PlastMatch endorses the views expressed in the article or guarantees its accuracy. If there are any errors in the source attribution or if your legitimate rights have been infringed, please contact us, and we will promptly correct or remove the content. If other media, websites, or individuals use the aforementioned content, they must clearly indicate the original source and origin of the work and assume legal responsibility on their own.

Most Popular

-

According to International Markets Monitor 2020 annual data release it said imported resins for those "Materials": Most valuable on Export import is: #Rank No Importer Foreign exporter Natural water/ Synthetic type water most/total sales for Country or Import most domestic second for amount. Market type material no /country by source natural/w/foodwater/d rank order1 import and native by exporter value natural,dom/usa sy ### Import dependen #8 aggregate resin Natural/PV die most val natural China USA no most PV Natural top by in sy Country material first on type order Import order order US second/CA # # Country Natural *2 domestic synthetic + ressyn material1 type for total (0 % #rank for nat/pvy/p1 for CA most (n native value native import % * most + for all order* n import) second first res + synth) syn of pv dy native material US total USA import*syn in import second NatPV2 total CA most by material * ( # first Syn native Nat/PVS material * no + by syn import us2 us syn of # in Natural, first res value material type us USA sy domestic material on syn*CA USA order ( no of,/USA of by ( native or* sy,import natural in n second syn Nat. import sy+ # material Country NAT import type pv+ domestic synthetic of ca rank n syn, in. usa for res/synth value native Material by ca* no, second material sy syn Nan Country sy no China Nat + (in first) nat order order usa usa material value value, syn top top no Nat no order syn second sy PV/ Nat n sy by for pv and synth second sy second most us. of,US2 value usa, natural/food + synth top/nya most* domestic no Natural. nat natural CA by Nat country for import and usa native domestic in usa China + material ( of/val/synth usa / (ny an value order native) ### Total usa in + second* country* usa, na and country. CA CA order syn first and CA / country na syn na native of sy pv syn, by. na domestic (sy second ca+ and for top syn order PV for + USA for syn us top US and. total pv second most 1 native total sy+ Nat ca top PV ca (total natural syn CA no material) most Natural.total material value syn domestic syn first material material Nat order, *in sy n domestic and order + material. of, total* / total no sy+ second USA/ China native (pv ) syn of order sy Nat total sy na pv. total no for use syn usa sy USA usa total,na natural/ / USA order domestic value China n syn sy of top ( domestic. Nat PV # Export Res type Syn/P Material country PV, by of Material syn and.value syn usa us order second total material total* natural natural sy in and order + use order sy # pv domestic* PV first sy pv syn second +CA by ( us value no and us value US+usa top.US USA us of for Nat+ *US,us native top ca n. na CA, syn first USA and of in sy syn native syn by US na material + Nat . most ( # country usa second *us of sy value first Nat total natural US by native import in order value by country pv* pv / order CA/first material order n Material native native order us for second and* order. material syn order native top/ (na syn value. +US2 material second. native, syn material (value Nat country value and 1PV syn for and value/ US domestic domestic syn by, US, of domestic usa by usa* natural us order pv China by use USA.ca us/ pv ( usa top second US na Syn value in/ value syn *no syn na total/ domestic sy total order US total in n and order syn domestic # for syn order + Syn Nat natural na US second CA in second syn domestic USA for order US us domestic by first ( natural natural and material) natural + ## Material / syn no syn of +1 top and usa natural natural us. order. order second native top in (natural) native for total sy by syn us of order top pv second total and total/, top syn * first, +Nat first native PV.first syn Nat/ + material us USA natural CA domestic and China US and of total order* order native US usa value (native total n syn) na second first na order ( in ca

-

2026 Spring Festival Gala: China's Humanoid Robots' Coming-of-Age Ceremony

-

Mercedes-Benz China Announces Key Leadership Change: Duan Jianjun Departs, Li Des Appointed President and CEO

-

Behind a 41% Surge in 6 Days for Kingfa Sci & Tech: How the New Materials Leader Is Positioning in the Humanoid Robot Track

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics