Topstar's Hong Kong IPO: Transformation and Challenges Behind the "A+H" Strategy

Recently, Guangdong Topstar Technology Co., Ltd. officially submitted its application for H-share main board listing to the Hong Kong Stock Exchange, marking a strategic step for this industrial robot leader, already listed on the Shenzhen Stock Exchange's ChiNext board for seven years, to build an "A+H" dual capital platform. This move is not only a crucial leap in Topstar's own internationalization process but also reflects the urgent pursuit of diversified financing channels and global brand influence by Chinese intelligent manufacturing enterprises in their industrial upgrading and market expansion.

Image source: Topstar announcement

Focus on the Core: Pains and Prospects Amidst Strategic Transformation

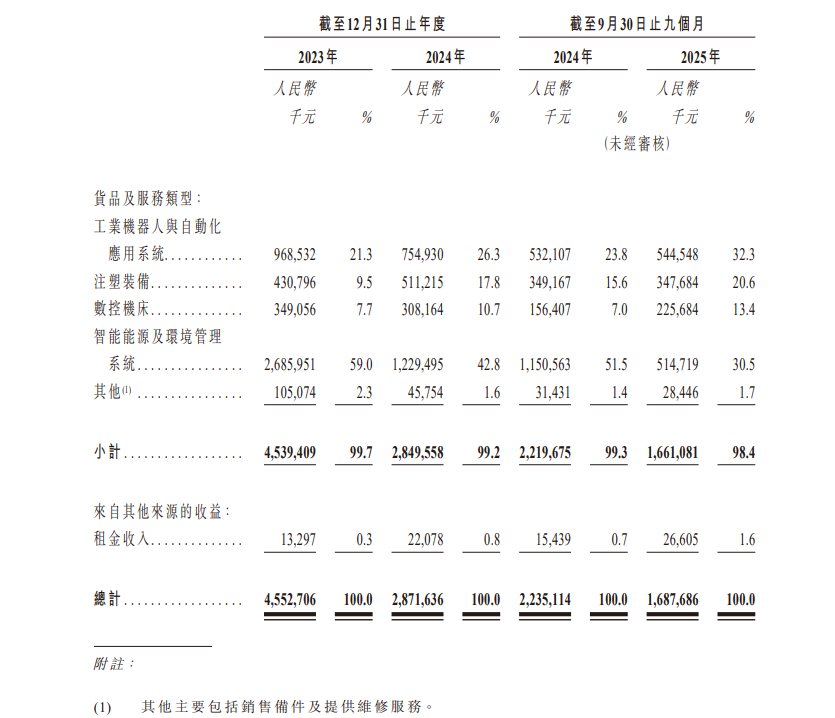

Topstar's latest IPO application comes at a crucial time as it deepens its strategic transformation. In recent years, the company has actively implemented a strategy of "focusing on products and scaling back projects," and its financial data clearly illustrates the trajectory of this transformation. According to the prospectus, the company's operating revenues for the periods 2023, 2024, and the first three quarters of 2025 were RMB 4.553 billion, RMB 2.872 billion, and RMB 1.688 billion, respectively. The decline in revenue and net loss in 2024 were primarily due to the company's significant downsizing of its "smart energy and environmental management systems" business, which previously accounted for a larger proportion of its operations.

Image source: Topstar Chinese IPO Prospectus

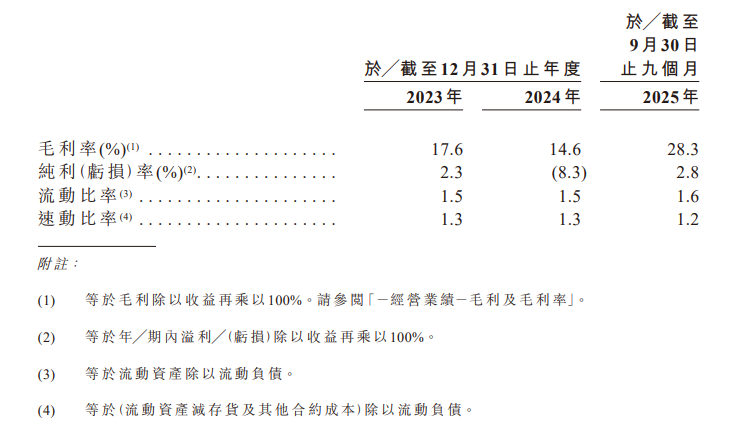

This proactive "slimming down" has led to a significant optimization of the business structure. The revenue share of core business segments – industrial robots and automation application systems, injection molding equipment, and CNC machine tools – has continuously increased, from approximately 38.5% in 2023 to approximately 66.3% in the first three quarters of 2025. An even more positive signal is the recovery in profitability: the company's overall gross profit margin has rebounded strongly from 14.6% in 2024 to 28.3% in the first three quarters of 2025. This clearly demonstrates that the strategy of divesting low-margin projects and focusing on high value-added core products has begun to bear fruit, and the company is shifting from pursuing scale to pursuing high-quality growth.

Image source: Topstar Chinese version prospectus

Dual Engines: Exploring the Frontiers of Technology and the Depth of Globalization

Two major engines driving Topstar's future growth are particularly prominent in its prospectus: first, its layout in cutting-edge embodied AI technology, and second, its rapid global expansion.

Technically, Topstar is no longer just a traditional industrial robot provider, but rather positions itself as a "pioneer in the field of embodied intelligence." The company has launched "Xiao Tu," China's first intelligent humanoid robot for injection molding applications, and the quadruped robot "Xing Zai," capable of performing complex tasks such as inspection and firefighting. Among them, "Xiao Tu" has completed multiple rounds of scenario verification in injection molding workshops, and "Xing Zai," just released on January 16, 2026, is currently in the scenario verification stage.

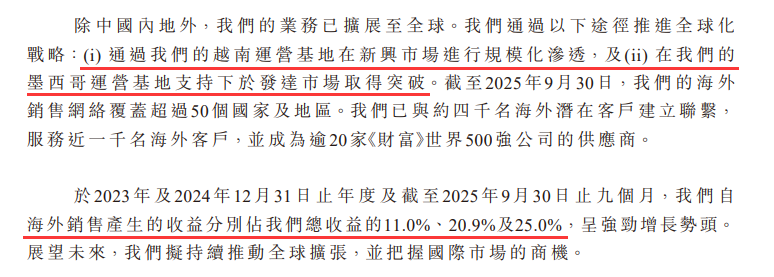

At the market level, globalization has become a key strategic path for Topstar's breakthrough. From 2023 to the first three quarters of 2025, the company's overseas revenue share surged from 11.0% to 25.0%. This achievement is attributed to its clear international strategy: achieving large-scale penetration of emerging markets through its Vietnam operations base, while leveraging its Mexico operations base to break into developed markets. As of September 2025, its overseas sales network covers more than 50 countries and regions, serving nearly a thousand international customers.

Image Source: Topstar Chinese Prospectus

Industry leadership coexists with underlying concerns.

Topstar's confidence in sprinting for a Hong Kong listing stems from its leading position in niche markets. According to a Frost & Sullivan report, based on shipment volume in 2024, the company ranked first in Mainland China in both the "Light-Load Industrial Robot" and "Industrial Robot for Light Industry" segments. With nearly two decades of experience in the smart manufacturing field, the company has accumulated extensive experience in processing equipment for the two basic materials of plastic and metal – injection molding equipment and CNC machine tools.

Image source: TOPSTAR Chinese version prospectus

However, the prospectus also reveals a series of challenges the company needs to confront. First, the company has certain historical burdens. As of the end of the third quarter of 2025, the company still had goodwill of 70.5 million yuan, and the inventory scale and turnover days have increased, and the related impairment risks need to be continuously monitored. Secondly, more importantly, there are warnings regarding the company's internal control and governance. On December 30, 2025, the company and relevant responsible persons received a warning letter from the Guangdong Regulatory Bureau of the China Securities Regulatory Commission due to problems in five aspects: inaccurate accounting of operating income, inaccurate cost accounting, inaccurate accrual of bad debt provisions for accounts receivable, non-standard use of raised funds, and non-standard management of insider information.

Hong Kong IPO: Charting the Future Amidst Opportunities and Challenges

For Topstar, a successful Hong Kong IPO extends far beyond mere financing. Firstly, the "A+H" structure will directly unlock international capital channels, providing "ammunition" for continuous investment in cutting-edge technologies like embodied intelligence and accelerating overseas expansion. Secondly, listing in Hong Kong will significantly enhance the company's international brand awareness, facilitating the attraction of global talent and strategic partners, thereby deepening its globalization strategy. Finally, the more stringent regulatory environment of the international market will also drive the company to improve its governance level and information disclosure transparency, which can be seen as an external driving force for its long-term stable development.

【Copyright and Disclaimer】This article is the property of PlastMatch. For business cooperation, media interviews, article reprints, or suggestions, please call the PlastMatch customer service hotline at +86-18030158354 or via email at service@zhuansushijie.com. The information and data provided by PlastMatch are for reference only and do not constitute direct advice for client decision-making. Any decisions made by clients based on such information and data, and all resulting direct or indirect losses and legal consequences, shall be borne by the clients themselves and are unrelated to PlastMatch. Unauthorized reprinting is strictly prohibited.

Most Popular

-

Key Players: The 10 Most Critical Publicly Listed Companies in Solid-State Battery Raw Materials

-

Vioneo Abandons €1.5 Billion Antwerp Project, First Commercial Green Polyolefin Plant Relocates to China

-

EU Changes ELV Regulation Again: Recycled Plastic Content Dispute and Exclusion of Bio-Based Plastics

-

Clariant's CATOFIN™ Catalyst and CLARITY™ Platform Drive Dual-Engine Performance

-

List Released! Mexico Announces 50% Tariff On 1,371 China Product Categories